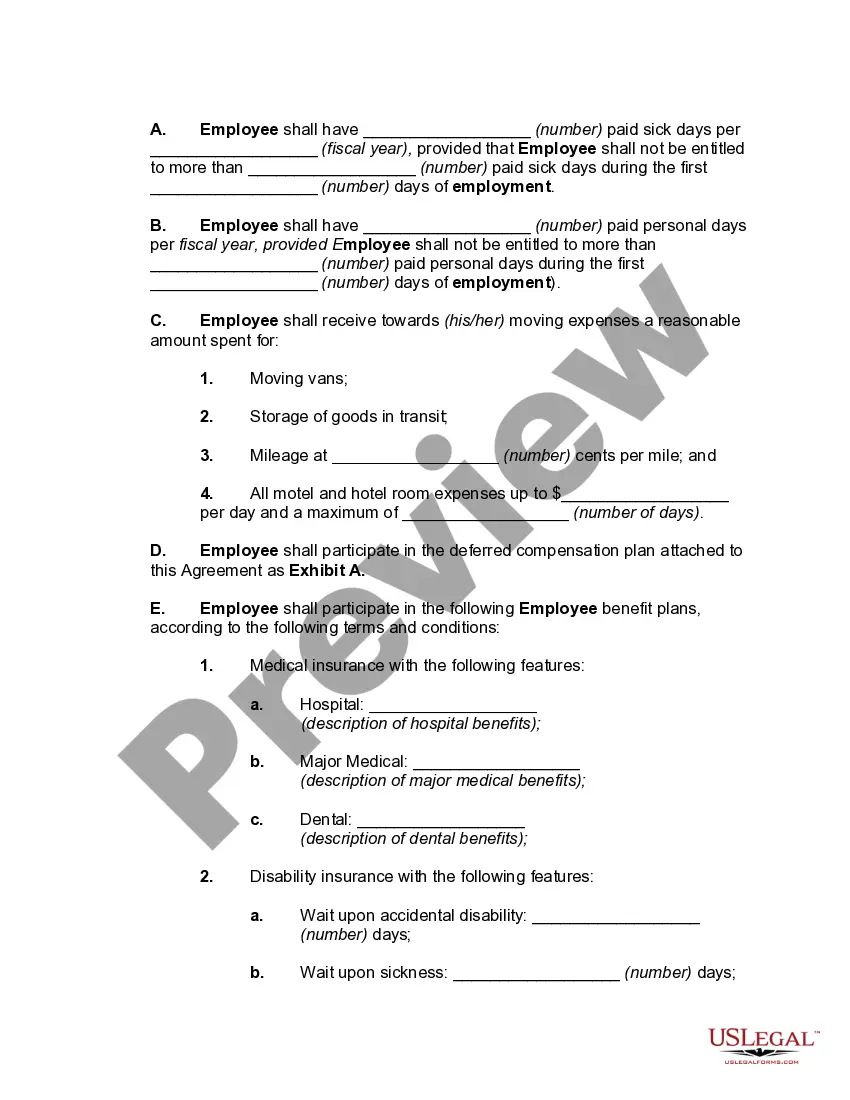

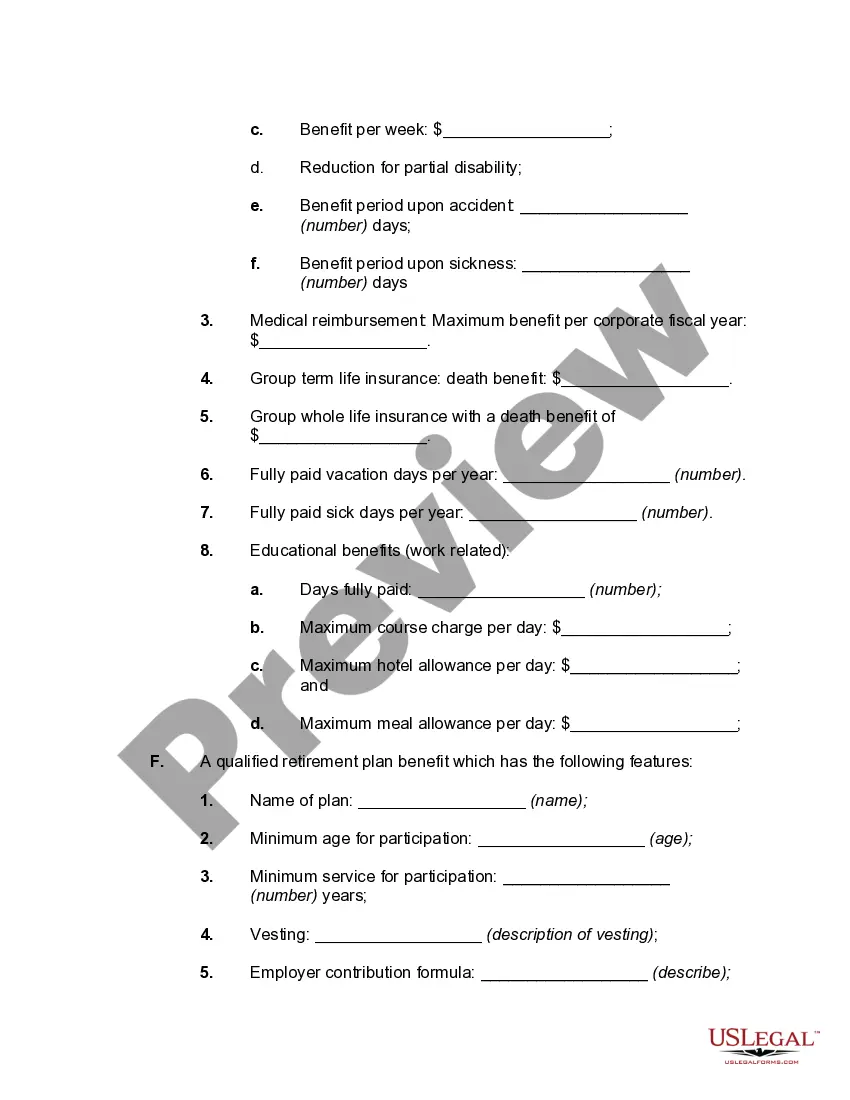

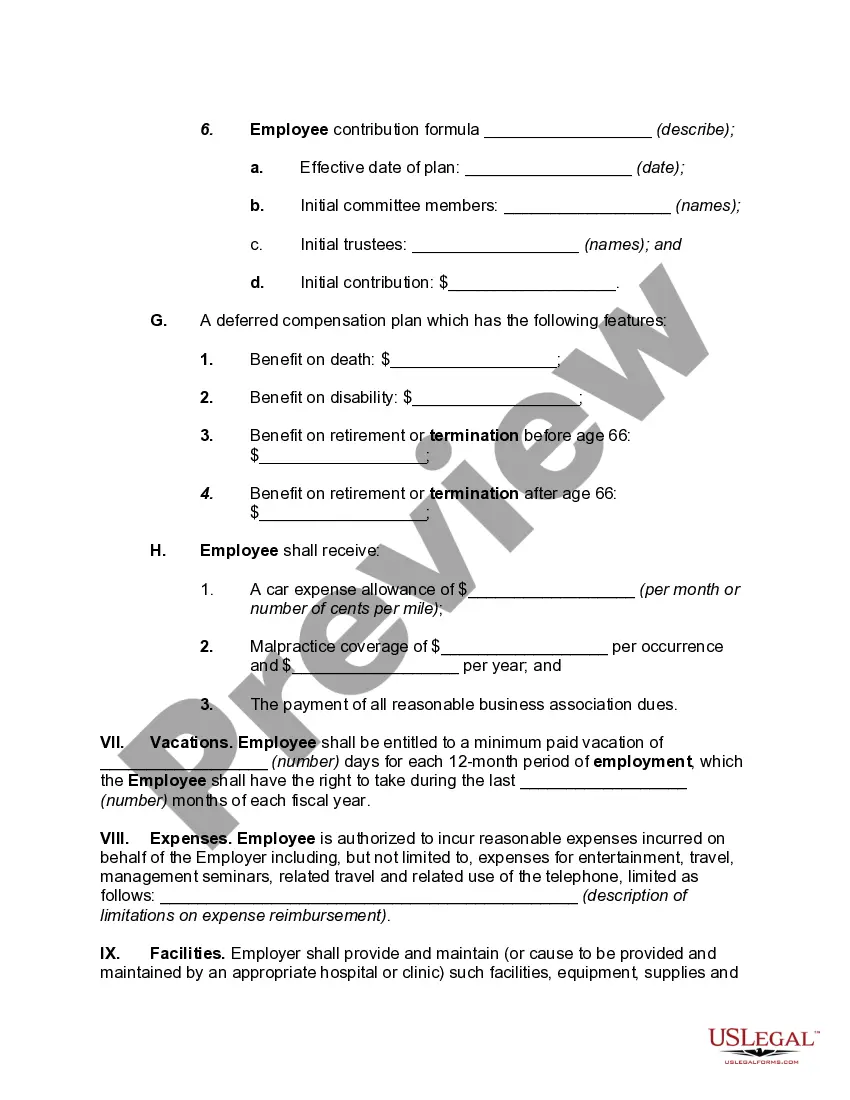

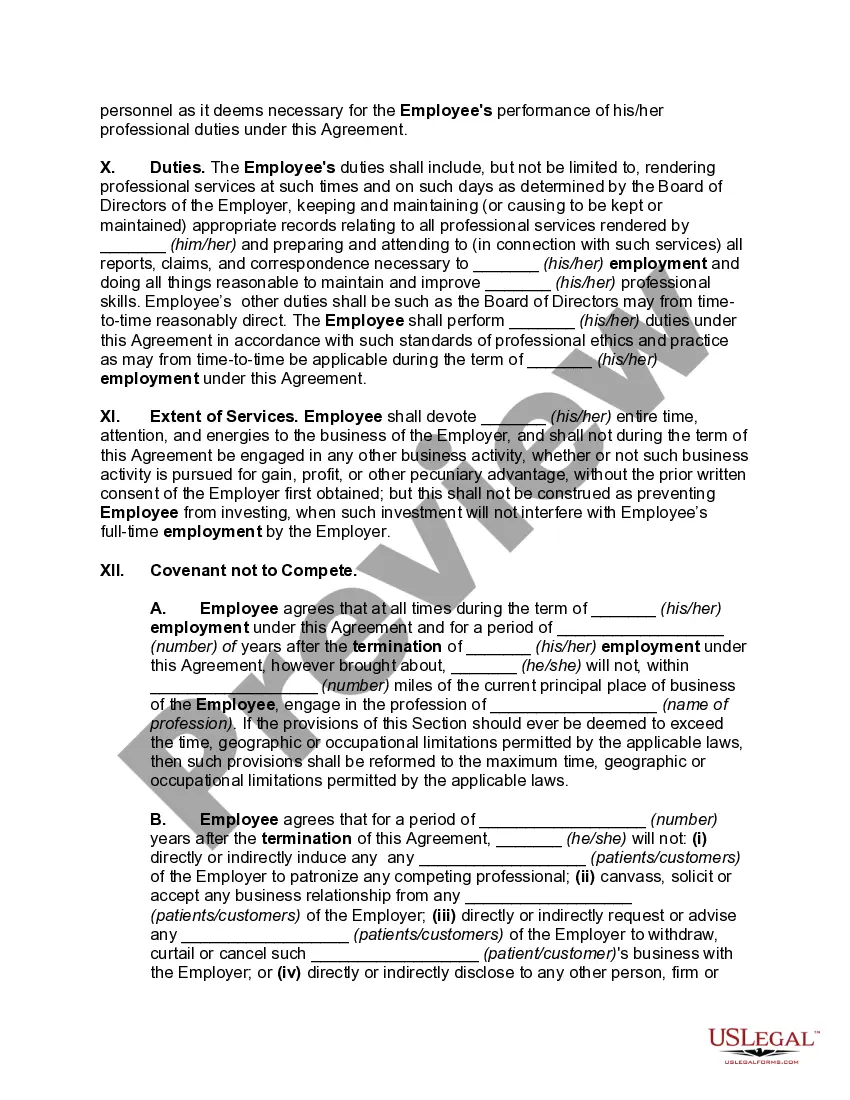

Connecticut General Form of Employment Agreement for Professional Corporation: A Comprehensive Overview The Connecticut General Form of Employment Agreement for Professional Corporation is a legally binding contract that establishes the terms and conditions of employment for professionals working within a professional corporation in the state of Connecticut. This agreement serves as a crucial document in outlining the rights and responsibilities of both the professional(s) and the corporation. Keywords: Connecticut, General Form, Employment Agreement, Professional Corporation. In Connecticut, professional corporations are entities specifically created for licensed professionals such as lawyers, doctors, architects, engineers, and accountants. The purpose of these corporations is to provide professional services while enjoying the advantages of a corporate structure, including certain tax benefits and limited liability. The General Form of Employment Agreement for Professional Corporation in Connecticut typically contains several sections that address various aspects related to the working arrangement. Some key portions of the agreement may include: 1. Parties: This section identifies the professional corporation as the employer and the individual professional(s) as the employee(s). It also outlines the scope of the agreement, defining the role and responsibilities of the professional within the corporation. 2. Term of Agreement: This specifies the duration of the employment agreement, whether it is for a fixed term or an open-ended arrangement. 3. Compensation: Details regarding the employee's salary, bonuses, commissions, or any other benefits, and the frequency of payments are outlined in this section. It may also cover provisions for expense reimbursement, retirement plans, healthcare benefits, and any other additional compensation. 4. Duties and Responsibilities: This section lays out the specific job description, professional obligations, and performance expectations for the employee. It may include aspects such as work hours, client interactions, professional conduct, and adherence to ethical standards. 5. Termination: The agreement should include provisions for termination of employment, defining the circumstances under which either party may terminate the agreement. It may include clauses on notice periods, severance pay, and non-compete agreements. 6. Confidentiality and Non-Disclosure: Professionals often have access to sensitive or proprietary information related to their work. This section outlines the employee's obligation to maintain confidentiality and prevent unauthorized disclosure of such information during employment and even after its termination. 7. Intellectual Property: If the nature of the professional's work involves creating intellectual property, such as inventions, copyrights, or patents, this section defines the ownership and usage rights of such property. Other types: While the Connecticut General Form of Employment Agreement for Professional Corporation generally covers the basic provisions outlined above, there may be variations depending on the specific profession or industry. For instance, an agreement for attorneys may contain additional clauses related to conflicts of interest, client retention, or disciplinary rules, which may not be relevant for other professionals. In conclusion, the Connecticut General Form of Employment Agreement for Professional Corporation is a vital document that establishes the terms and conditions of employment for licensed professionals working within the state's professional corporations. It provides clarity regarding compensation, duties and responsibilities, termination procedures, and various other aspects essential for maintaining a mutually beneficial professional relationship.

Connecticut General Form of Employment Agreement for Professional Corporation

Description

How to fill out Connecticut General Form Of Employment Agreement For Professional Corporation?

Discovering the right legal document design can be quite a have difficulties. Obviously, there are a variety of templates accessible on the Internet, but how can you get the legal kind you require? Utilize the US Legal Forms internet site. The support gives a large number of templates, like the Connecticut General Form of Employment Agreement for Professional Corporation, which can be used for business and private needs. Each of the varieties are checked by specialists and meet up with state and federal requirements.

In case you are previously signed up, log in for your accounts and click the Down load key to get the Connecticut General Form of Employment Agreement for Professional Corporation. Use your accounts to search throughout the legal varieties you may have ordered formerly. Proceed to the My Forms tab of your own accounts and obtain one more duplicate in the document you require.

In case you are a new user of US Legal Forms, listed here are straightforward recommendations that you should comply with:

- Initial, ensure you have chosen the proper kind for your metropolis/area. You are able to examine the shape while using Review key and read the shape outline to guarantee this is the right one for you.

- In the event the kind will not meet up with your needs, make use of the Seach area to discover the proper kind.

- Once you are sure that the shape is acceptable, click on the Purchase now key to get the kind.

- Select the prices prepare you want and type in the needed info. Build your accounts and purchase the order utilizing your PayPal accounts or bank card.

- Select the submit structure and acquire the legal document design for your gadget.

- Comprehensive, change and produce and sign the received Connecticut General Form of Employment Agreement for Professional Corporation.

US Legal Forms will be the most significant library of legal varieties that you will find a variety of document templates. Utilize the company to acquire expertly-produced documents that comply with status requirements.