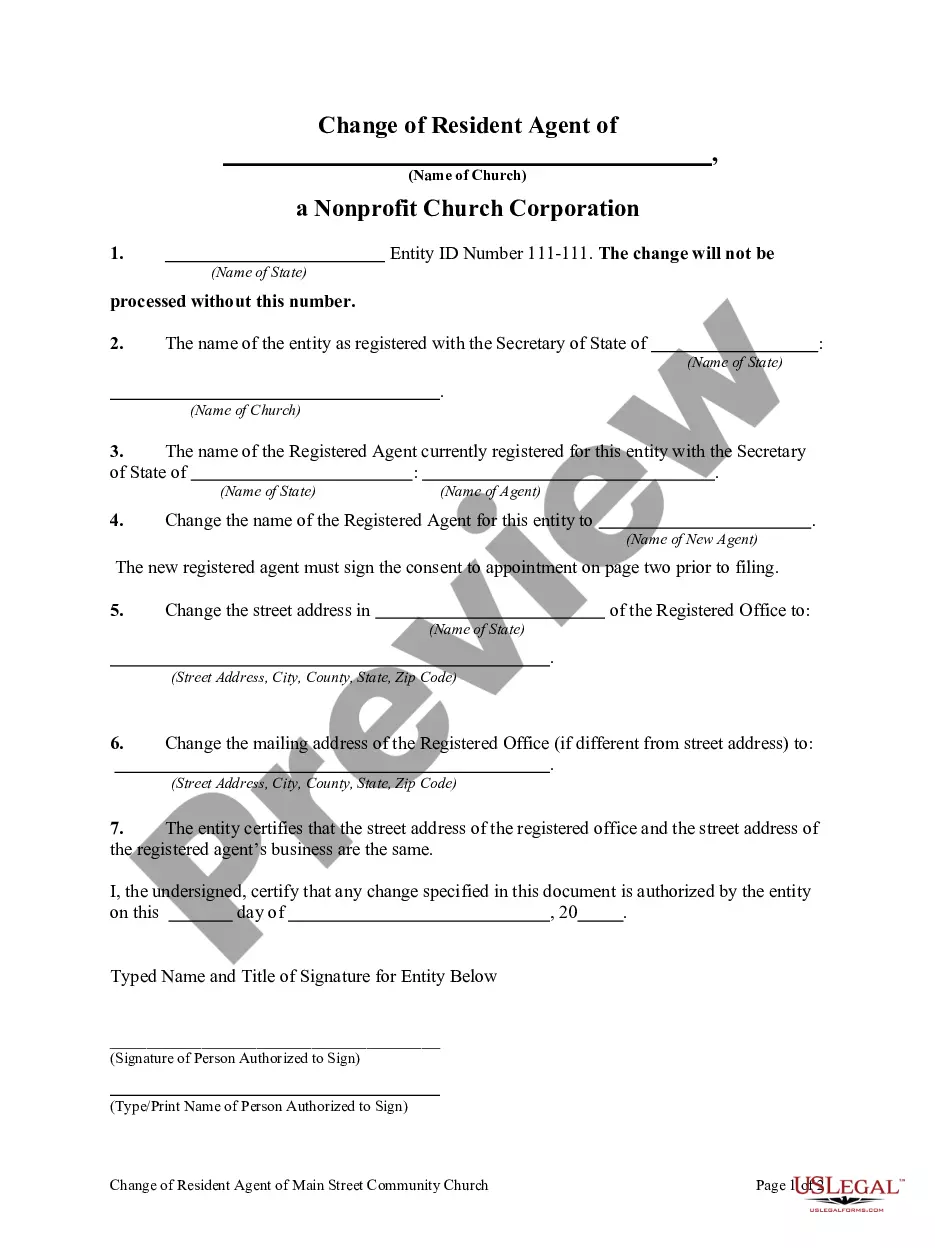

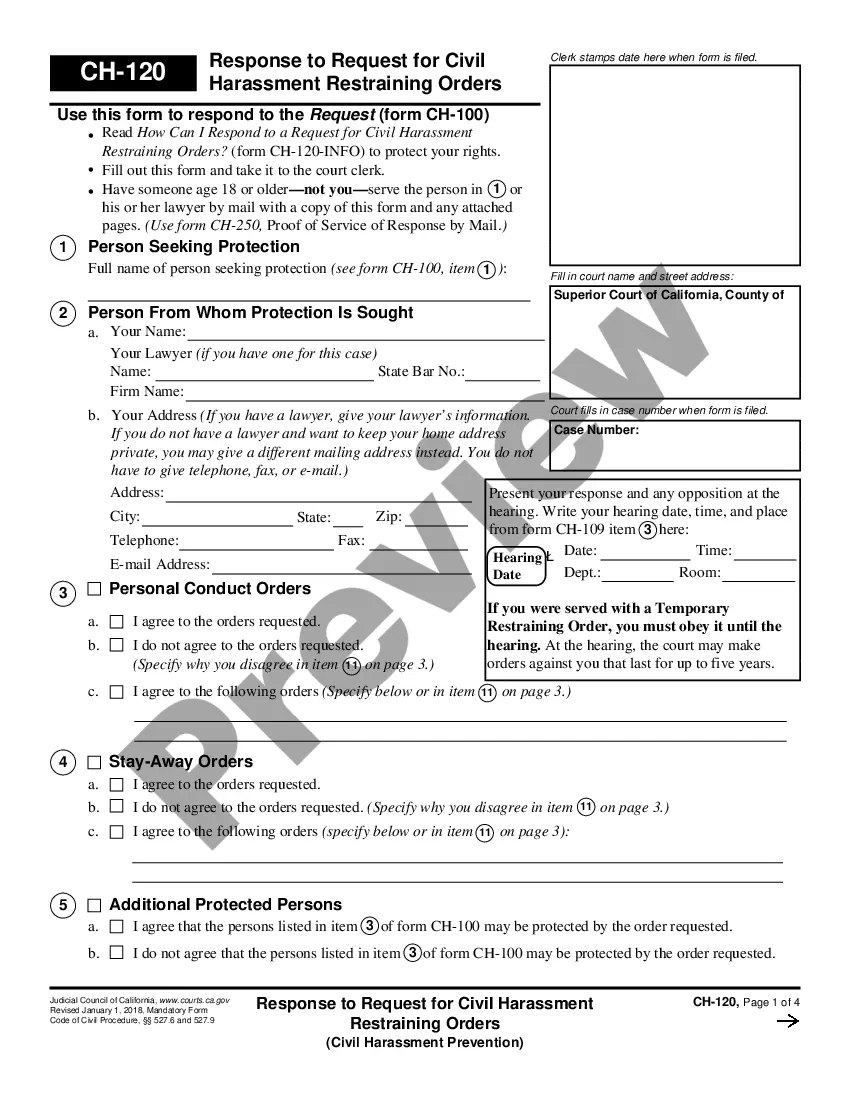

This form is used as formal notice to the state of a change in resident agent.

Connecticut Change of Resident Agent for Non-Profit Church Corporation: A Detailed Description Introduction: When operating a non-profit church corporation in Connecticut, there may come a time when the designated registered agent needs to be changed. A registered agent serves as the primary point of contact for receiving legal and official documents on behalf of the corporation. This article provides a detailed description of the process for changing the resident agent of a non-profit church corporation in Connecticut, including the necessary steps and key considerations. Keywords: Connecticut, Change of Resident Agent, Non-Profit Church Corporation, registered agent, legal documents, official documents, process, steps, key considerations. 1. Understanding the Change of Resident Agent: Changing the resident agent of a non-profit church corporation in Connecticut involves updating the legal representative responsible for receiving important documents. It is essential to ensure that the corporation can maintain compliance with state laws and regulations. 2. Types of Change of Resident Agent: In Connecticut, there may be different types of change of resident agent for non-profit church corporations. These variations may depend on specific circumstances such as: a) Change of Resident Agent within the Same Corporation: This type of change occurs when there is a need to replace the existing resident agent with a new individual or entity while retaining the same non-profit church corporation. b) Change of Resident Agent due to Relocation: If the non-profit church corporation physically relocates within Connecticut, it may be necessary to change the resident agent to someone located in the new designated address. c) Change of Resident Agent due to Dissolution: In some cases, a non-profit church corporation in Connecticut might dissolve, and therefore, the resident agent would need to be changed to reflect this change in status. 3. Steps to Change the Resident Agent: To successfully change the resident agent for a non-profit church corporation in Connecticut, follow these steps: a) Identify the New Resident Agent: Carefully select an individual or entity eligible to act as a registered agent, ensuring they meet the legal requirements set by the Connecticut Secretary of State. b) Prepare Change of Resident Agent Form: Obtain the necessary form (typically available on the Connecticut Secretary of State's website) for changing the resident agent of a non-profit church corporation. Complete the form accurately, providing the necessary information. c) Filing the Form: Submit the completed form, along with any required fees, to the Connecticut Secretary of State. Ensure all details are accurate and legible. d) Notification of Change: Notify the previous resident agent about the change and provide them with a copy of the filed form for their records. 4. Key Considerations: When undergoing a change of resident agent for a non-profit church corporation in Connecticut, keep the following considerations in mind: a) Eligibility Requirements: Ensure the new resident agent meets all the eligibility requirements determined by Connecticut law, such as being a registered business entity or a resident individual. b) Timely Filing: Submit the change of resident agent form promptly to avoid any potential disruptions in receiving crucial legal and official documents. c) Compliance: Maintain compliance with all Connecticut laws and regulations applicable to non-profit church corporations during the change of resident agent process. Conclusion: Understanding the process and types of Connecticut change of resident agent for non-profit church corporations is essential for any organization. By following the necessary steps and considering key factors, corporations can efficiently update their resident agent to ensure seamless operations and legal compliance.