Connecticut Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

How to fill out Revenue Sharing Agreement To Income From The Licensing And Custom Modification Of The Software?

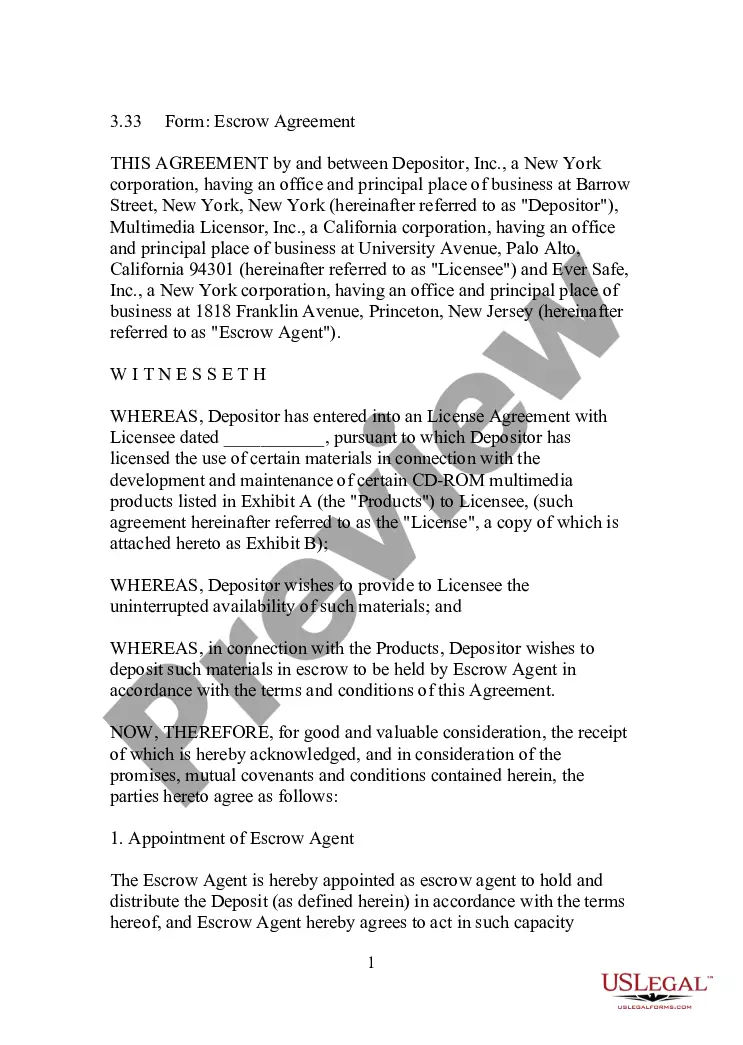

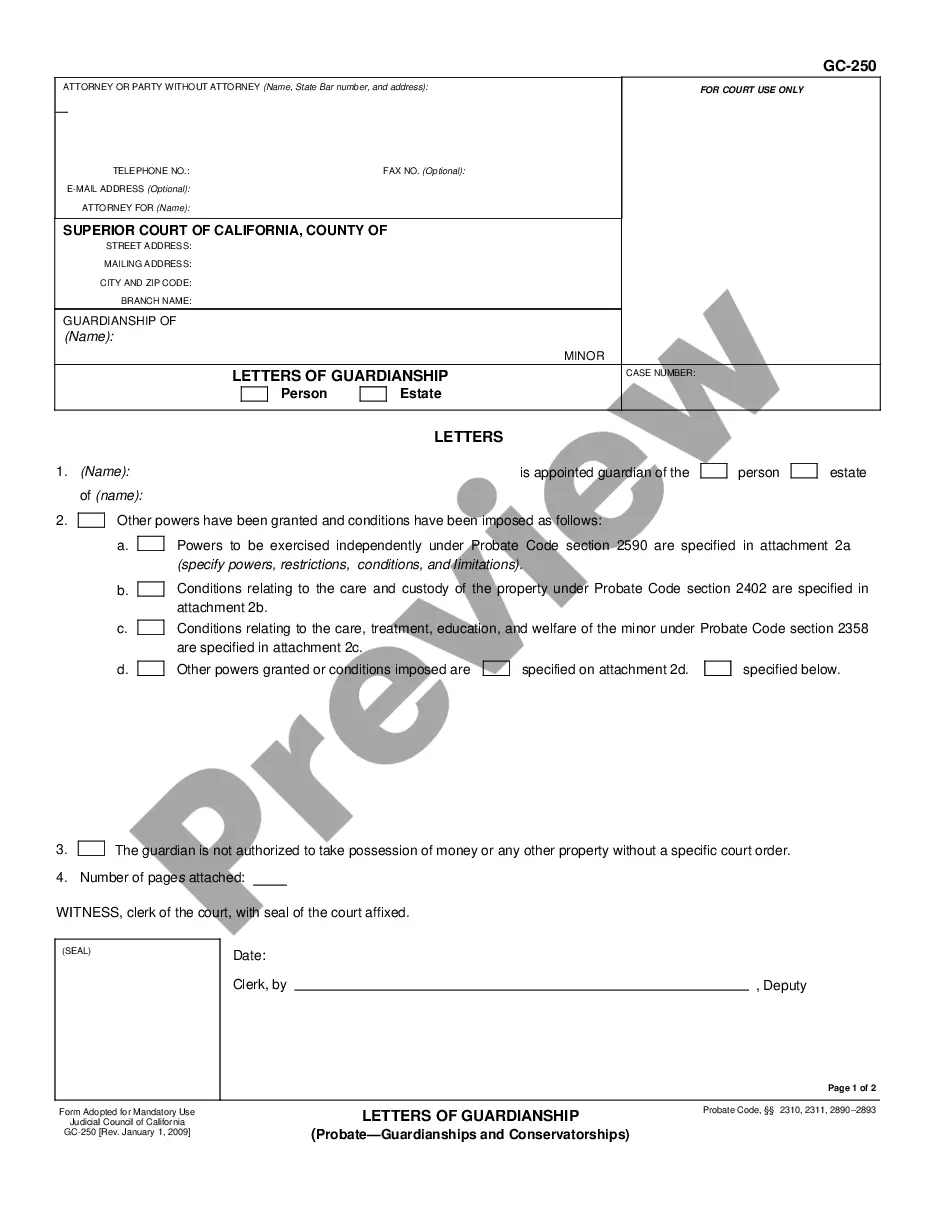

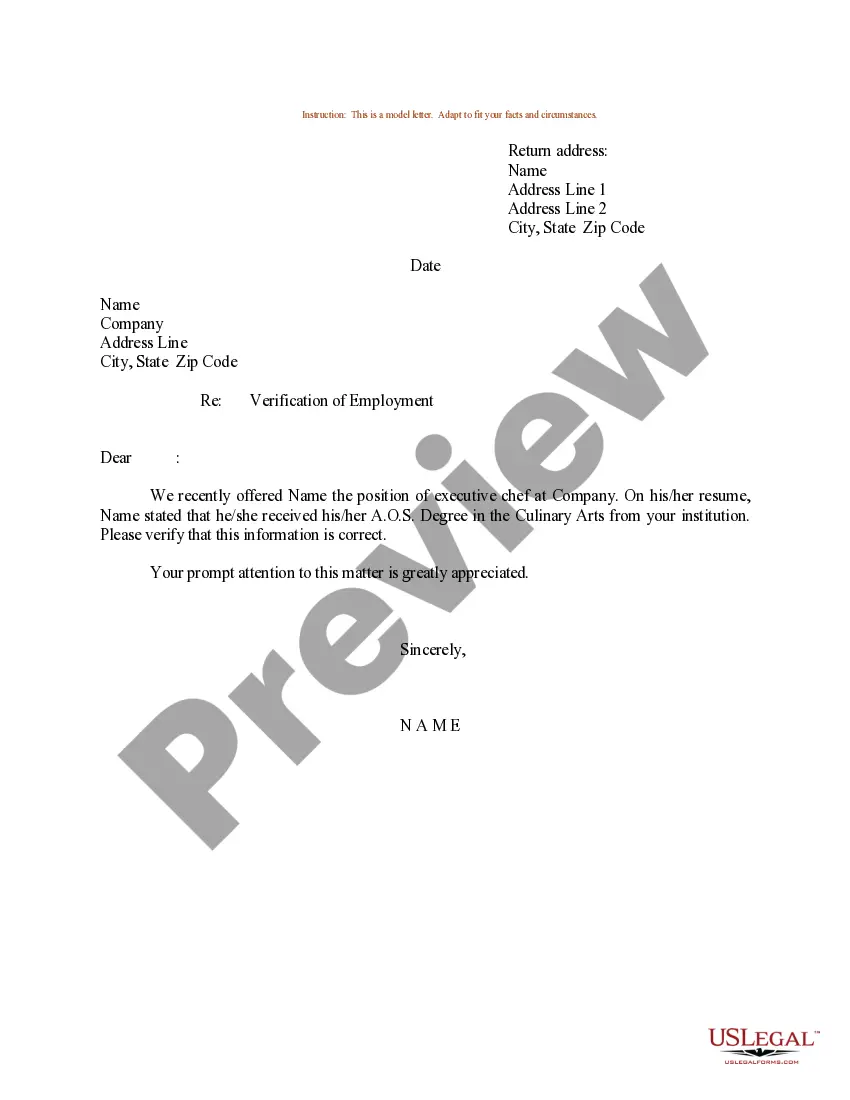

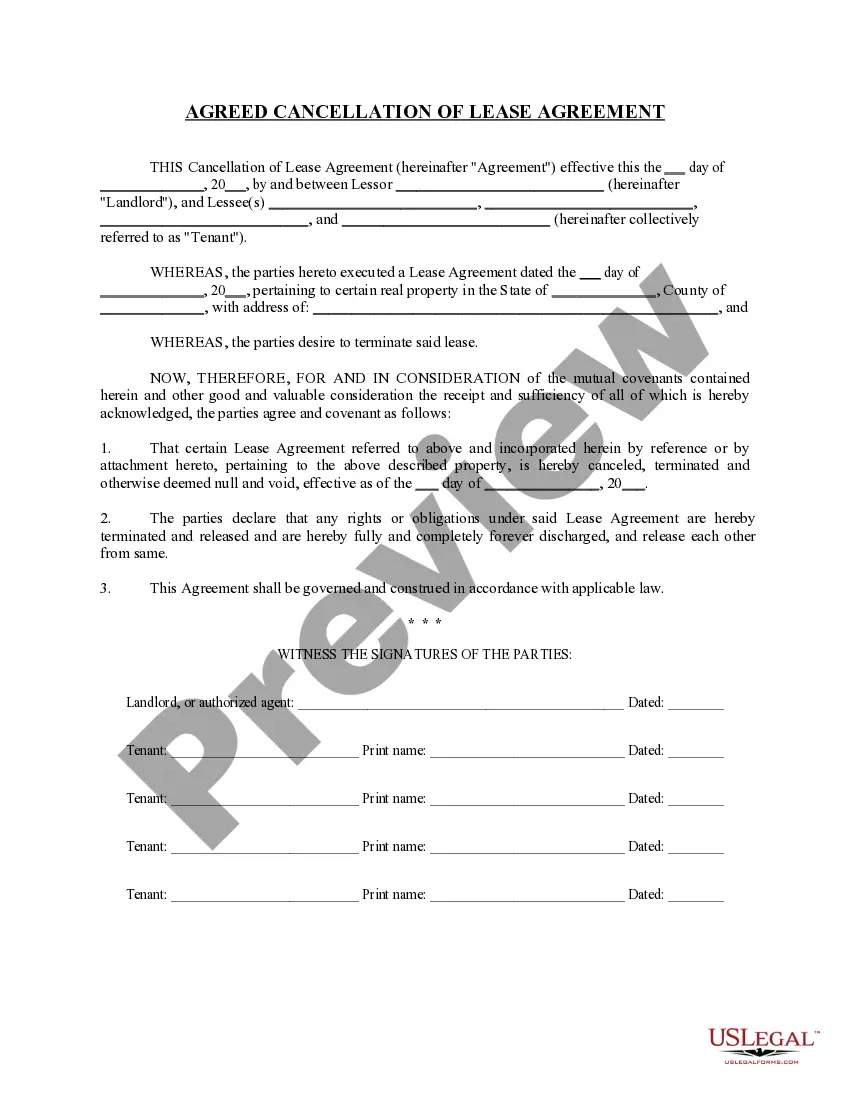

Are you within a place the place you will need documents for either company or personal purposes almost every working day? There are a variety of legitimate papers themes available on the net, but locating types you can rely on isn`t straightforward. US Legal Forms gives a large number of develop themes, such as the Connecticut Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software, which are written to satisfy federal and state needs.

In case you are presently familiar with US Legal Forms site and also have a free account, just log in. After that, you may obtain the Connecticut Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software format.

Unless you have an accounts and want to begin to use US Legal Forms, follow these steps:

- Find the develop you will need and make sure it is for your appropriate area/state.

- Use the Preview switch to review the form.

- Read the outline to actually have chosen the right develop.

- In case the develop isn`t what you`re looking for, utilize the Search area to obtain the develop that fits your needs and needs.

- Whenever you discover the appropriate develop, simply click Purchase now.

- Choose the pricing prepare you desire, submit the specified details to generate your bank account, and buy the order utilizing your PayPal or Visa or Mastercard.

- Select a practical paper file format and obtain your copy.

Get every one of the papers themes you possess purchased in the My Forms food selection. You can obtain a further copy of Connecticut Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software anytime, if necessary. Just select the needed develop to obtain or print out the papers format.

Use US Legal Forms, probably the most comprehensive variety of legitimate kinds, in order to save time as well as stay away from errors. The support gives professionally manufactured legitimate papers themes that you can use for a variety of purposes. Generate a free account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

Under a revenue-sharing contract, a retailer pays a supplier a wholesale price for each unit purchased plus a percentage of the revenue the retailer generates. Such contracts have become more prevalent in the video cassette rental industry relative to the more conventional wholesale price contract.

Maintenance of computer software is a computer and data processing service taxable at the 1% rate, whether the software is prewritten or custom.

Goods that are subject to sales tax in Connecticut include physical property like furniture, home appliances, and motor vehicles. Prescription medicine, non-prescription medicine, and groceries are tax-exempt. Connecticut charges a 8.1% or 25 cent per gallon excise tax rate on the purchase of gasoline.

A revenue sharing agreement is a legal document between two parties where one party has to pay a percentage of profits or revenues received to the other for the rights to use something.

Goods that are subject to sales tax in Connecticut include physical property like furniture, home appliances, and motor vehicles. Prescription medicine, non-prescription medicine, and groceries are tax-exempt. Connecticut charges a 8.1% or 25 cent per gallon excise tax rate on the purchase of gasoline.

Food in Connecticut is taxable when it meets this criteria: food products that are furnished, prepared, or served in such a form and in such portions that they are ready for immediate consumption, and includes food products that are sold on a 'take out' or 'to go' basis and that are actually packaged or wrapped.

Revenue sharing is a somewhat flexible concept that involves sharing operating profits or losses among associated financial actors. Revenue sharing can exist as a profit-sharing system that ensures each entity is compensated for its efforts.

Sales Tax Exemptions in Connecticut Several exemptions are certain types of safety gear, some types of groceries, certain types of clothing, children's car seats, children's bicycle helmets, college textbooks, compact fluorescent light bulbs, most types of medical equipment, and certain motor vehicles.

There are no additional sales taxes imposed by local jurisdictions in Connecticut. The statewide rate of 6.35% applies to the retail sale, lease, or rental of most goods and taxable services.

Sales Tax Rates There is only one statewide sales and use tax. There are no additional sales taxes imposed by local jurisdictions in Connecticut. The statewide rate of 6.35% applies to the retail sale, lease, or rental of most goods and taxable services.