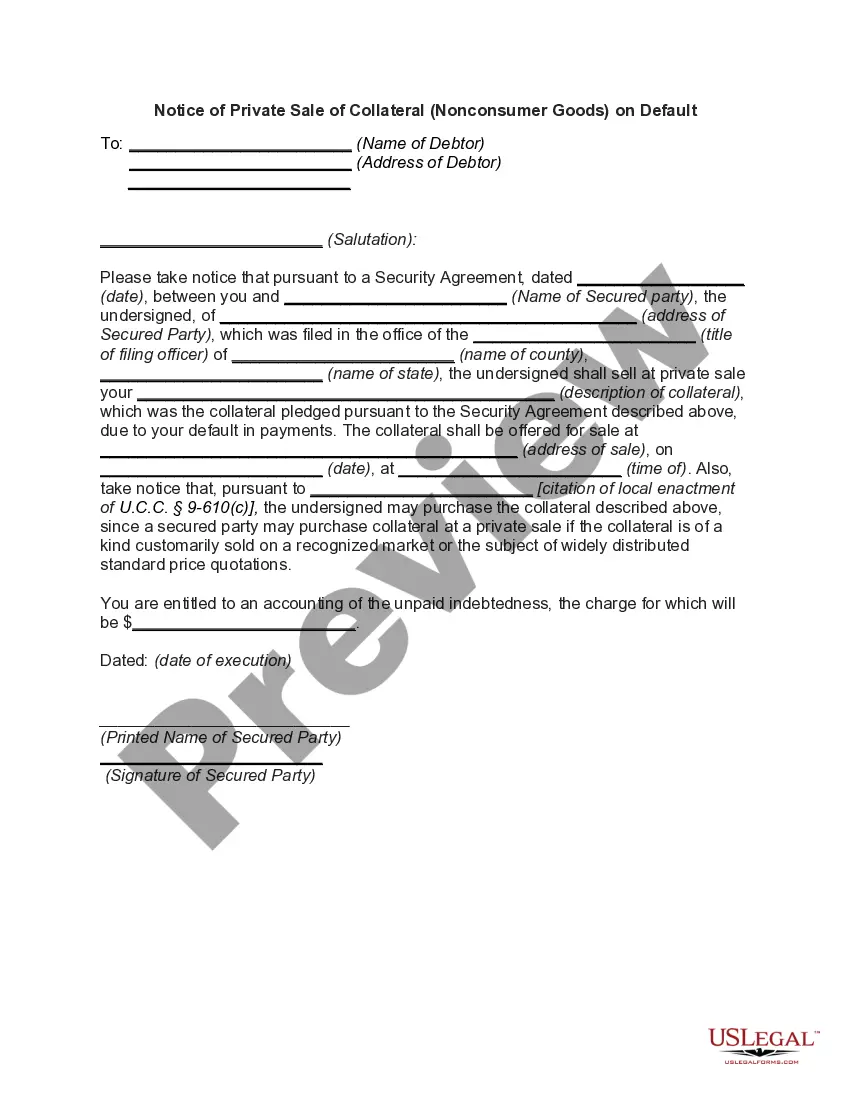

Connecticut Notice of Private Sale of Collateral (Non-consumer Goods) on Default The Connecticut Notice of Private Sale of Collateral (Non-consumer Goods) on Default is a legal document used when a borrower defaults on a loan agreement involving non-consumer goods. This notice alerts the borrower and any other interested parties about the lender's intention to sell the collateral in a private sale in order to repay the outstanding debt. Keywords: Connecticut, notice, private sale, collateral, non-consumer goods, default, borrower, loan agreement, interested parties, lender, outstanding debt. Types of Connecticut Notice of Private Sale of Collateral (Non-consumer Goods) on Default: 1. Simple Notice of Private Sale of Collateral (Non-consumer Goods) on Default: This type of notice provides a straightforward description of the default situation and the intent to sell the collateral privately to satisfy the debt. It includes basic information about the borrower, lender, details of the loan agreement, and a clear statement regarding the private sale. 2. Detailed Notice of Private Sale of Collateral (Non-consumer Goods) on Default: A detailed notice contains comprehensive information about the default, the outstanding debt, and the specifics of the collateral to be sold. It may include a detailed inventory of the collateral, its condition, estimated value, and any relevant appraisal reports. This type of notice aims to provide a thorough description to ensure transparency and avoid any potential disputes or conflicts. 3. Formal Notice of Private Sale of Collateral (Non-consumer Goods) on Default: A formal notice follows a specific format and includes all the required legal language and terminology. It complies with the Connecticut state laws and regulations regarding the private sale of collateral on default. This notice ensures that all necessary legal requirements are met and can be used as evidence in case of any legal proceedings. 4. Urgent Notice of Private Sale of Collateral (Non-consumer Goods) on Default: An urgent notice is used in situations where immediate action is required due to the urgency of the circumstances. This type of notice emphasizes the need for prompt payment or resolution to prevent the collateral from being sold. It may include additional language to stress the imminent sale and the consequences of further delays or non-payment. Note: It is crucial to consult with a legal professional or attorney to ensure compliance with Connecticut laws and regulations when drafting and issuing a Notice of Private Sale of Collateral (Non-consumer Goods) on Default.

Connecticut Notice of Private Sale of Collateral (Non-consumer Goods) on Default

Description

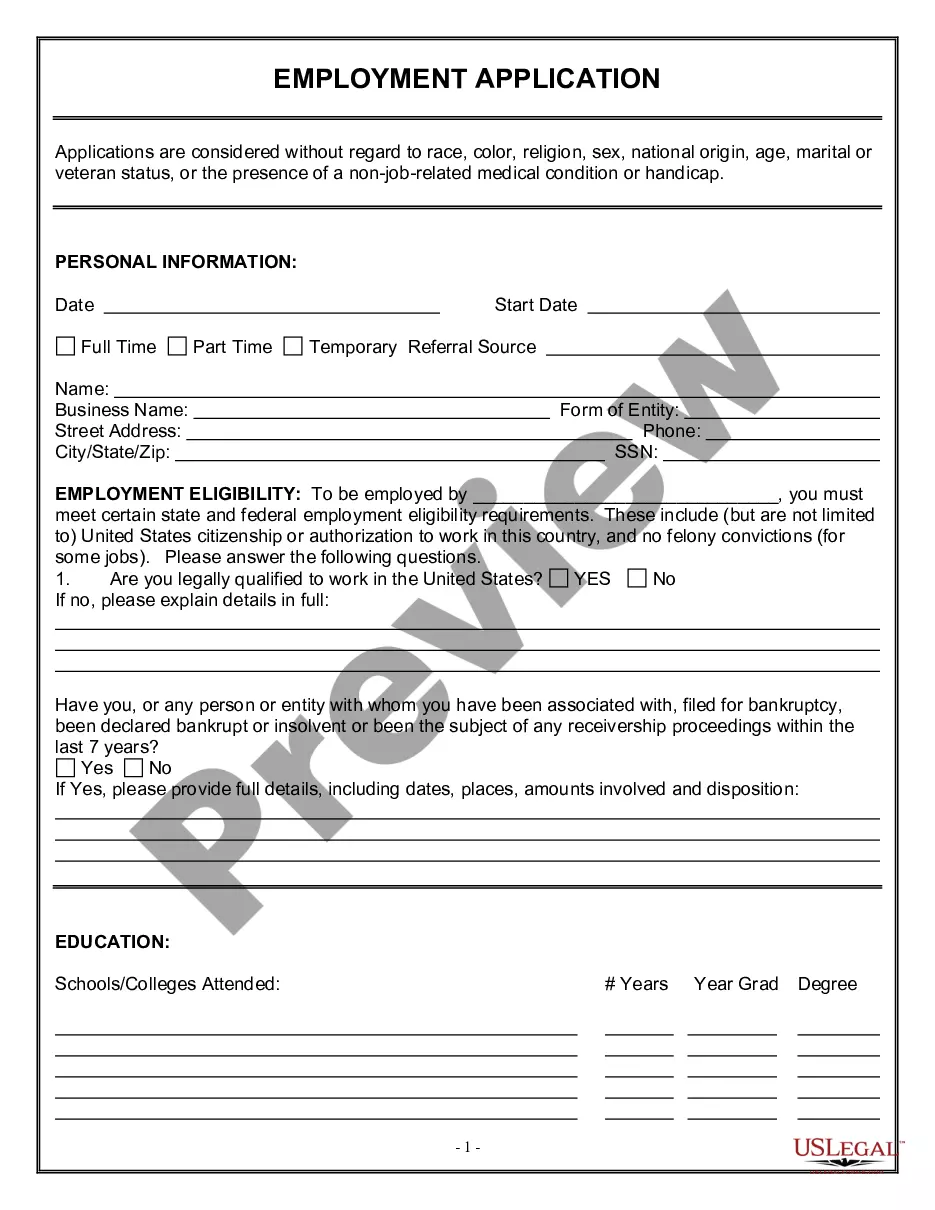

How to fill out Connecticut Notice Of Private Sale Of Collateral (Non-consumer Goods) On Default?

US Legal Forms - among the biggest libraries of legitimate forms in America - gives an array of legitimate papers themes you may obtain or produce. Making use of the website, you can get a large number of forms for business and specific functions, categorized by groups, claims, or search phrases.You can get the most up-to-date versions of forms such as the Connecticut Notice of Private Sale of Collateral (Non-consumer Goods) on Default in seconds.

If you have a membership, log in and obtain Connecticut Notice of Private Sale of Collateral (Non-consumer Goods) on Default in the US Legal Forms catalogue. The Download switch will show up on every single develop you view. You gain access to all earlier acquired forms within the My Forms tab of your respective profile.

In order to use US Legal Forms for the first time, listed here are straightforward recommendations to help you began:

- Make sure you have picked out the proper develop for your personal metropolis/area. Go through the Review switch to check the form`s articles. Read the develop explanation to actually have selected the right develop.

- When the develop doesn`t suit your requirements, make use of the Lookup area at the top of the monitor to discover the one which does.

- When you are satisfied with the form, validate your option by clicking the Acquire now switch. Then, pick the costs prepare you favor and supply your qualifications to register for the profile.

- Method the transaction. Make use of your Visa or Mastercard or PayPal profile to accomplish the transaction.

- Select the format and obtain the form on the device.

- Make adjustments. Fill out, revise and produce and sign the acquired Connecticut Notice of Private Sale of Collateral (Non-consumer Goods) on Default.

Every single template you added to your bank account lacks an expiration day and is also the one you have eternally. So, if you wish to obtain or produce an additional copy, just go to the My Forms segment and click on about the develop you want.

Gain access to the Connecticut Notice of Private Sale of Collateral (Non-consumer Goods) on Default with US Legal Forms, the most considerable catalogue of legitimate papers themes. Use a large number of skilled and condition-particular themes that meet up with your small business or specific requirements and requirements.