Connecticut Self-Assessment Worksheet is a comprehensive tool designed to help individuals assess their personal, financial, and professional circumstances in the state of Connecticut. It is specifically tailored to the unique requirements and laws governing taxes, employment, and resident status in Connecticut. This self-assessment worksheet assists individuals in calculating their Connecticut state tax liability accurately, allowing them to determine if they meet the state's residency requirements. By carefully considering various factors such as duration of stay, sources of income, property ownership, and Connecticut-specific deductions and credits, individuals can evaluate their eligibility for resident status. This is crucial as it determines their tax obligations and access to state-specific benefits and services. Connecticut Self-Assessment Worksheet covers several areas, including income assessment, residency status evaluation, deductions and credits determination, and tax liability calculation. It prompts individuals to provide detailed information about their income sources, such as wages, self-employment income, interest, dividends, rental income, or capital gains. Individuals are also required to disclose any out-of-state income and taxes paid to determine their Connecticut tax liability accurately. The self-assessment worksheet offers guidance on determining residency status. It provides instructions on counting the number of days spent in Connecticut versus out-of-state, addressing the factors that might affect one's residency status. The worksheet also assists in identifying specific deductions and credits available to Connecticut residents, such as the Property Tax Credit, Child and Dependent Care Credit, Earned Income Tax Credit, and more. These deductions and credits can significantly impact an individual's overall tax liability. Different variations of the Connecticut Self-Assessment Worksheet may exist, targeting different groups or specific circumstances. Examples include: 1. Individual Resident Self-Assessment Worksheet: Tailored for individuals who are full-time residents of Connecticut, this worksheet guides residents through the process of assessing their income, deductions, credits, and tax liability. 2. Part-Year Resident Self-Assessment Worksheet: This worksheet is designed for individuals who have resided in Connecticut for only part of the tax year. It helps them determine their Connecticut tax liability proportionate to their residency period. 3. Non-Resident Self-Assessment Worksheet: Individuals who earn income from Connecticut sources but are not residents of the state can utilize this worksheet to assess their Connecticut tax liability based on income derived from within the state. In conclusion, the Connecticut Self-Assessment Worksheet is a valuable tool for individuals residing in or earning income from Connecticut. By utilizing this worksheet, individuals can accurately evaluate their residency status, calculate their tax liability, and assess eligibility for deductions and credits. It is important to refer to the specific worksheet that corresponds to an individual's residency status to ensure accurate assessment and compliance with Connecticut tax laws.

Connecticut Self-Assessment Worksheet

Description

How to fill out Connecticut Self-Assessment Worksheet?

Choosing the best authorized file web template could be a struggle. Naturally, there are a variety of layouts accessible on the Internet, but how do you obtain the authorized type you need? Use the US Legal Forms site. The service gives 1000s of layouts, including the Connecticut Self-Assessment Worksheet, that can be used for business and private demands. Each of the kinds are examined by professionals and fulfill state and federal needs.

If you are currently signed up, log in for your account and click the Acquire key to obtain the Connecticut Self-Assessment Worksheet. Utilize your account to search through the authorized kinds you possess bought in the past. Check out the My Forms tab of the account and get yet another copy in the file you need.

If you are a new end user of US Legal Forms, here are straightforward directions so that you can adhere to:

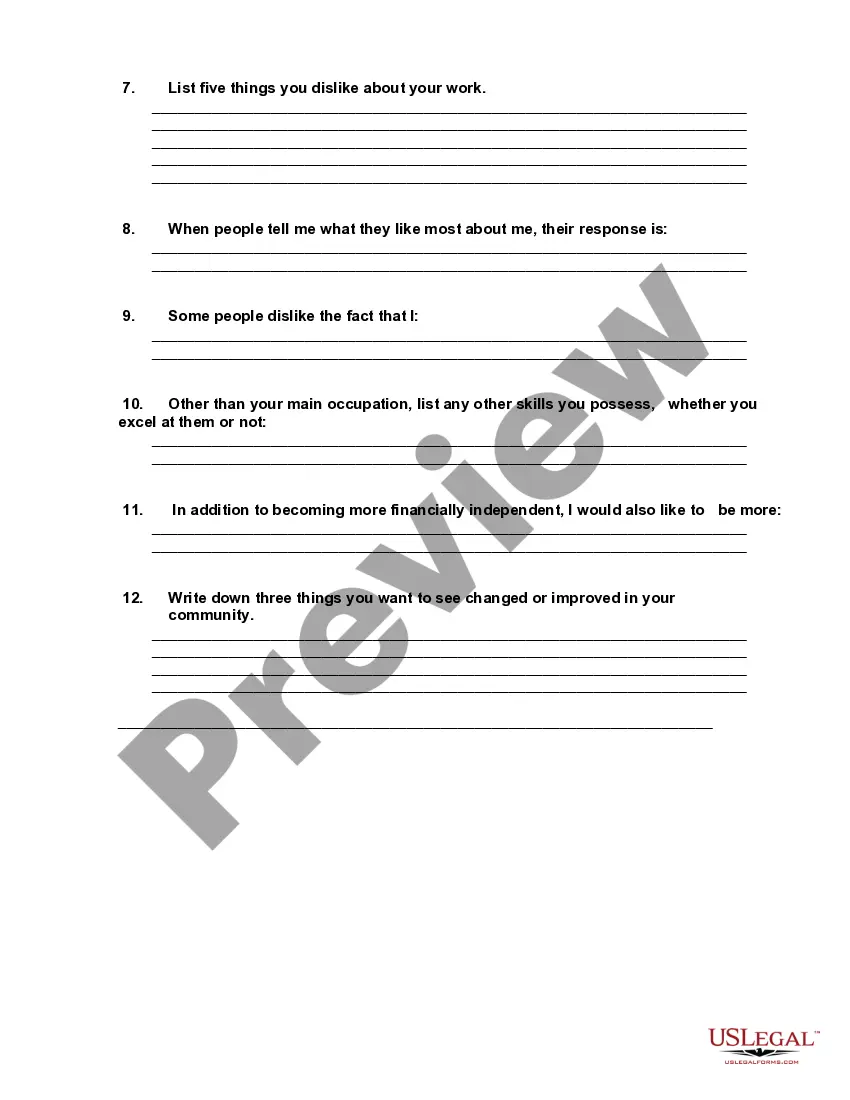

- Initial, make certain you have chosen the proper type for your town/area. You may examine the form making use of the Preview key and browse the form outline to guarantee this is the best for you.

- In the event the type will not fulfill your preferences, utilize the Seach discipline to get the proper type.

- Once you are certain that the form is acceptable, select the Acquire now key to obtain the type.

- Choose the pricing plan you desire and type in the needed information and facts. Make your account and purchase the order using your PayPal account or Visa or Mastercard.

- Opt for the document structure and down load the authorized file web template for your system.

- Full, change and printing and signal the attained Connecticut Self-Assessment Worksheet.

US Legal Forms is the most significant local library of authorized kinds that you will find numerous file layouts. Use the company to down load appropriately-manufactured documents that adhere to state needs.