Connecticut Checklist - Action to Improve Collection of Accounts

Description

How to fill out Checklist - Action To Improve Collection Of Accounts?

If you need to acquire, gather, or print authorized document templates, utilize US Legal Forms, the premier selection of legal forms available online.

Take advantage of the website's simple and user-friendly search feature to locate the documents you need.

A multitude of templates for business and personal use are categorized by types and regions, or keywords.

Step 3. If you are not happy with the form, utilize the Search field at the top of the screen to find other variations in the legal form format.

Step 4. After identifying the form you need, click the Get now button. Choose the pricing plan that suits you and provide your details to create an account.

- Use US Legal Forms to obtain the Connecticut Checklist - Action to Enhance Collection of Accounts in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and select the Download button to retrieve the Connecticut Checklist - Action to Enhance Collection of Accounts.

- You can also view forms you previously acquired in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for your relevant city/state.

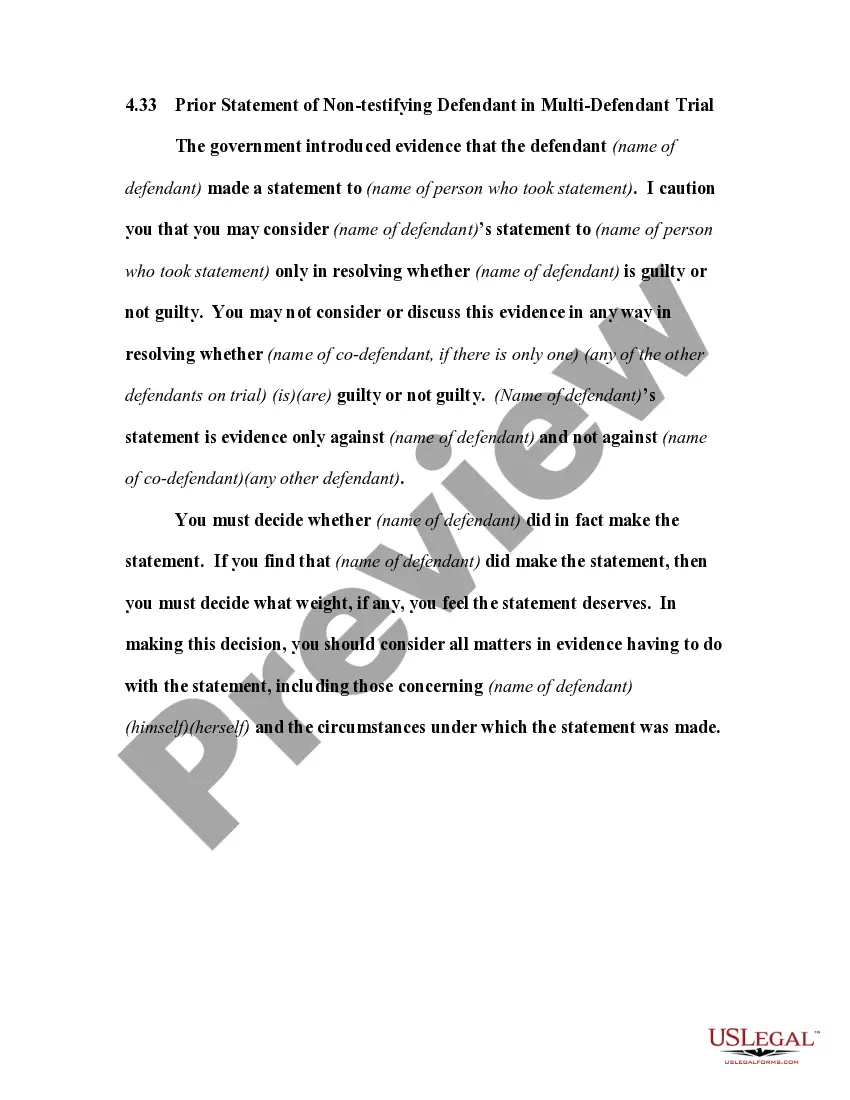

- Step 2. Use the Preview option to review the form's content. Don’t forget to check the overview.

Form popularity

FAQ

The Creditors Collection Practices Act in Connecticut regulates how creditors can collect debts. This law protects consumers from unfair practices while allowing creditors to pursue payments legally. Understanding this act is essential for anyone using the Connecticut Checklist - Action to Improve Collection of Accounts, as it outlines the appropriate actions creditors must take. By adhering to these guidelines, creditors can effectively manage collections while maintaining compliance with state laws.

The first pivotal step a company can take to improve collections of accounts receivable is to establish a robust invoicing process, as detailed in the Connecticut Checklist - Action to Improve Collection of Accounts. This involves creating accurate and timely invoices that clearly outline payment terms and due dates. Ensuring that your invoicing process is efficient sets the foundation for effective collections. Additionally, prompt communication with clients about their obligations is essential for minimizing late payments.

The 5 main internal controls essential for effective receivables management are segregation of duties, authorization, recording, reconciliation, and safeguarding assets. These controls help prevent errors and fraud, maintaining the integrity of your accounts. By incorporating the Connecticut Checklist - Action to Improve Collection of Accounts, you can bolster your internal controls and enhance your overall collection process.

The 5 C's of accounts receivable management include Character, Capacity, Capital, Collateral, and Conditions. Each element plays a vital role in evaluating the creditworthiness of customers, which directly impacts collections. Utilize the Connecticut Checklist - Action to Improve Collection of Accounts to integrate these concepts into your management strategy, ensuring a comprehensive approach to receivables.

To improve collection strategies, analyze current processes and identify weaknesses that may hinder timely payments. Regularly updating your methods is essential, so refer to the Connecticut Checklist - Action to Improve Collection of Accounts for proven tactics. Implementing diversified collection approaches tailored to different client profiles can significantly boost your success rate.

Several strategies can enhance the collection of receivables, including setting up automated reminders and offering discounts for early payments. Additionally, applying the Connecticut Checklist - Action to Improve Collection of Accounts can refine these strategies by identifying the most effective practices for your business. Adapt your approach based on client feedback and payment behavior to optimize results.

Improving AR collection involves establishing clear terms of payment and actively communicating with clients about their outstanding balances. Implement regular follow-up procedures and employ the Connecticut Checklist - Action to Improve Collection of Accounts for actionable insights that can optimize your collection efforts. By maintaining consistent communication, you can foster better relationships and encourage timely payments.

To improve the collection of accounts receivable, begin by reviewing your invoicing process. Ensure invoices are clear, sent promptly, and follow up on overdue payments systematically. Utilize the Connecticut Checklist - Action to Improve Collection of Accounts to track progress and apply effective strategies, ensuring a focused approach to collecting outstanding balances.

To speed up the collection of receivables, consider adopting a proactive communication strategy. Establish a regular schedule for contacting clients regarding overdue accounts, and utilize a Connecticut Checklist - Action to Improve Collection of Accounts to ensure each interaction is productive. Emphasizing the importance of prompt payments during your discussions can encourage clients to take immediate action. By fostering an environment of accountability, you can ultimately enhance your collection speed.

Increasing efficiency in the collection process involves creating a clear, organized strategy. Implementing a Connecticut Checklist - Action to Improve Collection of Accounts can help you streamline your actions, making sure no steps are overlooked. Regular training for your team on best practices for communication and negotiation will also enhance their ability to resolve issues swiftly. As a result, you will notice a significant reduction in the time taken to collect overdue payments.