Connecticut Borrowers Certification of No Material Change No Damage is a legal document that serves as evidence that no material change or damage has occurred to a property owned by a borrower in the state of Connecticut. This certification is often required by lenders, mortgage companies, or financial institutions when there is a need to verify that the property's condition has not significantly changed since the initial loan approval or closing. Keywords: Connecticut, borrowers, certification, material change, no damage, legal document, evidence, property, lenders, mortgage companies, financial institutions, loan approval, closing. Types of Connecticut Borrowers Certification of No Material Change No Damage: 1. Residential Property Borrowers Certification: This type of certification is specific to residential properties, such as single-family homes, townhouses, or condominium units. It is generally used in mortgage or refinancing applications where the borrower must provide assurance that there have been no material changes or damages to the property. 2. Commercial Property Borrowers Certification: This certification is for commercial properties, such as office buildings, retail spaces, industrial facilities, or apartment complexes. It is required when borrowers seek financing for commercial real estate projects or when refinancing existing loans. 3. Construction Loan Borrowers Certification: This type of certification is applicable to borrowers who have obtained a construction loan to fund the development or renovation of a property in Connecticut. The certification ensures that the property's condition has not substantially changed during the construction process. 4. Home Equity Line of Credit (HELOT) Borrowers Certification: This certification is specifically designed for borrowers who have a home equity line of credit in Connecticut. It certifies that there have been no material changes or damages to the property that may affect the borrower's credit line or loan terms. 5. Reverse Mortgage Borrowers Certification: Borrowers who have secured a reverse mortgage, a type of loan available to senior homeowners, may be required to submit this certification. It verifies that the property has not undergone any significant changes or damages that could impact the reverse mortgage agreement. In conclusion, the Connecticut Borrowers Certification of No Material Change No Damage is a vital document used to confirm that no considerable changes or damages have occurred to a property owned by a borrower in Connecticut, particularly in the context of mortgage or loan applications. The different types of certifications mentioned above cater to various scenarios, such as residential or commercial property financing, construction loans, home equity lines of credit, or reverse mortgage agreements.

Connecticut Borrowers Certification of No Material Change No Damage

Description

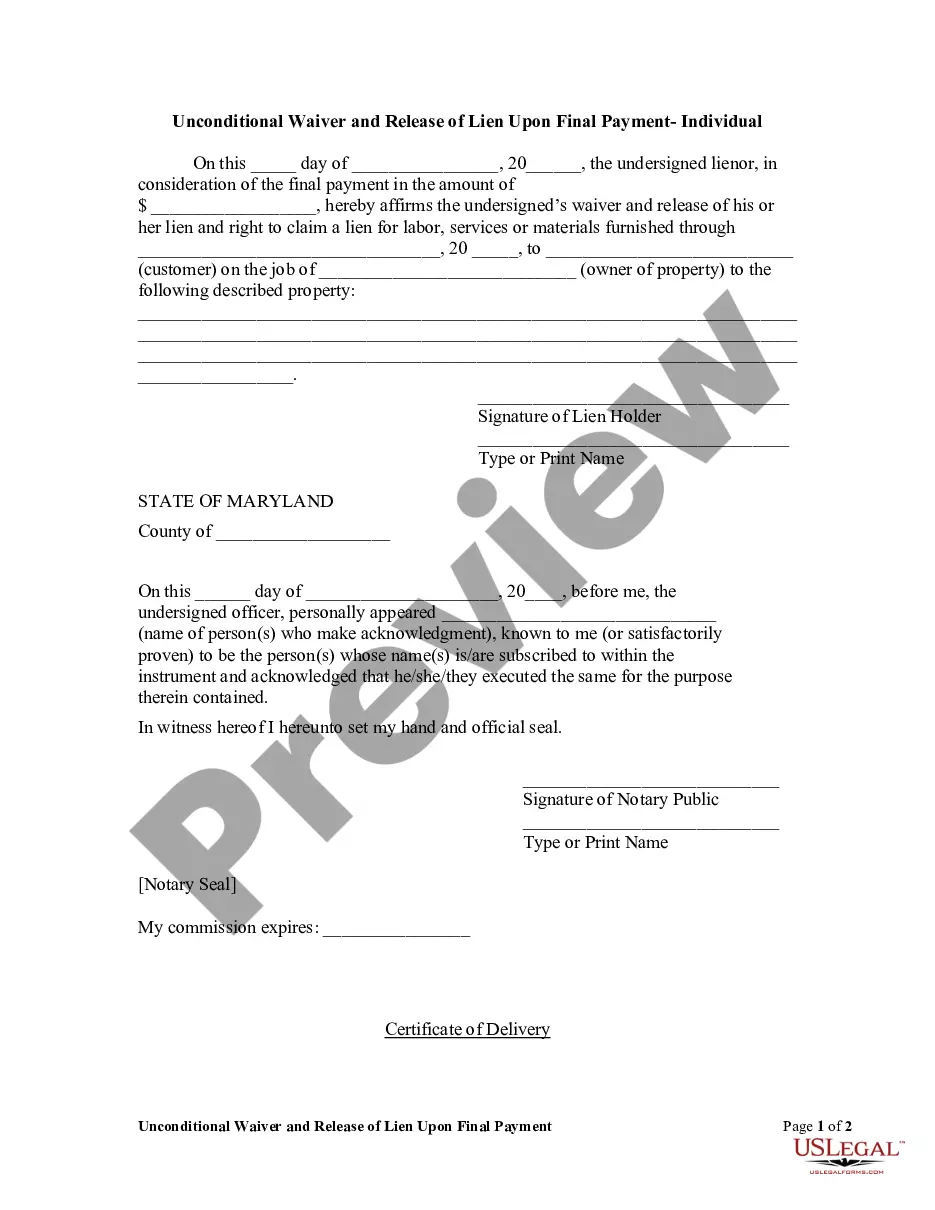

How to fill out Connecticut Borrowers Certification Of No Material Change No Damage?

It is possible to invest several hours on the Internet attempting to find the authorized document format which fits the federal and state demands you need. US Legal Forms gives thousands of authorized types that are reviewed by experts. It is simple to down load or produce the Connecticut Borrowers Certification of No Material Change No Damage from my service.

If you already possess a US Legal Forms account, you are able to log in and then click the Obtain switch. After that, you are able to full, modify, produce, or indicator the Connecticut Borrowers Certification of No Material Change No Damage. Each and every authorized document format you purchase is the one you have forever. To have yet another duplicate associated with a acquired type, go to the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms website the first time, keep to the basic directions below:

- Initially, ensure that you have chosen the correct document format for that region/town of your choice. Browse the type explanation to ensure you have picked the proper type. If available, use the Preview switch to check with the document format also.

- If you wish to locate yet another version in the type, use the Lookup discipline to obtain the format that suits you and demands.

- After you have located the format you want, just click Purchase now to proceed.

- Select the rates plan you want, type in your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You can use your Visa or Mastercard or PayPal account to purchase the authorized type.

- Select the structure in the document and down load it for your device.

- Make alterations for your document if required. It is possible to full, modify and indicator and produce Connecticut Borrowers Certification of No Material Change No Damage.

Obtain and produce thousands of document themes using the US Legal Forms Internet site, which provides the most important selection of authorized types. Use professional and condition-specific themes to tackle your business or person requires.

Form popularity

FAQ

If there is evidence that the mortgage lender engaged in fraudulent practices or coerced the borrower to agree to its terms when forming the contract. Any such actions are illegal and will most likely render the mortgage loan contract as null and void.

Ancient Mortgage - CGS 49-13a ? cites that a mortgage is invalid 20 years after a stated maturity date or 40 years after date of recording of mortgage if no due date is set forth in the mortgage. An affidavit must be recorded signed by owner of the property alleging these facts.

The Connecticut Abusive Home Loan Lending Practices Act and the nonprime lending statutes impose additional requirements, disclosures, and loan structures on high-cost and nonprime home loans, respectively.

Section 49-37 - Dissolution of mechanic's lien by substitution of bond. Joinder of actions on claim and bond.

49-9a. Validation of release of mortgage. Affidavit.

Section 49-8 - Release of satisfied or partially satisfied mortgage or ineffective attachment, lis pendens or lien. Damages.

Section 49-2a - Interest on funds held in escrow for payment of taxes and insurance, Conn. Gen. Stat. § 49-2a | Casetext Search + Citator.