Connecticut Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure

Description

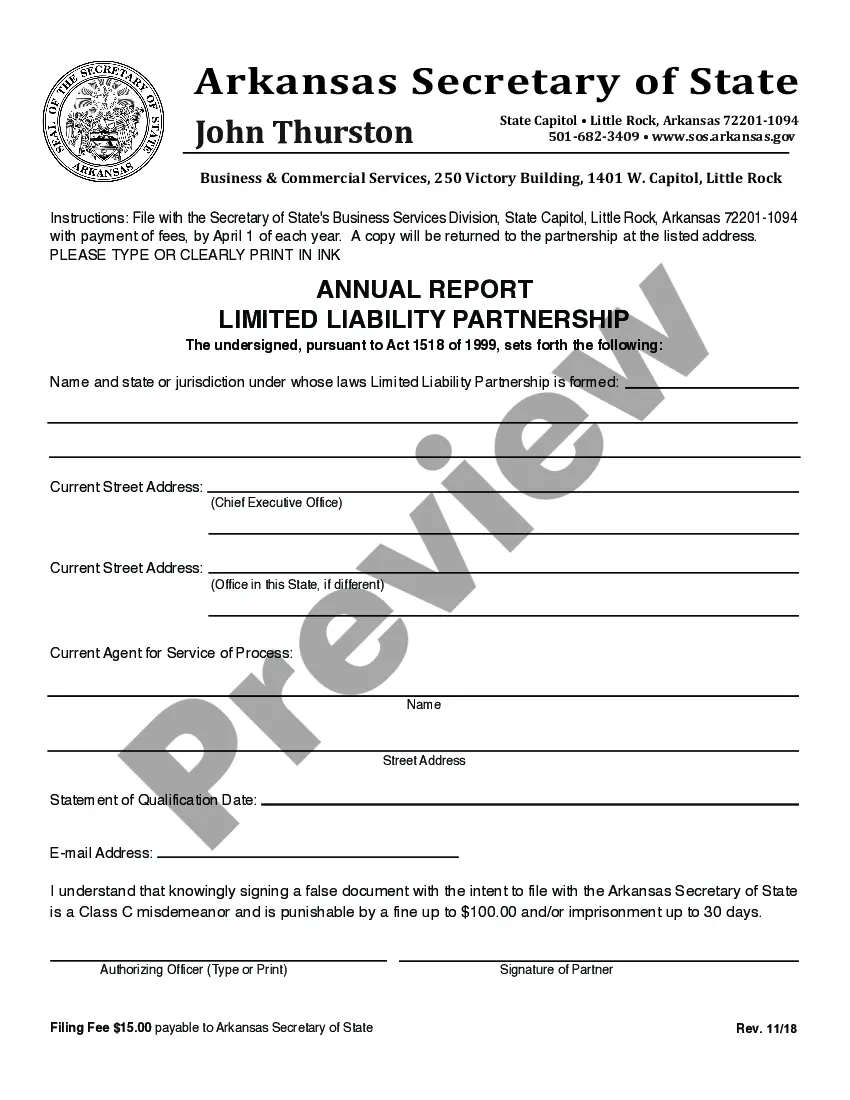

How to fill out Sample Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure?

Are you currently inside a situation the place you require papers for sometimes enterprise or individual uses almost every working day? There are plenty of lawful record web templates available online, but getting versions you can rely on isn`t easy. US Legal Forms delivers 1000s of form web templates, like the Connecticut Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure, that are written to fulfill federal and state requirements.

When you are already familiar with US Legal Forms internet site and get an account, merely log in. Following that, you can obtain the Connecticut Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure design.

If you do not provide an bank account and need to start using US Legal Forms, follow these steps:

- Find the form you want and make sure it is for that correct town/region.

- Use the Preview switch to review the shape.

- Read the outline to actually have selected the appropriate form.

- In case the form isn`t what you`re searching for, take advantage of the Research industry to discover the form that meets your needs and requirements.

- If you get the correct form, click Acquire now.

- Select the prices prepare you want, complete the specified information to generate your money, and pay for an order utilizing your PayPal or credit card.

- Select a convenient file format and obtain your copy.

Locate all the record web templates you have purchased in the My Forms menu. You may get a extra copy of Connecticut Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure any time, if needed. Just select the required form to obtain or print out the record design.

Use US Legal Forms, the most extensive selection of lawful forms, to save lots of some time and stay away from errors. The service delivers skillfully made lawful record web templates which you can use for a selection of uses. Create an account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

Generally, you should send a debt validation request if you're contacted by a collection agency and you don't recognize the debt. Send a validation request within 30 days of receiving contact from a collection agency, otherwise, they'll assume the debt is valid and can legally continue to contact you about it.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

The debt validation letter must include at least the following information: The amount of debt owed. The name of the creditor to whom the debt is owed. A statement of notice that the debt will be considered valid by the debt collector unless the consumer disputes it within 30 days of notice.

If you've already paid the debt If you're sure that you're talking with a legitimate debt collector, you can send copies of documents that prove you made the payments, including cancelled checks or credit card statements. You may also include copies of any correspondence about settling the debt.

It's generally easier for first-party creditors to prove you owe a debt. They simply produce the original credit agreement that shows your name and identifying information, like your address and Social Security number.

A debt validation letter is a letter that debt collectors must provide that includes information about the size of your debt, when to pay it, and how to dispute it. A debt collection letter essentially proves you owe the debt collector money.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.