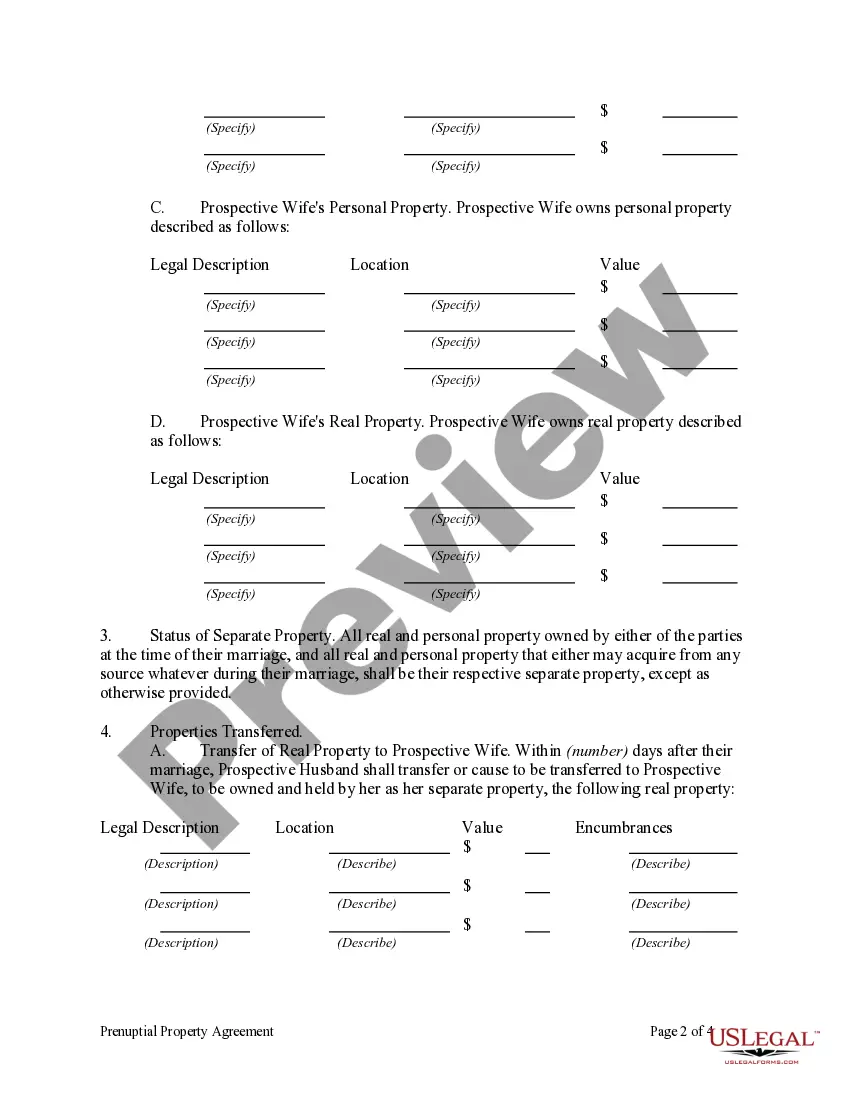

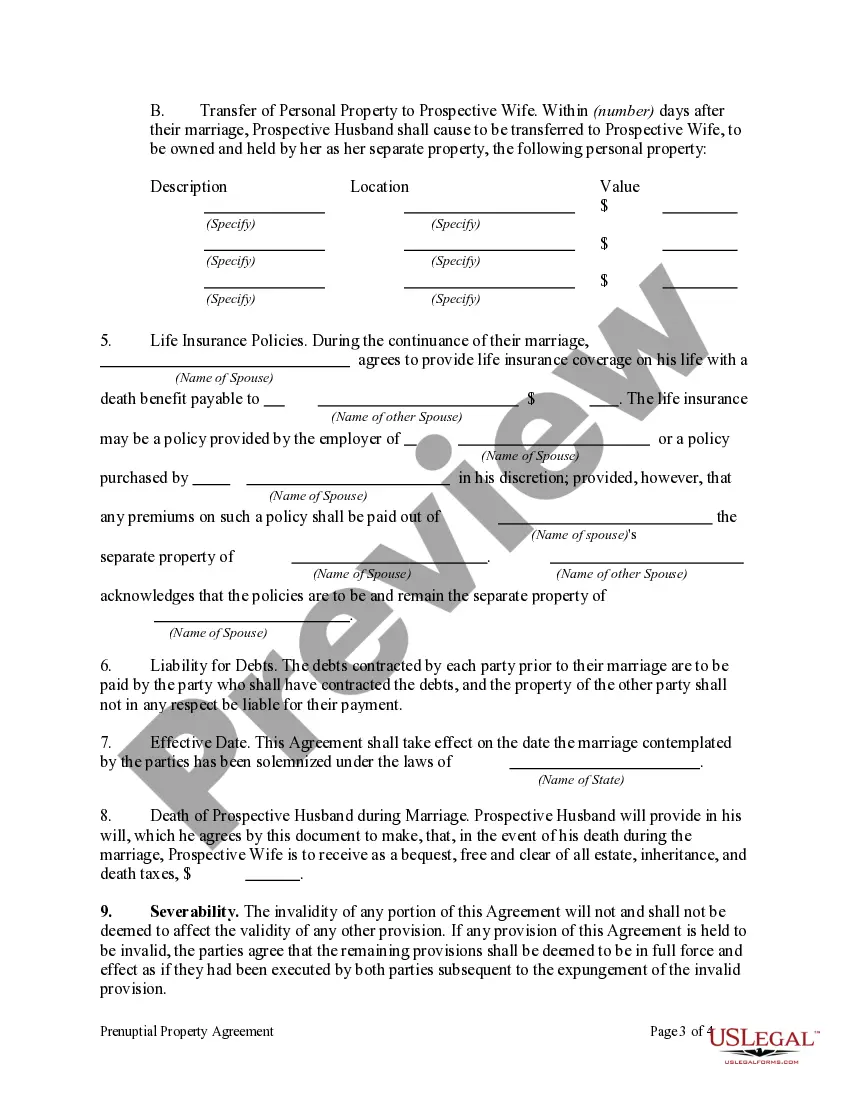

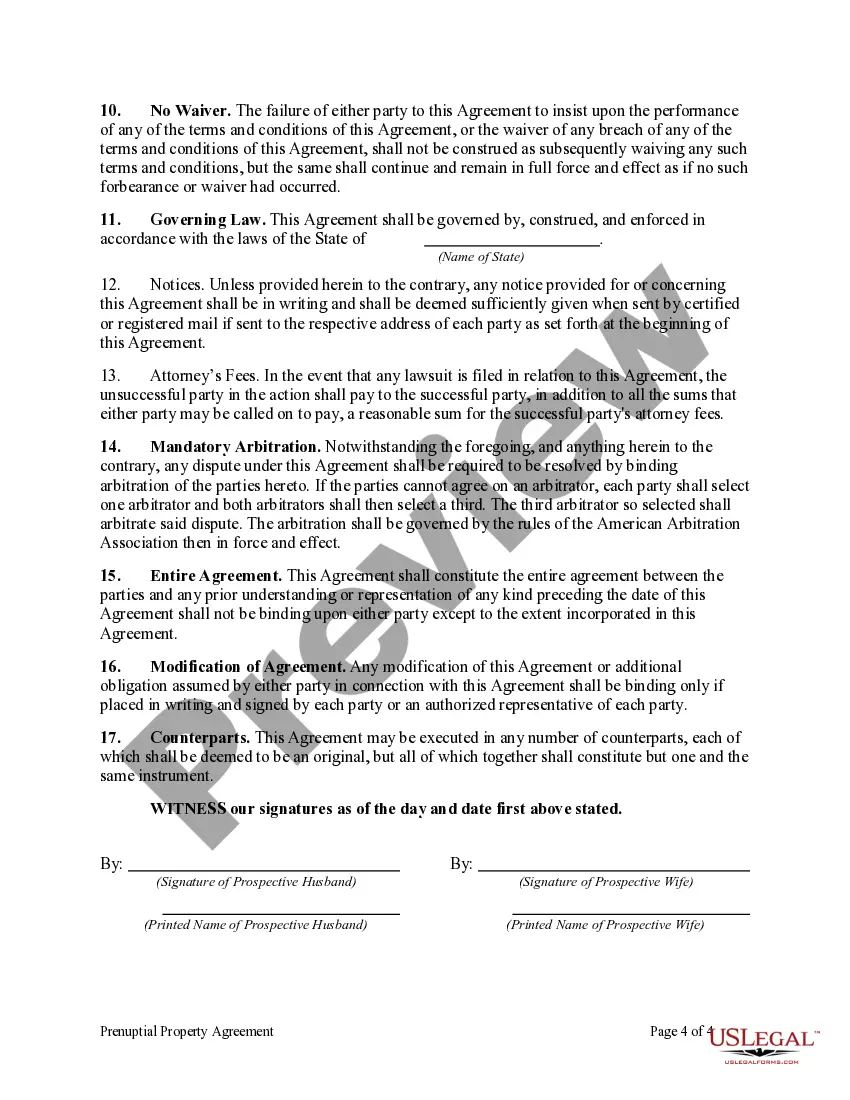

Connecticut Prenuptial Property Agreement, commonly referred to as a prenup, is a legally binding contract entered into by individuals intending to get married. This agreement outlines how the property and financial assets would be divided in the event of divorce, separation, or death. A Connecticut Prenuptial Property Agreement typically includes clauses addressing various aspects such as property division, spousal support, debt allocation, and estate planning. It allows couples to establish their own terms and conditions regarding the distribution of assets, protecting their individual rights and interests. In Connecticut, there are two types of prenuptial property agreements recognized by the state law: 1. Comprehensive Prenuptial Agreements: This type of agreement covers a wide range of financial matters, including the classification, division, and distribution of property, assets, debts, and spousal support. Comprehensive prenups allow couples to have more control over their financial futures and provide clarity and certainty in the event of a divorce. 2. Limited Scope Prenuptial Agreements: These agreements focus on specific assets, properties, or financial matters rather than addressing all aspects of the couple's finances. Limited scope prenups may be used in situations where one or both parties have particular assets they wish to protect, such as business interests, real estate, investments, or inheritances. It is important to note that Connecticut requires both parties to make full and fair financial disclosures during the creation of a prenuptial agreement, ensuring that all assets, liabilities, and income are transparently disclosed. Additionally, each party should seek independent legal advice before signing the agreement to ensure their rights and interests are protected. Connecticut Prenuptial Property Agreements are valuable legal tools that provide individuals with the opportunity to safeguard their assets and protect their financial well-being should their marriage end. By clearly outlining the division of property and financial responsibilities, a prenup can bring peace of mind to both partners and help facilitate a smoother resolution in the event of a divorce or separation.

Connecticut Prenuptial Property Agreement

Description

How to fill out Connecticut Prenuptial Property Agreement?

Have you been in the position in which you require paperwork for either enterprise or person functions just about every day? There are a lot of legitimate file web templates available online, but discovering versions you can rely is not effortless. US Legal Forms gives 1000s of kind web templates, such as the Connecticut Prenuptial Property Agreement, that are written to satisfy federal and state requirements.

Should you be currently familiar with US Legal Forms web site and possess your account, merely log in. Following that, you may download the Connecticut Prenuptial Property Agreement design.

If you do not have an accounts and need to begin to use US Legal Forms, follow these steps:

- Find the kind you will need and make sure it is to the appropriate city/area.

- Use the Review option to examine the shape.

- See the information to actually have selected the right kind.

- In case the kind is not what you`re looking for, make use of the Lookup area to get the kind that suits you and requirements.

- If you obtain the appropriate kind, just click Get now.

- Opt for the costs program you would like, submit the necessary info to generate your bank account, and pay for the order using your PayPal or credit card.

- Decide on a practical paper structure and download your version.

Locate all the file web templates you possess bought in the My Forms food list. You may get a extra version of Connecticut Prenuptial Property Agreement anytime, if necessary. Just go through the needed kind to download or produce the file design.

Use US Legal Forms, one of the most comprehensive variety of legitimate types, to save lots of time and stay away from blunders. The support gives professionally created legitimate file web templates that can be used for a range of functions. Create your account on US Legal Forms and start creating your way of life a little easier.