Connecticut Sample Letter for Deed of Trust and Promissory Note

Description

How to fill out Sample Letter For Deed Of Trust And Promissory Note?

You can devote hrs on-line searching for the legal record web template that fits the federal and state specifications you want. US Legal Forms offers thousands of legal types that are examined by specialists. It is simple to download or print the Connecticut Sample Letter for Deed of Trust and Promissory Note from your service.

If you already have a US Legal Forms profile, you may log in and click the Obtain key. Following that, you may total, change, print, or indication the Connecticut Sample Letter for Deed of Trust and Promissory Note. Every legal record web template you buy is your own property forever. To acquire another duplicate of any bought develop, proceed to the My Forms tab and click the related key.

Should you use the US Legal Forms internet site for the first time, adhere to the simple instructions under:

- Initially, make certain you have selected the proper record web template for the area/area that you pick. Read the develop explanation to make sure you have chosen the proper develop. If accessible, utilize the Review key to search from the record web template at the same time.

- In order to discover another model of your develop, utilize the Look for field to discover the web template that meets your requirements and specifications.

- Upon having discovered the web template you would like, just click Buy now to continue.

- Select the rates plan you would like, enter your accreditations, and register for an account on US Legal Forms.

- Total the purchase. You can use your bank card or PayPal profile to cover the legal develop.

- Select the format of your record and download it in your gadget.

- Make adjustments in your record if required. You can total, change and indication and print Connecticut Sample Letter for Deed of Trust and Promissory Note.

Obtain and print thousands of record templates utilizing the US Legal Forms website, that offers the largest assortment of legal types. Use specialist and condition-specific templates to take on your business or person requires.

Form popularity

FAQ

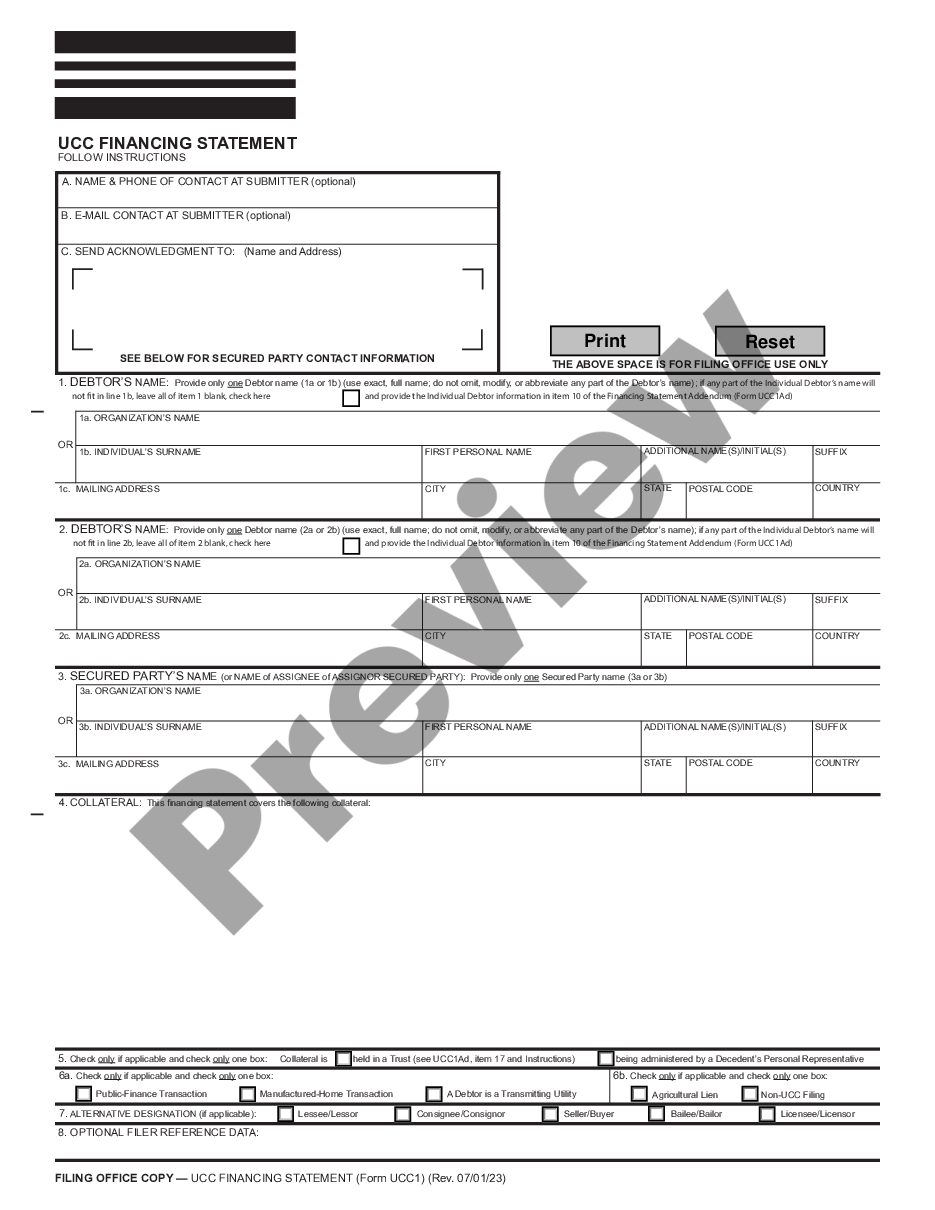

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A Standard Document used for transferring an interest in an unsecured promissory note to a revocable trust that can be customized for use in any US jurisdiction. This Standard Document contains integrated notes and drafting tips.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

A deed of trust, also called a trust deed, is the functional equivalent of a mortgage. It does not transfer the ownership of real property, as the typical deed does. Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan.

A promissory note is a kind of IOU that's secured by property, often property that the borrower owns. This type of loan secures the repayment from the borrower by coupling the deed of trust with the promissory note. The deed of trust acts as a promise from the borrower to repay the loan.

To Recap: The Deed is a recorded document memorializing the transfer of property from the Grantor to the Grantee. The Note is an unrecorded paper that binds an individual who has assumed debt through a promise-to-pay instrument.

The promissory note is held by the lender until the loan is paid in full, and generally is not recorded with the county recorder or registrar of titles (sometimes also referred to as the county clerk, register of deeds, or land registry) whereas a deed of trust is recorded.

The promissory note describes the debt's amount, interest rate, and late fees. A lender holds the promissory note until the mortgage loan is paid off. Unlike the mortgage or deed of trust, the promissory note is not entered into county land records.