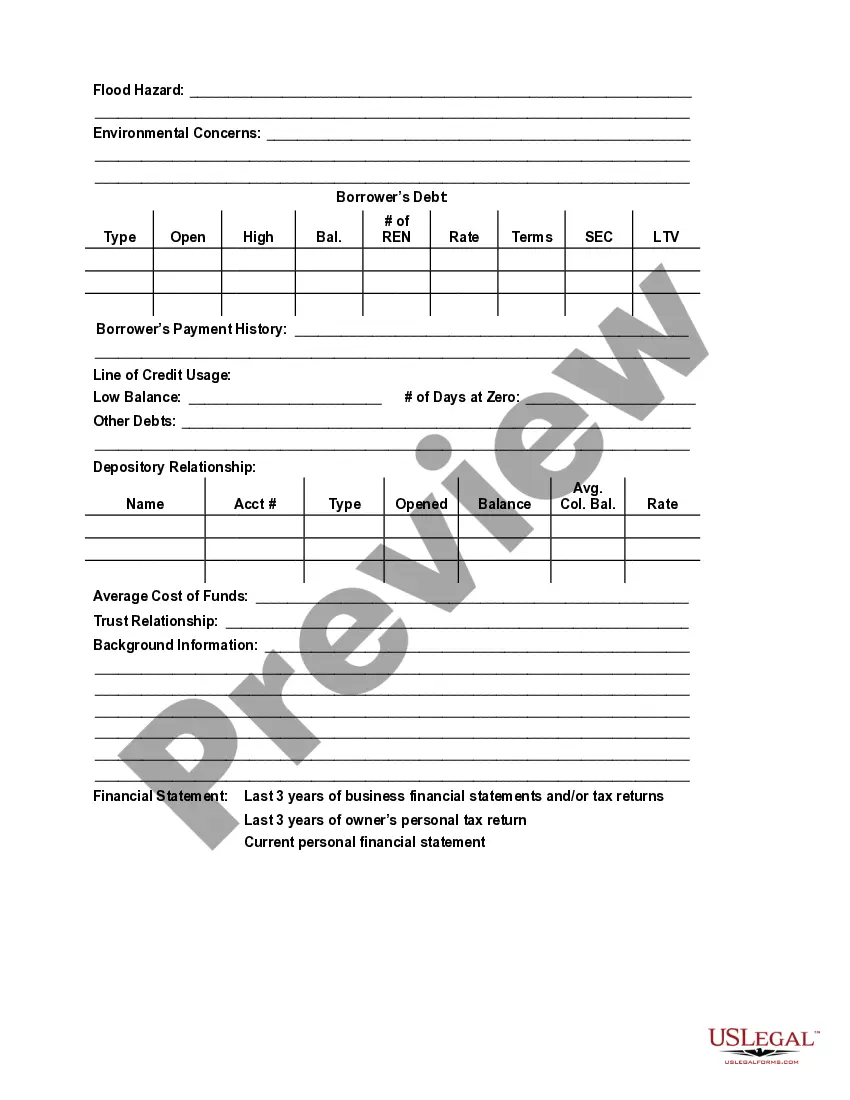

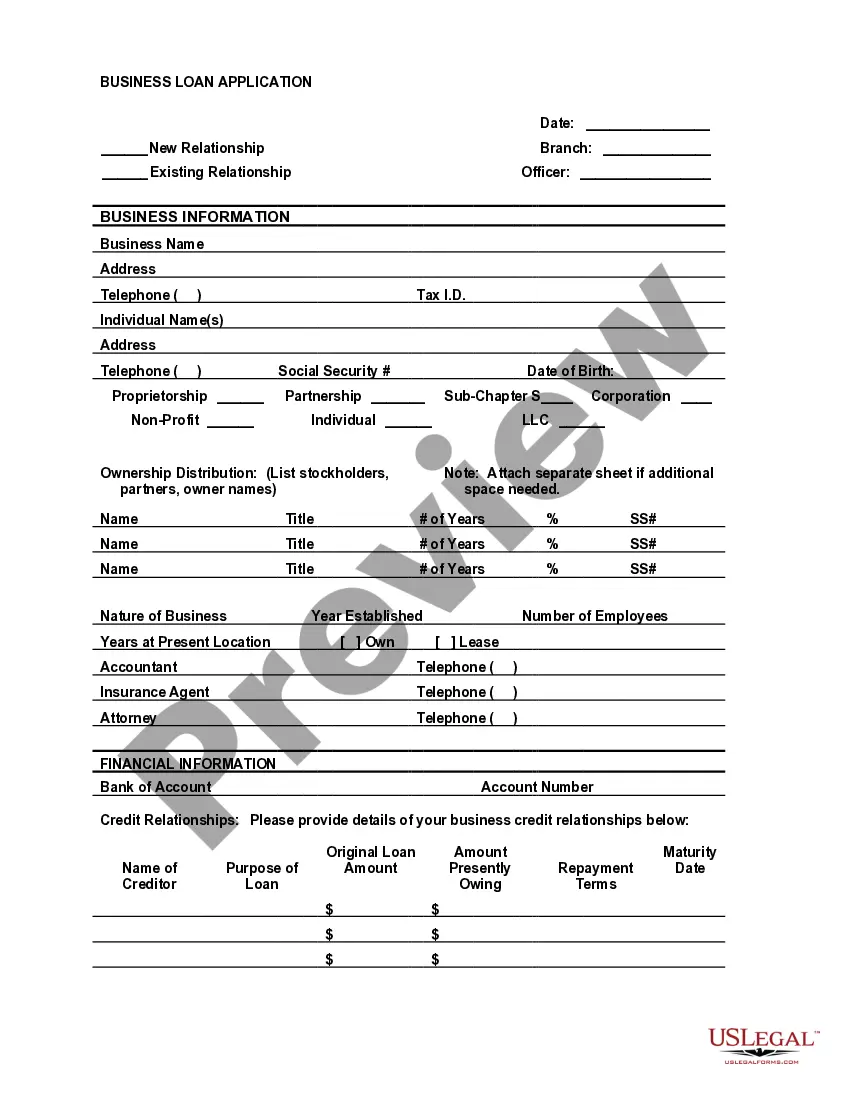

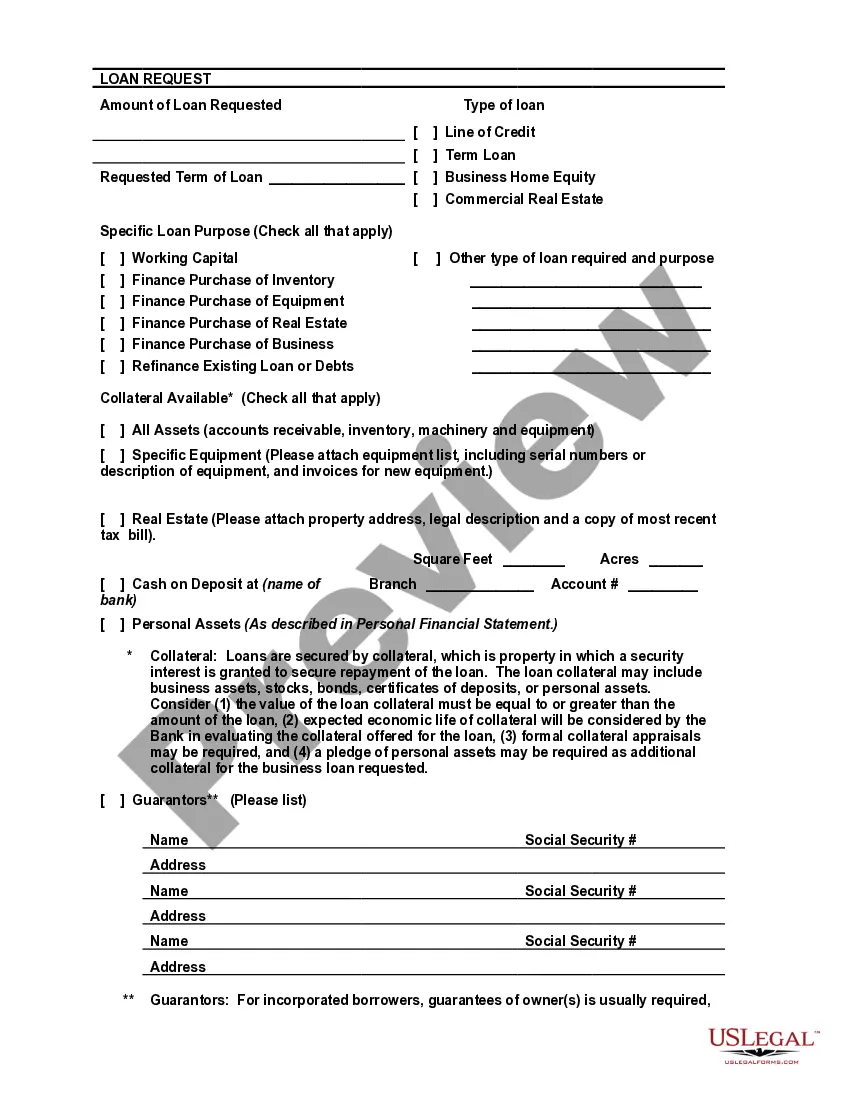

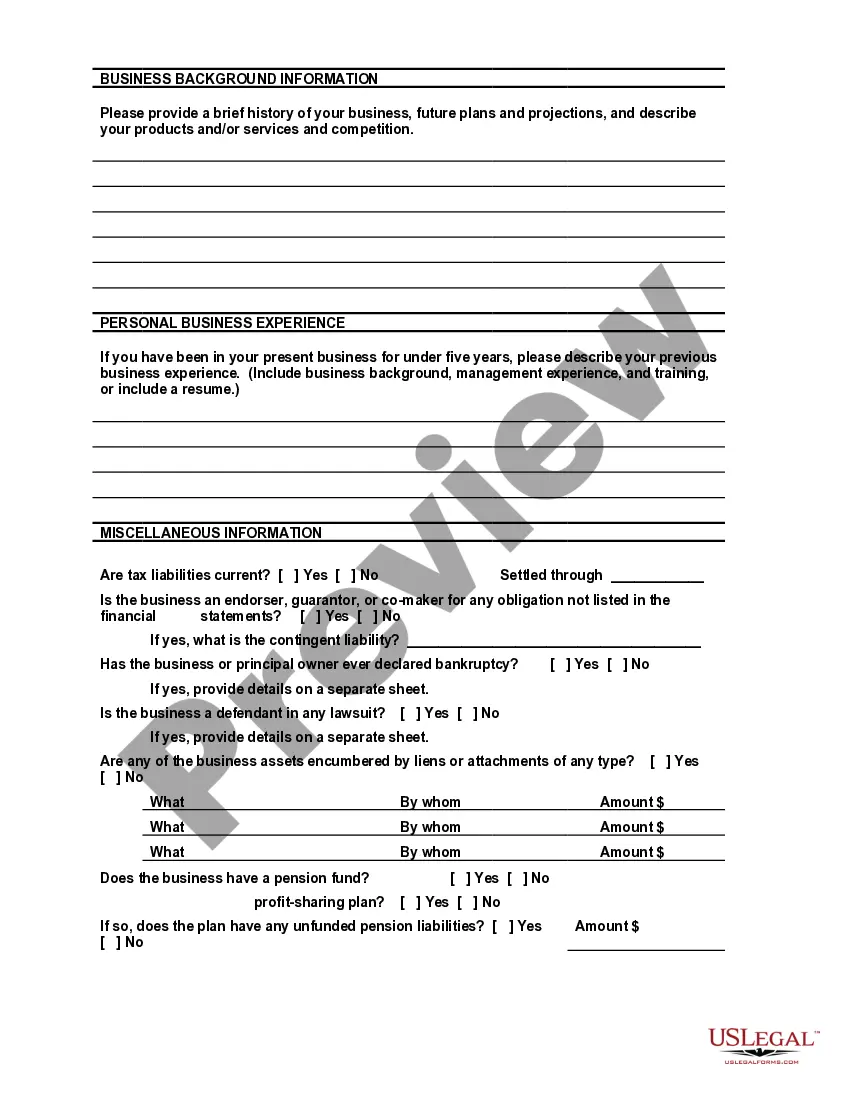

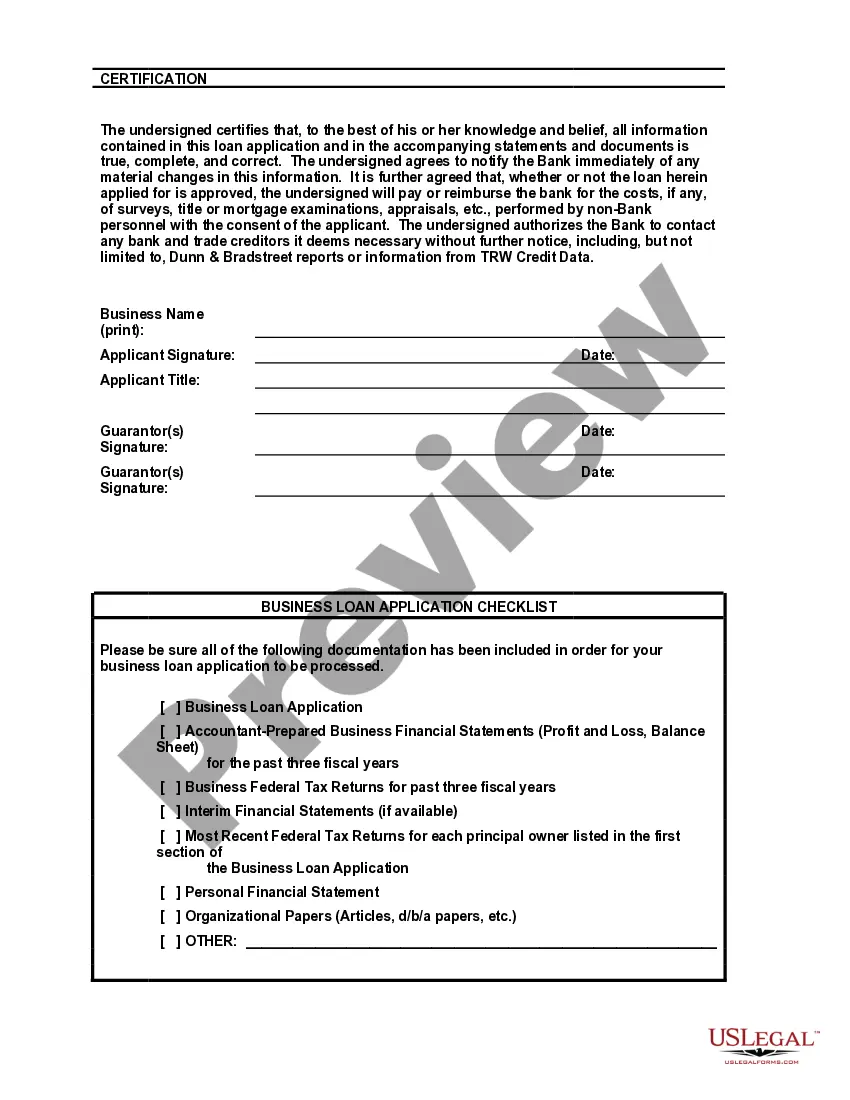

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

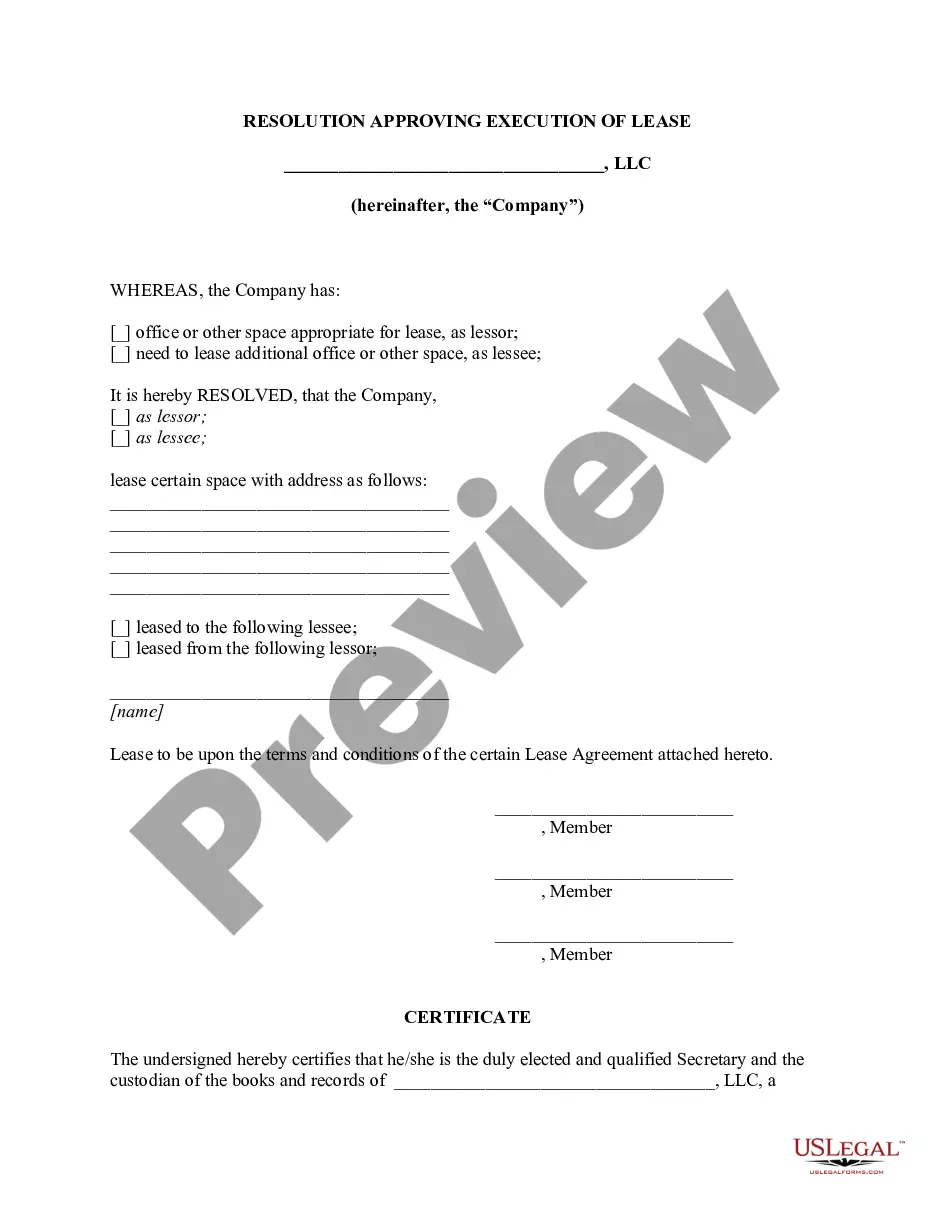

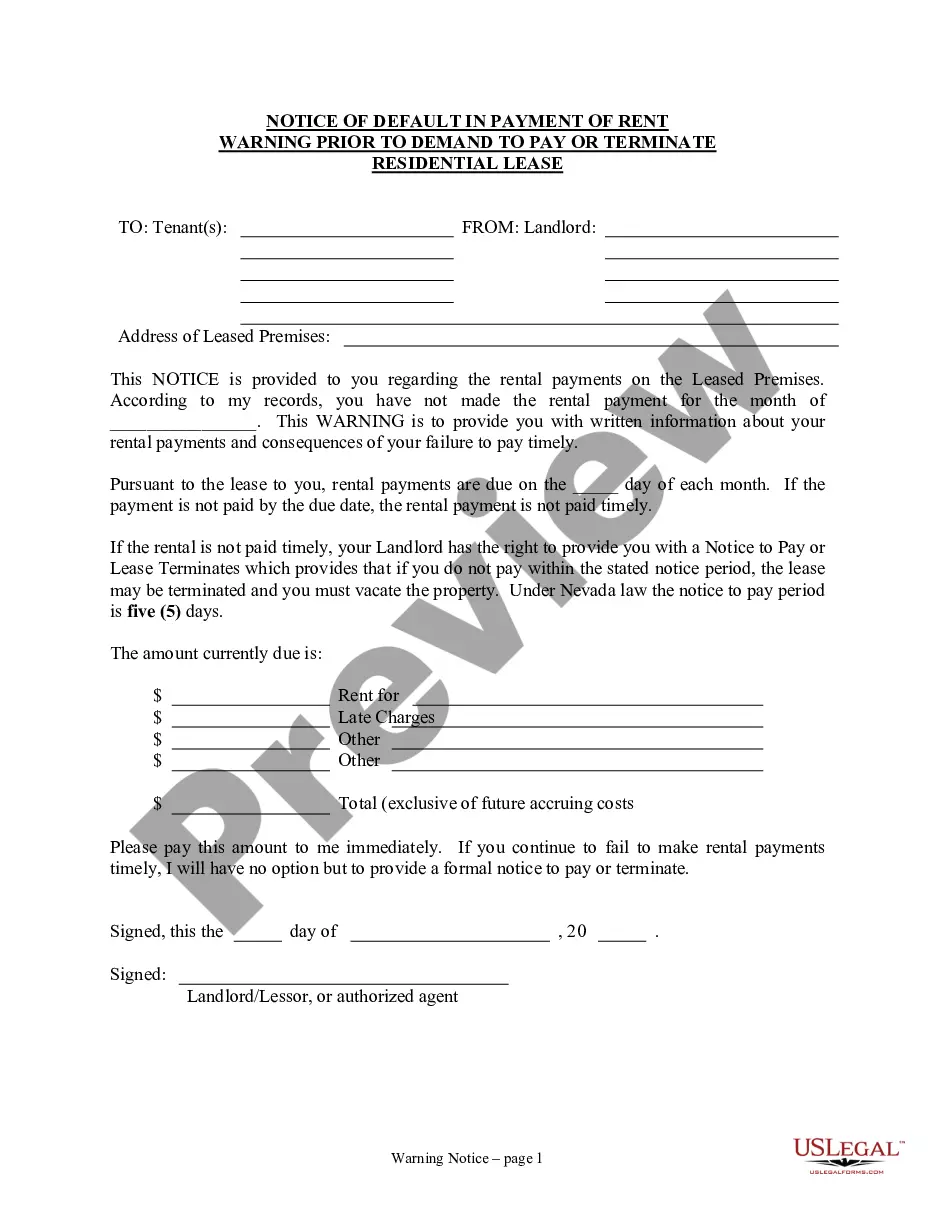

Connecticut Bank Loan Application Form and Checklist — Business Loan Connecticut Bank offers various types of business loans to help entrepreneurs and established businesses achieve their financial goals. To apply for a business loan, applicants are required to complete the Connecticut Bank Loan Application Form and provide all the necessary documents listed in the checklist. This comprehensive checklist ensures that applicants submit all the required information, making the loan approval process streamlined and efficient. The Connecticut Bank Loan Application Form serves as the initial step towards securing a business loan. It captures vital details such as the applicant's contact information, business entity type, loan amount requested, and purpose of the loan. The form also includes sections where applicants can provide additional information about their business, such as the number of years in operation, annual revenue, and existing debt obligations. The checklist for a business loan application includes: 1. Financial statements: Connecticut Bank requires applicants to submit their business's financial statements, including income statements, balance sheets, and cash flow statements. These statements provide a clear picture of the business's financial health and help the bank assess its repayment capacity. 2. Business plan: A well-structured business plan outlining the company's objectives, marketing strategies, target market, and financial projections is essential. It allows the bank to understand the business's potential and assess its viability for lending purposes. 3. Tax returns: Applicants must provide both personal and business tax returns for the past few years, enabling the bank to evaluate the applicant's financial history and compliance with tax obligations. 4. Collateral information: If the loan requires collateral, applicants need to provide documentation related to the collateral's ownership, valuation, and details about any existing liens. This information is crucial for determining the loan's security and assists in establishing the loan-to-value ratio. 5. Business licenses and permits: Applicants should include copies of all relevant business licenses, permits, and certifications applicable to their industry. These documents demonstrate the legitimacy of the business and its compliance with regulatory requirements. 6. Legal documentation: Any legal agreements, such as leases, contracts, or partnership agreements that impact the business's financials, must be included to provide a comprehensive overview to the bank. Connecticut Bank offers different types of business loan application forms and checklists to cater to specific loan programs. These may include: 1. Connecticut Bank Small Business Loan application: This form is specifically designed for small business owners seeking microloans or government-backed loans like SBA loans. 2. Connecticut Bank Commercial Real Estate Loan application: For businesses looking to purchase, refinance, or develop commercial real estate properties, this form focuses on gathering information related to property details, construction plans, and environmental assessments. 3. Connecticut Bank Equipment Loan application: Designed for businesses requiring financing for purchasing equipment, this form focuses on the type of equipment, its value, and expected benefits to the business. 4. Connecticut Bank Working Capital Loan application: For businesses seeking financial support to meet short-term operational expenses, this form emphasizes cash flow, accounts receivable, and inventory management. By providing all the necessary information and completing the appropriate application form and checklist, business owners ensure a smooth loan application process with Connecticut Bank. This attention to detail enhances the chances of obtaining the required financing to fuel business growth and expansion.