Connecticut Estoppel Affidavit of Mortgagor

Description

How to fill out Estoppel Affidavit Of Mortgagor?

Are you currently in a situation where you require documents for either business or personal purposes on a frequent basis.

There are numerous legal document templates available online, but locating ones that you can trust isn't easy.

US Legal Forms offers a vast array of form templates, including the Connecticut Estoppel Affidavit of Mortgagor, which are designed to meet both federal and state regulations.

Choose the pricing option you desire, complete the required information to create your account, and process the payment through PayPal or credit card.

Select a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- Once logged in, you can download the Connecticut Estoppel Affidavit of Mortgagor template.

- If you don't have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the necessary form and ensure it corresponds to the correct city/region.

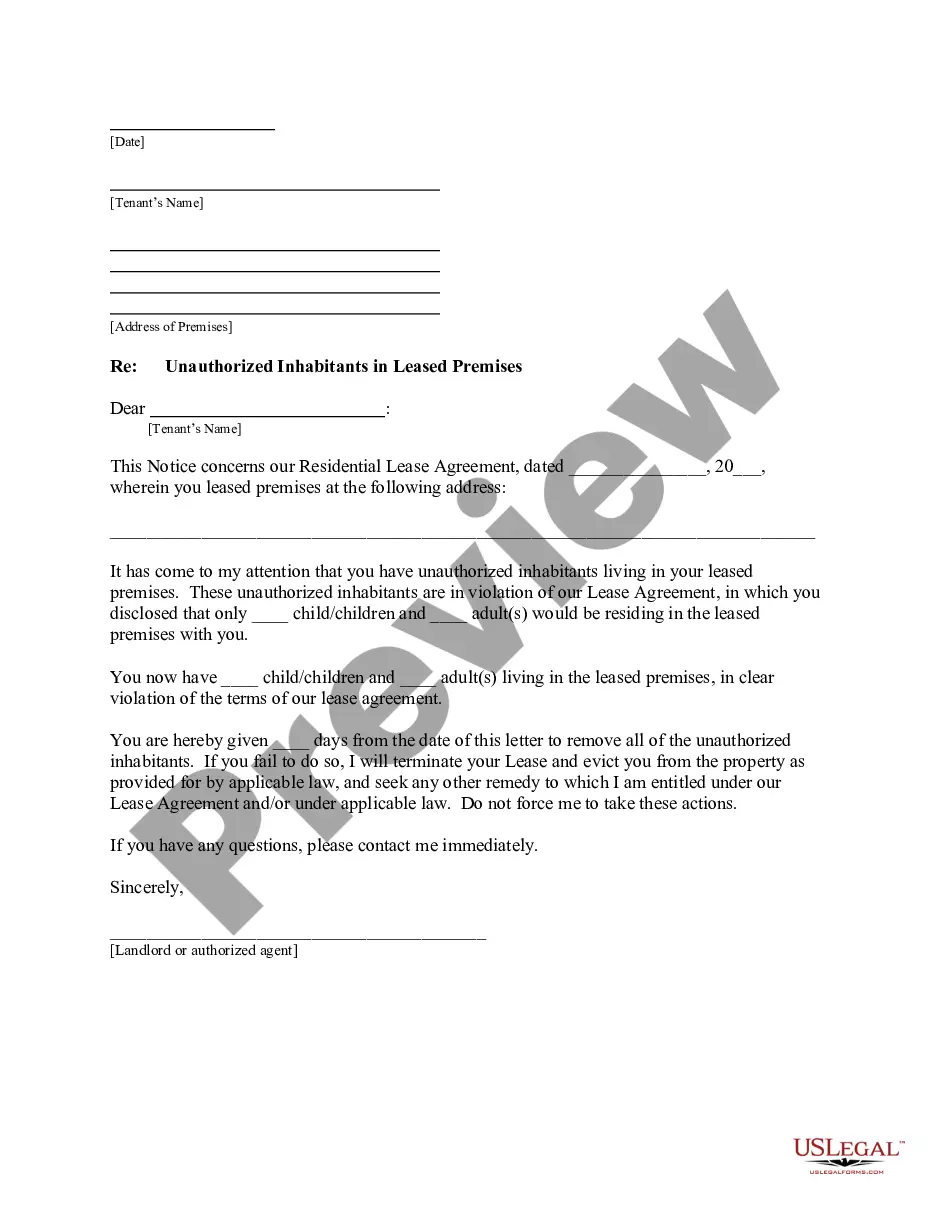

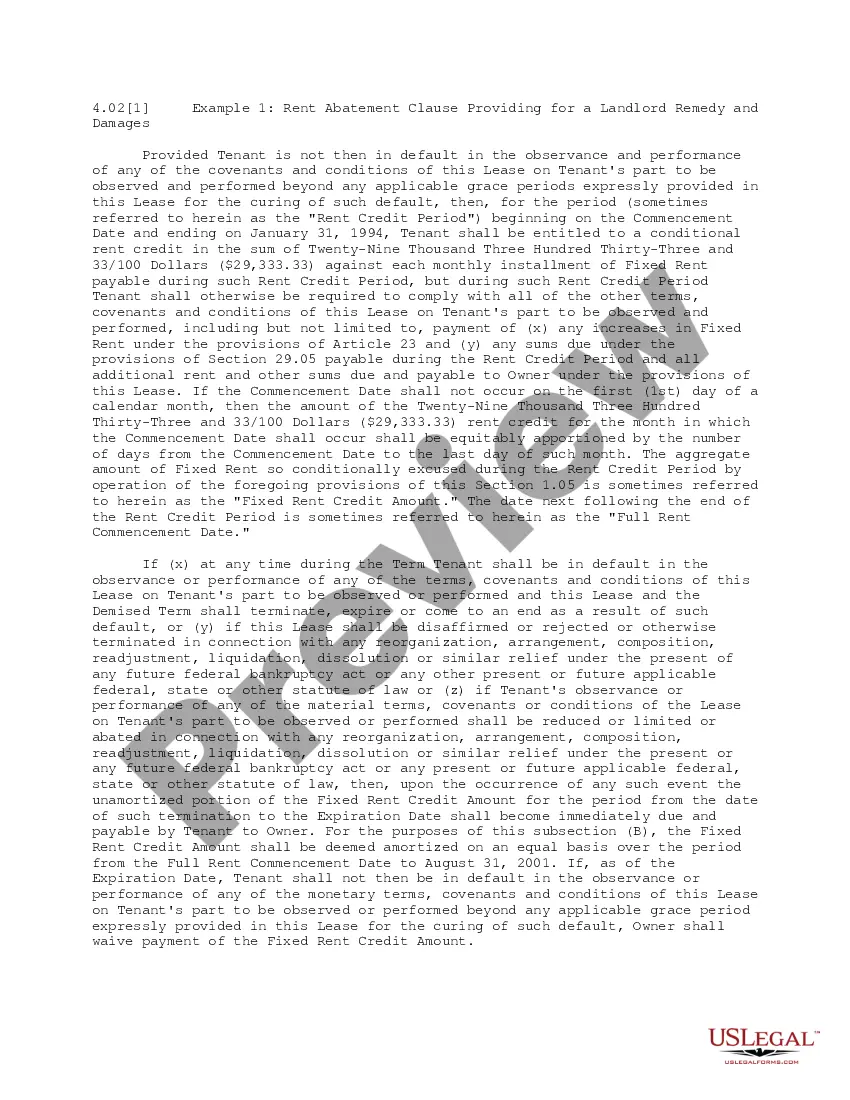

- Use the Preview button to review the document.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you're looking for, utilize the Lookup field to find the form that fits your needs and criteria.

- When you locate the right form, click on Acquire now.

Form popularity

FAQ

The right of the mortgagor to regain title is often referred to as the 'right of redemption.' This legal right allows the mortgagor to reclaim property after foreclosure by paying off the debt in full. Utilizing the Connecticut Estoppel Affidavit of Mortgagor can help ensure that this process is handled correctly and protect your interests throughout.

The principle of 'mortgage as security' applies here, where the mortgagor conveys legal title to the mortgagee but maintains equitable title and the right of possession. Thus, the mortgagor can reside in the property and benefit from it while still owing debt. Understanding this principle is crucial for homeowners, and the Connecticut Estoppel Affidavit of Mortgagor can be a useful document in clarifying these terms.

Yes, you can buy a house after a deed in lieu of foreclosure, but it may be challenging. Lenders often impose waiting periods before approving a new mortgage following a deed in lieu. Using the Connecticut Estoppel Affidavit of Mortgagor may assist in demonstrating your financial stability to potential lenders.

During the term of an installment land contract, the seller typically holds the legal title to the property while the buyer holds the equitable title. This means that the buyer has a right to the property and benefits from it, but does not yet have formal ownership. The Connecticut Estoppel Affidavit of Mortgagor can help clarify these titles and protect the buyer’s interests.

Lenders risk losing their ability to seek the owed debt in full by accepting a deed in lieu of foreclosure. This irrevocable choice might limit their legal avenues for recovering any additional amounts. Such an approach could also lead to potential depreciation of the property’s value, complicating the lender's asset management. Engaging a Connecticut Estoppel Affidavit of Mortgagor can provide clarity and reinforce financial accountability in these transactions.

An estoppel certificate is typically prepared by the lender or their legal representative. They gather information about the mortgage account, including payment history and outstanding balances, which is crucial for the document's accuracy. This process may also involve input from the mortgagor to ensure all details align with their understanding. A Connecticut Estoppel Affidavit of Mortgagor helps facilitate this preparation by formalizing the borrower's financial position.

A significant disadvantage for lenders accepting a deed in lieu of foreclosure is the potential loss of recoverable debt. By accepting this option, lenders may not receive the full amount owed, as they forfeit the right to pursue further actions against the borrower. Additionally, lenders might have to deal with property valuation issues and the costs associated with restructuring their assets. For clarity in such processes, a Connecticut Estoppel Affidavit of Mortgagor can outline the borrower’s financial commitments.

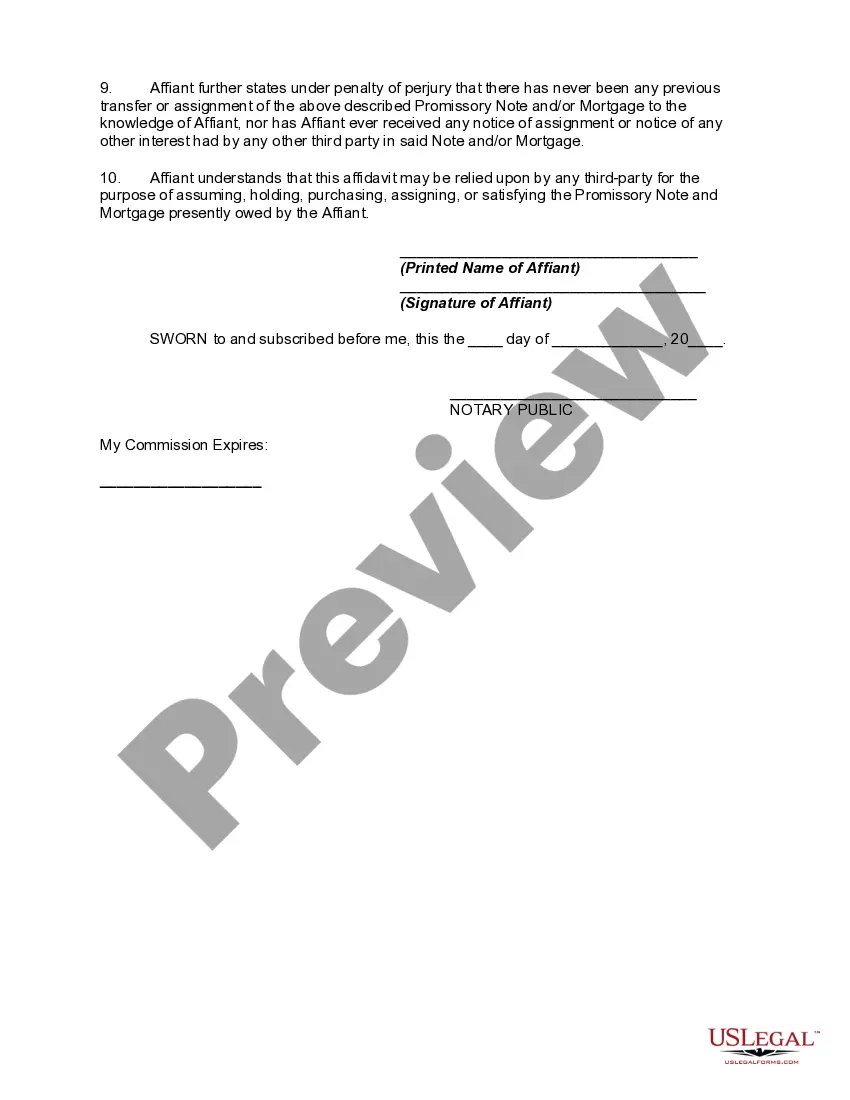

A mortgagor's affidavit is a specific type of affidavit that a mortgagor signs to affirm their declarations regarding their mortgage. This document can include information about payments, property ownership, and current mortgage terms. When you use the Connecticut Estoppel Affidavit of Mortgagor, you create an official record that can help avoid misunderstandings and disputes. It is an essential tool that enhances trust between you and your lender.

The purpose of an affidavit is to provide a sworn statement that serves as evidence in legal matters. Affidavits verify facts and can support claims made in court or during transactions. Specifically, the Connecticut Estoppel Affidavit of Mortgagor helps to confirm details about your mortgage status, aiding lenders and protecting your interests. By utilizing this document, you contribute positively to a transparent mortgage process.

The mortgage affidavit refers to a sworn statement that contains information about a mortgage agreement. This document is significant in establishing the borrower's obligations and the lender's rights. When you engage with the Connecticut Estoppel Affidavit of Mortgagor, you provide essential disclosures about your mortgage, which are crucial for closing the deal smoothly. Understanding this affidavit helps both lenders and borrowers clarify their responsibilities.