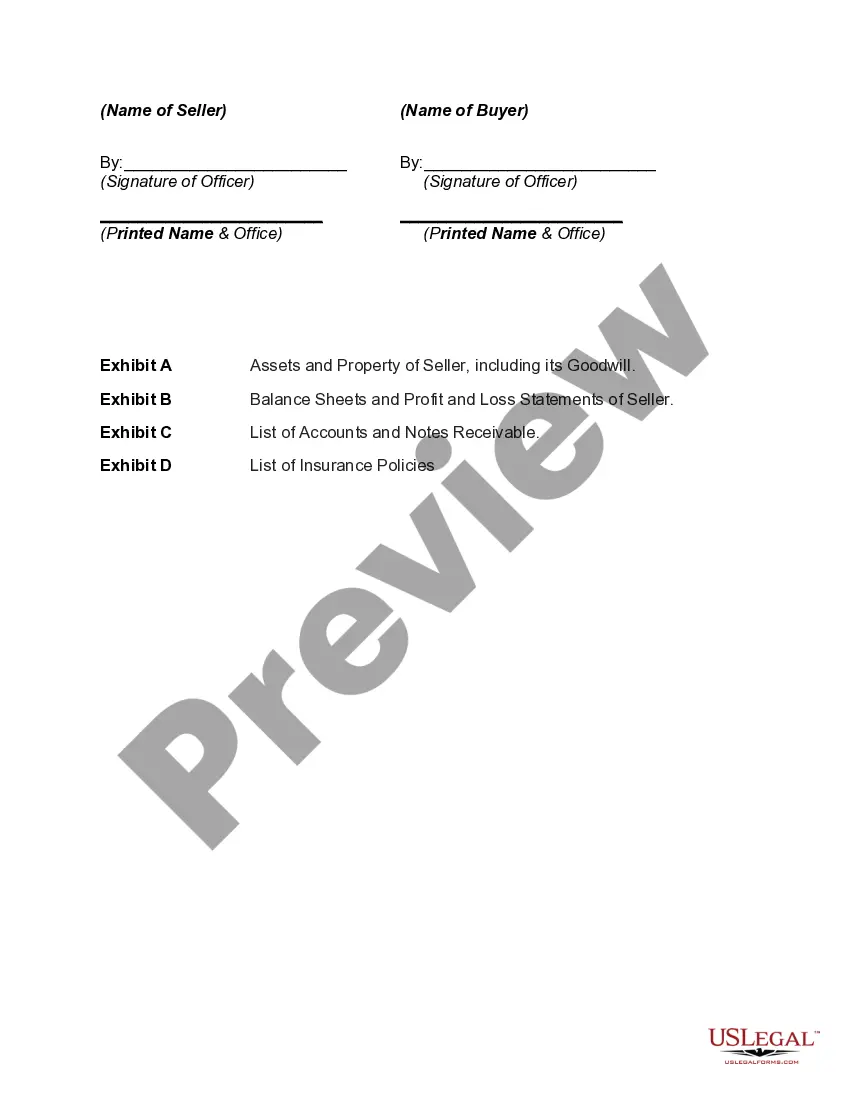

Connecticut Agreement for Sale of Assets of Corporation is a legal document that outlines the terms and conditions surrounding the sale of assets of a corporation located in the state of Connecticut. It specifies the rights and obligations of both the buyer and seller and aims to protect the interests of all parties involved in the transaction. The agreement typically contains various essential clauses that cover crucial aspects of the asset sale, such as the identification of the assets being sold, purchase price, payment terms, representations and warranties, allocation of liabilities, closing conditions, and dispute resolution mechanisms. The document's primary purpose is to provide a comprehensive framework that governs the sale and transfer of assets, ensuring a smooth and legally binding transaction between the buyer and the seller. Some specific types of Connecticut Agreements for Sale of Assets of a Corporation include: 1. Asset Purchase Agreement: This type of agreement details the specific assets being sold, such as equipment, real estate, intellectual property, contracts, inventory, or any other tangible or intangible assets. It addresses the terms and conditions related to the transfer of these assets from the seller to the buyer. 2. Stock Purchase Agreement: Unlike an asset purchase agreement, a stock purchase agreement involves the sale of the entire corporation, including all its assets, liabilities, and obligations. The agreement outlines the terms of transfer of ownership, stock purchase price, representations and warranties, and closing conditions. 3. Merger Agreement: In situations where two corporations decide to merge, a merger agreement is utilized. This agreement covers various aspects such as the purchase price, method of payment, treatment of shares, the structure of the resulting entity, and governance provisions post-merger. 4. Acquisition Agreement: This type of agreement typically focuses on the acquisition of a smaller corporation by a larger corporation. It sets out the terms for the acquisition, including the purchase price, representations and warranties, due diligence requirements, and any conditions precedent to closing. In conclusion, a Connecticut Agreement for Sale of Assets of Corporation is a vital legal document that serves to protect the interests of both the buyer and seller in the asset sale transaction. Depending on the nature of the deal, different types of agreements, such as asset purchase agreements, stock purchase agreements, merger agreements, or acquisition agreements, may be utilized to govern the specific terms and conditions of the transaction.

Connecticut Agreement for Sale of Assets of Corporation

Description

How to fill out Agreement For Sale Of Assets Of Corporation?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a vast array of legal document samples that you can download or create.

By using the website, you can obtain thousands of forms for business and personal use, organized by categories, states, or keywords. You'll find the most recent versions of forms like the Connecticut Agreement for Sale of Assets of Corporation in just minutes.

If you already have a subscription, Log In to obtain the Connecticut Agreement for Sale of Assets of Corporation from your US Legal Forms library. The Download button will be visible on every form you view. You can access all previously acquired forms in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Connecticut Agreement for Sale of Assets of Corporation. All templates added to your account do not have an expiration date and belong to you permanently. To download or print another copy, simply go to the My documents section and click on the form you want. Access the Connecticut Agreement for Sale of Assets of Corporation with US Legal Forms, the largest repository of legal document templates. Utilize a wide selection of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the correct form for your area/state.

- Press the Review button to view the form's details.

- Check the form description to confirm that you have selected the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose your preferred payment plan and provide your details to register for your account.

Form popularity

FAQ

Writing a contract for the sale of a business involves several essential steps to ensure the document is comprehensive and legally sound. Begin by identifying the parties involved and detailing the assets being sold, followed by laying out the terms of payment and any contingencies. Utilizing a Connecticut Agreement for Sale of Assets of Corporation template from the US Legal Forms platform can simplify this process, providing a structured framework that covers all necessary components while ensuring compliance with state laws.

Writing an easy agreement involves keeping the language simple and focusing on the core aspects of the agreement. Clearly define the parties, the subject of the agreement, and any essential terms. Make sure to include space for signatures to validate the agreement. Consider utilizing standard templates like the Connecticut Agreement for Sale of Assets of Corporation to streamline the process and ensure nothing is overlooked.

To create a business sale agreement, detail the specific assets being sold, their valuation, and any liabilities assumed by the buyer. Include representations and warranties that both parties agree upon, as well as a payment schedule. Additionally, think about specific legal requirements unique to Connecticut. A Connecticut Agreement for Sale of Assets of Corporation can guide you in drafting a comprehensive and legally binding document.

Writing a simple business agreement begins with stating the purpose and names of the parties involved. Include key terms such as services provided, compensation, duration, and any required signatures. Keep the language clear and straightforward to avoid misunderstandings. Utilizing a Connecticut Agreement for Sale of Assets of Corporation can simplify this process and ensure compliance with legal standards.

Selling a business in Connecticut involves several steps to ensure a smooth transaction. First, prepare a thorough appraisal of your business to determine its value and gather all necessary documents. Once you have a buyer, it is crucial to draft a Connecticut Agreement for Sale of Assets of Corporation to protect both parties' interests. You may consider using platforms like US Legal Forms to access customizable templates that simplify the process.

The acquired assets usually include all fixed assets (usually supported by a detailed list), all inventory, all supplies, tools, computers and related software, websites, all social media accounts used in connection with the Business, all permits, patents, trademarks, service marks, trade names (including but not

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

Writing a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

However, there are some basic items that should be included in every purchase agreement.Buyer and seller information.Property details.Pricing and financing.Fixtures and appliances included/excluded in the sale.Closing and possession dates.Earnest money deposit amount.Closing costs and who is responsible for paying.More items...?

More info

Buyer has agreed that a buyer shall not enter into.