Judicial lien is a lien obtained by judgment, levy, sequestration or other legal or equitable process or proceeding. If a court finds that a debtor owes money to a creditor and the judgment remains unsatisfied, the creditor can ask the court to impose a lien on specific property owned and possessed by the debtor. After imposing the lien, the court issues a writ directing the local sheriff to seize the property, sell it and turn over the proceeds to the creditor.

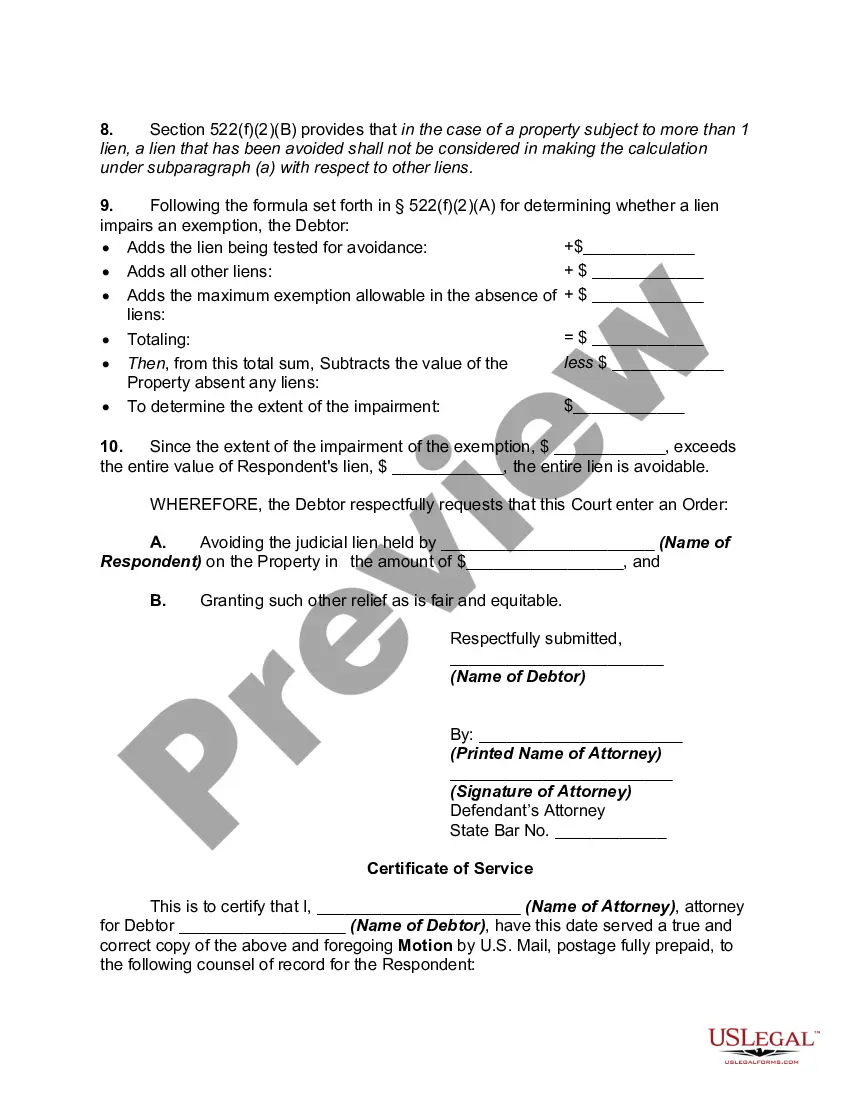

Under Bankruptcy proceedings, a creditor can obtain a judicial lien by filing a final judgment issued against a debtor through a lawsuit filed in state court. A certified copy of a final judgment may be filed in the county in which the debtor owns real property. A bankruptcy debtor can file a motion to avoid Judicial Lien. A Motion to avoid Judicial Lien can be filed by a debtor in either a chapter 7 or chapter 13 bankruptcy proceeding. In a Chapter 7 proceeding, an Order Avoiding Judicial Lien will remove the debt totally.

Connecticut Motion to Avoid Creditor's Lien is a legal process that allows individuals filing for bankruptcy in Connecticut to seek the removal or avoidance of a creditor's lien on certain property. A lien is a legal claim that a creditor has on a debtor's property as security for the repayment of a debt. By filing a motion to avoid a creditor's lien, individuals can potentially protect their property from being sold in order to satisfy outstanding debts. There are several types of Connecticut Motion to Avoid Creditor's Lien, including: 1. Connecticut Homestead Exemption: This type of motion is specifically used to protect a debtor's equity in their primary residence by utilizing the Connecticut homestead exemption. The Homestead Exemption allows individuals to shield a certain amount of equity in their home from being claimed by creditors during bankruptcy proceedings. 2. Motor Vehicle Lien Avoidance: This motion is designed to remove liens on vehicles owned by individuals filing for bankruptcy. By using specific exemptions, debtors can potentially retain possession of their motor vehicles by removing any liens that exist. 3. Personal Property Lien Avoidance: This motion allows debtors to avoid liens on personal property such as furniture, jewelry, electronics, or other valuable assets. By demonstrating that the lien impairs exemption rights, individuals can protect their personal property from being seized by creditors. 4. Judicial Lien Avoidance: This type of motion applies to any nonconsensual liens, including those obtained through legal proceedings such as lawsuits or judgments. Debtors can seek to avoid these liens by demonstrating that they compromise their exempt property or undermine their fresh start in the bankruptcy process. In Connecticut, the process of filing a Motion to Avoid a Creditor's Lien involves submitting a formal motion to the bankruptcy court, providing supporting documentation, and attending a hearing. It is crucial to consult with a knowledgeable bankruptcy attorney in Connecticut to navigate the complex legal procedures and ensure the best possible outcome in avoiding creditor's liens.Connecticut Motion to Avoid Creditor's Lien is a legal process that allows individuals filing for bankruptcy in Connecticut to seek the removal or avoidance of a creditor's lien on certain property. A lien is a legal claim that a creditor has on a debtor's property as security for the repayment of a debt. By filing a motion to avoid a creditor's lien, individuals can potentially protect their property from being sold in order to satisfy outstanding debts. There are several types of Connecticut Motion to Avoid Creditor's Lien, including: 1. Connecticut Homestead Exemption: This type of motion is specifically used to protect a debtor's equity in their primary residence by utilizing the Connecticut homestead exemption. The Homestead Exemption allows individuals to shield a certain amount of equity in their home from being claimed by creditors during bankruptcy proceedings. 2. Motor Vehicle Lien Avoidance: This motion is designed to remove liens on vehicles owned by individuals filing for bankruptcy. By using specific exemptions, debtors can potentially retain possession of their motor vehicles by removing any liens that exist. 3. Personal Property Lien Avoidance: This motion allows debtors to avoid liens on personal property such as furniture, jewelry, electronics, or other valuable assets. By demonstrating that the lien impairs exemption rights, individuals can protect their personal property from being seized by creditors. 4. Judicial Lien Avoidance: This type of motion applies to any nonconsensual liens, including those obtained through legal proceedings such as lawsuits or judgments. Debtors can seek to avoid these liens by demonstrating that they compromise their exempt property or undermine their fresh start in the bankruptcy process. In Connecticut, the process of filing a Motion to Avoid a Creditor's Lien involves submitting a formal motion to the bankruptcy court, providing supporting documentation, and attending a hearing. It is crucial to consult with a knowledgeable bankruptcy attorney in Connecticut to navigate the complex legal procedures and ensure the best possible outcome in avoiding creditor's liens.