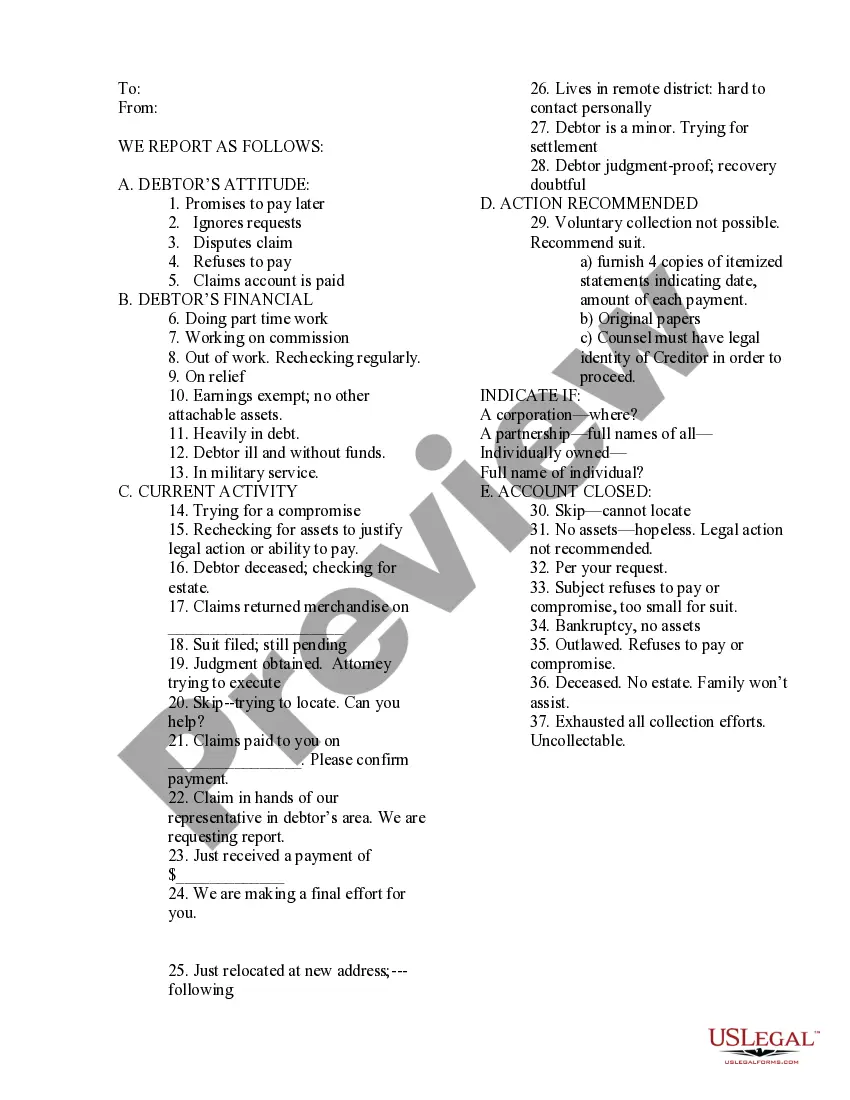

Connecticut Collection Report

Description

How to fill out Collection Report?

You might spend multiple hours online looking for the appropriate legal document format that meets the local and federal requirements you need.

US Legal Forms provides a vast array of legal documents that are reviewed by specialists.

It is easy to obtain or print the Connecticut Collection Report from the service.

If available, utilize the Review button to view the document format simultaneously. To find another version of the form, use the Search field to locate the format that meets your needs.

- If you have a US Legal Forms account, you can Log In to the site and click on the Download button.

- Afterward, you can complete, modify, print, or sign the Connecticut Collection Report.

- Every legal document format you acquire is yours permanently.

- To download another copy of any purchased form, visit the My documents tab and click on the relevant button.

- If you're using the US Legal Forms website for the first time, follow the simple steps provided.

- First, ensure you have selected the correct document format for your chosen state/region.

- Read the form description to confirm you’ve selected the right one.

Form popularity

FAQ

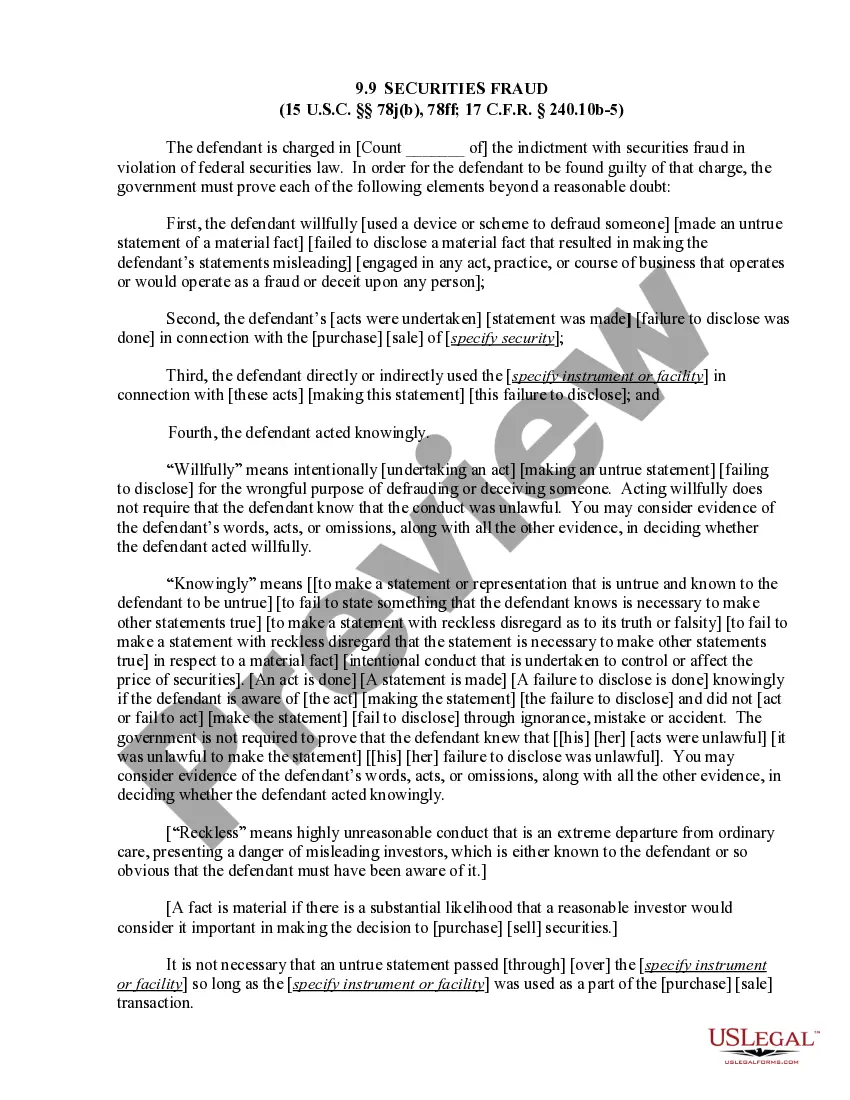

A judgment in Connecticut generally lasts for 20 years from the date it was entered. If not renewed, it may expire after this period, making it uncollectible. To ensure your judgment remains valid for the full term, consider monitoring the status and taking appropriate actions when necessary. Resources like the Connecticut Collection Report offer valuable information on maintaining judgments effectively.

If you don't go to court for a judgment in Connecticut, the court may issue a default judgment against you. This means the creditor automatically wins the case, and you may face significant financial consequences. Additionally, the judgment can appear on your credit report, negatively affecting your credit score. To avoid this, consider using resources like the Connecticut Collection Report for guidance.

Check Your Credit Report The first thing to do to find out if you have debt in collections is review your credit report. You can obtain a free credit report from each of the three major credit bureaus Equifax, Experian and TransUnion once every 12 months from AnnualCreditReport.com.

Collection accounts stay on the credit report for seven years from the original delinquency date of the original debt, or the date of the first missed payment after which the account was no longer brought current.

A collection account will be automatically removed from your credit report seven years after the original account went delinquent. The original delinquency date is when your account first became 30 days past due, kicking off the series of missed payments that ended with your account going to collections.

Old (Time-Barred) Debts In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

STATUTE OF LIMITATIONS FOR DEBT COLLECTION Creditors attempting to collect past-due debt, must bring an action in court (known as an action for account) within six years of the time the right of action accrues or the claim is barred by operation of the statute.

Connecticut has a six-year statute of limitations for debt collection actions resulting from simple and implied contracts (CGS § 52-576; attachment 1). Medical bills generally are simple or implied contracts and thus the SOL is six years.

To find out what you have in collections, you will need to check your latest credit reports from each of the 3 credit bureaus. Collection agencies are not required to report their account information to all three of the national credit reporting agencies.