Connecticut Business Deductions Checklist: Comprehensive Guide for Entrepreneurs As a business owner in Connecticut, it is crucial to stay updated on the various deductions available to minimize your tax liability. Utilizing the Connecticut Business Deductions Checklist can streamline the process, ensuring you don't miss out on any eligible expenses. This article will provide a detailed description of what a Connecticut Business Deductions Checklist is and highlight different types of checklists that entrepreneurs can utilize. A Connecticut Business Deductions Checklist is a tool designed to assist business owners in identifying deductible expenses specific to the state. It serves as a comprehensive guide, keeping entrepreneurs well-informed about the expenses they can claim for their businesses while complying with Connecticut state tax laws. Key areas covered in a Connecticut Business Deductions Checklist may include: 1. Business Operating Expenses: This section encompasses ordinary and necessary expenses related to daily operations, including rent, utilities, office supplies, equipment maintenance, and insurance premiums. 2. Employee-Related Expenses: Connecticut businesses can deduct various costs associated with hiring and retaining employees. These deductions may include salaries, wages, benefits, training costs, and payroll taxes. 3. Travel and Entertainment: Business-related travel expenses, such as transportation, lodging, meals, and entertainment, are eligible deductions. The checklist may list specific rules and limitations related to these expenses for Connecticut businesses. 4. Home Office Expenses: If you operate your business from a designated home office, certain deductions may be available. These deductions cover a portion of your rent, mortgage interest, utilities, insurance, and depreciation. 5. Professional Services and Fees: Connecticut businesses often incur expenses for professional services such as legal, accounting, or consulting services. The checklist may outline how these expenses qualify as deductions. 6. Advertising and Marketing: Costs associated with promoting your business, including advertising campaigns, website development, online marketing, and printing materials, can be deducted from your taxable income. 7. Business Vehicle Expenses: If you use a vehicle for business purposes, expenses such as fuel, maintenance, repairs, and lease payments may be deductible. The checklist may detail specific recording methods and reimbursement limits. Different types of Connecticut Business Deductions Checklists can exist based on factors such as business type, size, or industry. For example: 1. Small Business Deductions Checklist: Designed specifically for small businesses, this checklist focuses on deductions and credits commonly applicable to enterprises with limited resources and employees. 2. Home-Based Business Deductions Checklist: Tailored for entrepreneurs running their businesses from home, this checklist outlines deductions related to the use of a home office and associated expenses. 3. Industry-Specific Deductions Checklist: Some businesses, such as manufacturing, healthcare, or technology, may have unique deductions specific to their industry. This checklist provides guidance on industry-specific expenses that can be deducted. By utilizing a Connecticut Business Deductions Checklist, entrepreneurs can maximize their tax savings and ensure compliance with state regulations. Note that tax laws frequently change, so it's crucial to stay updated and consult with a tax professional for accurate advice.

Connecticut Business Deductions Checklist

Description

How to fill out Connecticut Business Deductions Checklist?

Finding the right lawful papers format might be a battle. Naturally, there are a lot of templates available online, but how do you obtain the lawful develop you require? Take advantage of the US Legal Forms web site. The services provides 1000s of templates, like the Connecticut Business Deductions Checklist, which can be used for enterprise and personal requirements. Every one of the varieties are inspected by specialists and meet state and federal specifications.

When you are currently registered, log in to your bank account and click on the Download option to obtain the Connecticut Business Deductions Checklist. Make use of your bank account to look throughout the lawful varieties you might have ordered formerly. Go to the My Forms tab of your respective bank account and get one more copy of the papers you require.

When you are a whole new consumer of US Legal Forms, allow me to share simple guidelines that you can comply with:

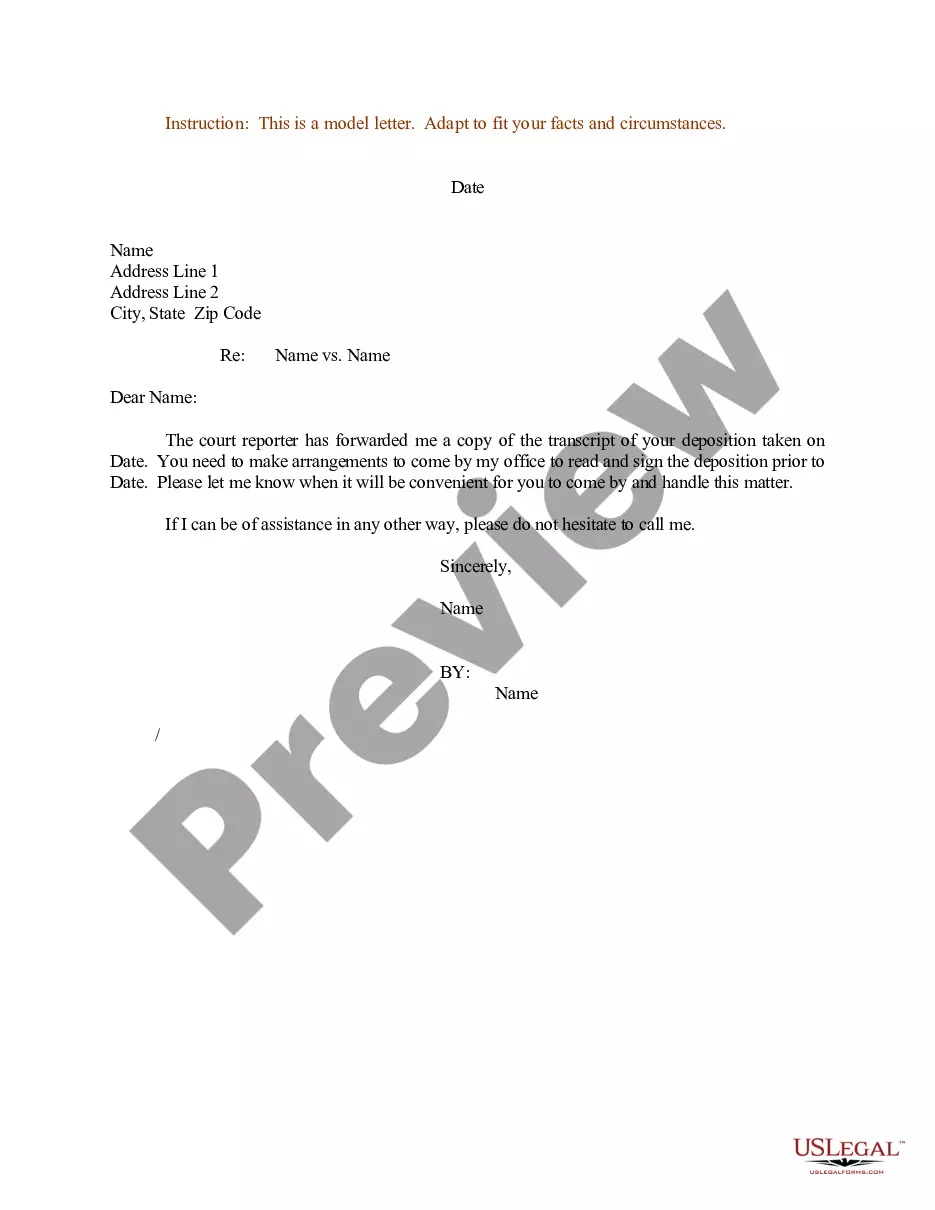

- Initial, make certain you have selected the right develop for your personal area/region. You can check out the form making use of the Preview option and read the form information to guarantee this is basically the best for you.

- When the develop is not going to meet your needs, take advantage of the Seach discipline to discover the correct develop.

- Once you are certain the form is proper, select the Purchase now option to obtain the develop.

- Choose the rates program you desire and type in the essential details. Make your bank account and pay for the order utilizing your PayPal bank account or bank card.

- Select the document formatting and download the lawful papers format to your device.

- Complete, edit and produce and indication the acquired Connecticut Business Deductions Checklist.

US Legal Forms is definitely the most significant library of lawful varieties that you can see different papers templates. Take advantage of the company to download expertly-produced paperwork that comply with status specifications.