Connecticut Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal arrangement that allows an individual, known as the trust or, to transfer assets to a trust for the benefit of themselves or others. This type of trust ensures that the trust or can receive income from the trust after a specific period of time has passed. The Connecticut Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time offers several advantages. Firstly, it allows for asset protection and estate tax planning. By transferring assets into the trust, the trust or can potentially minimize estate taxes and protect them from creditors. Secondly, it provides a way for the trust or to ensure a steady stream of income in the future. By specifying a particular time period before income becomes payable, the trust or can plan for their financial needs while safeguarding their assets. There are different types of Connecticut Irrevocable Trusts for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, including: 1. Connecticut Dynasty Trust: This type of trust allows the trust or to transfer assets to future generations, ensuring long-term financial security. The income generated from the trust can be payable to the trust or at a later specified time, such as after they reach a certain age. 2. Connecticut Qualified Personnel Residence Trust (PRT): A PRT enables the trust or to transfer a personal residence into the trust while retaining the right to reside in it for a specified period. After this time, the income generated from the trust becomes payable to the trust or. 3. Connecticut Granter Retained Annuity Trust (GREAT): A GREAT allows the trust or to transfer assets into the trust while retaining a fixed annuity payment for a specified period. After this period, the income generated by the trust becomes payable to the trust or. 4. Connecticut Charitable Lead Annuity Trust (FLAT): A FLAT allows the trust or to transfer assets to a trust for a specific term, during which income is paid to a designated charity. At the end of the term, the remaining assets are either distributed to beneficiaries or remain with the trust. It is important to consult with a qualified attorney or financial advisor when considering establishing a Connecticut Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time. They can provide personalized advice based on individual objectives and circumstances, ensuring that all legal requirements are met and financial goals are effectively achieved.

Connecticut Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

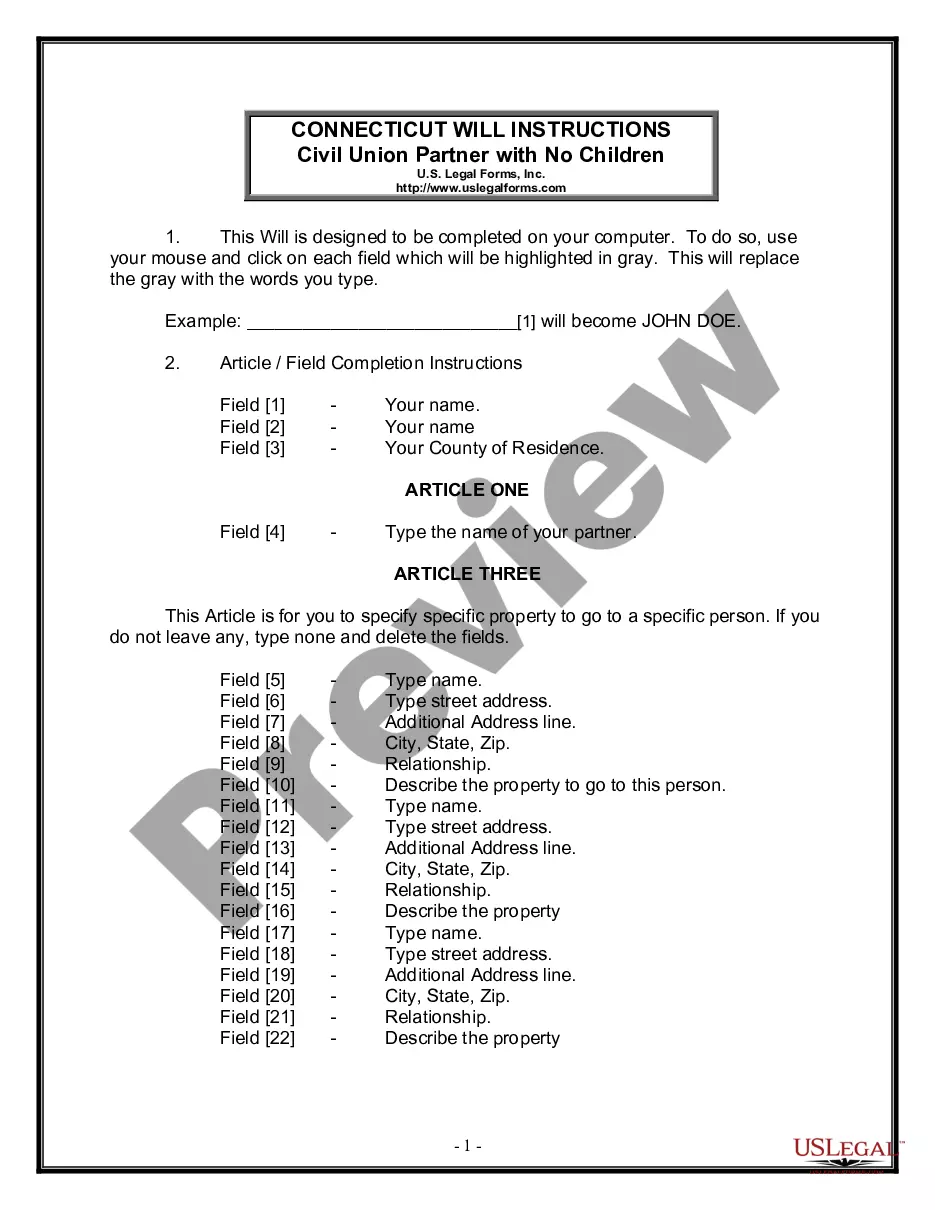

How to fill out Connecticut Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

US Legal Forms - among the largest libraries of legitimate forms in the USA - provides a wide array of legitimate record templates you are able to down load or printing. While using web site, you will get thousands of forms for company and person uses, categorized by classes, says, or keywords.You can get the latest types of forms just like the Connecticut Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time in seconds.

If you already have a subscription, log in and down load Connecticut Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time through the US Legal Forms catalogue. The Obtain button can look on every form you see. You gain access to all formerly delivered electronically forms inside the My Forms tab of your bank account.

If you would like use US Legal Forms initially, allow me to share basic recommendations to obtain started:

- Ensure you have selected the correct form for your city/county. Click on the Preview button to examine the form`s content. Look at the form description to actually have chosen the correct form.

- In case the form does not satisfy your requirements, use the Research industry near the top of the display screen to get the one which does.

- When you are satisfied with the shape, validate your decision by visiting the Buy now button. Then, choose the costs program you like and provide your references to register on an bank account.

- Process the financial transaction. Use your charge card or PayPal bank account to finish the financial transaction.

- Find the structure and down load the shape on the gadget.

- Make changes. Load, modify and printing and sign the delivered electronically Connecticut Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

Every web template you included with your bank account lacks an expiration day and is also your own for a long time. So, if you wish to down load or printing an additional backup, just visit the My Forms section and then click in the form you require.

Obtain access to the Connecticut Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time with US Legal Forms, probably the most substantial catalogue of legitimate record templates. Use thousands of professional and express-distinct templates that meet your organization or person needs and requirements.

Form popularity

FAQ

An irrevocable trust reports income on Form 1041, the IRS's trust and estate tax return. Even if a trust is a separate taxpayer, it may not have to pay taxes. If it makes distributions to a beneficiary, the trust will take a distribution deduction on its tax return and the beneficiary will receive IRS Schedule K-1.

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

An irrevocable trust is a very powerful tool for Medicaid Asset Protection, as it allows you to shelter assets from a nursing home after they have been in the trust for five years.

An irrevocable trust provides an alternative to simply giving an asset to a beneficiary in order to reduce your taxable estate. With a trust, you can set the timing of distributions (i.e. when the beneficiary attains 30 years of age) as well as the reasons for distributions (i.e. for education only).

Can a beneficiary withdraw money from an irrevocable trust? The trustee of an irrevocable Trust cannot withdraw money except to benefit the Trust. These terms include paying maintenance costs and disbursement income to beneficiaries. However, it is not possible to withdraw money for personal or business use.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

The step-up in basis tax provision protects the asset in a revocable trust from heavy taxation. Grantors and trustees can take advantage of this provision to reduce or eliminate capital gains taxes. The assets in a revocable trust appreciate and provide the grantor with a consistent stream of income in their lifetime.

The step-up in basis is equal to the fair market value of the property on the date of death. In our example, if the parents had put their home in this irrevocable income only trust, and the fair market value upon their demise was $300,000, the children would receive the home with a basis equal to this $300,000 value.

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust.