Connecticut Notice of Transfer of Reserved Corporate Name is a legal document used in the state of Connecticut to transfer the reserved corporate name from one entity to another. This process ensures that a previously reserved name retains its exclusivity and is now being transferred to a different corporation or entity. The Notice of Transfer of Reserved Corporate Name must include specific details regarding the entities involved in the name transfer and the desired effective date of the transfer. It is crucial to accurately complete this form to avoid any confusion or potential legal complications. Keywords: Connecticut, Notice of Transfer, Reserved Corporate Name, legal document, transfer, entity, exclusivity, corporation, effective date, form, confusion, legal complications. Different Types of Connecticut Notice of Transfer of Reserved Corporate Name: 1. Standard Notice of Transfer of Reserved Corporate Name: This is the common type used when a corporation in Connecticut wants to transfer a reserved corporate name to another entity. The form requires information about both the current holder of the reserved name and the new entity that will assume rights to the name. 2. Intra-term Transfer of Reserved Corporate Name: This type of transfer is designed for situations where a corporation wants to transfer a reserved name to a different subsidiary or related entity within the same corporate structure. This ensures that the exclusivity of the reserved name is maintained within the organization. 3. Non-Profit Organization Transfer of Reserved Corporate Name: Connecticut also allows non-profit organizations to transfer reserved corporate names. This type of transfer requires additional documentation and proof of the non-profit status. 4. Merger or Acquisition Transfer of Reserved Corporate Name: In cases where a company is involved in a merger or acquisition, the reserved corporate name may need to be transferred to the new entity. This type of transfer requires careful consideration of the legal implications and should be executed in accordance with applicable laws and regulations. It is crucial to consult with a legal professional or the Connecticut Secretary of State's office for specific instructions and guidance when preparing and submitting a Notice of Transfer of Reserved Corporate Name, as requirements may vary based on the type of transfer and unique circumstances.

Connecticut Notice of Transfer of Reserved Corporate Name

Description

How to fill out Connecticut Notice Of Transfer Of Reserved Corporate Name?

Choosing the best authorized record web template can be a have a problem. Obviously, there are a lot of templates available on the Internet, but how can you find the authorized type you require? Use the US Legal Forms web site. The service offers 1000s of templates, like the Connecticut Notice of Transfer of Reserved Corporate Name, which you can use for company and private needs. All of the varieties are checked out by pros and meet federal and state demands.

If you are already listed, log in for your profile and click on the Obtain switch to get the Connecticut Notice of Transfer of Reserved Corporate Name. Make use of your profile to look through the authorized varieties you have bought previously. Visit the My Forms tab of your respective profile and acquire yet another copy of your record you require.

If you are a whole new consumer of US Legal Forms, listed below are straightforward instructions that you should adhere to:

- Initially, make sure you have selected the correct type for the metropolis/county. You are able to check out the form utilizing the Preview switch and read the form explanation to ensure it is the best for you.

- In the event the type does not meet your preferences, use the Seach field to get the appropriate type.

- When you are certain that the form is acceptable, click on the Buy now switch to get the type.

- Choose the rates plan you need and enter the necessary information and facts. Make your profile and pay for your order making use of your PayPal profile or credit card.

- Pick the document formatting and acquire the authorized record web template for your gadget.

- Comprehensive, edit and produce and signal the acquired Connecticut Notice of Transfer of Reserved Corporate Name.

US Legal Forms may be the biggest collection of authorized varieties where you can discover various record templates. Use the service to acquire appropriately-created paperwork that adhere to express demands.

Form popularity

FAQ

To amend the Certificate of Organization for your Connecticut LLC, you'll need to file a Certificate of Amendment with the Connecticut Secretary of State. Along with the amendment, you'll need to pay a $120 filing fee.

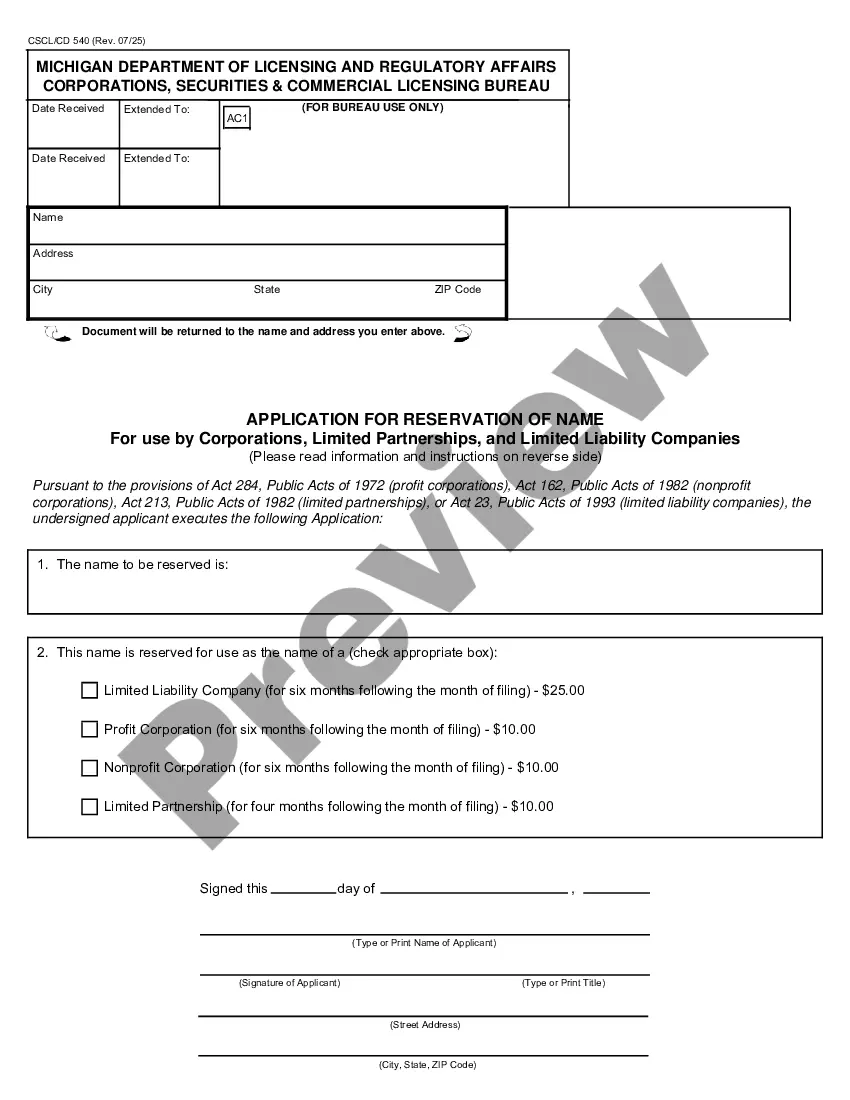

You'll need to complete an Application for Reservation of Name form and file it with the Connecticut Secretary of State. Once you do so, your name will be reserved for 120 days. You don't need to reserve a name if you're forming your business right away.

The main starting cost to form a Connecticut LLC is the $120 filing fee for the Connecticut LLC Certificate of Organization. Filing this document with the Connecticut Secretary of State officially forms your LLC. You can file by mail, in person, or online via the CT Business OneStop portal.

A foreign corporation authorized to transact business in Connecticut may withdraw its Certificate of Authority by filing an Application for Certificate of Withdrawal.

Payment of $250 is due at the time of filing the application and affidavit, forms PC-900 and PC-910A for minors, forms PC-901 and PC-910 for adults. o Payment may be made by cash, credit card, check, or money order. Make checks payable to ?Treasurer, State of Connecticut.?

You can change the corporations officers and directors by filing an amendment, but amendments are fairly expensive. You are required to report all of your officers and directors on the corporations annual report.

If you want to change or edit the name of your business, you can file an amendment that is specific to the type of business entity you have. For example, if you have a CT Limited Liability Company you would need to complete the Certificate of Amendment listed under the Domestic Limited Liability Company Forms Index.

The first step is to file a form called the Certificate of Amendment with the Secretary of State and wait for it to be approved. This is how you officially change your LLC name in Connecticut. The filing fee for a Certificate of Amendment in Connecticut is $120.