Connecticut LLC Operating Agreement for S Corp: A Detailed Description When forming a limited liability company (LLC) in Connecticut, many business owners opt for the S Corporation (S Corp) tax status due to its favorable tax benefits. To ensure the smooth functioning of an S Corp in Connecticut, having an LLC operating agreement specifically designed for this purpose is crucial. In this article, we will provide a detailed description of a Connecticut LLC Operating Agreement for S Corp, highlighting key elements and important keywords. 1. Purpose of the Operating Agreement: A Connecticut LLC Operating Agreement for S Corp establishes the rights, responsibilities, and obligations of LLC members and outlines the operational guidelines specific to an S Corporation. It is an essential legal document that governs the LLC's day-to-day operations, management structure, profit distribution, and other crucial aspects. 2. Membership Interests: The agreement should clearly define the ownership interests held by each member of the LLC. It includes details such as the number of authorized shares and the percentage of ownership each member holds. Additionally, it outlines the procedures for transferring or selling membership interests and restrictions, if any, on such transfers. 3. Management Structure: An S Corp's management structure typically comprises a board of directors and officers. The operating agreement specifies the roles and responsibilities of directors and officers, including their selection and removal procedures. It further outlines the decision-making process for matters requiring member approval, such as amendments to the operating agreement or major business transactions. 4. Voting Rights: The operating agreement should clearly define the voting rights of members, including the weightage assigned to each membership interest. Voting rights enable members to participate in decision-making processes, elect directors, and approve important actions relating to the S Corp's operation, such as mergers or acquisitions. 5. Tax Treatment and Profit Allocation: As an S Corp, the LLC is subject to pass-through taxation, and profits and losses are typically allocated based on membership interests. The operating agreement outlines the profit allocation methodology, specifying how profits and losses are divided among members and whether any special allocations or distributions may be made. 6. Dissolution and Liquidation: The Connecticut LLC Operating Agreement for S Corp should address the process and conditions for dissolving the LLC. It outlines the steps to be taken and the approvals required for voluntary or involuntary dissolution, as well as the distribution of assets and liabilities during the liquidation process. Variations of Connecticut LLC Operating Agreements for S Corp: 1. Single-Member Operating Agreement for S Corp: This agreement is specifically tailored for LCS with a single member or owner seeking S Corp tax treatment. It provides detailed provisions relevant to the sole proprietor's responsibilities, obligations, and decision-making authority. 2. Multi-Member Operating Agreement for S Corp: When an LLC has multiple members electing S Corp tax status, a multi-member operating agreement becomes necessary. It covers matters related to member relationships, profit-sharing, management roles, and dispute resolution methods. In conclusion, if you plan to establish an S Corp in Connecticut, obtaining an LLC operating agreement specialized for an S Corp is essential. Such an agreement ensures legal compliance and provides clarity on important matters, protecting the rights and interests of all LLC members. Remember to consult with a qualified attorney or legal professional to draft a customized operating agreement that meets your specific requirements and adheres to Connecticut state laws.

Connecticut LLC Operating Agreement for S Corp

Description

How to fill out Connecticut LLC Operating Agreement For S Corp?

Are you presently inside a situation in which you need paperwork for both organization or person reasons just about every day time? There are a variety of authorized file web templates available on the net, but locating ones you can rely is not easy. US Legal Forms provides 1000s of develop web templates, just like the Connecticut LLC Operating Agreement for S Corp, which are created in order to meet federal and state specifications.

In case you are previously familiar with US Legal Forms site and get a free account, just log in. Next, you may down load the Connecticut LLC Operating Agreement for S Corp template.

Should you not provide an bank account and want to begin to use US Legal Forms, adopt these measures:

- Find the develop you will need and make sure it is to the appropriate area/region.

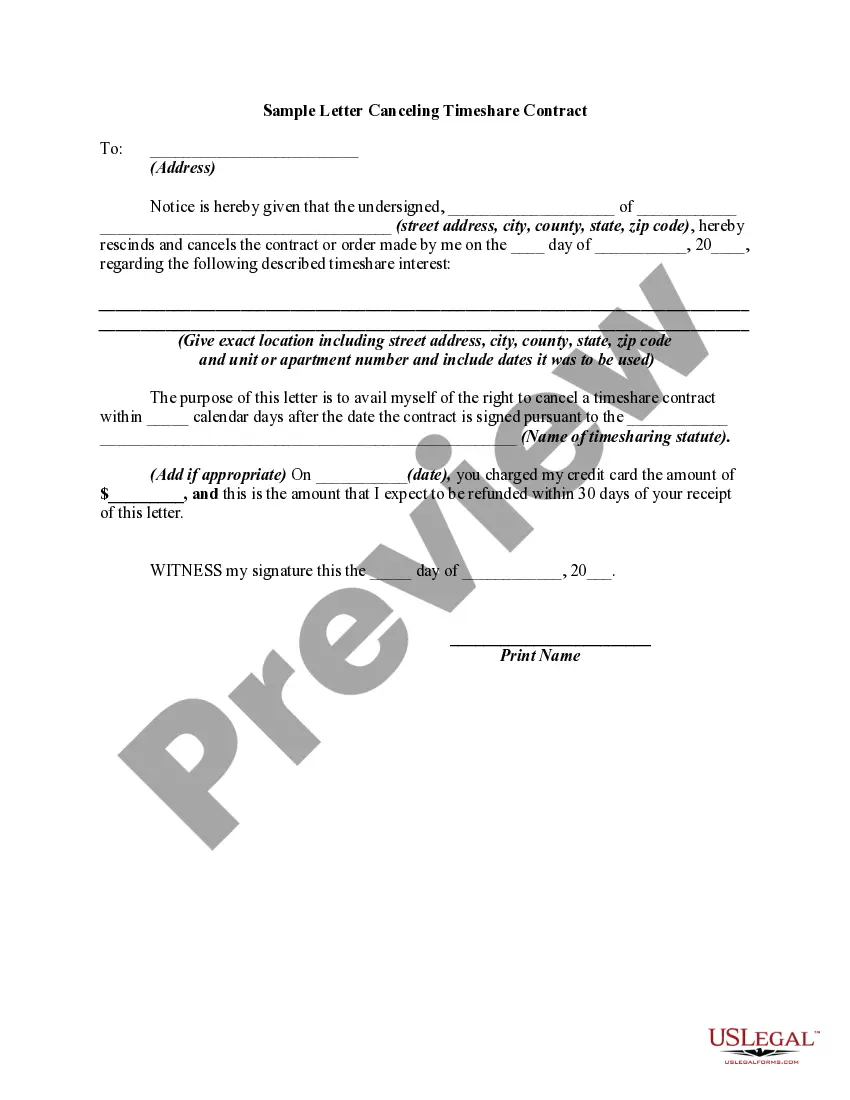

- Take advantage of the Preview option to analyze the form.

- Browse the outline to ensure that you have chosen the correct develop.

- In the event the develop is not what you`re searching for, utilize the Look for area to find the develop that meets your requirements and specifications.

- If you discover the appropriate develop, click on Get now.

- Opt for the pricing plan you need, fill out the desired information and facts to make your account, and buy your order making use of your PayPal or bank card.

- Select a convenient paper format and down load your copy.

Find each of the file web templates you might have purchased in the My Forms menu. You can aquire a additional copy of Connecticut LLC Operating Agreement for S Corp any time, if possible. Just click the necessary develop to down load or produce the file template.

Use US Legal Forms, one of the most substantial selection of authorized forms, in order to save time as well as steer clear of faults. The support provides skillfully manufactured authorized file web templates that can be used for a range of reasons. Create a free account on US Legal Forms and begin generating your way of life easier.