A Connecticut Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the state of Connecticut. It serves as evidence of a debt and specifies the amount borrowed, the interest rate, the repayment terms, and the deadline by which the borrower must repay the loan in full. These promissory notes are often used in various financial transactions, including personal loans, business loans, student loans, and real estate transactions. They provide security and clarity for both parties involved, ensuring that the terms of the loan are clearly defined and agreed upon. There are several types of Connecticut Promissory Note Payable on a Specific Date, including: 1. Simple Promissory Note: This type of promissory note is the most basic form and is typically used for smaller loans between individuals. It outlines the principal amount, the interest rate (if any), the repayment schedule, and any other terms agreed upon by the borrower and lender. 2. Secured Promissory Note: In this type of promissory note, the borrower pledges collateral, such as real estate or a vehicle, to secure the loan. This provides an added layer of protection for the lender if the borrower defaults on the loan. 3. Demand Promissory Note: Unlike other promissory notes with predetermined repayment schedules, a demand promissory note allows the lender to demand repayment at any time. However, it is important to note that the borrower should still be given reasonable notice before payment is required. 4. Installment Promissory Note: This type of promissory note divides the loan amount into equal installments to be paid at regular intervals, such as monthly or quarterly. It specifies the due date for each installment and also includes the interest rate applicable to the loan. 5. Balloon Promissory Note: A balloon promissory note requires the borrower to make smaller regular payments for a specified period, followed by a larger "balloon" payment at the end. This type of note is often used in cases where the borrower expects to have sufficient funds available at the end of the loan term to make the final payment. 6. Convertible Promissory Note: In certain situations, a convertible promissory note may be used, allowing the lender to convert the debt into equity in the borrower's company. This type of note is often used in startup financing or venture capital investments. When entering into a Connecticut Promissory Note Payable on a Specific Date, it is crucial for both parties to carefully review and understand the terms and conditions before signing. It is recommended to consult with a legal professional to ensure that the note complies with all applicable laws and to protect the rights and interests of both the borrower and lender.

Connecticut Promissory Note Payable on a Specific Date

Description

How to fill out Connecticut Promissory Note Payable On A Specific Date?

If you need to comprehensive, down load, or printing lawful record layouts, use US Legal Forms, the most important variety of lawful forms, that can be found on-line. Make use of the site`s easy and practical research to find the papers you require. Numerous layouts for enterprise and personal purposes are sorted by groups and claims, or search phrases. Use US Legal Forms to find the Connecticut Promissory Note Payable on a Specific Date in a couple of mouse clicks.

In case you are previously a US Legal Forms consumer, log in in your profile and click the Download switch to obtain the Connecticut Promissory Note Payable on a Specific Date. You can also entry forms you previously downloaded in the My Forms tab of your own profile.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Ensure you have selected the shape for your correct town/nation.

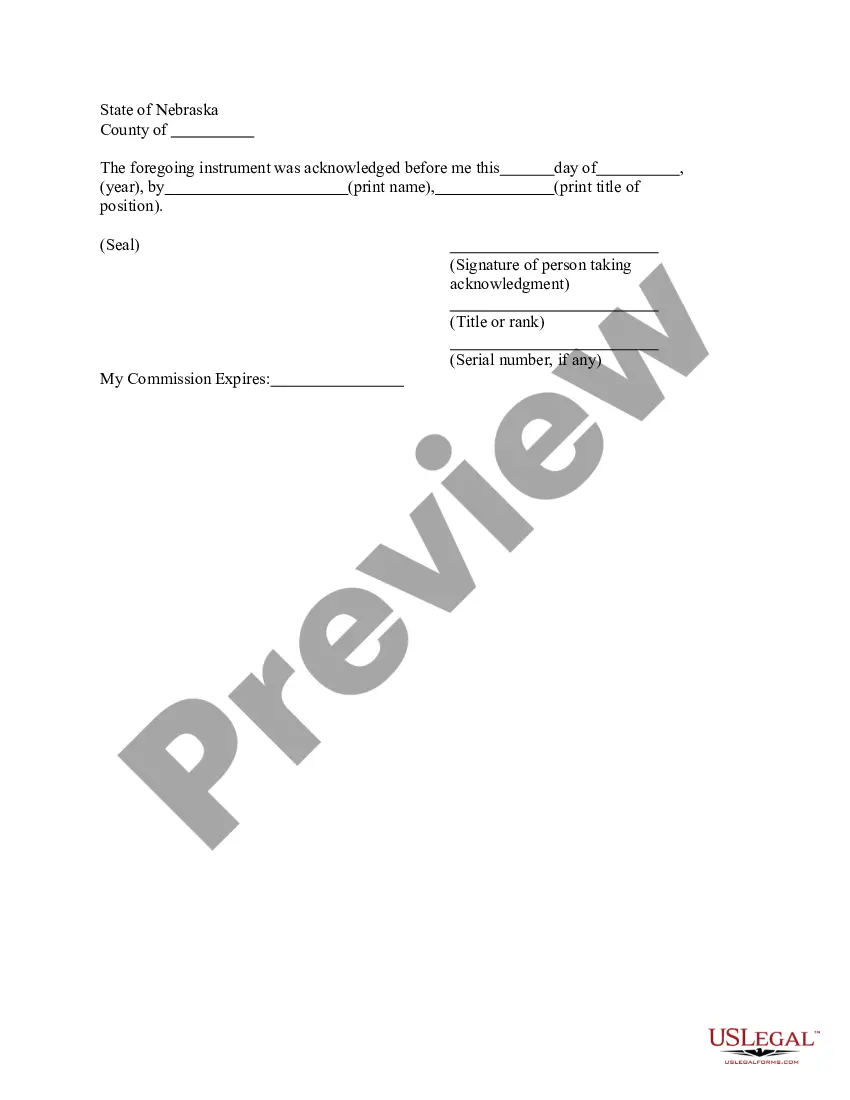

- Step 2. Take advantage of the Preview choice to look over the form`s information. Do not overlook to read through the explanation.

- Step 3. In case you are unsatisfied using the develop, make use of the Look for industry towards the top of the monitor to get other types in the lawful develop web template.

- Step 4. Upon having found the shape you require, click on the Purchase now switch. Choose the rates prepare you choose and include your qualifications to register to have an profile.

- Step 5. Method the transaction. You may use your charge card or PayPal profile to finish the transaction.

- Step 6. Pick the formatting in the lawful develop and down load it on your own system.

- Step 7. Complete, edit and printing or sign the Connecticut Promissory Note Payable on a Specific Date.

Every lawful record web template you acquire is your own property forever. You possess acces to each and every develop you downloaded in your acccount. Select the My Forms area and decide on a develop to printing or down load once again.

Remain competitive and down load, and printing the Connecticut Promissory Note Payable on a Specific Date with US Legal Forms. There are many specialist and state-certain forms you can utilize for your enterprise or personal requires.

Form popularity

FAQ

The Note Date is the date of the Note.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

Many differences among promissory notes relate to when and how the borrowed amount will be repaid. Although you are free to negotiate terms that work for your arrangement, your note must either have an end date or be payable when the lender demands it. Unconditional .

Days of grace. Every promissory note or bill of exchange which is not expressed to be payable on demand, at sight or on presentment is at maturity on the third day after the day on which it is expressed to be payable.

Definition: The maturity date of a note is the time and date when the interest and principal is due in full and must be repaid. A note or promissory note is a written promise to a pay specific amount of money at a future date. The future date is called the maturity date.

The following rules are used to determine the due date:Specific Date or Number of Days. If the note states a specific maturity date or details the exact number of days, then the due date is three days later than the maturity date.Time Period in Months.

Short answer: A promissory note must be signed by the borrower. However, an undated but signed promissory note is valid and effective because the signature date is not an essential element of a promissory note.

Generally, a note cannot be prepaid before the date established in the note for payment. A state statute that establishes a ceiling or maximum rate of interest to be charged on the loan is called a usury statute.

Definition: The maturity date of a note is the time and date when the interest and principal is due in full and must be repaid. A note or promissory note is a written promise to a pay specific amount of money at a future date. The future date is called the maturity date.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.