Connecticut Checklist — Sale of a Business: A Comprehensive Guide When it comes to the sale of a business in Connecticut, there are several crucial steps and considerations to keep in mind. This checklist aims to provide a detailed overview of the essential elements involved in successfully selling a business in the state. Whether you are a buyer or a seller, understanding and adhering to this comprehensive checklist will ensure a smooth and legally sound transaction. 1. Business Valuation: Before listing your business for sale, it is crucial to determine its value accurately. Hire a professional business appraiser who specializes in Connecticut businesses to evaluate your company and provide an accurate valuation. 2. Confidentiality Agreements: Protecting the sensitive information of your business during the sale process is crucial. Prepare confidentiality agreements (also known as non-disclosure agreements or NDAs) to be signed by prospective buyers before sharing any confidential information. 3. Financial Information: Gather and organize your financial records, including tax returns, income statements, balance sheets, and other relevant financial documents. This includes historical financial data as well as projections for the future. 4. Marketing Strategy: Develop a comprehensive marketing strategy to attract potential buyers. Utilize both traditional means, such as advertising in local newspapers and industry publications, as well as digital platforms, like business-for-sale websites and social media. 5. Engage Professionals: Hire an experienced business broker, attorney, and accountant who specialize in business sales in Connecticut. These professionals will guide you through the legal and financial aspects of the transaction, ensuring compliance with state laws and regulations. 6. Due Diligence: Prepare a due diligence package that includes all relevant information about your business. This package should include financial statements, customer contracts, lease agreements, employee records, and any other legal documents related to the business. 7. Negotiations: Once potential buyers express interest, conduct negotiations regarding the sale price, terms, and conditions. Be prepared to negotiate on various aspects, including the transfer of assets, non-compete agreements, and seller financing, if applicable. 8. Purchase Agreement: Engage your attorney to draft a comprehensive purchase agreement, detailing the terms and conditions of the sale. This legally binding document will encompass various aspects such as the purchase price, payment terms, warranties, and representations. 9. Required Licenses and Permits: Ensure that all necessary licenses and permits required to operate the business are transferred to the buyer as part of the sale process. Liaise with relevant authorities and agencies to facilitate a smooth transfer of licenses. 10. Closing and Transition: Plan for a smooth transition of ownership and operations. Schedule a closing date with all parties involved, and make necessary arrangements for transfer of assets, licenses, and contracts. Types of Connecticut Checklists — Sale of a Business: 1. Checklist for Selling a Retail Business in Connecticut 2. Checklist for Selling a Restaurant or Food Services Business in Connecticut 3. Checklist for Selling a Manufacturing Business in Connecticut 4. Checklist for Selling a Service-based Business in Connecticut 5. Checklist for Selling a Professional Practice (Medical, Legal, Accounting) in Connecticut Each type of business sale checklist will have specific considerations and steps unique to the industry or nature of the business being sold. It is essential to consult with industry-specific professionals to ensure the checklist meets the requirements of your particular business type. Remember, selling a business involves complex legal and financial considerations that vary depending on the specific circumstances. It is crucial to consult with professionals and seek legal advice throughout the entire process to ensure a successful and legally sound sale.

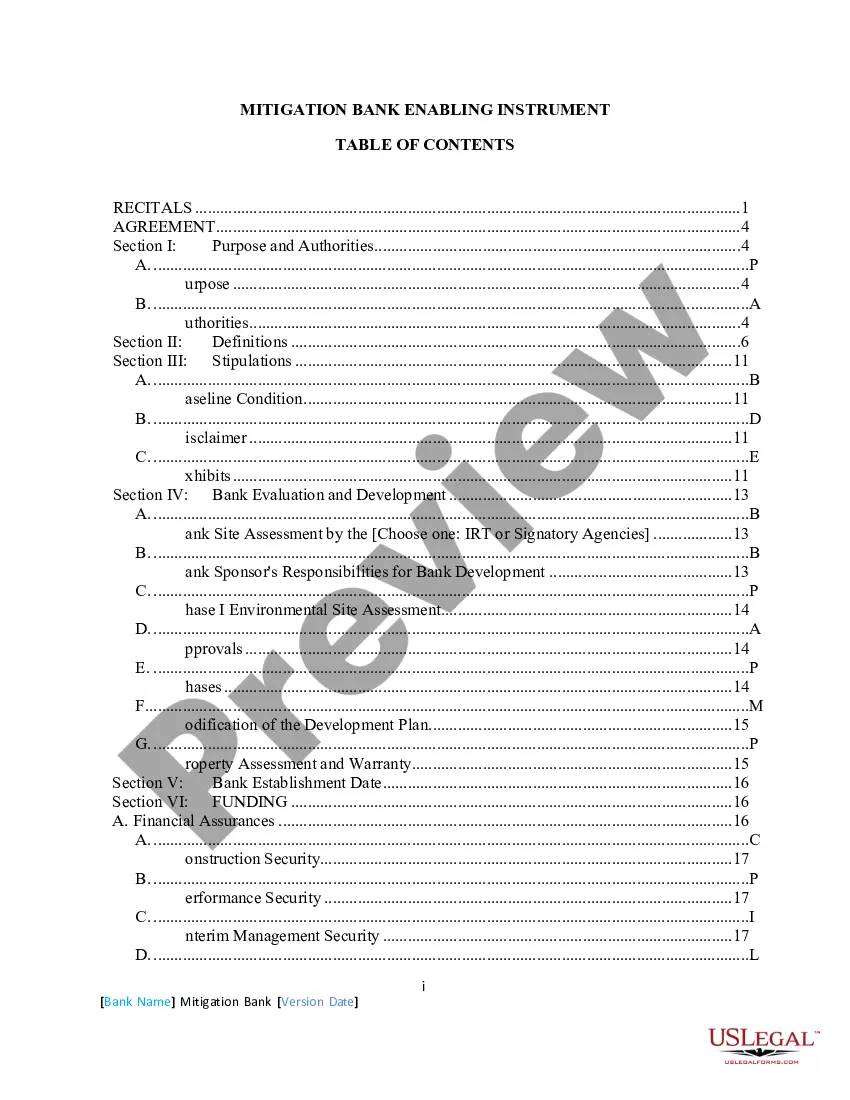

Connecticut Checklist - Sale of a Business

Description

How to fill out Connecticut Checklist - Sale Of A Business?

If you wish to comprehensive, download, or produce lawful file web templates, use US Legal Forms, the greatest assortment of lawful kinds, that can be found on the Internet. Use the site`s simple and handy lookup to get the papers you want. Different web templates for company and individual purposes are sorted by types and says, or keywords and phrases. Use US Legal Forms to get the Connecticut Checklist - Sale of a Business with a couple of mouse clicks.

Should you be presently a US Legal Forms buyer, log in to the profile and then click the Download option to find the Connecticut Checklist - Sale of a Business. You can even access kinds you previously acquired within the My Forms tab of your profile.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the shape for the proper city/region.

- Step 2. Make use of the Preview choice to look over the form`s content material. Never overlook to read through the explanation.

- Step 3. Should you be unsatisfied together with the form, utilize the Search discipline towards the top of the monitor to discover other models of your lawful form design.

- Step 4. When you have found the shape you want, click the Acquire now option. Opt for the pricing strategy you prefer and put your qualifications to register to have an profile.

- Step 5. Process the deal. You can use your Мisa or Ьastercard or PayPal profile to accomplish the deal.

- Step 6. Choose the file format of your lawful form and download it on your system.

- Step 7. Complete, change and produce or sign the Connecticut Checklist - Sale of a Business.

Each and every lawful file design you get is the one you have forever. You possess acces to each and every form you acquired with your acccount. Select the My Forms segment and choose a form to produce or download again.

Be competitive and download, and produce the Connecticut Checklist - Sale of a Business with US Legal Forms. There are thousands of specialist and state-specific kinds you may use for your personal company or individual needs.