Connecticut Inquiry of Credit Cardholder Concerning Billing Error

Description

How to fill out Inquiry Of Credit Cardholder Concerning Billing Error?

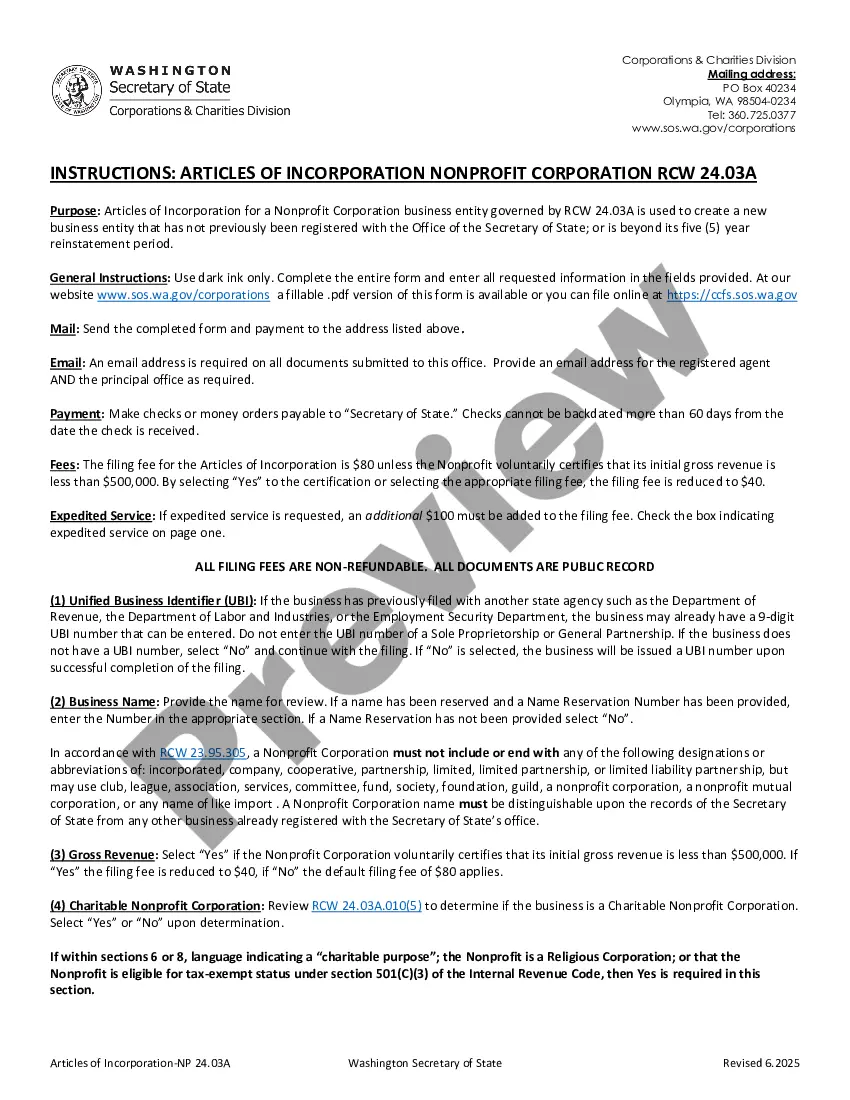

Discovering the right authorized record design could be a battle. Naturally, there are a variety of themes available on the net, but how would you obtain the authorized kind you will need? Utilize the US Legal Forms internet site. The support offers thousands of themes, such as the Connecticut Inquiry of Credit Cardholder Concerning Billing Error, which you can use for business and private needs. Each of the forms are checked by specialists and satisfy federal and state needs.

If you are currently registered, log in to the bank account and then click the Acquire key to obtain the Connecticut Inquiry of Credit Cardholder Concerning Billing Error. Utilize your bank account to search with the authorized forms you possess acquired earlier. Go to the My Forms tab of the bank account and acquire yet another copy of the record you will need.

If you are a whole new customer of US Legal Forms, allow me to share easy instructions that you should follow:

- Initially, ensure you have selected the correct kind for your city/state. You are able to examine the form making use of the Preview key and study the form explanation to guarantee this is the right one for you.

- If the kind is not going to satisfy your preferences, utilize the Seach field to find the right kind.

- Once you are certain that the form would work, go through the Buy now key to obtain the kind.

- Pick the rates program you need and type in the essential information and facts. Create your bank account and buy an order utilizing your PayPal bank account or charge card.

- Opt for the data file structure and obtain the authorized record design to the system.

- Complete, change and print out and indicator the obtained Connecticut Inquiry of Credit Cardholder Concerning Billing Error.

US Legal Forms will be the most significant local library of authorized forms that you can see different record themes. Utilize the service to obtain professionally-made files that follow state needs.

Form popularity

FAQ

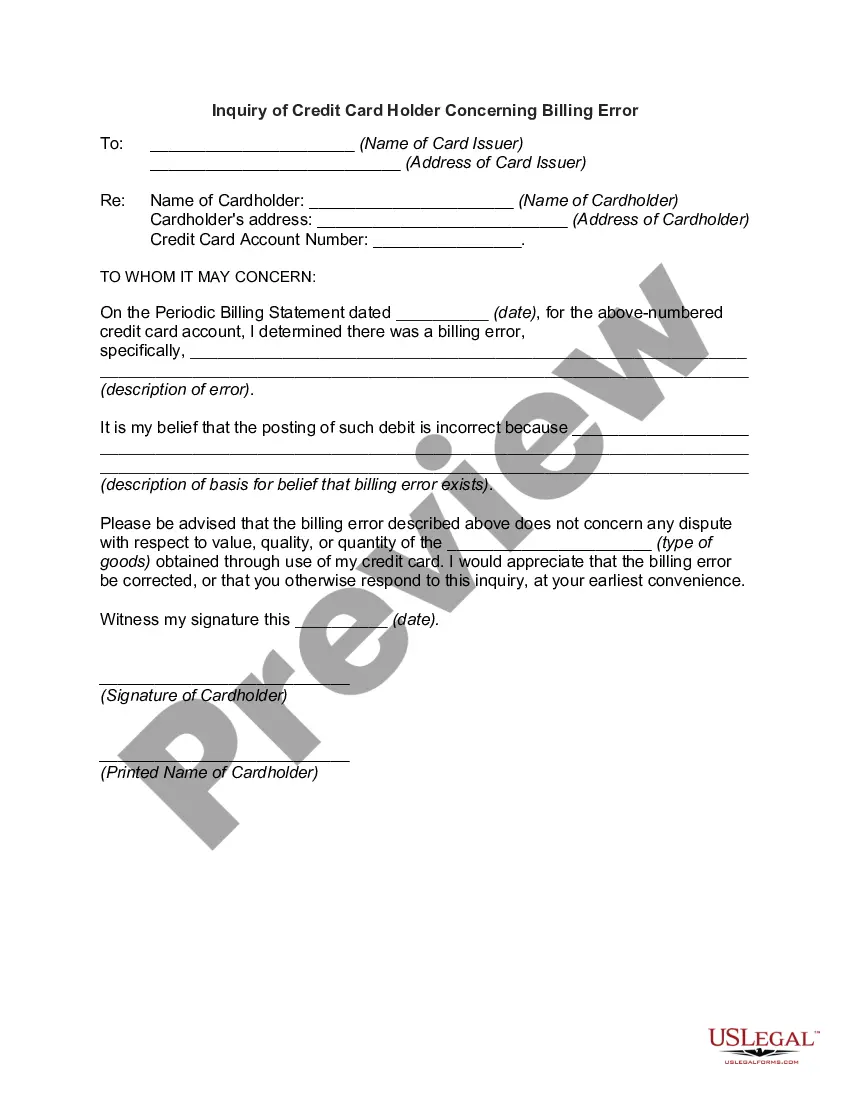

Federal law only protects cardholders for a limited time 60 days to be exact after a fraudulent or incorrect charge has been made. Thankfully I noticed the billing error within a few days of it posting to my account and started the dispute process right away.

How to Dispute a Billing ErrorRespond quickly. You have 60 days from the time the billing statement is sent to request a correction, so act quickly.Your request needs to be in writing.Then you wait.Don't withhold payment!Cover yourself.

Before you get yourself involved in a lengthy formal dispute, speak with the merchant. Bring your receipt and credit card statement, and take the time to explain the discrepancy. The merchant may clear up the mistake without having to involve the credit card company. If not, take your complaint to the next level.

Section 1026.13(c)(2) requires creditors to investigate the dispute, correct any errors found, and notify the consumer of the outcome no later than two complete billing cycles or 90 days after receiving the billing error notice.

If you believe an error has been made on your credit card bill, you should send your credit card company a written letter within 60 days of the charge appearing on your billing statement. The letter should include information that identifies yourself and what you are disputing.

If you believe an error has been made on your credit card bill, you should send your credit card company a written letter within 60 days of the charge appearing on your billing statement. The letter should include information that identifies yourself and what you are disputing.

If you have an issue with your credit card or bank account, report it to the Consumer Financial Protection Bureau. Go to consumerfinance.gov/complaint or call (855) 411-CFPB (2372).

How to Dispute a Billing ErrorRespond quickly. You have 60 days from the time the billing statement is sent to request a correction, so act quickly.Your request needs to be in writing.Then you wait.Don't withhold payment!Cover yourself.

It's important to let your credit card company know about the problem within 60 days. Send them a letter including relevant documents and request a delivery receipt so that you have proof of its arrival. Some credit card providers also give you the option to file disputes online.