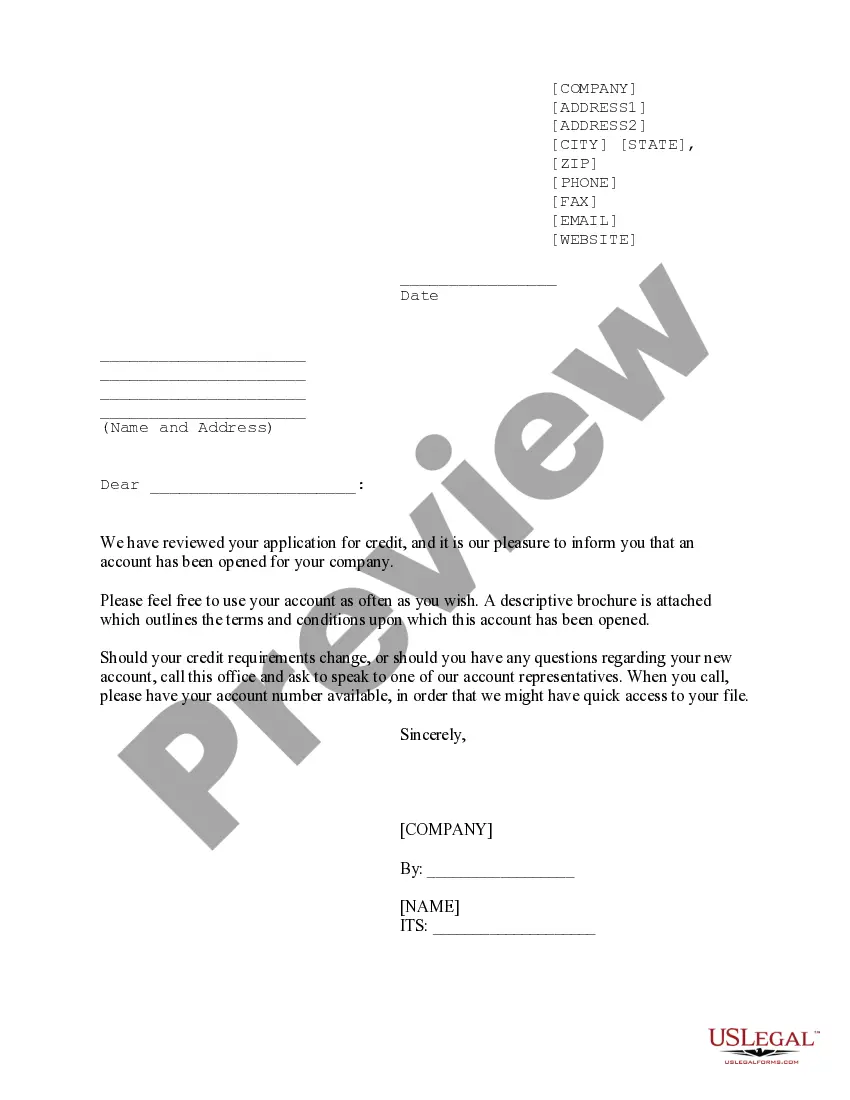

Connecticut Credit Approval Form

Description

How to fill out Credit Approval Form?

You have the ability to invest hours online searching for the legal document template that fulfills the federal and state requirements you seek.

US Legal Forms offers a vast array of legal documents that are reviewed by professionals.

You can conveniently obtain or print the Connecticut Credit Approval Form from your services.

Review the form description to confirm you have selected the correct document. If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can fill out, modify, print, or sign the Connecticut Credit Approval Form.

- Every legal document template you acquire is yours indefinitely.

- To obtain an additional copy of the purchased form, navigate to the My documents section and click on the relevant button.

- If you're using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the appropriate document template for the county/region of your choice.

Form popularity

FAQ

The non-resident tax form for Connecticut is known as Form CT-1040NR. This form is specifically designed for individuals who earn income in Connecticut but do not reside there. Filing this form accurately is crucial to ensure compliance with state tax regulations. Additionally, consider the Connecticut Credit Approval Form to streamline your tax obligations.