Connecticut Security Agreement Covering Goods, Equipment, Inventory, Etc., is a legal document that establishes a security interest in various assets to secure a loan or debt. This agreement provides protection to lenders by allowing them to claim ownership or control over the specified assets if the borrower fails to repay the loan according to the agreed terms. Keywords: Connecticut, security agreement, goods, equipment, inventory, assets, loan, debt, lender, borrower, ownership, control. Types of Connecticut Security Agreements Covering Goods, Equipment, Inventory, Etc.: 1. Goods Security Agreement: This type of security agreement specifically covers goods or tangible personal property. It includes assets such as vehicles, machinery, furniture, electronic equipment, and other physical assets that can be used as collateral. 2. Equipment Security Agreement: An equipment security agreement focuses on securing equipment assets. It could include items like tools, machinery, computers, specialized equipment, or any other equipment used for business purposes. 3. Inventory Security Agreement: This type of security agreement covers inventory or stock of goods held by a business. It includes goods that are held for sale, raw materials used in production, or finished products awaiting shipment or distribution. 4. Mixed Collateral Security Agreement: In some cases, a security agreement may cover a combination of different assets, including goods, equipment, and inventory. This type of agreement provides a comprehensive and all-encompassing security interest for lenders. It is important to note that Connecticut law requires security agreements to be in writing and properly executed to be legally enforceable. These agreements usually include a detailed description of the collateral, the loan amount or debt being secured, repayment terms, and default provisions. They may also contain clauses specifying the rights and responsibilities of both the borrower and the lender regarding the collateral. Overall, a Connecticut Security Agreement Covering Goods, Equipment, Inventory, Etc., plays a crucial role in the lending process by providing lenders with a legal way to protect their interests and recover their investment if the borrower defaults on the loan.

Connecticut Security Agreement Covering Goods, Equipment, Inventory, Etc.

Description

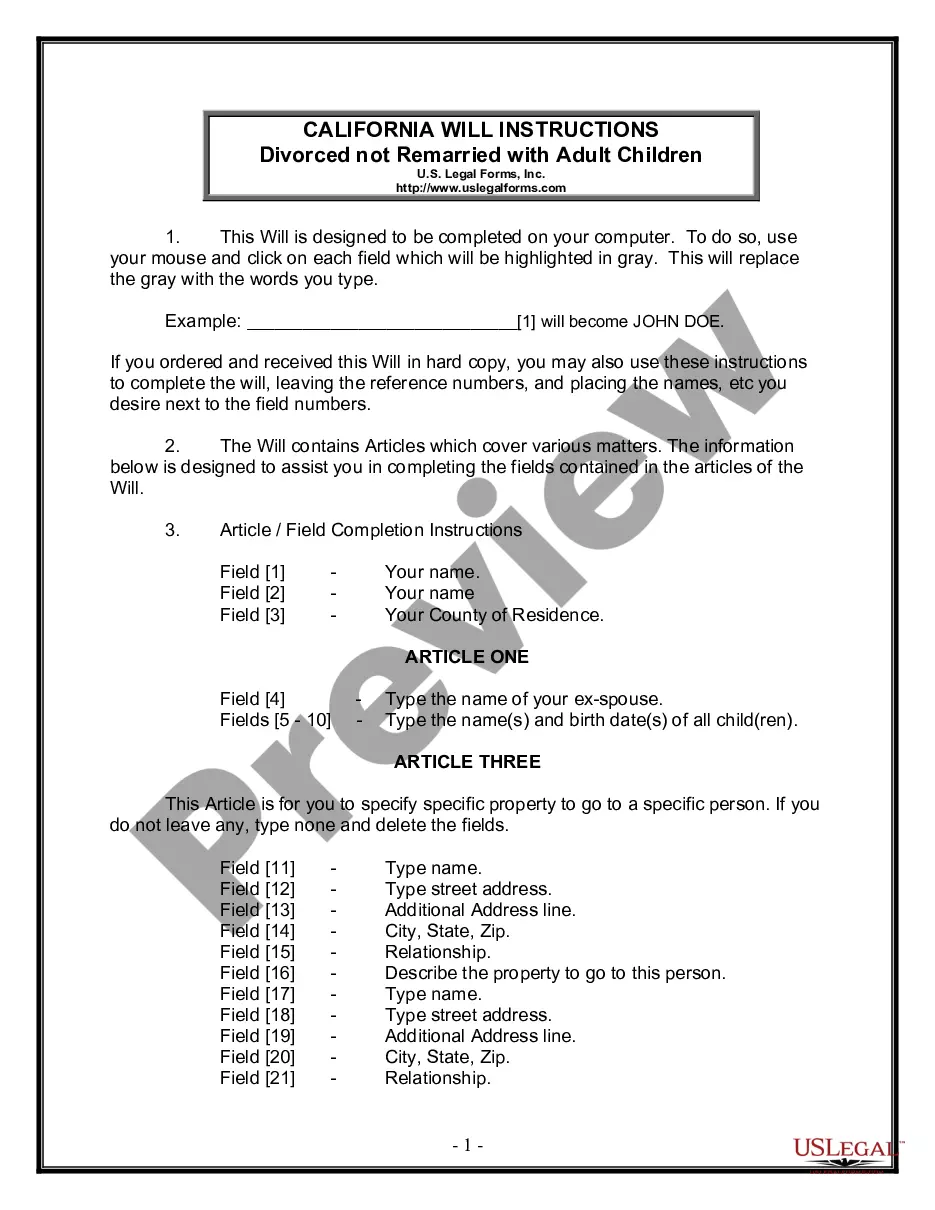

How to fill out Connecticut Security Agreement Covering Goods, Equipment, Inventory, Etc.?

US Legal Forms - one of the most significant libraries of authorized varieties in the USA - delivers a wide range of authorized papers templates you can obtain or print. Making use of the site, you will get 1000s of varieties for business and person functions, sorted by categories, claims, or search phrases.You can get the most up-to-date types of varieties just like the Connecticut Security Agreement Covering Goods, Equipment, Inventory, Etc. in seconds.

If you currently have a monthly subscription, log in and obtain Connecticut Security Agreement Covering Goods, Equipment, Inventory, Etc. in the US Legal Forms library. The Acquire key will show up on every form you perspective. You get access to all earlier downloaded varieties within the My Forms tab of your bank account.

If you wish to use US Legal Forms the first time, here are easy directions to obtain began:

- Ensure you have chosen the correct form to your metropolis/state. Click the Review key to analyze the form`s content material. See the form information to actually have chosen the right form.

- If the form does not satisfy your specifications, utilize the Lookup discipline near the top of the display screen to find the one who does.

- Should you be pleased with the shape, confirm your option by visiting the Buy now key. Then, opt for the prices prepare you want and give your references to sign up for the bank account.

- Process the deal. Make use of bank card or PayPal bank account to perform the deal.

- Find the format and obtain the shape in your device.

- Make modifications. Complete, change and print and indication the downloaded Connecticut Security Agreement Covering Goods, Equipment, Inventory, Etc..

Every design you added to your money does not have an expiration time which is the one you have eternally. So, in order to obtain or print another version, just go to the My Forms portion and then click on the form you need.

Gain access to the Connecticut Security Agreement Covering Goods, Equipment, Inventory, Etc. with US Legal Forms, one of the most substantial library of authorized papers templates. Use 1000s of expert and status-particular templates that satisfy your company or person requirements and specifications.