Dear [Client's Name], I hope this letter finds you well. As your trusted attorney, I am writing to provide you with important information regarding the Connecticut Sample Letter for Estate. It is crucial to understand the various types of correspondence that can arise during the probate process in Connecticut. 1. Letter of Notification: This type of letter is typically sent by the executor or personal representative of the estate to inform beneficiaries, heirs, and interested parties about the probate proceedings. It outlines the basic details of the estate, including the decedent's name, date of death, and the appointed executor. 2. Letter of Probate Appointment: Once the court approves the appointment of an executor or administrator, a letter is issued confirming their authority to act on behalf of the estate. This correspondence is crucial as it signifies the official start of the probate process. 3. Letter to Creditors: In Connecticut, it is essential for the executor to notify creditors of the decedent's death. This ensures that any outstanding debts owed by the deceased are properly addressed within the probate proceedings. The letter must provide creditors with instructions on how to file a claim against the estate, including the deadline for doing so. 4. Letter to Beneficiaries: This letter is typically sent by the executor to beneficiaries named in the decedent's will. It serves as a formal notification of their inclusion in the estate and provides details regarding their entitlements, whether its specific assets or a designated share of the estate. 5. Final Accounting Letter: After the administration of the estate is complete, the executor must provide beneficiaries with a final accounting letter. This document details the financial transactions, expenses, asset distributions, and any outstanding taxes or debts. It offers a comprehensive overview of the estate's financial affairs throughout the probate process. As an attorney, it is my responsibility to draft these letters accurately and effectively, ensuring compliance with Connecticut's probate laws. Each letter must be customized to the unique circumstances of the estate and tailored to the needs of the individuals involved. I understand that the probate process can be overwhelming, but rest assured that I am here to guide you through every step. If you have any questions or concerns about the Connecticut Sample Letter for Estate or any other aspect of the probate proceedings, please do not hesitate to reach out to me. Thank you for entrusting me with this important matter. Sincerely, [Your Name] [Your Title] [Law Firm Name]

Connecticut Sample Letter for Estate - Correspondence from Attorney

Description

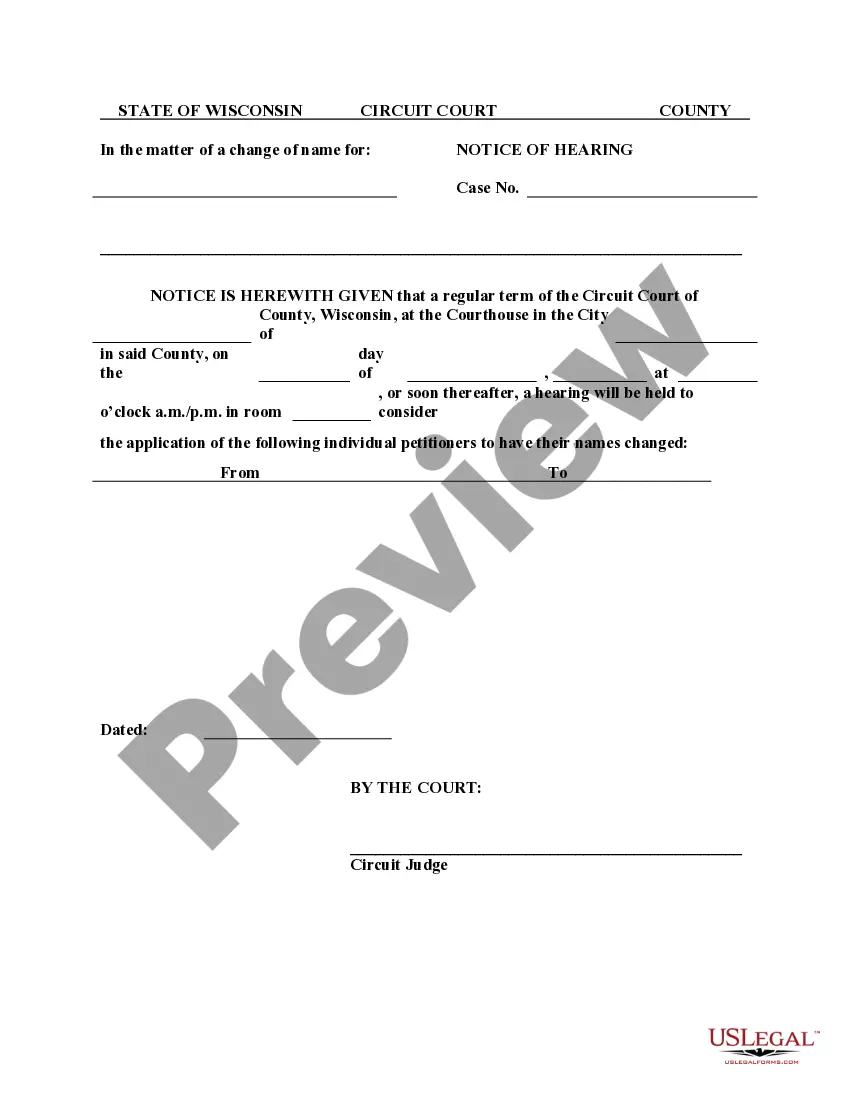

How to fill out Connecticut Sample Letter For Estate - Correspondence From Attorney?

It is possible to spend time on the web searching for the lawful papers format that suits the federal and state requirements you need. US Legal Forms supplies 1000s of lawful varieties which are analyzed by experts. You can easily acquire or print out the Connecticut Sample Letter for Estate - Correspondence from Attorney from my support.

If you currently have a US Legal Forms account, you may log in and click on the Down load button. After that, you may full, edit, print out, or signal the Connecticut Sample Letter for Estate - Correspondence from Attorney. Each lawful papers format you acquire is the one you have permanently. To acquire another version for any obtained form, go to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms internet site the very first time, stick to the simple guidelines listed below:

- First, make certain you have chosen the proper papers format for the state/metropolis of your choosing. Read the form description to ensure you have chosen the right form. If readily available, take advantage of the Preview button to look with the papers format at the same time.

- If you wish to locate another edition of your form, take advantage of the Look for area to find the format that suits you and requirements.

- Upon having found the format you want, click on Get now to carry on.

- Pick the prices program you want, enter your qualifications, and register for an account on US Legal Forms.

- Total the deal. You should use your bank card or PayPal account to fund the lawful form.

- Pick the structure of your papers and acquire it to the gadget.

- Make adjustments to the papers if necessary. It is possible to full, edit and signal and print out Connecticut Sample Letter for Estate - Correspondence from Attorney.

Down load and print out 1000s of papers web templates using the US Legal Forms website, that provides the greatest variety of lawful varieties. Use expert and condition-particular web templates to deal with your business or person demands.