Connecticut Irrevocable Trust is a legal entity created under Connecticut state law that provides individuals and businesses with a way to protect their assets and optimize tax benefits. Specifically, a Connecticut Irrevocable Trust can be structured as a Qualifying Subchapter-S Trust (SST), which offers additional advantages for certain beneficiaries and stakeholders. An SST is a specific type of Connecticut Irrevocable Trust that qualifies for Subchapter S tax treatment under the Internal Revenue Code. This status allows the trust to operate as an S corporation, enabling it to pass income, deductions, credits, and losses directly to its beneficiaries, who can then report them on their personal tax returns. By doing so, the trust itself avoids paying federal income tax. One key aspect of an SST is that it must name only one income beneficiary. This beneficiary is entitled to receive all trust income, while the trust principal remains untouched. The SST structure is often utilized when a trust owns S corporation stock and seeks to pass along the income generated by the stock directly to a single beneficiary for tax purposes. While the term "Connecticut Irrevocable Trust" encompasses various subtypes, the SST variation is particularly relevant in Connecticut for those seeking to minimize tax burdens and protect their assets. Some example subtypes of Connecticut Irrevocable Trusts may include: 1. General Connecticut Irrevocable Trust: This refers to a standard irrevocable trust established in Connecticut, providing asset protection and tax benefits for beneficiaries as per state laws. 2. Connecticut Irrevocable Life Insurance Trust (IIT): This type of trust is specifically designed to hold and manage life insurance policies, ensuring the proceeds are distributed according to the granter's wishes while avoiding estate taxes. 3. Connecticut Charitable Remainder Trust: This trust allows individuals to donate assets to a charitable organization while retaining an income stream from those assets during their lifetime or a specified period. 4. Connecticut Special Needs Trust: Designed to protect the assets of individuals with special needs, this trust ensures that government benefits are not jeopardized while providing supplemental support for their wellbeing and quality of life. In conclusion, a Connecticut Irrevocable Trust set up as a Qualifying Subchapter-S Trust, or one of its various subtypes, offers unique advantages for tax planning, asset protection, and estate planning purposes. Understanding the specific requirements and features of each trust variation can help individuals and entities make informed decisions regarding their financial affairs.

Connecticut Irrevocable Trust which is a Qualifying Subchapter-S Trust

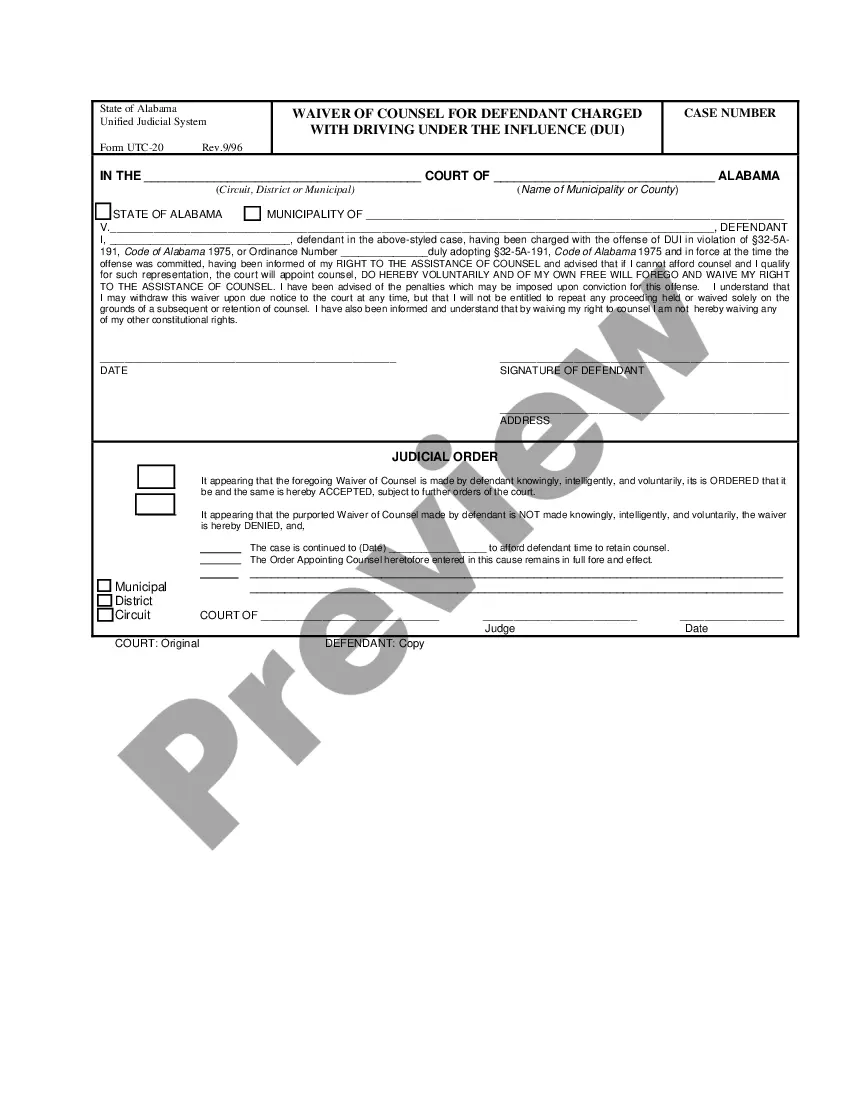

Description

How to fill out Connecticut Irrevocable Trust Which Is A Qualifying Subchapter-S Trust?

If you want to total, download, or produce legal document themes, use US Legal Forms, the largest assortment of legal types, that can be found on-line. Utilize the site`s basic and handy look for to obtain the papers you want. Numerous themes for enterprise and personal uses are sorted by types and states, or keywords. Use US Legal Forms to obtain the Connecticut Irrevocable Trust which is a Qualifying Subchapter-S Trust with a couple of clicks.

In case you are presently a US Legal Forms consumer, log in to your profile and click on the Acquire option to obtain the Connecticut Irrevocable Trust which is a Qualifying Subchapter-S Trust. You can also gain access to types you formerly delivered electronically in the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your right town/country.

- Step 2. Utilize the Preview solution to look over the form`s content material. Do not overlook to learn the explanation.

- Step 3. In case you are unhappy with the develop, utilize the Lookup field on top of the display screen to discover other models of your legal develop template.

- Step 4. After you have identified the shape you want, click the Purchase now option. Opt for the costs plan you choose and add your credentials to register for an profile.

- Step 5. Procedure the transaction. You can use your charge card or PayPal profile to perform the transaction.

- Step 6. Pick the file format of your legal develop and download it in your device.

- Step 7. Full, modify and produce or sign the Connecticut Irrevocable Trust which is a Qualifying Subchapter-S Trust.

Every single legal document template you acquire is yours eternally. You possess acces to every single develop you delivered electronically within your acccount. Click on the My Forms area and choose a develop to produce or download once more.

Compete and download, and produce the Connecticut Irrevocable Trust which is a Qualifying Subchapter-S Trust with US Legal Forms. There are millions of expert and status-distinct types you may use for the enterprise or personal demands.