Connecticut Post Bankruptcy Petition Discharge Letter is an official document that signifies the completion of the bankruptcy process and grants the debtor a discharge from their remaining eligible debts. This discharge letter serves as proof that the debtor has successfully completed their bankruptcy case in Connecticut and is no longer legally obligated to repay certain debts. Filing for bankruptcy can be a complex legal procedure, and the discharge letter is a crucial document that provides relief to debtors by wiping out their outstanding debts. It is important to note that not all debts are dischargeable in bankruptcy, and some obligations may still remain after the process is completed. There are several types of bankruptcy that individuals can file in Connecticut, each of which may have different variations of the discharge letter. The most common types include Chapter 7, Chapter 11, and Chapter 13 bankruptcies. 1. Chapter 7 Bankruptcy Discharge Letter: This type of bankruptcy is also known as liquidation bankruptcy, where a trustee is appointed to sell the debtor's non-exempt assets to repay the creditors. Upon the successful completion of Chapter 7 bankruptcy, debtors receive a discharge letter stating that their eligible debts have been wiped out. 2. Chapter 11 Bankruptcy Discharge Letter: Chapter 11 bankruptcy is primarily utilized by businesses to reorganize their debts and continue their operations. The discharge letter for Chapter 11 bankruptcy signifies that the debtor has successfully restructured their obligations and can continue operating under the court's supervision. 3. Chapter 13 Bankruptcy Discharge Letter: Chapter 13 bankruptcy allows individuals with regular income to reorganize their debts and develop a repayment plan over three to five years. Upon completing the repayment plan, debtors are issued a discharge letter that signifies the elimination of any remaining eligible debts. It is crucial for individuals who have received a Connecticut Post Bankruptcy Petition Discharge Letter to keep this document safe and readily accessible. This letter provides a fresh start for debtors, allowing them to rebuild their financial lives and move forward towards a more stable future. Disclaimer: The information provided is for general informational purposes only and should not be considered legal advice. It is advisable to consult with a qualified bankruptcy attorney for personalized guidance regarding specific bankruptcy cases.

Connecticut Post Bankruptcy Petition Discharge Letter

Description

How to fill out Connecticut Post Bankruptcy Petition Discharge Letter?

US Legal Forms - among the largest libraries of legal varieties in the USA - provides a wide range of legal papers web templates you may obtain or printing. Making use of the website, you can find 1000s of varieties for company and specific functions, categorized by categories, states, or keywords.You can get the newest types of varieties like the Connecticut Post Bankruptcy Petition Discharge Letter in seconds.

If you already possess a membership, log in and obtain Connecticut Post Bankruptcy Petition Discharge Letter from your US Legal Forms library. The Download key will appear on every develop you look at. You have access to all earlier saved varieties from the My Forms tab of your own profile.

If you wish to use US Legal Forms initially, listed here are easy recommendations to help you get started out:

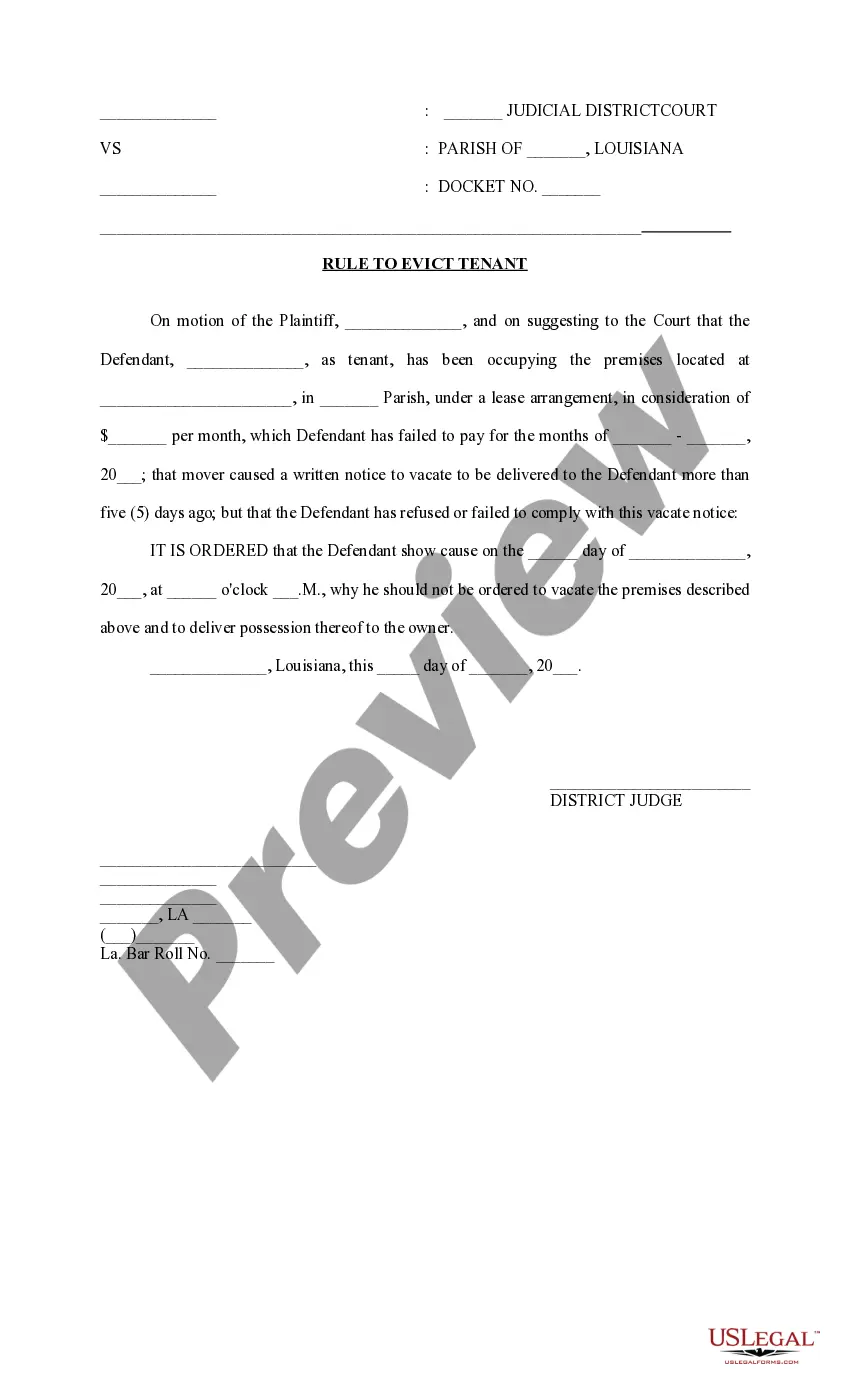

- Be sure you have picked out the best develop for your city/region. Click on the Preview key to analyze the form`s content material. Look at the develop explanation to actually have chosen the proper develop.

- If the develop doesn`t match your demands, take advantage of the Lookup area near the top of the monitor to obtain the one who does.

- In case you are content with the form, verify your selection by clicking the Buy now key. Then, pick the costs strategy you want and offer your references to sign up for the profile.

- Method the transaction. Utilize your Visa or Mastercard or PayPal profile to complete the transaction.

- Find the file format and obtain the form on the product.

- Make modifications. Complete, modify and printing and indication the saved Connecticut Post Bankruptcy Petition Discharge Letter.

Every template you added to your money does not have an expiration time and it is your own forever. So, in order to obtain or printing an additional duplicate, just go to the My Forms section and click around the develop you will need.

Obtain access to the Connecticut Post Bankruptcy Petition Discharge Letter with US Legal Forms, by far the most comprehensive library of legal papers web templates. Use 1000s of expert and condition-specific web templates that meet your company or specific demands and demands.