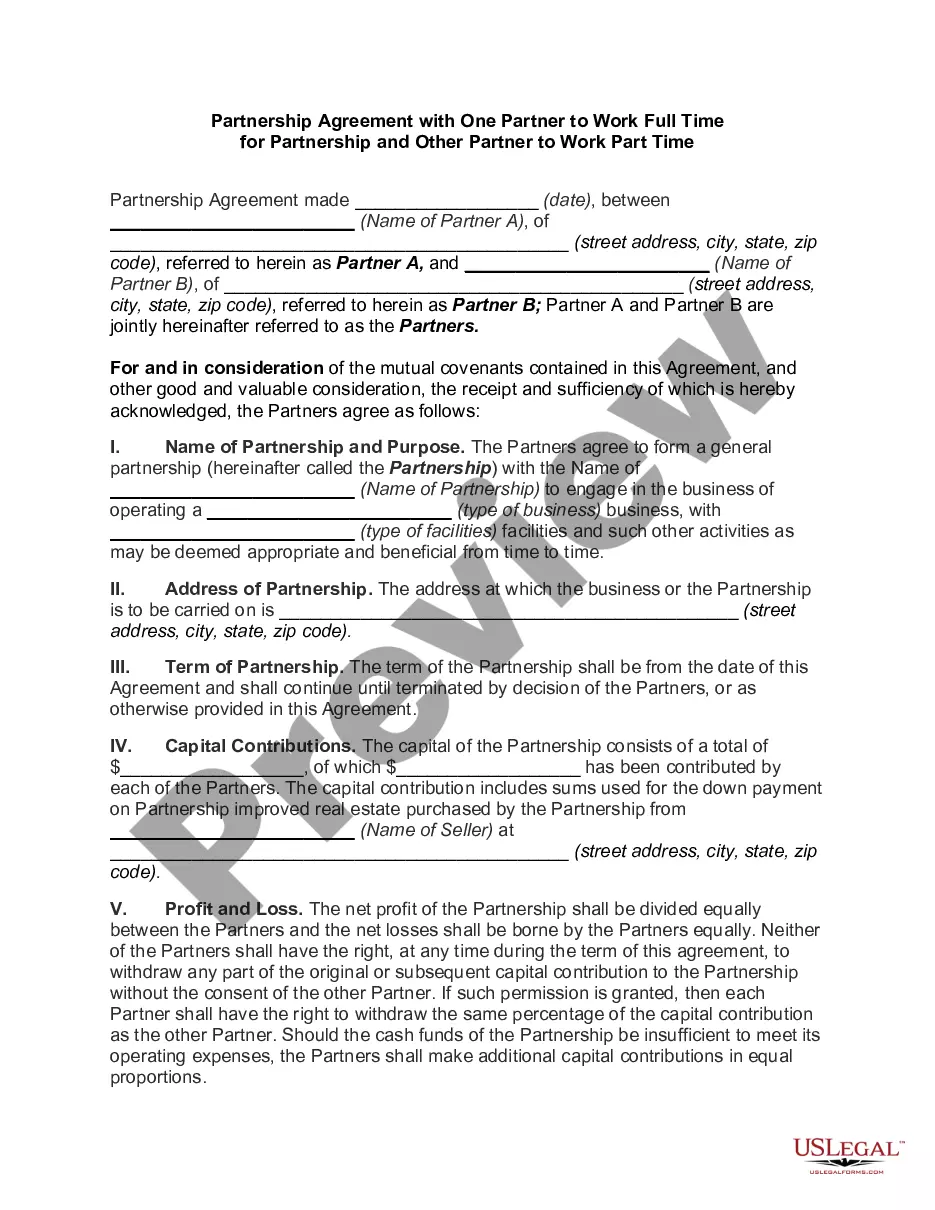

Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time

Description

How to fill out Partnership Agreement With One Partner To Work Full Time For Partnership And Other Partner To Work Part Time?

US Legal Forms - one of the largest collections of legal documents in the USA - provides an extensive selection of legal form templates that you can obtain or print. By utilizing the website, you can access thousands of forms for commercial and personal needs, organized by categories, states, or keywords.

You can find the most recent versions of forms like the Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time in moments.

If you have an account, Log In to download the Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time from your US Legal Forms library. The Download button will be displayed on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device.

Make modifications. Fill out, edit, and print and sign the downloaded Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time.

Each template you acquire does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you desire.

Access the Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time through US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are some simple steps to get you started.

- Ensure you have selected the correct form for your locality/region.

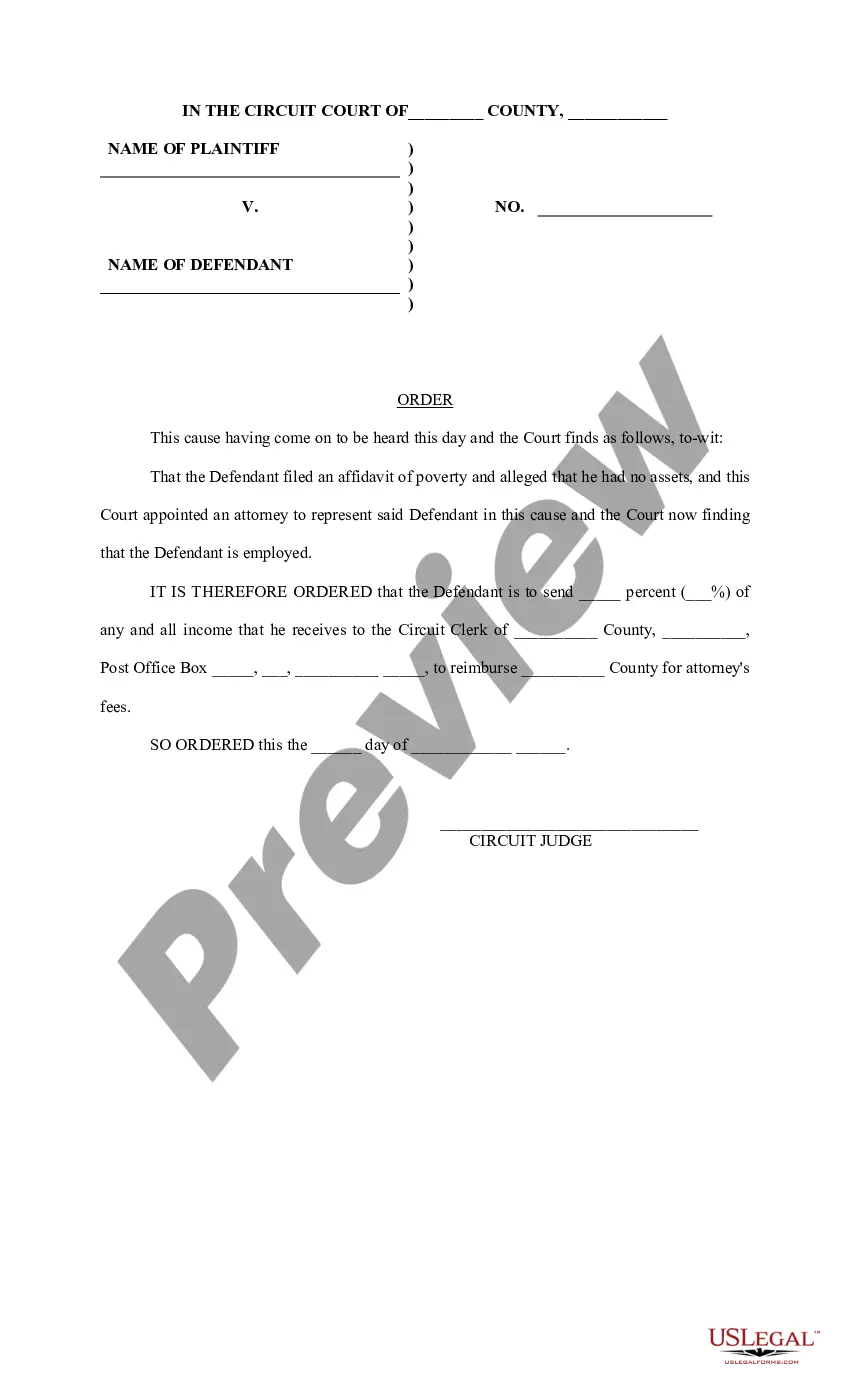

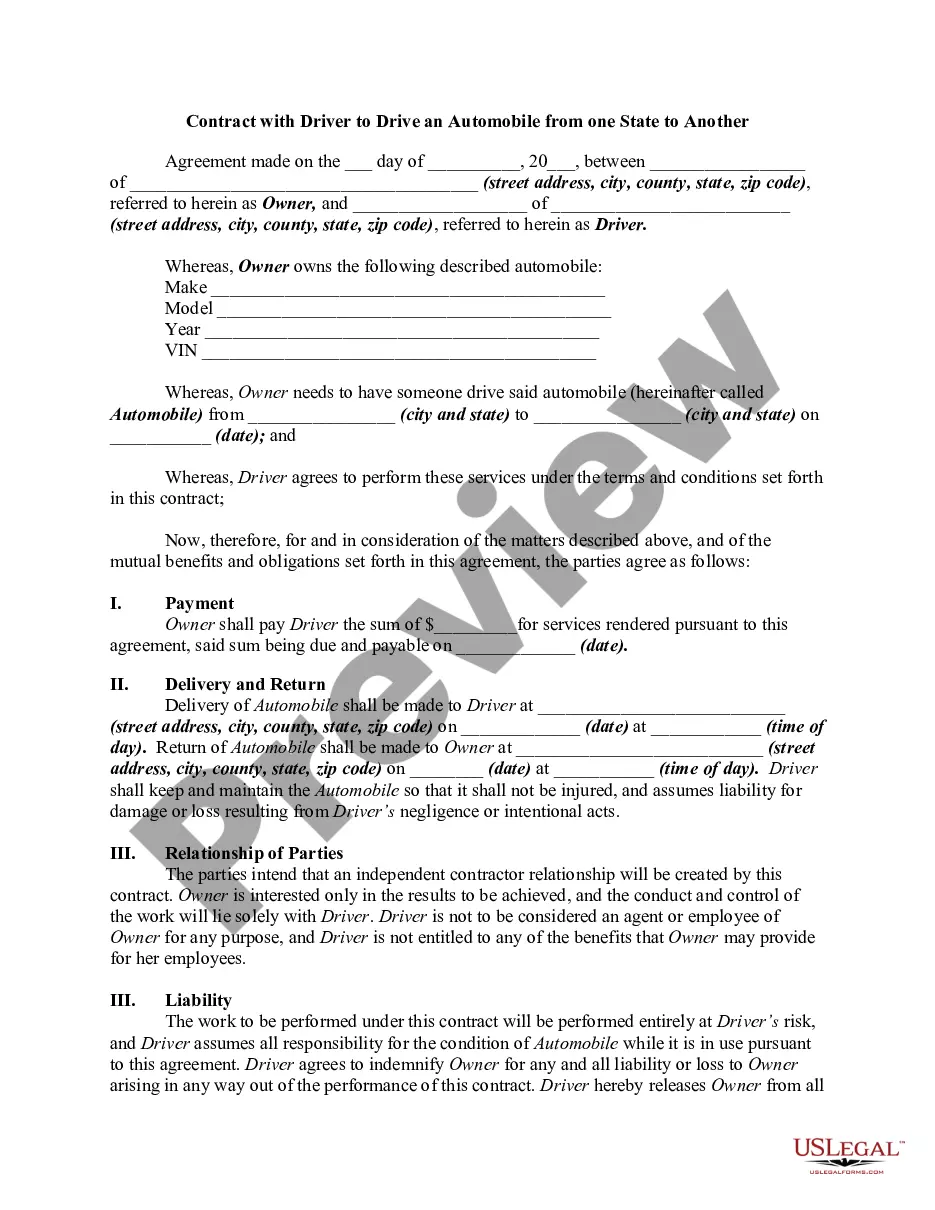

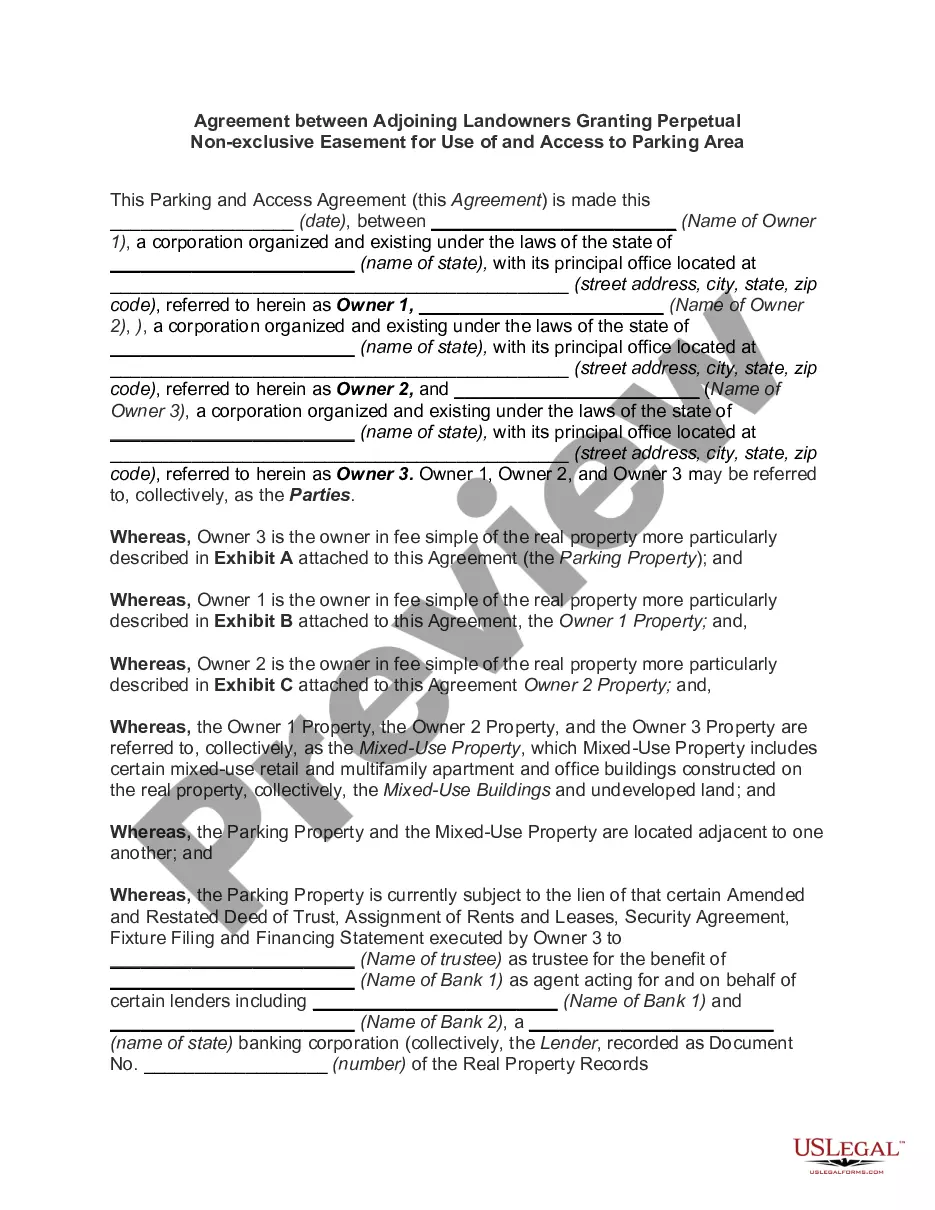

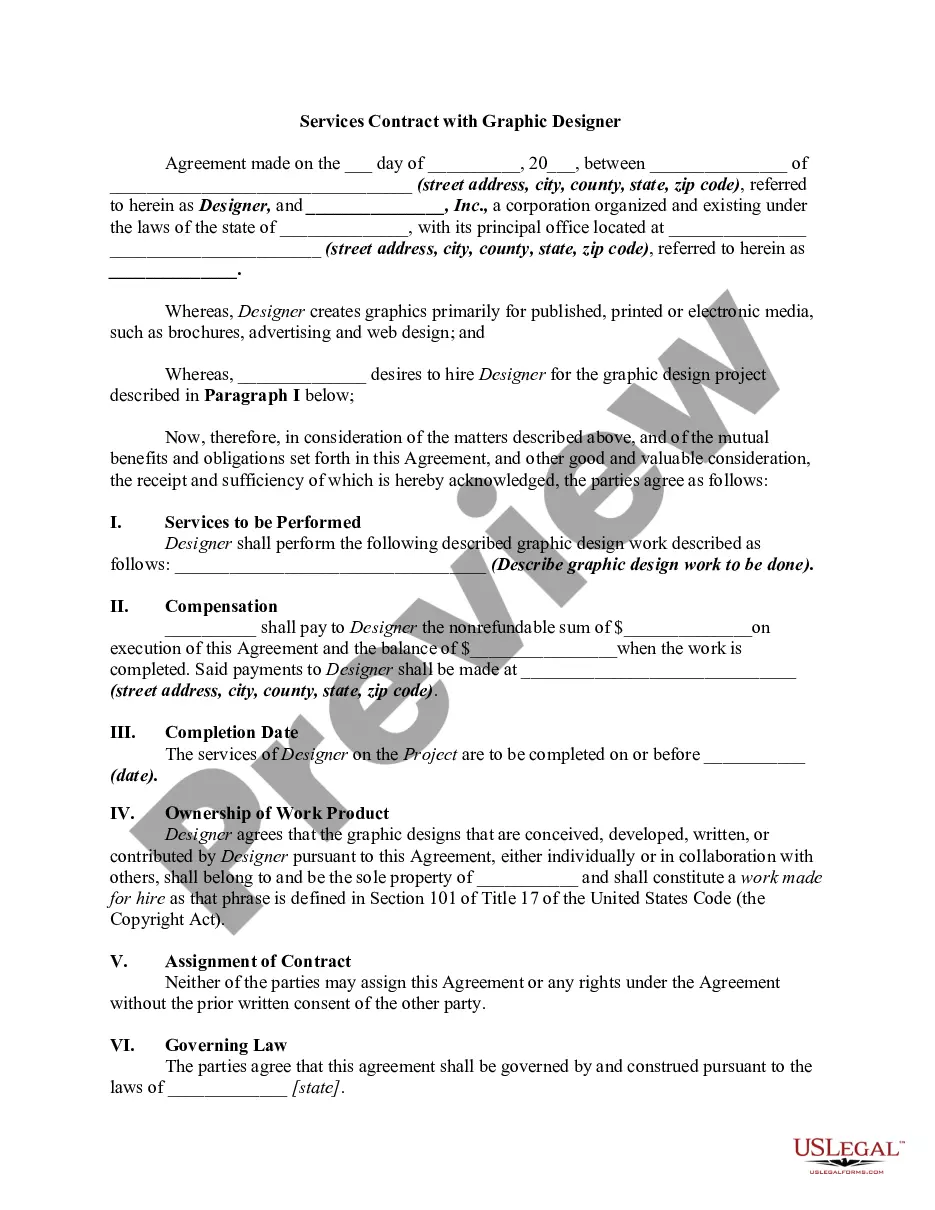

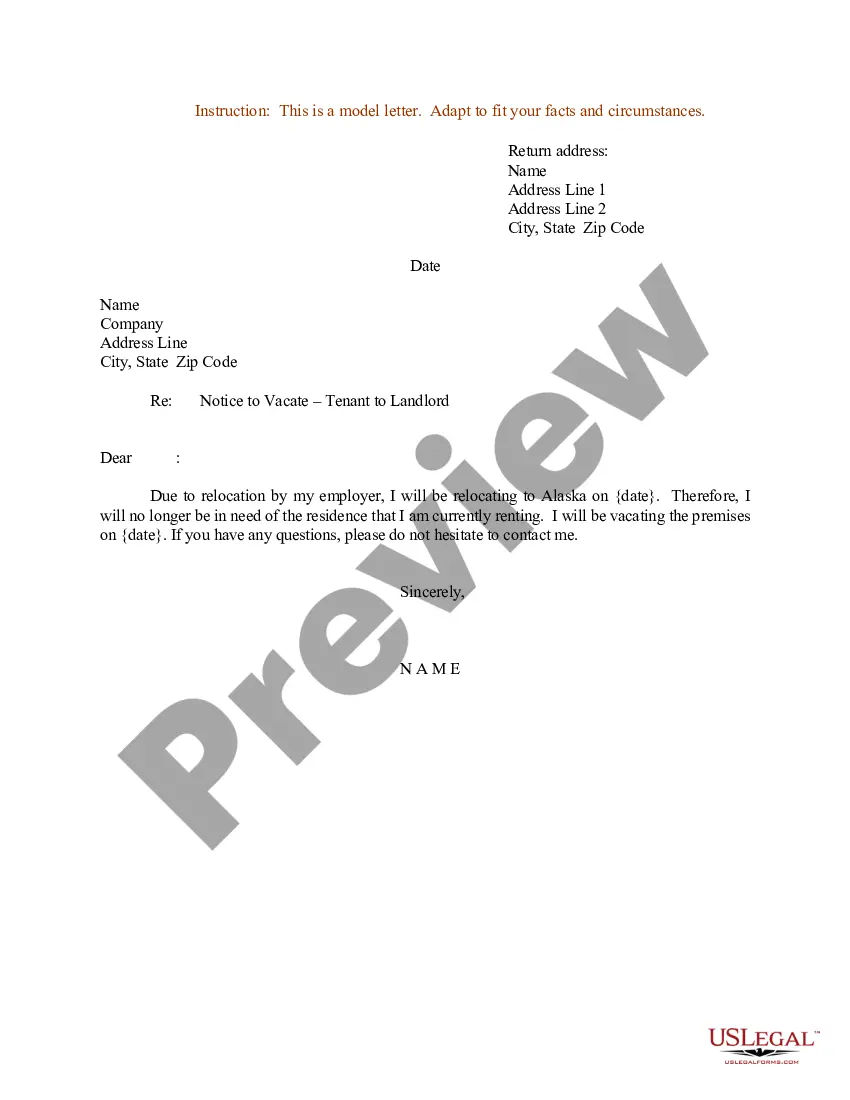

- Click the Review button to examine the form's details.

- Check the form summary to ensure you have chosen the right form.

- If the form does not meet your needs, use the Search feature at the top of the page to find the appropriate one.

- If you are satisfied with the form, confirm your selection by hitting the Buy now button.

- Then, choose the pricing plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

No, a partnership by definition requires at least two individuals to be legally recognized. However, you could explore forming a single-member LLC if you're looking to operate independently while still enjoying certain benefits similar to those of partnerships. For detailed guidance on partnership structures, including a Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, consider using platforms like US Legal Forms, which provide templates and advice tailored to your needs.

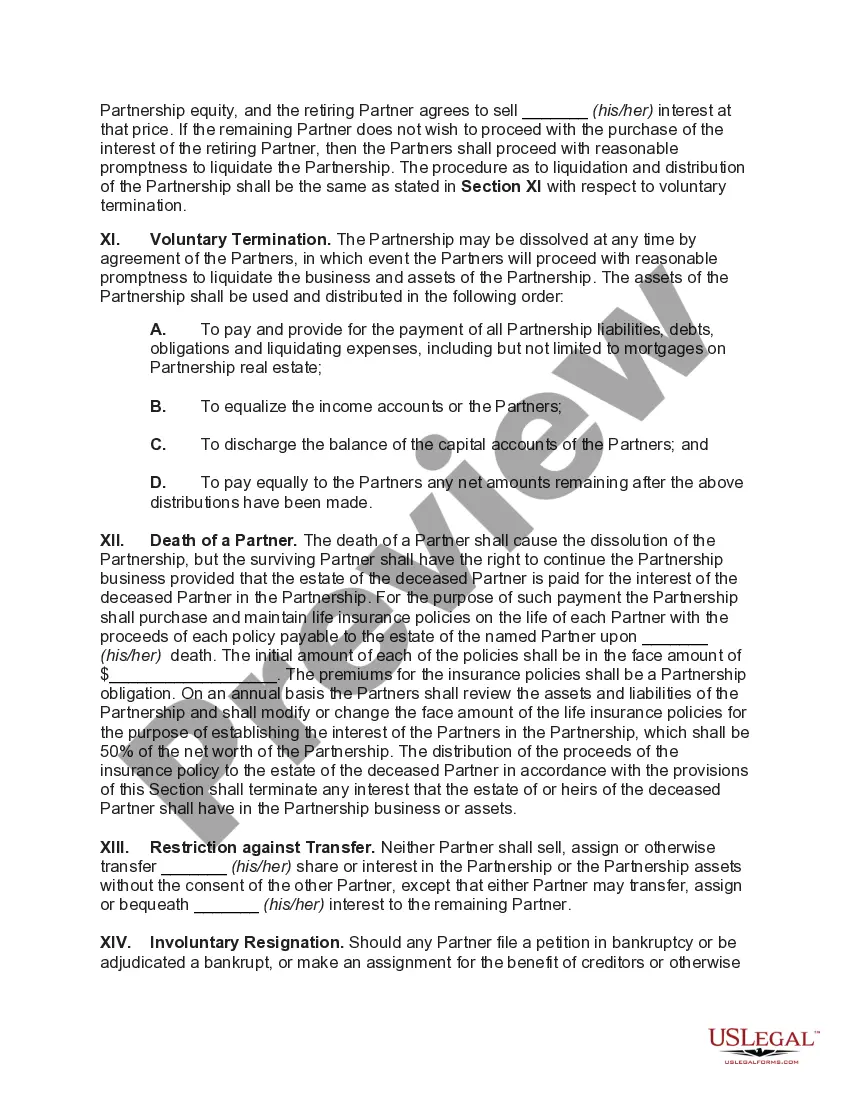

In a limited partnership, if only one partner is left, the partnership generally cannot continue. Limited partnerships require at least one general partner and one limited partner. Thus, if a limited partnership in Connecticut has only one active partner, it may need to restructure or dissolve according to the terms outlined in the Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time.

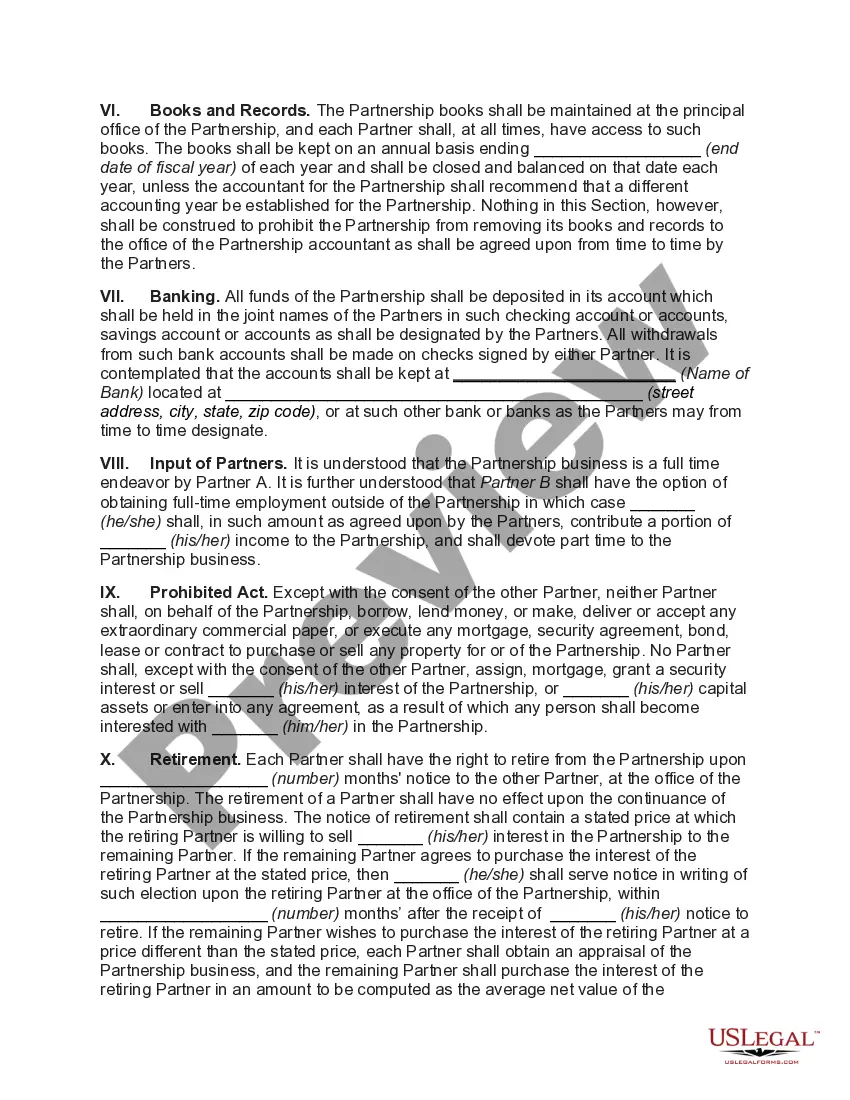

When drafting a partnership agreement, especially a Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, consider detailing profit-sharing ratios, roles of each partner, dispute resolution processes, terms for partner exit, and procedures for bringing in new partners. These elements create a solid foundation for the partnership's operations and help prevent misunderstandings.

Yes, a partnership can continue even if one partner decides to leave, provided the partnership agreement allows for it. In a Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, the remaining partner may take over the obligations or bring in a new partner. It's crucial to address such situations in your agreement to avoid future conflict.

A partnership must have at least two partners to be legally recognized. In the context of a Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, this means both partners must be actively engaged, even if one works more hours than the other. Having a minimum of two partners allows for shared decision-making and diverse input.

A working partner clause in a partnership deed outlines the roles and responsibilities of partners within the business. This clause is vital in a Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, as it specifies who manages daily operations and who contributes on a part-time basis. By including this in your agreement, you clarify expectations and ensure smooth collaboration.

The 80% rule for partnerships refers to an understanding that at least one partner must contribute a significant amount of the work or capital to the partnership. This rule is typically seen in the context of Connecticut Partnership Agreements with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time. By ensuring a primary working partner, the partnership can maintain productivity while balancing the contributions of all members.

Any partnership operating in Connecticut must file a partnership return, including those under a Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time. This requirement exists regardless of whether the partnership earns a profit or has losses. Keeping up with these filing obligations will help you maintain compliance and avoid penalties.

Partnership income is pass-through income, meaning it is reported on individual partners' tax returns and is subject to taxation. This is important to understand, especially for those with a Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time. By knowing this structure, partners can effectively plan their tax strategies.

Certain individuals may be exempt from Connecticut state income tax, including specific types of retirees and military personnel. Partnerships, including those formed under a Connecticut Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, may have partners who qualify for exemptions based on their income or residence. Always verify your eligibility with a tax professional for clarity.