Dear [Tax Authority's Name], I am writing to submit our corporate tax return for the tax year ending [year] in accordance with the requirements set forth by the state of Connecticut. Our company, [Company Name], is a legally registered corporation in the state and all information provided in this return is accurate and complete to the best of our knowledge. Please find enclosed the necessary documents and forms required for filing our corporate tax return. These include: 1. Form CT-1120: This form serves as the main document for reporting our company's income, deductions, credits, and tax liability for the tax year in question. We have meticulously filled out all sections and attached relevant schedules as per the instructions provided with the form. 2. Schedule A: This schedule outlines the details of our company's apportionment and demonstrates our nexus within Connecticut. It provides a breakdown of our property, payroll, and sales factors for determining our state tax liability. 3. Schedule B: Here, we have disclosed any additions, subtractions, or modifications to our federal taxable income, as required by Connecticut state tax regulations. We have carefully calculated and included all necessary adjustments, such as bonuses, interest expenses, depreciation, and amortization. 4. Schedule C: This schedule focuses on the various tax credits or incentives that our company may be eligible for under Connecticut law. We have diligently reviewed the available options and, where applicable, claimed the appropriate credits, such as research and development or job creation incentives. 5. Supporting Documents: Alongside the aforementioned forms and schedules, we have included copies of relevant federal tax returns, financial statements, payroll records, sales records, and any other records deemed necessary to substantiate the accuracy of the information provided. We understand the importance of filing our corporate tax return within the designated deadline and, therefore, assure you that this submission has been made on time. Should you require any additional information or have any questions concerning our tax return, please do not hesitate to contact our designated representative, [Contact Name], at [Contact Details]. We are more than willing to cooperate and provide any further documentation or clarification required. Thank you for your attention to this matter. We appreciate the diligent work and support provided by the Connecticut Department of Revenue Services in ensuring a fair and accurate tax reporting process. We remain committed to complying with all applicable tax laws and regulations as responsible corporate citizens. Sincerely, [Your Name] [Company Name] [Company Address] [City, State, ZIP] [Phone Number] [Email Address] Keywords: Connecticut, sample letter, corporate tax return, Form CT-1120, Schedule A, Schedule B, Schedule C, tax credits, tax incentives, financial statements, payroll records, sales records, tax regulations, tax liability, tax reporting, tax laws, corporate citizens, tax authority.

Connecticut Sample Letter for Corporate Tax Return

Description

How to fill out Connecticut Sample Letter For Corporate Tax Return?

US Legal Forms - among the largest libraries of authorized types in the States - provides an array of authorized file templates you can acquire or produce. Utilizing the web site, you may get a large number of types for company and person uses, sorted by types, suggests, or keywords and phrases.You can find the latest models of types like the Connecticut Sample Letter for Corporate Tax Return within minutes.

If you already have a subscription, log in and acquire Connecticut Sample Letter for Corporate Tax Return from your US Legal Forms catalogue. The Acquire button will show up on every single type you perspective. You get access to all formerly saved types from the My Forms tab of your own bank account.

If you wish to use US Legal Forms the very first time, listed here are simple directions to help you get started off:

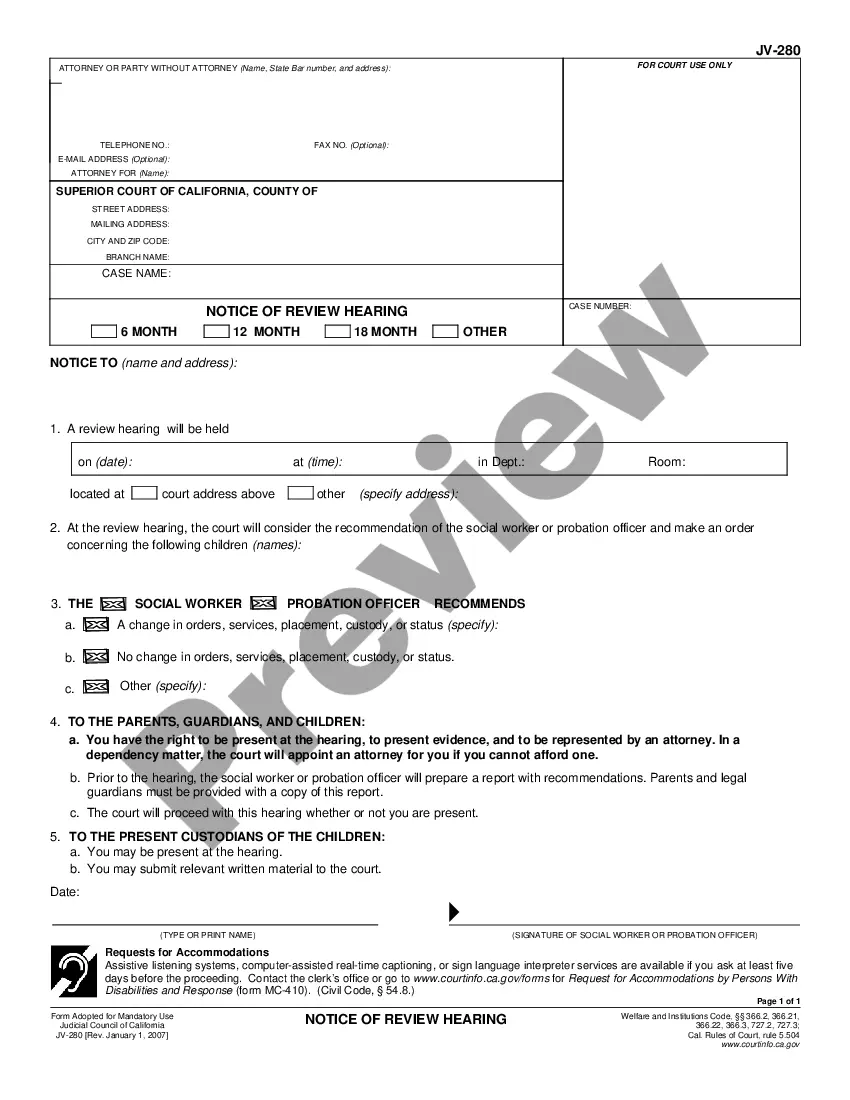

- Ensure you have chosen the best type for the town/area. Click the Review button to analyze the form`s articles. See the type outline to actually have selected the correct type.

- In case the type doesn`t match your specifications, use the Research industry on top of the screen to get the one that does.

- In case you are pleased with the shape, confirm your choice by clicking on the Get now button. Then, choose the rates program you favor and supply your accreditations to register on an bank account.

- Approach the financial transaction. Use your charge card or PayPal bank account to accomplish the financial transaction.

- Choose the formatting and acquire the shape in your device.

- Make alterations. Fill out, change and produce and signal the saved Connecticut Sample Letter for Corporate Tax Return.

Every template you included with your money lacks an expiration date and is your own for a long time. So, if you want to acquire or produce yet another duplicate, just check out the My Forms section and click about the type you want.

Gain access to the Connecticut Sample Letter for Corporate Tax Return with US Legal Forms, probably the most substantial catalogue of authorized file templates. Use a large number of skilled and express-specific templates that meet up with your small business or person requires and specifications.

Form popularity

FAQ

Form 1120-C If the corporation's principal business, office, or agency is located in:Use the following IRS center address:The United StatesDepartment of the Treasury Internal Revenue Service Ogden, UT 84201-0012A foreign country or U.S. possessionInternal Revenue Service PO Box 409101 Ogden, UT 84409

Form CT-1120, Corporation Business Tax Return, is used to compute tax both on a net income basis and on a capital stock basis. Tax is paid on the basis that yields the higher tax. The minimum tax is $250.

Every corporation must file a return on or before the fifteenth day of the month following the due date of the corporation's corresponding federal income tax return for the income year (May 15 for calendar year taxpayers).

Connecticut Corporation Business Tax. Return Instructions. For additional information on the Connecticut Corporation Business Tax, visit portal.ct.gov/DRS/Corporation-Tax/ Tax-Information.

Corporation Business Tax Surcharge Extended The surcharge is 10% of a taxpayer's CBT owed. It continues to apply to companies that have more than $250 in CBT liability and (1) have at least $100 million in gross income for that year or (2) file unitary combined returns.

No matter what kind of business entity you have, including a corporation, you'll need to provide the following documentation: Estimated tax payment receipts. Year-end balance sheet and profit & loss statement. Year-end business bank account and investment account statements.

Every corporation must file a return on or before the fifteenth day of the month following the due date of the corporation's corresponding federal income tax return for the income year (May 15 for calendar year taxpayers).

Use Form CT-1120 MEC to claim the credit available under Conn. Gen. Stat. § 12-217o for the incremental increase in the amount spent by a corporation on machinery and equipment.