Connecticut Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity is a type of trust that allows individuals to preserve and manage their assets during their lifetime while providing financial security for their surviving spouse after their death. This legal arrangement is established in accordance with Connecticut trust laws and typically involves the following key elements: 1. Trust or: The individual creating the trust, also known as the granter or settler. 2. Revocable Trust: A trust that can be altered, amended, or revoked by the trust or during their lifetime, providing flexibility and control over their assets. 3. Lifetime Benefit: The trust or retains access to the income generated by the trust assets during their lifetime, allowing them to maintain their standard of living and financial security. 4. Surviving Spouse: The spouse of the trust or who will continue to reap the financial benefits of the trust after the trust or's death. 5. Annuity: In some cases, the trust may include an annuity provision, which guarantees a specific income stream for the trust or during their lifetime. The Connecticut Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity provides numerous benefits, including: 1. Probate Avoidance: Assets placed in the trust do not go through the probate process, allowing for a smoother transition of assets and avoiding potential delays and costs associated with probate. 2. Estate Tax Planning: By properly structuring the trust, individuals can minimize estate tax liability, ensuring that more assets pass to their surviving spouse. 3. Asset Protection: The trust can provide safeguards for the trust or's assets, such as protecting them from creditors or ensuring they are used solely for the benefit of the trust or and surviving spouse. 4. Flexibility: Being a revocable trust, the trust or can make changes or terminate the trust in the future if their circumstances or intentions change. While there may not be specific types of Connecticut Revocable Trusts for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity, variations in the terms and provisions of the trust can be customized to suit the unique needs and goals of the trust or and surviving spouse. These variations could include specific instructions for asset distribution, provisions for children or other beneficiaries, and additional estate planning techniques to further enhance the financial benefits of the trust. In conclusion, a Connecticut Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity is a versatile estate planning tool that allows individuals to maintain control over their assets during their lifetime, while ensuring their surviving spouse's financial well-being after their death. It provides numerous advantages, such as probate avoidance, tax planning, and asset protection.

Connecticut Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

Description

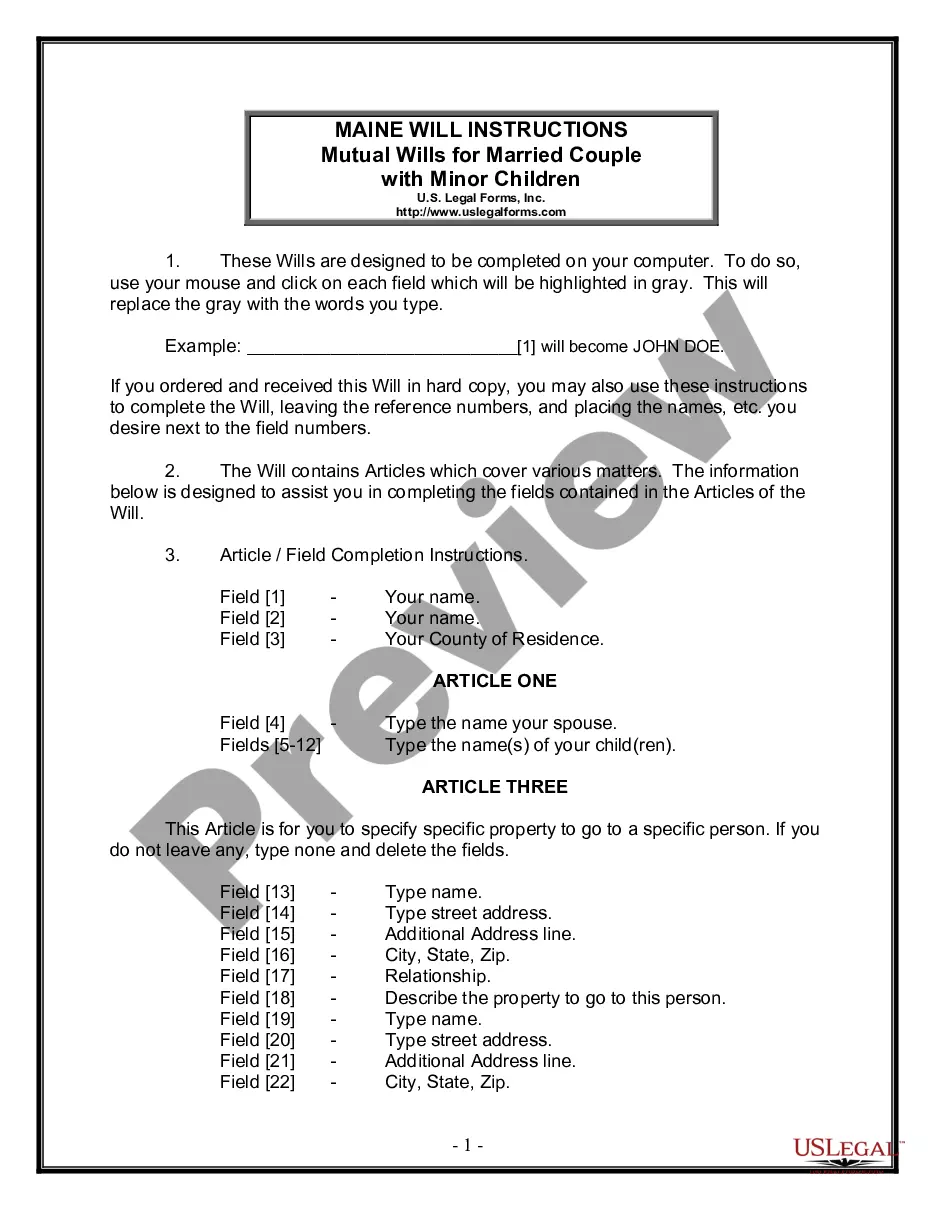

How to fill out Connecticut Revocable Trust For Lifetime Benefit Of Trustor For Lifetime Benefit Of Surviving Spouse After Death Of Trustor's With Annuity?

Are you in a place that you need to have documents for sometimes company or individual reasons nearly every time? There are plenty of legal papers templates available online, but getting versions you can depend on is not simple. US Legal Forms offers a large number of develop templates, just like the Connecticut Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity, which can be composed in order to meet federal and state specifications.

In case you are presently knowledgeable about US Legal Forms internet site and possess an account, merely log in. Afterward, it is possible to acquire the Connecticut Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity design.

Should you not provide an accounts and need to begin using US Legal Forms, adopt these measures:

- Find the develop you need and make sure it is for that appropriate city/region.

- Use the Preview key to review the shape.

- Read the description to ensure that you have chosen the right develop.

- In case the develop is not what you are searching for, utilize the Search field to find the develop that suits you and specifications.

- Once you find the appropriate develop, just click Purchase now.

- Pick the prices plan you want, fill out the required information to produce your money, and pay money for an order using your PayPal or charge card.

- Select a practical paper format and acquire your copy.

Get all of the papers templates you may have bought in the My Forms menu. You can get a further copy of Connecticut Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity any time, if necessary. Just click the necessary develop to acquire or produce the papers design.

Use US Legal Forms, by far the most considerable selection of legal forms, to save efforts and steer clear of blunders. The support offers appropriately created legal papers templates which can be used for an array of reasons. Generate an account on US Legal Forms and start generating your life easier.