Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement

Description

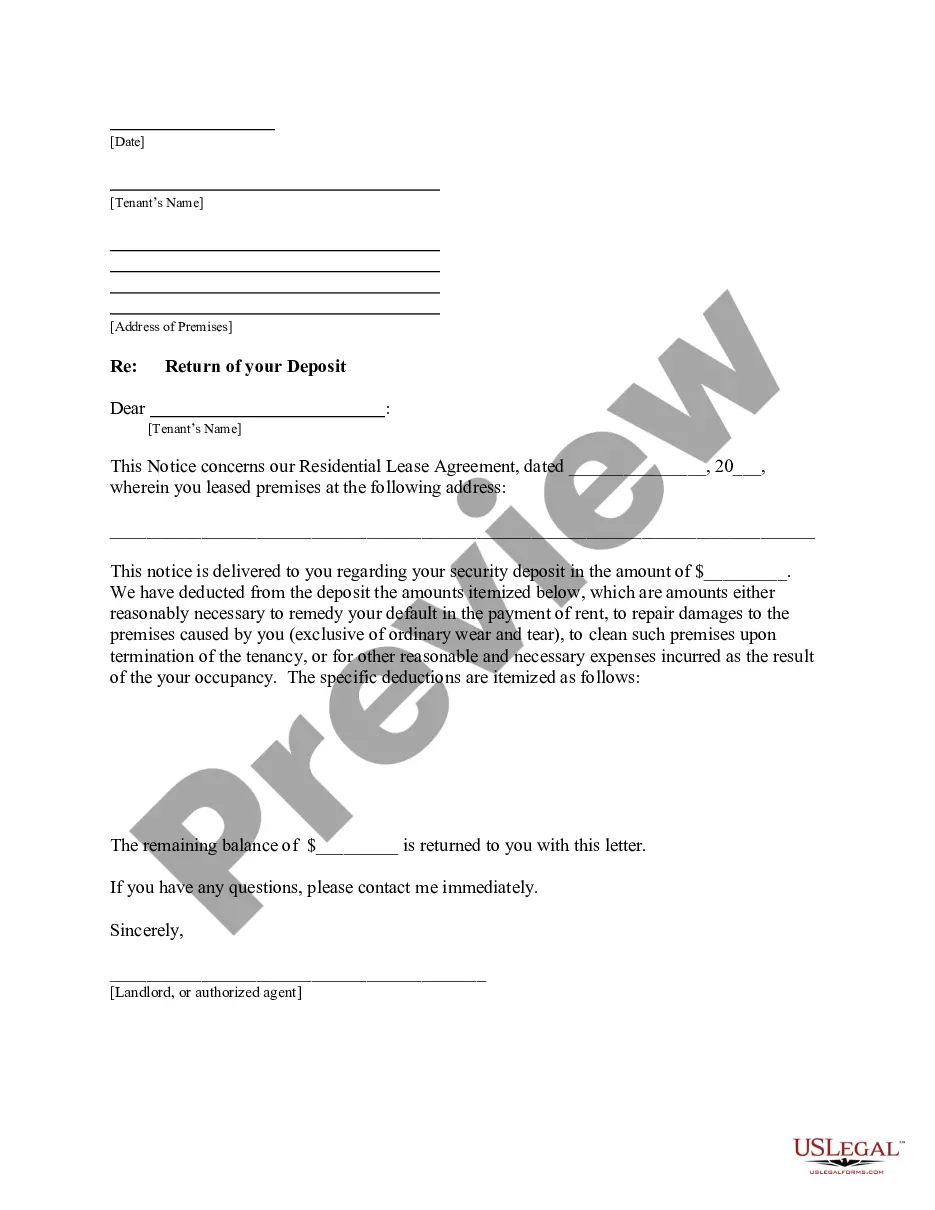

How to fill out Sample Letter For Policy On Vehicle Expense Reimbursement?

If you require complete, obtain, or print official document templates, utilize US Legal Forms, the most extensive assortment of legal forms, accessible online.

Utilize the site's straightforward and convenient search to access the documents you need.

A range of templates for commercial and personal purposes are categorized by types and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variants of the legal form template.

Step 4. Once you have identified the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Use US Legal Forms to obtain the Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement.

- You can also find forms you have previously obtained inside the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions provided below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to check the description.

Form popularity

FAQ

The amount reimbursed for mileage depends on the current reimbursement rate set by the IRS and the distance traveled for business purposes. It's advisable to maintain detailed records of your travel, as these will support your reimbursement claim. For a clear understanding of reimbursement calculations, a Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement offers a helpful framework.

Rules for mileage reimbursement usually include documentation of business-related travel, maintenance of accurate mileage logs, and adherence to IRS guidelines. Employers and employees should be well aware of these policies to ensure compliance and smooth reimbursement processes. A Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement can serve as a practical reference for understanding these rules.

The mileage reimbursement rate for 2025 in CT is typically determined by the IRS and can vary from year to year. Employers should stay updated on these rates to ensure fair compensation for their employees. Using a Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement can help address any changes in reimbursement rates effectively.

To politely ask for travel expenses, initiate the conversation by thanking the employer for the opportunity. Clearly express the expenses you incurred and provide relevant documentation. A well-organized Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement can help articulate your request in a considerate manner.

When asking for travel expenses for an interview, be polite and express your enthusiasm for the opportunity. Clearly state your request for reimbursement and mention the specific expenses incurred. A Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement can be an effective way to make your request seem professional and understandable.

Mileage reimbursement in CT allows employees to receive compensation for the miles driven while conducting business activities. This process helps employees recover costs associated with using their personal vehicles for work. Familiarizing yourself with the guidelines can be easier with tools like a Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement.

When asking for expenses, it’s essential to be polite and straightforward. Mention the context of your expenses and provide any supporting documentation. Utilizing a Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement can help structure your request professionally and clearly convey your needs.

To request travel reimbursement, draft a clear and concise email or letter outlining your travel details and expenses incurred. Provide all necessary receipts and documentation to validate your expenses. A Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement can provide a useful template to ensure you include all pertinent information for a successful request.

When you need to ask for travel expenses, it’s best to be direct and respectful. You can start by expressing appreciation for the opportunity and then clearly state your request for reimbursement. Using a Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement is an excellent way to present your case clearly and effectively.

CT mileage reimbursement refers to the compensation provided to employees for the use of their personal vehicles for business purposes. This compensation often covers fuel costs, wear and tear, and other vehicle-related expenses. Understanding the policies surrounding reimbursement is important, and a Connecticut Sample Letter for Policy on Vehicle Expense Reimbursement can help clarify these procedures for everyone involved.