Connecticut Loan Agreement for LLC is a legally binding contract that outlines the terms and conditions of a loan transaction between a lending party and a limited liability company (LLC) based in Connecticut. This agreement is designed to protect the interests of both the lender and the borrower by clearly defining their rights and obligations. Key terms that are typically covered in a Connecticut Loan Agreement for LLC include: 1. Loan Amount: The agreement specifies the principal amount that the LLC is borrowing from the lender. 2. Interest Rate: The interest rate, either fixed or variable, at which the loan will accrue interest over the agreed-upon loan term. 3. Repayment Terms: This section outlines the repayment structure, including the frequency of payments, the due date of each payment, and the total number of installments the loan will be divided into. 4. Security/Collateral: If applicable, the agreement may identify any assets or property that the LLC will pledge as collateral to secure the loan. This provides assurance to the lender that they can recoup their investment in case of default. 5. Use of Loan Funds: The LLC is typically required to state the purpose of the loan and ensure that the funds will be used exclusively for legitimate business needs. 6. Default and Remedies: The agreement defines the consequences of default, such as late payments or failure to fulfill any other obligations. It also establishes the remedies available to the lender in such cases, including any penalties or legal actions. 7. Governing Law: As this agreement pertains specifically to loans issued in Connecticut, it will specify that the laws of the state govern the interpretation and enforcement of the agreement. There are various types of Connecticut Loan Agreements for LCS, each catering to specific loan purposes or situations. Some common types include: 1. Term Loan Agreement: This type of agreement sets out a fixed repayment term, usually with a fixed interest rate, where the LLC borrows a lump sum and repays it in regular installments over a predetermined period. 2. Revolving Line of Credit Agreement: In this agreement, the lender establishes a maximum loan amount for the LLC to borrow from over a specified period. The LLC can access funds repeatedly within the limit and repay as per agreed terms. 3. Bridge Loan Agreement: A bridge loan agreement provides temporary financing to an LLC until it secures permanent financing or fulfills specific conditions. It offers short-term capital to cover immediate needs. 4. Convertible Debt Agreement: This agreement combines a loan with an option to convert the debt into equity at a later stage if certain conditions are met. It is crucial for both parties involved in a Connecticut Loan Agreement for LLC to seek legal counsel to ensure compliance with state laws and to protect their respective rights and interests.

Connecticut Loan Agreement for LLC

Description

How to fill out Connecticut Loan Agreement For LLC?

You are able to devote hrs on the Internet trying to find the legal file design that meets the federal and state requirements you want. US Legal Forms offers 1000s of legal kinds that happen to be reviewed by specialists. You can easily down load or print the Connecticut Loan Agreement for LLC from your services.

If you already possess a US Legal Forms profile, you can log in and click on the Down load button. Afterward, you can full, edit, print, or indicator the Connecticut Loan Agreement for LLC. Every single legal file design you get is your own for a long time. To acquire another backup of the purchased type, go to the My Forms tab and click on the related button.

Should you use the US Legal Forms internet site for the first time, keep to the simple recommendations below:

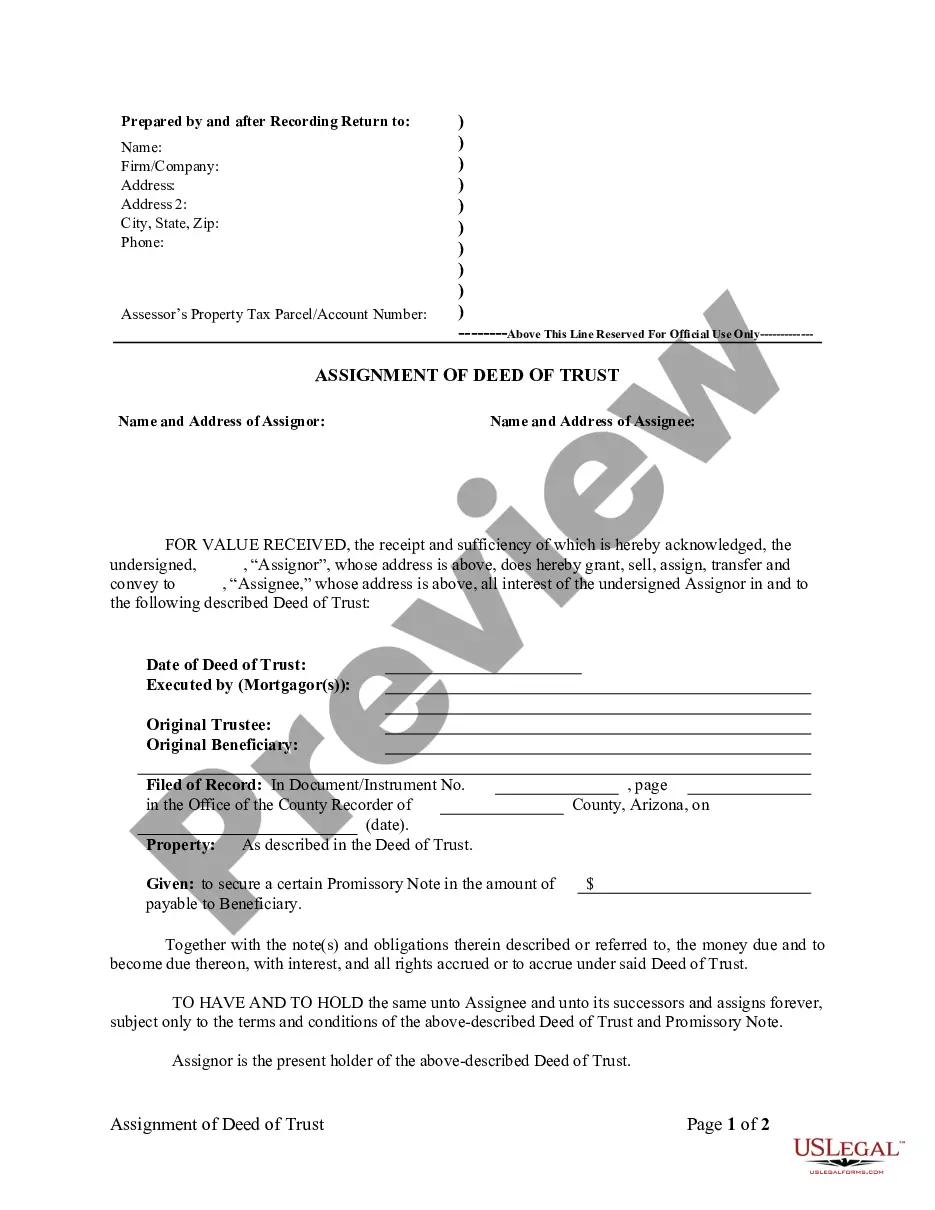

- Very first, ensure that you have selected the right file design for your region/city of your liking. Look at the type information to ensure you have picked out the correct type. If offered, take advantage of the Preview button to appear through the file design as well.

- If you wish to locate another variation in the type, take advantage of the Research industry to discover the design that fits your needs and requirements.

- After you have found the design you desire, click Acquire now to proceed.

- Select the costs program you desire, type in your accreditations, and register for a merchant account on US Legal Forms.

- Full the purchase. You may use your Visa or Mastercard or PayPal profile to purchase the legal type.

- Select the formatting in the file and down load it in your product.

- Make changes in your file if needed. You are able to full, edit and indicator and print Connecticut Loan Agreement for LLC.

Down load and print 1000s of file web templates making use of the US Legal Forms Internet site, that offers the most important collection of legal kinds. Use expert and express-specific web templates to handle your business or specific needs.