Connecticut Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

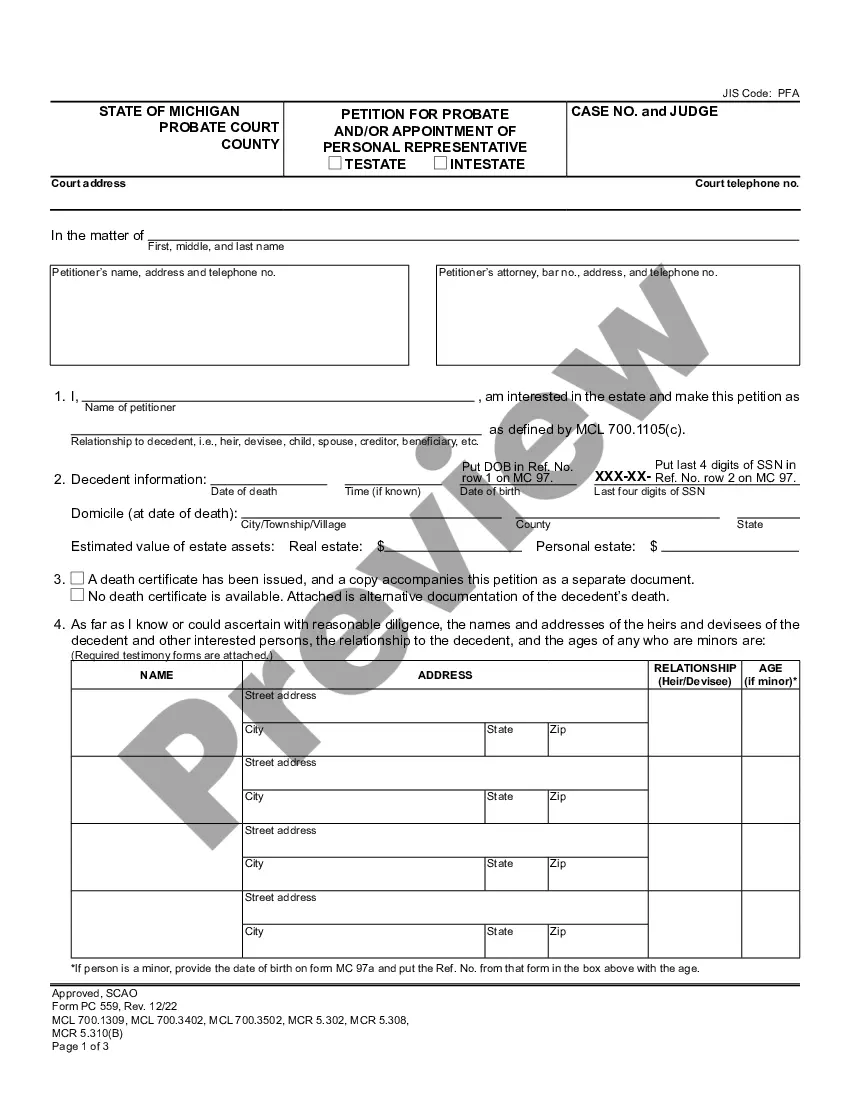

How to fill out Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

Choosing the best lawful file web template could be a have difficulties. Obviously, there are tons of templates available on the net, but how will you find the lawful form you will need? Use the US Legal Forms internet site. The assistance offers a huge number of templates, like the Connecticut Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name, that you can use for enterprise and private requires. All the kinds are examined by experts and meet federal and state requirements.

Should you be currently listed, log in to the accounts and click the Obtain button to have the Connecticut Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name. Make use of your accounts to check through the lawful kinds you have ordered previously. Visit the My Forms tab of your accounts and acquire one more version of your file you will need.

Should you be a new consumer of US Legal Forms, here are easy instructions so that you can stick to:

- First, be sure you have chosen the appropriate form to your area/county. You can look through the form while using Review button and read the form information to ensure this is the right one for you.

- In the event the form will not meet your preferences, utilize the Seach area to get the correct form.

- When you are sure that the form is suitable, click the Acquire now button to have the form.

- Opt for the pricing plan you want and type in the essential information. Build your accounts and pay for the order with your PayPal accounts or Visa or Mastercard.

- Opt for the file file format and acquire the lawful file web template to the gadget.

- Total, change and print out and indicator the acquired Connecticut Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name.

US Legal Forms is the most significant library of lawful kinds that you can find a variety of file templates. Use the service to acquire skillfully-made files that stick to express requirements.

Form popularity

FAQ

As part of the car insurance claims process, your insurer will tell you if it will file a subrogation claim. This doesn't mean your insurance company will do this for every not-at-fault claim. Keep in mind that state laws vary, so some claims or expenses may not be eligible for subrogation.

A subrogation receipt transferring the insured's entire causes of action to the insurer allows the insurer to recover in the insured's name for the entire loss, not just to the extent of its payment.

If you've been in an accident and filed a claim with your insurance company, you may have received a subrogation letter. This document allows the insurance company to pursue a claim against a third party that caused damage to their insured, after the insurance company has paid out a claim to the insured.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault. It's common in auto, health insurance and homeowners policies. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault.

This right is called subrogation and is an equitable doctrine. A person can satisfy his/her loss that is created by the wrongful act or omission of another person by stepping into the shoes of another and recovering on the claim from the wrongdoer.

Principle of subrogation refers to the practice of substitution of a person or group by another in cases of debt claims in insurance. Subrogation is an important component of indemnity principle, which is a differentiating factor between a commercial contract and an insurance contract.

The Collateral Source Rule In other words, subrogation of a collateral source is prohibited unless a right of subrogation exists. Medical pay subrogation is allowed, however, if the policy has subrogation language, as the Collateral Source Rule allows a policy to contain a subrogation clause for med pay benefits.

The rule of subrogation known as the ?Sutton Rule? states that a tenant and landlord are automatically considered ?co-insureds? under a fire insurance policy as a matter of law and, therefore, the insurer of the landlord who pays for the fire damage caused by the negligence of a tenant may not sue the tenant in ...