Connecticut Jury Instruction 10.10.3 refers to the guidelines provided to a jury when determining whether an individual should be classified as an employee or a self-employed independent contractor. This instruction is crucial in legal proceedings where the classification of an individual's work status is in question. Keywords: Connecticut, jury instruction, 10.10.3, employee, self-employed, independent contractor. There are no different types of Connecticut Jury Instruction 10.10.3 as it pertains specifically to the classification of an individual's work status as an employee or a self-employed independent contractor. It is essential to understand the distinctions between these categories to determine an individual's employment rights, tax obligations, and legal responsibilities. The Connecticut Jury Instruction 10.10.3 Employee vs. Self-Employed Independent Contractor provides detailed information and criteria for the jury to consider during legal proceedings. Some of the factors that may be mentioned in this instruction include: 1. Control: The degree of control exercised by the employer over the work performed by the individual. This may involve instructions given to the worker, supervision, and control over working hours. 2. Integration: Whether the individual's work is an integral part of the employer's business operations or if it is an independent, separate venture. 3. Financial arrangement: How the individual is compensated for their work. This may include considerations such as whether the individual is paid a salary or an hourly wage, whether they have the opportunity to make a profit or suffer a loss, and if they are eligible for raises or bonuses. 4. Provision of tools and equipment: Whether the individual is responsible for providing their own tools, equipment, and resources required for their work, or if the employer provides them. 5. Hiring of employees or subcontractors: Whether the individual has the authority to hire and manage their own employees or subcontractors, or if they are solely responsible for their own work. 6. Duration and permanence: The length of the working relationship between the individual and the employer. This may include whether the individual is engaged in a long-term, ongoing relationship with the employer or if the work is project-based or temporary. By considering these factors, the jury can effectively determine whether an individual should be classified as an employee or a self-employed independent contractor. This classification has significant implications for the individual's rights, benefits, and legal obligations, making it crucial to follow accurate guidelines such as Connecticut Jury Instruction 10.10.3.

Connecticut Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor

Description

How to fill out Connecticut Jury Instruction - 10.10.3 Employee Vs. Self-Employed Independent Contractor?

US Legal Forms - one of many largest libraries of legitimate forms in America - delivers a variety of legitimate file web templates it is possible to acquire or produce. Using the web site, you will get 1000s of forms for enterprise and personal uses, sorted by classes, states, or search phrases.You will find the most up-to-date versions of forms just like the Connecticut Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor within minutes.

If you already have a monthly subscription, log in and acquire Connecticut Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor from your US Legal Forms catalogue. The Obtain option can look on each and every form you perspective. You have access to all earlier downloaded forms inside the My Forms tab of your bank account.

In order to use US Legal Forms initially, listed below are simple instructions to help you get began:

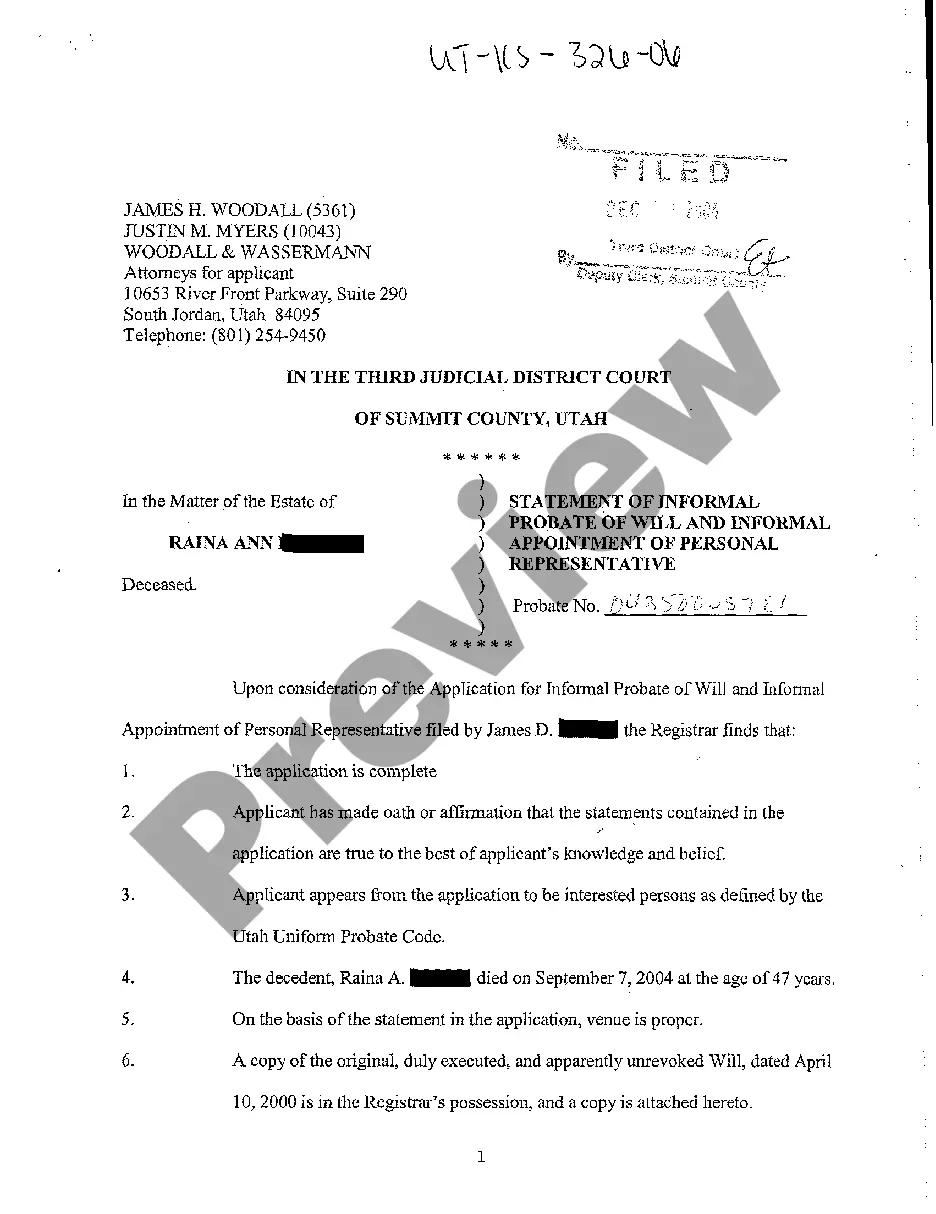

- Make sure you have picked the best form for your personal city/state. Click the Preview option to review the form`s content material. See the form outline to ensure that you have chosen the appropriate form.

- In case the form does not satisfy your requirements, use the Research industry towards the top of the screen to get the one that does.

- When you are happy with the form, verify your decision by clicking on the Purchase now option. Then, select the prices program you prefer and give your accreditations to register to have an bank account.

- Approach the financial transaction. Make use of bank card or PayPal bank account to accomplish the financial transaction.

- Choose the formatting and acquire the form on your own device.

- Make alterations. Fill out, edit and produce and indicator the downloaded Connecticut Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor.

Every template you put into your account lacks an expiry time and it is your own property eternally. So, if you would like acquire or produce yet another copy, just visit the My Forms portion and click about the form you need.

Gain access to the Connecticut Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor with US Legal Forms, one of the most considerable catalogue of legitimate file web templates. Use 1000s of professional and express-distinct web templates that fulfill your small business or personal requirements and requirements.