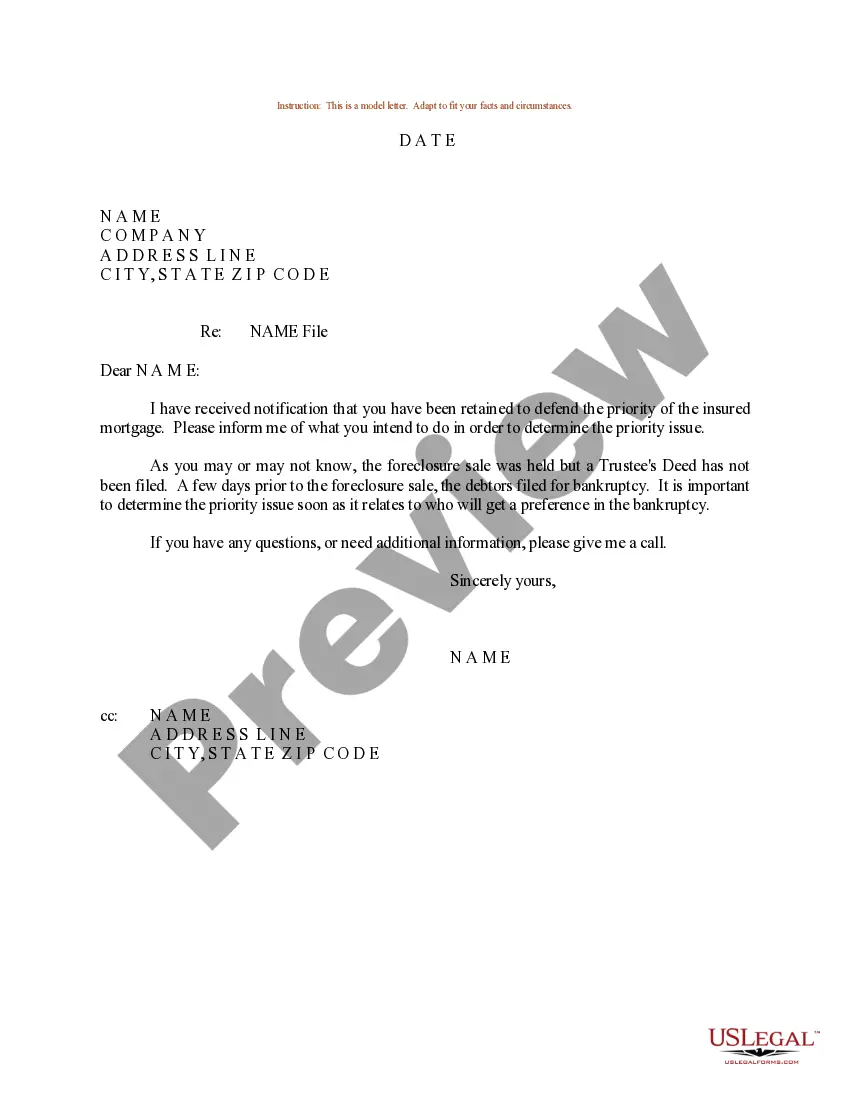

Connecticut Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage

Description

How to fill out Sample Letter For Intentions Regarding Defense Of Priority Of Insured Mortgage?

Finding the right authorized file template could be a struggle. Needless to say, there are tons of themes available online, but how can you discover the authorized type you will need? Utilize the US Legal Forms internet site. The support offers 1000s of themes, like the Connecticut Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage, that can be used for organization and private demands. Each of the types are checked out by experts and satisfy state and federal demands.

In case you are already registered, log in to your account and click the Download option to get the Connecticut Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage. Make use of account to check through the authorized types you might have bought earlier. Visit the My Forms tab of your respective account and get yet another copy of the file you will need.

In case you are a fresh consumer of US Legal Forms, listed here are straightforward guidelines for you to stick to:

- Very first, make certain you have chosen the right type for the town/region. You are able to look through the form making use of the Preview option and browse the form outline to make certain it is the right one for you.

- If the type fails to satisfy your expectations, take advantage of the Seach industry to obtain the appropriate type.

- When you are sure that the form is acceptable, select the Get now option to get the type.

- Opt for the rates program you want and enter the essential information. Create your account and purchase an order with your PayPal account or Visa or Mastercard.

- Pick the file structure and download the authorized file template to your device.

- Total, edit and printing and indication the acquired Connecticut Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage.

US Legal Forms is the biggest catalogue of authorized types that you can see a variety of file themes. Utilize the company to download appropriately-made documents that stick to express demands.

Form popularity

FAQ

What is a letter of explanation address verification? You'll need to send a letter of explanation address verification to your lender if your current physical address does not match the address on your mortgage application or credit report.

A document that expresses an offer to lend with rates and terms. The letter of intent explains a simple process and contains basic conditions that a borrower can review to determine if the lending offer fits with the borrower's project parameters.

A letter of explanation for a mortgage is a document that provides further details about a borrower's credit or financial circumstances. The letter of explanation might describe why you were unemployed for a period of time, for example, or why there's an unpaid balance on your credit report.

To write an intent to occupy letter, you should include your name, the home's address, your decision to apply for a mortgage and your intent to occupy the home as the owner. You should also include any specific details that your lender requests.

Here are some of the things mortgage experts recommend you include: The date you're writing the letter. The lender's name, mailing address, and phone number. Your full legal name and loan application number. Your explanation, with references to any supporting documents you're including. Your mailing address and phone number.

If an underwriter requests a letter of explanation, welcome it as an opportunity to clarify your financial situation and clear up any confusion about your credit history or assets. Whether you're applying for a mortgage for your first or second home, writing a letter of explanation can be vital in securing funds.

Dear [recipient's name], I write to you today in response to a letter I received from you, dated [insert date], about [insert number] of late payments on my loan from [insert date to date]. I am writing this letter today to explain to you the reasons for my delay.

How to write a letter of explanation Facts. Include all the details with correct dates and dollar amounts. Resolution. Explain how and when the situation was resolved. Acknowledgment. It's important that the letter outline why the problem won't arise again. Recognize if and how you could have avoided this mistake.