Connecticut Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

Description

How to fill out Agreement To Devise Or Bequeath Property Of A Business Transferred To Business Partner?

If you aim to be thorough, obtain, or download authentic document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Take advantage of the website's straightforward and convenient search feature to find the documents you require. Various templates for business and personal purposes are organized by categories and jurisdictions or keywords.

Utilize US Legal Forms to access the Connecticut Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner with just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you saved in your account. Simply choose the My documents section and select a form to print or download again.

Compete and acquire, and print the Connecticut Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Connecticut Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/region.

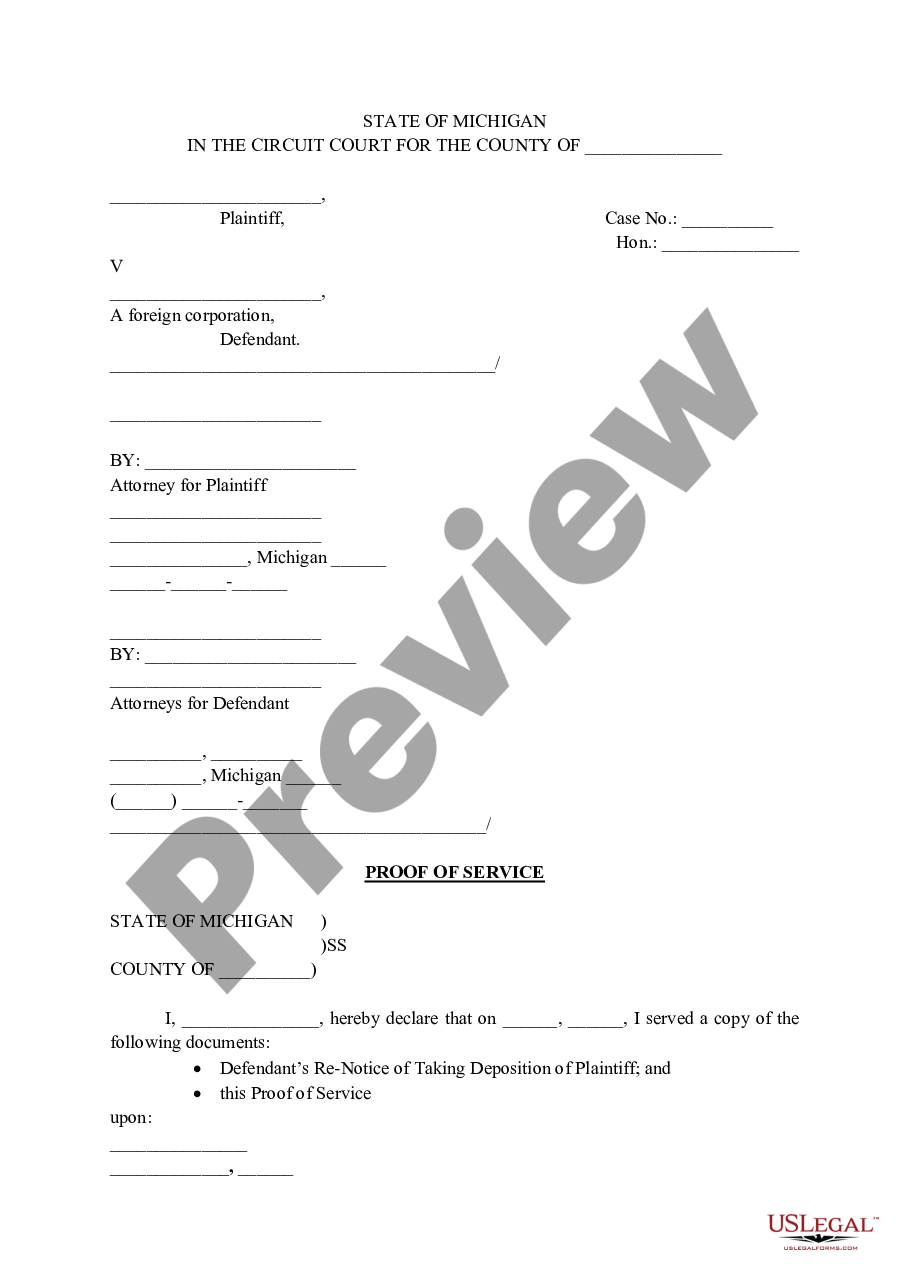

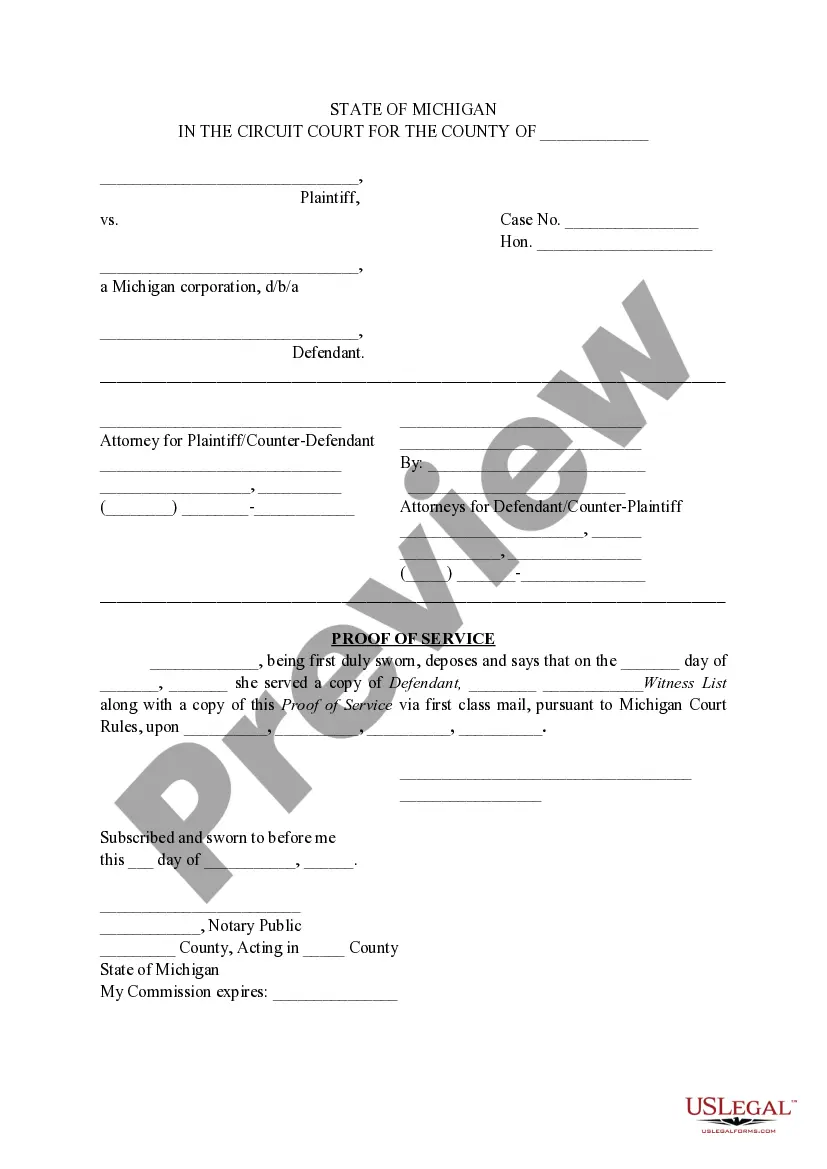

- Step 2. Use the Preview option to review the form's details. Don’t forget to check the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you find the form you want, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the deal.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Connecticut Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner.

Form popularity

FAQ

For the person who dies, their share of the property passes to the surviving joint owner automatically on their death. If however the property is owned as tenants in common, then the deceased's share of the property will pass in accordance with their Will or under the rules of intestacy if they have not made a Will.

He bequeathed his talent to his son. To hand down; to transmit. To bequeath is to leave assets for others after your death or to give someone something that you own, especially something of value. An example of bequeath is writing a will that leaves your home to your child.

A gift given by means of the will of a decedent of an interest in real property.

Strictly speaking, a devise (verb: to devise) is a testamentary gift of real property (bienes inmuebles), the beneficiary of which is known as a devisee. In contrast, a bequest (verb: to bequeath) usually refers to a testamentary gift of personal property (bienes muebles), often excluding money.

There are disadvantages, primarily tax disadvantages, to either type of joint tenancy for estate planning. You might incur gift taxes when creating joint title to property. If the other owner is your spouse, there is no problem because unlimited tax free gifts can be made between spouses.

If the partners were beneficial joint tenants at the time of the death, the surviving partner will automatically inherit the other partner's share of the property. There is no need for probate or letters of administration unless there are other assets that are not jointly owned.

One form of holding ownership ( is / is not ) joint ownership. One form of holding ownership ( is / is not ) a trust.

What is the difference between these two phrases? Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.

Probate will not usually be needed if all the assets in the estate were jointly owned by both spouses. This can include assets such as a property, bank, building society accounts and savings accounts. Jointly held assets, usually pass to the surviving spouse automatically by the Right of Survivorship.

You can bequeath the property by writing, "I leave to my brother, Karl, my 1966 Ford Mustang." Name alternate beneficiaries. Your first pick might die before you, so you can name someone to inherit the property in their place.