Connecticut Sample Letter for Tax Exemption - Scheduled Meeting

Description

How to fill out Sample Letter For Tax Exemption - Scheduled Meeting?

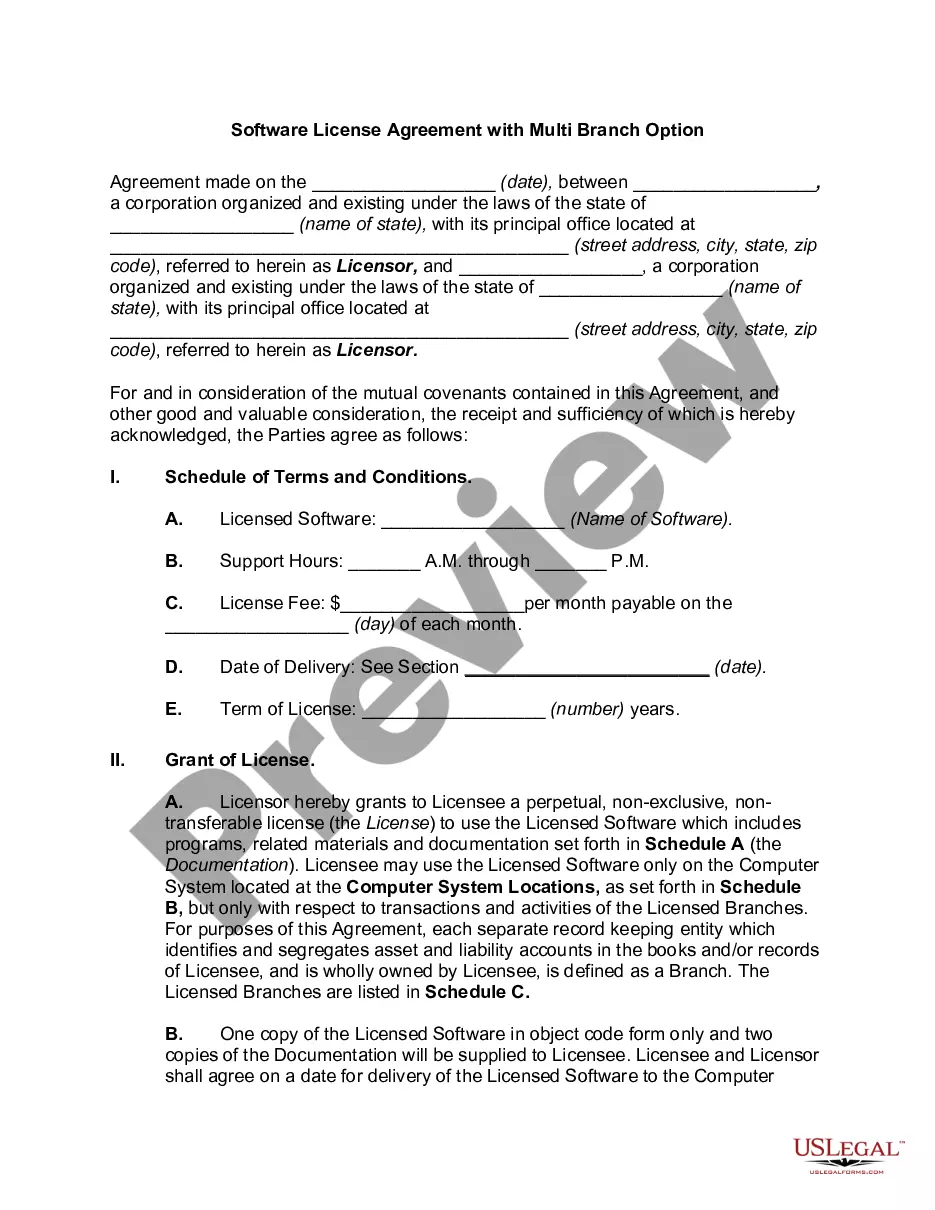

If you need to complete, acquire, or print out legitimate document templates, use US Legal Forms, the most important variety of legitimate types, which can be found on the web. Utilize the site`s basic and convenient research to discover the files you will need. A variety of templates for enterprise and person purposes are categorized by categories and states, or search phrases. Use US Legal Forms to discover the Connecticut Sample Letter for Tax Exemption - Scheduled Meeting in a couple of click throughs.

In case you are already a US Legal Forms buyer, log in to the account and click on the Download key to find the Connecticut Sample Letter for Tax Exemption - Scheduled Meeting. You may also gain access to types you earlier delivered electronically from the My Forms tab of your account.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for the proper city/land.

- Step 2. Make use of the Review option to look over the form`s content. Never neglect to read through the explanation.

- Step 3. In case you are unsatisfied together with the develop, use the Research industry towards the top of the screen to discover other models in the legitimate develop template.

- Step 4. After you have identified the form you will need, click the Get now key. Choose the pricing strategy you prefer and add your accreditations to sign up for an account.

- Step 5. Procedure the financial transaction. You may use your Мisa or Ьastercard or PayPal account to finish the financial transaction.

- Step 6. Find the formatting in the legitimate develop and acquire it on the device.

- Step 7. Comprehensive, revise and print out or indication the Connecticut Sample Letter for Tax Exemption - Scheduled Meeting.

Each and every legitimate document template you purchase is the one you have for a long time. You have acces to each and every develop you delivered electronically in your acccount. Click the My Forms segment and choose a develop to print out or acquire once more.

Remain competitive and acquire, and print out the Connecticut Sample Letter for Tax Exemption - Scheduled Meeting with US Legal Forms. There are thousands of specialist and express-specific types you may use to your enterprise or person requirements.

Form popularity

FAQ

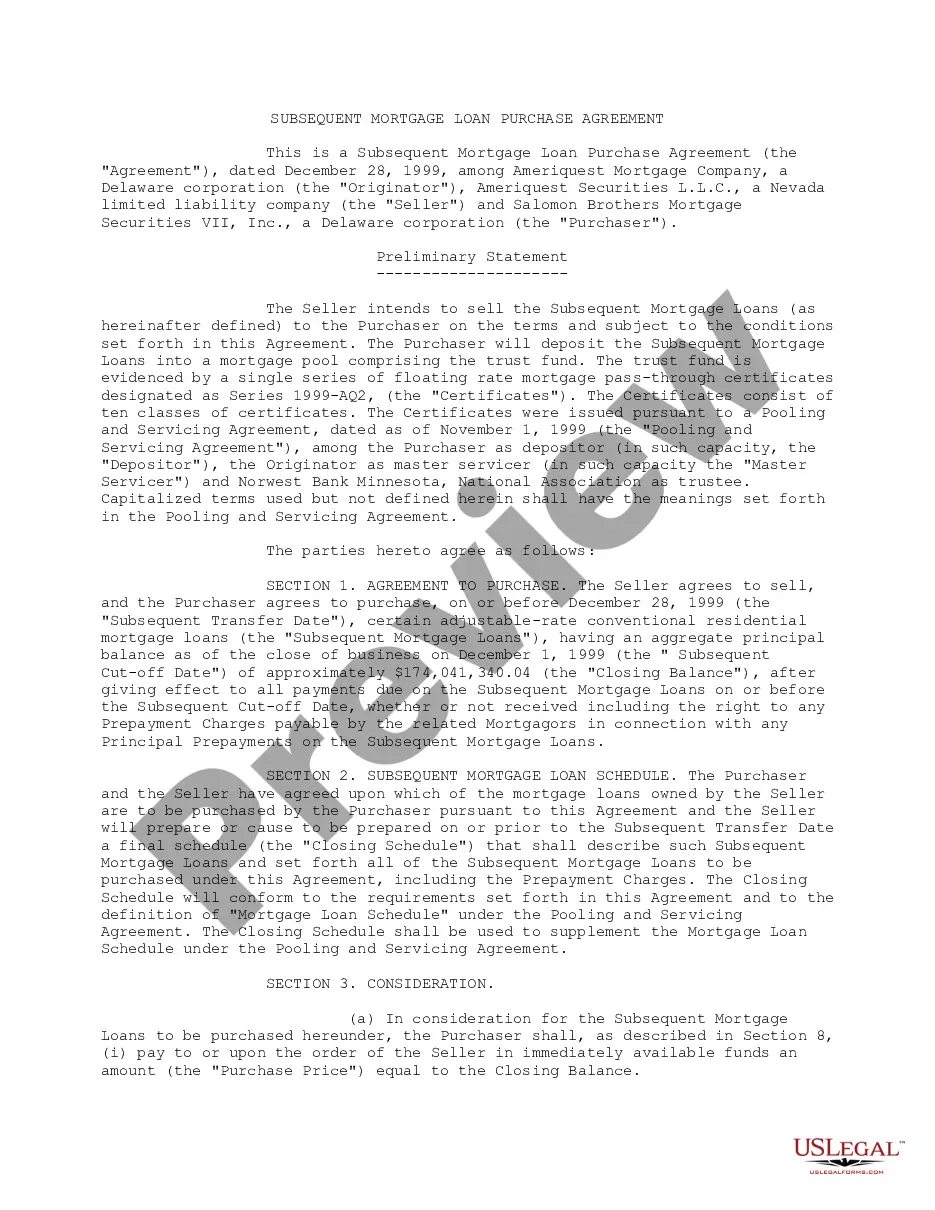

General Purpose: A qualifying exempt organization must issue this certificate to retailers when purchasing items to be used by the organization exclusively for the purposes for which it was established.

Different levels of real and personal property tax exemptions are available for different types of investments. For newly acquired and installed machinery and equipment eligible for five- to seven-year depreciation, the real and personal property tax exemption is 100% for five years.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

You may contact the IRS Tax Exempt and Government Entities Division for further information at 877-829-5500. Once you receive the determination letter a copy of the letter must be submitted with your Registration application to claim exemption from Connecticut sales and use taxes.

22-118 §408 (effective ). In addition, eligibility for the property tax credit is expanded to all adults within current income limits ($109,500 for single filers and $130,500 for joint filers). Previously, the property tax credit was limited to only those over the age of 65 or those with dependents. Conn.

The homestead exemption applies to the primary residence up to a value of $250,000, accounting for certain liens. For exemption purposes, a homestead is an owner-occupied real property, co-op or mobile manufactured home that is used as a primary residence.

To be eligible you must be a property owner or have life use. You or your spouse must have turned age 70 by December 31st, 2022.

State law authorizes various property tax exemptions for Connecticut residents, some of which are available in every city and town.