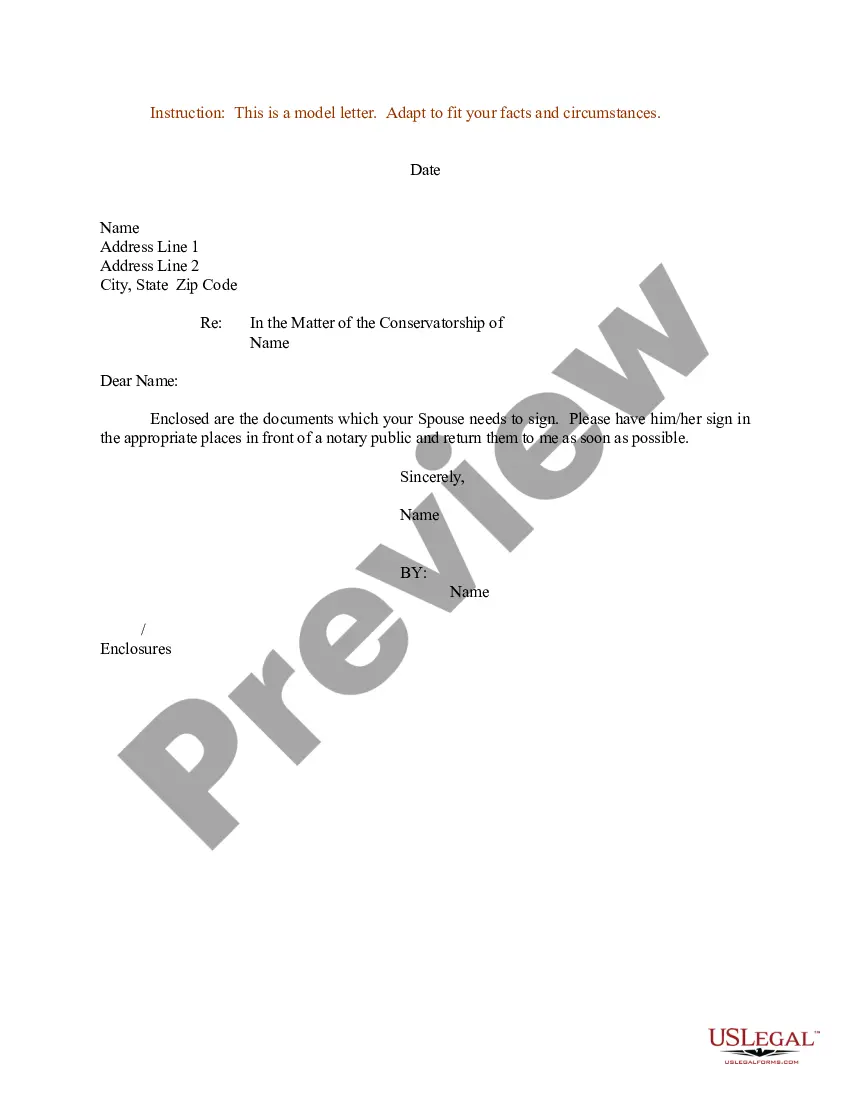

Connecticut Sample Letter for Spouse Signature

Description

How to fill out Sample Letter For Spouse Signature?

Choosing the right authorized document design might be a battle. Of course, there are a variety of web templates available online, but how would you get the authorized kind you need? Utilize the US Legal Forms internet site. The assistance delivers 1000s of web templates, including the Connecticut Sample Letter for Spouse Signature, that can be used for organization and private requires. All of the varieties are checked out by experts and fulfill state and federal requirements.

In case you are previously signed up, log in to your profile and click the Obtain option to get the Connecticut Sample Letter for Spouse Signature. Utilize your profile to search from the authorized varieties you might have bought previously. Go to the My Forms tab of your respective profile and get yet another version in the document you need.

In case you are a new consumer of US Legal Forms, listed below are simple directions for you to stick to:

- First, ensure you have selected the right kind to your area/region. It is possible to examine the shape while using Preview option and look at the shape outline to ensure it is the best for you.

- If the kind will not fulfill your needs, utilize the Seach discipline to find the right kind.

- Once you are positive that the shape is acceptable, go through the Acquire now option to get the kind.

- Choose the rates plan you would like and type in the necessary info. Design your profile and pay for the order making use of your PayPal profile or charge card.

- Choose the document format and obtain the authorized document design to your gadget.

- Complete, modify and printing and signal the attained Connecticut Sample Letter for Spouse Signature.

US Legal Forms will be the greatest collection of authorized varieties in which you can find numerous document web templates. Utilize the service to obtain skillfully-made paperwork that stick to condition requirements.

Form popularity

FAQ

To request injured spouse relief, file Form 8379, Injured Spouse Allocation. You can file it with your tax return by mail or electronically. You can also mail it separately when you receive notice that your refund was applied to an outstanding debt.

Sincerely,[Name of Tax Authority Representative] Subject: Notice of Income Tax Obligations Dear [Recipient's Name], I am writing to inform you of your income tax obligations for the tax year [year]. ing to our records, your taxable income for the year was [amount].

Purpose: Use Form CT-8379, Nonobligated Spouse Claim, if: ? You are a nonobligated spouse and all or part of your overpayment. was (or is expected to be) applied against: ? Your spouse's past due State of Connecticut debt (such as. child support, student loan, or any debt to any Connecticut state.

Use Form CT-8857, Request for Innocent Spouse Relief (And Separation of Liability and Equitable Relief), to request relief from liability for tax, plus related penalties and interest, for which you believe only your spouse or former spouse should be held liable.