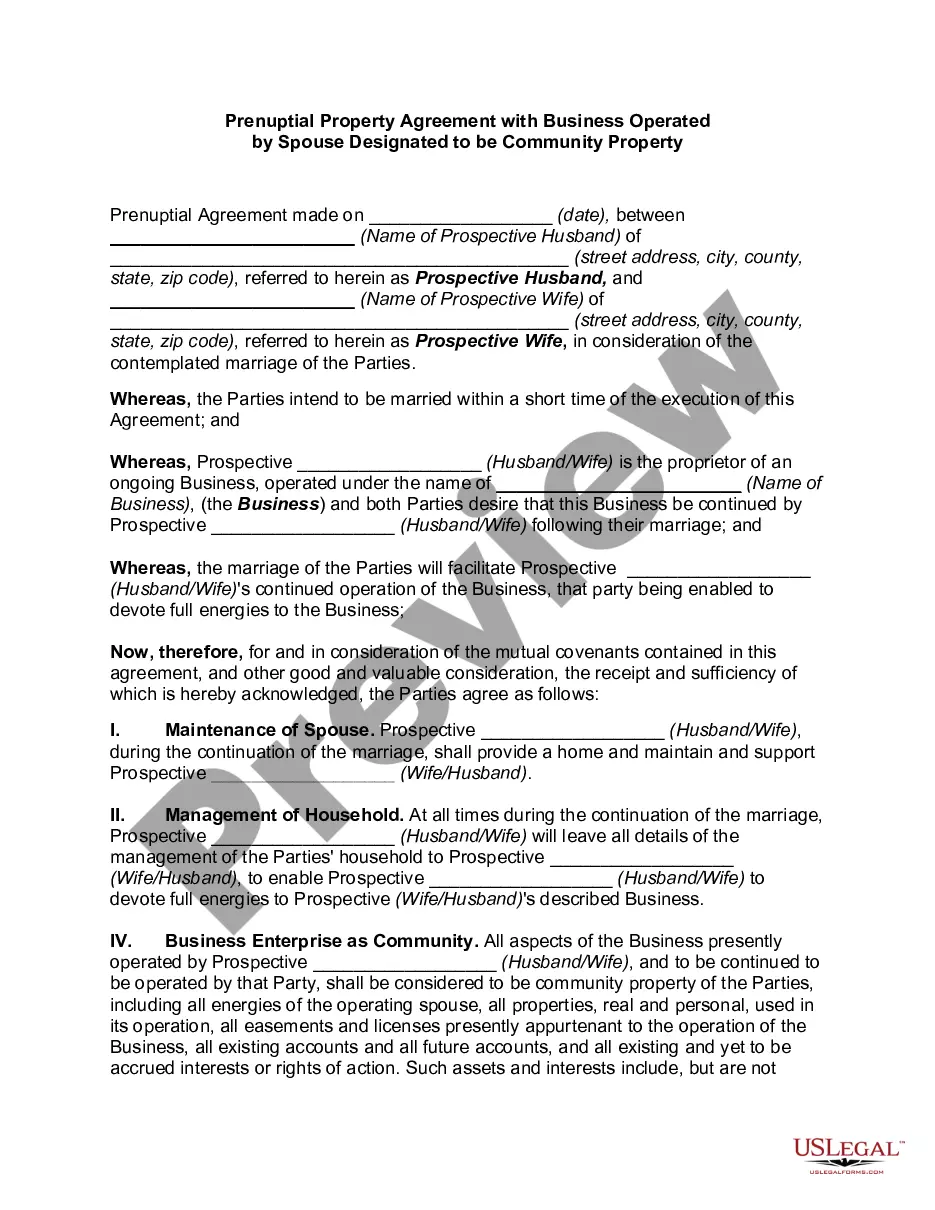

Connecticut Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property: A Detailed Description A Connecticut Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property is a legal contract entered into by prospective spouses in the state of Connecticut, with the purpose of determining the property and financial rights of the parties involved in the event of a divorce or separation. In this specific type of agreement, the focus is on protecting the business interests of one spouse who operates a business that is considered community property. Community property refers to assets, including businesses, acquired during the course of the marriage, which are jointly owned by both spouses. A Connecticut Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property typically includes the following key elements: 1. Identification of the Business: The agreement clearly identifies the business operated by one spouse that is to be deemed as community property. This includes providing specific details about the nature of the business and its current value. 2. Boundary of Community Property: The agreement outlines specific terms defining how the community property boundary will be established. This includes explicitly stating the business assets and income that will be considered community property. 3. Ownership and Management Rights: The document defines the ownership rights and management responsibilities of the spouse operating the business as community property. It outlines the rights, obligations, and limitations of both spouses regarding the business's day-to-day operations and decision-making authority. 4. Distribution of Profits and Losses: The agreement addresses how profits and losses generated by the business will be allocated between the spouses. It may establish predetermined percentages or provide a formula for distribution based on specific factors such as the level of involvement of each spouse in the business. 5. Distribution in the Event of Separation or Divorce: This section governs the division of the community property business in case of separation or divorce. It may outline terms regarding the sale, buyout, or transfer of business ownership, as well as the valuation method to be used. Types of Connecticut Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property: 1. Full Community Property Agreement: This type of agreement designates the entirety of the business operated by one spouse as community property, subject to division in case of separation or divorce. 2. Partial Community Property Agreement: In this scenario, only a portion of the business operated by one spouse is designated as community property. The remainder is considered separate property and not subject to division. 3. Limited Liability for Business Debts: This variation of the agreement limits the liability of the non-operating spouse for any debts or obligations incurred by the business. In conclusion, a Connecticut Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property is a crucial legal tool that provides clarity, protection, and direction for spouses involved in a marriage where one partner operates a business classified as community property. It offers a framework for property division, profit distribution, and business management rights, bringing security and peace of mind to both parties.

Connecticut Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property

Description

How to fill out Connecticut Prenuptial Property Agreement With Business Operated By Spouse Designated To Be Community Property?

If you have to complete, acquire, or produce authorized record web templates, use US Legal Forms, the largest collection of authorized forms, that can be found online. Take advantage of the site`s simple and easy hassle-free look for to obtain the papers you require. Different web templates for organization and specific purposes are categorized by categories and claims, or search phrases. Use US Legal Forms to obtain the Connecticut Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property with a few mouse clicks.

If you are previously a US Legal Forms consumer, log in to your bank account and then click the Download button to get the Connecticut Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property. Also you can gain access to forms you previously saved in the My Forms tab of the bank account.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for your correct city/country.

- Step 2. Use the Preview option to look over the form`s information. Do not forget about to read through the information.

- Step 3. If you are not satisfied with the develop, utilize the Lookup discipline towards the top of the screen to get other models from the authorized develop design.

- Step 4. Once you have identified the form you require, select the Get now button. Opt for the rates prepare you like and add your references to register to have an bank account.

- Step 5. Approach the purchase. You should use your charge card or PayPal bank account to finish the purchase.

- Step 6. Pick the format from the authorized develop and acquire it on your system.

- Step 7. Full, edit and produce or signal the Connecticut Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property.

Every authorized record design you purchase is your own for a long time. You might have acces to each and every develop you saved in your acccount. Go through the My Forms segment and pick a develop to produce or acquire once again.

Be competitive and acquire, and produce the Connecticut Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property with US Legal Forms. There are thousands of specialist and status-distinct forms you can use for the organization or specific demands.