Connecticut Sample Letter regarding Discharge of Debtor

Description

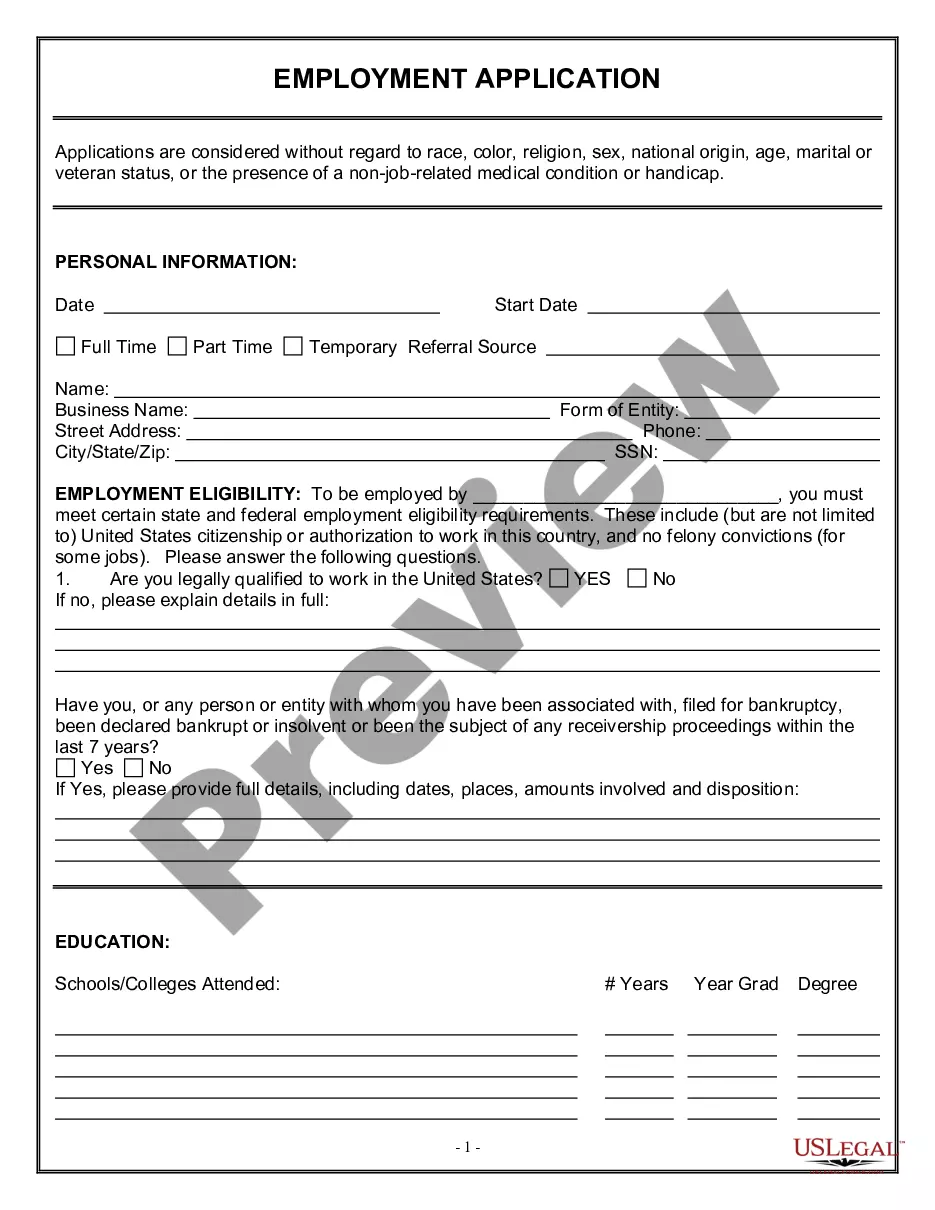

How to fill out Sample Letter Regarding Discharge Of Debtor?

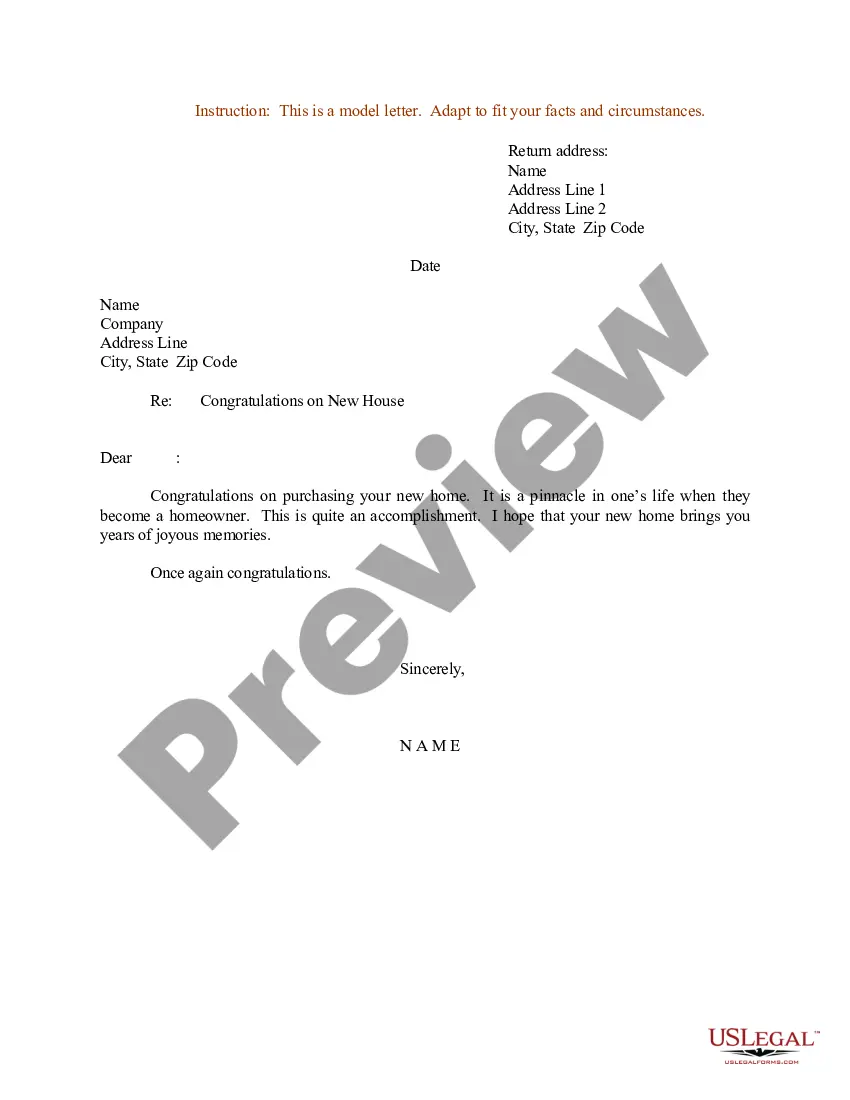

Are you presently inside a placement in which you need to have paperwork for possibly company or personal purposes nearly every working day? There are tons of legal record templates available online, but discovering versions you can trust isn`t effortless. US Legal Forms delivers thousands of type templates, such as the Connecticut Sample Letter regarding Discharge of Debtor, which can be created to meet state and federal specifications.

If you are presently knowledgeable about US Legal Forms internet site and get a free account, basically log in. Following that, you are able to acquire the Connecticut Sample Letter regarding Discharge of Debtor design.

Unless you offer an profile and want to begin using US Legal Forms, follow these steps:

- Find the type you want and ensure it is for your right metropolis/county.

- Utilize the Review button to review the shape.

- Browse the outline to ensure that you have chosen the appropriate type.

- When the type isn`t what you are trying to find, use the Search discipline to find the type that suits you and specifications.

- Whenever you get the right type, simply click Acquire now.

- Pick the costs prepare you need, complete the desired details to produce your money, and purchase the transaction utilizing your PayPal or Visa or Mastercard.

- Select a handy data file formatting and acquire your version.

Find all of the record templates you may have purchased in the My Forms food selection. You can obtain a additional version of Connecticut Sample Letter regarding Discharge of Debtor at any time, if possible. Just click on the needed type to acquire or print out the record design.

Use US Legal Forms, one of the most considerable variety of legal kinds, to conserve time as well as stay away from mistakes. The support delivers skillfully made legal record templates that can be used for an array of purposes. Generate a free account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

When a debt is discharged, the debtor is no longer liable for the debt and the lender is no longer allowed to make attempts to collect the debt. Debt discharge can result in taxable income to the debtor unless certain IRS conditions are met. A debt discharge occurs when a debtor qualifies through bankruptcy court.

You no longer have further obligation to repay the loan, you will receive a reimbursement of payments made voluntarily or through forced collection, and. the discharge will be reported to credit bureaus to delete any adverse credit history associated with the loan.

The following categories of debts are not released on discharge: A debt incurred in respect of, or the payment of which was avoided by, any fraud or fraudulent breach of trust to which the bankrupt was a party (see paragraph 40.178).

The Process of a Debt Discharge The bankruptcy court will look at your plan and decide whether it is fair and in ance with the law. You will also need to work with a trustee who will distribute these payments to the creditors. The trustee will pay creditors ing to priority.

In individual chapter 11 cases, and in cases under chapter 12 (adjustment of debts of a family farmer or fisherman) and 13 (adjustment of debts of an individual with regular income), the court generally grants the discharge as soon as practicable after the debtor completes all payments under the plan.

People who file for personal bankruptcy get a discharge ? a court order that says they don't have to repay certain debts. Bankruptcy is generally considered your last option because of its long-term negative impact on your credit.

Generally, a discharge removes the debtors' personal liability for debts owed before the debtors' bankruptcy case was filed. Also, if this case began under a different chapter of the Bankruptcy Code and was later converted to chapter 7, debts owed before the conversion are discharged.

Connecticut has a six-year statute of limitations for debt collection actions resulting from simple and implied contracts (CGS § 52-576; attachment 1). Medical bills generally are simple or implied contracts and thus the SOL is six years.