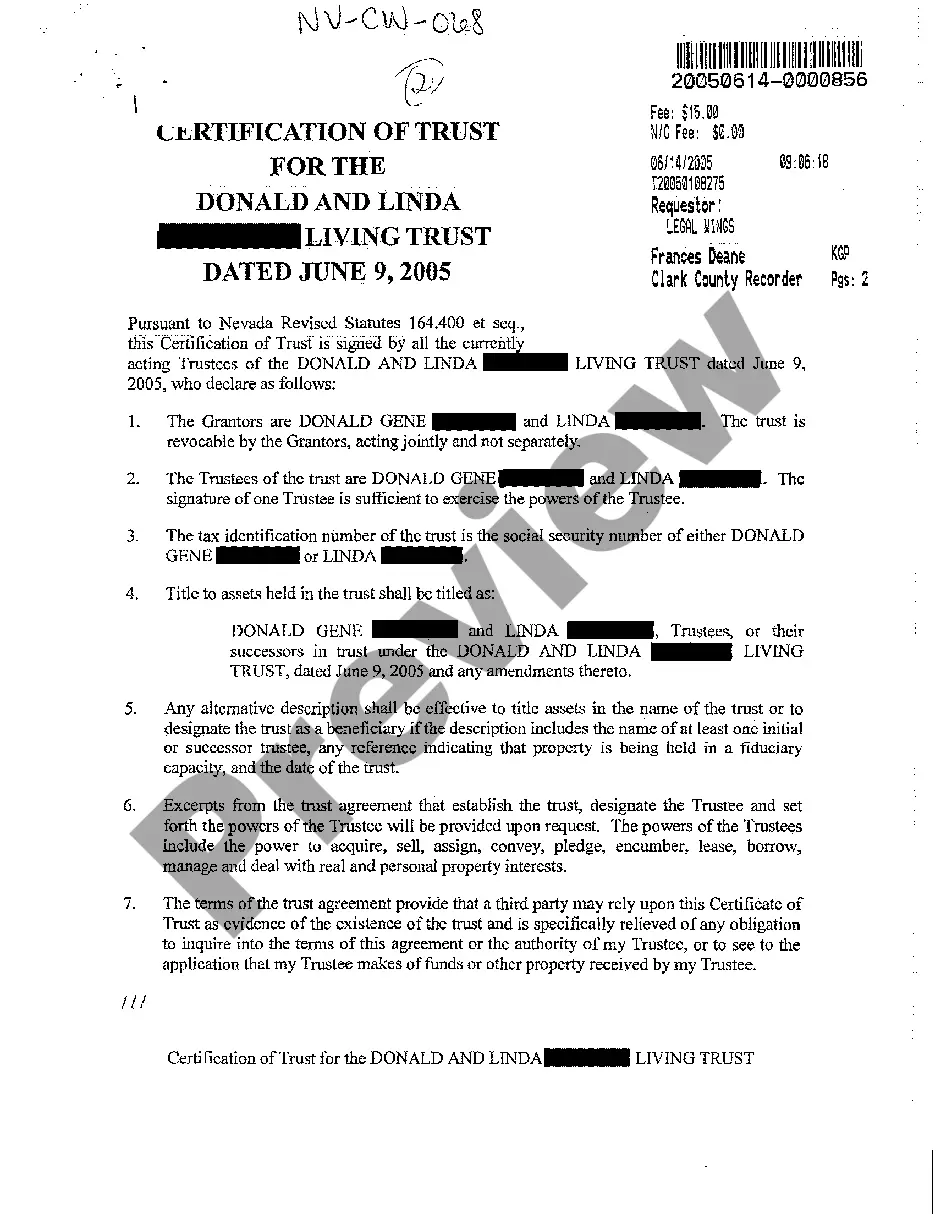

Connecticut Independent Contractor Agreement for Accountant and Bookkeeper: A Comprehensive Overview and Types Introduction: In Connecticut, independent contractors often engage in professional services such as accounting and bookkeeping. To ensure a clear and mutually beneficial working relationship between independent accountants/bookkeepers and clients, a Connecticut Independent Contractor Agreement is commonly utilized. This legally binding document outlines the terms and conditions that will govern their engagement, protecting both parties' rights and responsibilities. Main Components of a Connecticut Independent Contractor Agreement: 1. Identification of Parties: The agreement begins by clearly identifying the independent accountant/bookkeeper (the "Contractor") and the client or business entity (the "Client") involved in the engagement. 2. Scope of Services: This section outlines in detail the services the Contractor will provide, including financial reporting, tax preparation, bookkeeping, payroll processing, or any accounting-related tasks specific to the engagement. It ensures clarity regarding the services to be performed. 3. Payment and Compensation: The agreement specifies the payment terms, such as hourly rates, flat fees, or project-based pricing. Additionally, it outlines the payment schedule, invoicing procedures, and any additional expenses that will be reimbursed to the Contractor. 4. Independent Contractor Relationship: It is essential to clarify that the Contractor operates as an independent contractor, not an employee. This section defines the independent nature of the engagement, including the Contractor's responsibilities regarding withholding taxes, liability insurance, and compliance with state and federal regulations. 5. Confidentiality and Non-Disclosure: Protecting sensitive financial information is crucial, and this section establishes the Contractor's obligation to maintain confidentiality and not disclose any client information to third parties. 6. Intellectual Property: If the Contractor develops or contributes to any intellectual property during the engagement, this clause should address ownership rights. 7. Term and Termination: The agreement specifies the starting date, duration, and conditions for terminating the engagement, ensuring a clear understanding of when the agreement can be terminated by either party. 8. Indemnification: This clause details each party's responsibilities for indemnifying the other from any legal claims arising from the engagement. Types of Connecticut Independent Contractor Agreements: 1. Connecticut Accountant Independent Contractor Agreement: Specifically designed for independent accountants providing a wide range of accounting services, tax preparation, and financial advisement. 2. Connecticut Bookkeeper Independent Contractor Agreement: Tailored for independent bookkeepers offering services such as maintaining financial records, reconciling accounts, and various bookkeeping tasks. 3. Connecticut Payroll Processor Independent Contractor Agreement: More focused on independent contractors providing payroll processing services, managing employee compensation, and ensuring compliance with payroll regulations. 4. Connecticut Tax Preparer Independent Contractor Agreement: Primarily for independent contractors specializing in tax preparation, including filing tax returns, providing tax advice, and staying updated on changing tax laws. Conclusion: A Connecticut Independent Contractor Agreement for Accountant and Bookkeeper provides a vital foundation for establishing a professional relationship between independent accountants/bookkeepers and their clients in Connecticut. By clearly outlining rights, obligations, and expectations, these agreements foster a smooth working dynamic while protecting both parties' interests. Whether it is for general accounting, bookkeeping, payroll processing, or tax preparation, having a comprehensive agreement tailored to the specific engagement ensures a successful collaboration.

Independent Contractor Agreement Connecticut

Description

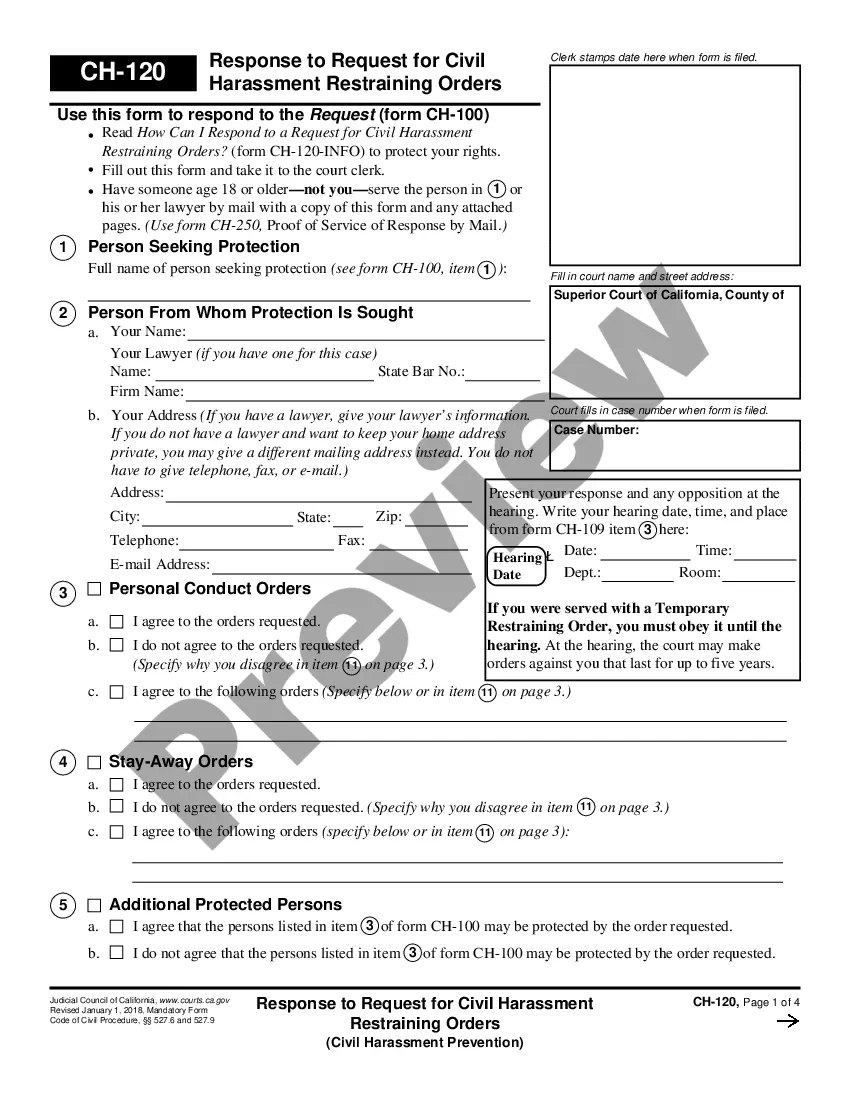

How to fill out Connecticut Independent Contractor Agreement For Accountant And Bookkeeper?

You are able to invest hrs on-line searching for the lawful file web template that fits the state and federal demands you will need. US Legal Forms gives a large number of lawful forms which can be analyzed by specialists. You can actually acquire or printing the Connecticut Independent Contractor Agreement for Accountant and Bookkeeper from your services.

If you already possess a US Legal Forms profile, you may log in and then click the Down load switch. Afterward, you may comprehensive, revise, printing, or sign the Connecticut Independent Contractor Agreement for Accountant and Bookkeeper. Each lawful file web template you purchase is your own property eternally. To have an additional duplicate for any bought kind, check out the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms internet site for the first time, adhere to the simple directions listed below:

- First, make sure that you have chosen the proper file web template to the area/area that you pick. Read the kind information to ensure you have picked the correct kind. If offered, take advantage of the Review switch to appear with the file web template as well.

- In order to locate an additional variation of the kind, take advantage of the Lookup discipline to find the web template that meets your needs and demands.

- Once you have discovered the web template you want, click on Purchase now to move forward.

- Pick the rates plan you want, enter your qualifications, and register for a merchant account on US Legal Forms.

- Complete the deal. You may use your Visa or Mastercard or PayPal profile to fund the lawful kind.

- Pick the formatting of the file and acquire it to your device.

- Make modifications to your file if needed. You are able to comprehensive, revise and sign and printing Connecticut Independent Contractor Agreement for Accountant and Bookkeeper.

Down load and printing a large number of file layouts using the US Legal Forms web site, that offers the greatest selection of lawful forms. Use specialist and status-distinct layouts to take on your business or specific demands.

Form popularity

FAQ

Payroll software automates a large majority of your payroll program, and can calculate wages and taxes, and some even will turn in taxes for you. Doing payroll by hand is the most time-consuming and requires someone learning how to do payroll, and that person is called a bookkeeper.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

How to Become an Independent BookkeeperGet Your Degree. No one's going to trust you with their money if you haven't studied accounting and bookkeeping.Gain Practical Experience.Add Some Credentials.Handle Your Legal Issues.Start Marketing Yourself.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

So if you're paying unlicensed California accountants or bookkeepers as independent contractors, you're probably going to have to rehire them as employees regardless of whether or not your firm is located in California.

The accountant's not to-do list: 5 things to stop nowDo not waste time with bad clients.Do not check email regularly during your day.Do not say yes to everything.Do not give accounting advice for free.Do not keep knowledge to yourself.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

Accountants and their clients often use Accounting Contracts as a means of defining the scope and payment terms for work to be done. Signed by the client and the accountant, this essential document can help each party to set expectations and reduce the risk of disagreements.

An Accounting Contract is a legal agreement between a client (individual or company) and an accountant, regarding the accounting needs of the client. Use this document to clarify your rights and responsibilities concerning the accounting services, define the scope of these services, and determine the deadlines.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.