Connecticut Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases Connecticut employment agreements of executives with deferred compensation and cost-of-living increases are crucial documents that outline the terms and conditions of employment for high-ranking individuals in organizations based in Connecticut. These agreements are designed to provide executives with financial security and incentives for long-term commitment and outstanding performance. Deferred compensation is a vital component of these agreements, allowing executives to defer a portion of their salary or bonuses to be received at a future date, typically upon retirement or termination of employment. This deferred amount can accrue interest or other investment gains over time, providing executives with a substantial financial cushion for the future. Cost-of-living increases (COLA) are another significant feature of Connecticut employment agreements for executives. As the cost of living constantly fluctuates, COLA provisions ensure that executives' salaries are periodically adjusted to reflect changes in inflation rates. This ensures that executives can maintain their standard of living and purchasing power over time. Different types of Connecticut employment agreements of executives with deferred compensation and cost-of-living increases may include: 1. Fixed Deferred Compensation Agreement: This agreement specifies a fixed amount or percentage of the executive's salary or bonuses that will be deferred and paid out at a predetermined date or event. The agreement may also outline the investment options for the deferred amount. 2. Performance-Based Deferred Compensation Agreement: In this type of agreement, the deferred compensation is tied to the achievement of specific performance goals or targets. Executives may receive a higher deferred amount if they meet or exceed these targets, providing an additional incentive for exceptional performance. 3. Cost-of-Living Adjusted Employment Agreement: This agreement guarantees that the executive's salary will be adjusted annually based on changes in the cost of living. A COLA provision ensures that executives can maintain their purchasing power despite inflationary pressures. 4. Hybrid Employment Agreement: Some Connecticut employment agreements may combine the elements of deferred compensation and cost-of-living increases into a single comprehensive agreement. This hybrid agreement provides executives with both long-term financial security through deferred compensation and protection against inflation through cost-of-living adjustments. Connecticut Employment Agreements of Executives with Deferred Compensation and Cost-of-Living Increases play a vital role in attracting and retaining top talent in the state. These agreements provide executives with valuable financial incentives and ensure their long-term commitment and dedication to the organization. Executives can enjoy financial stability, investment opportunities, and protection against inflation, ultimately contributing to their overall job satisfaction and performance.

Connecticut Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases

Description

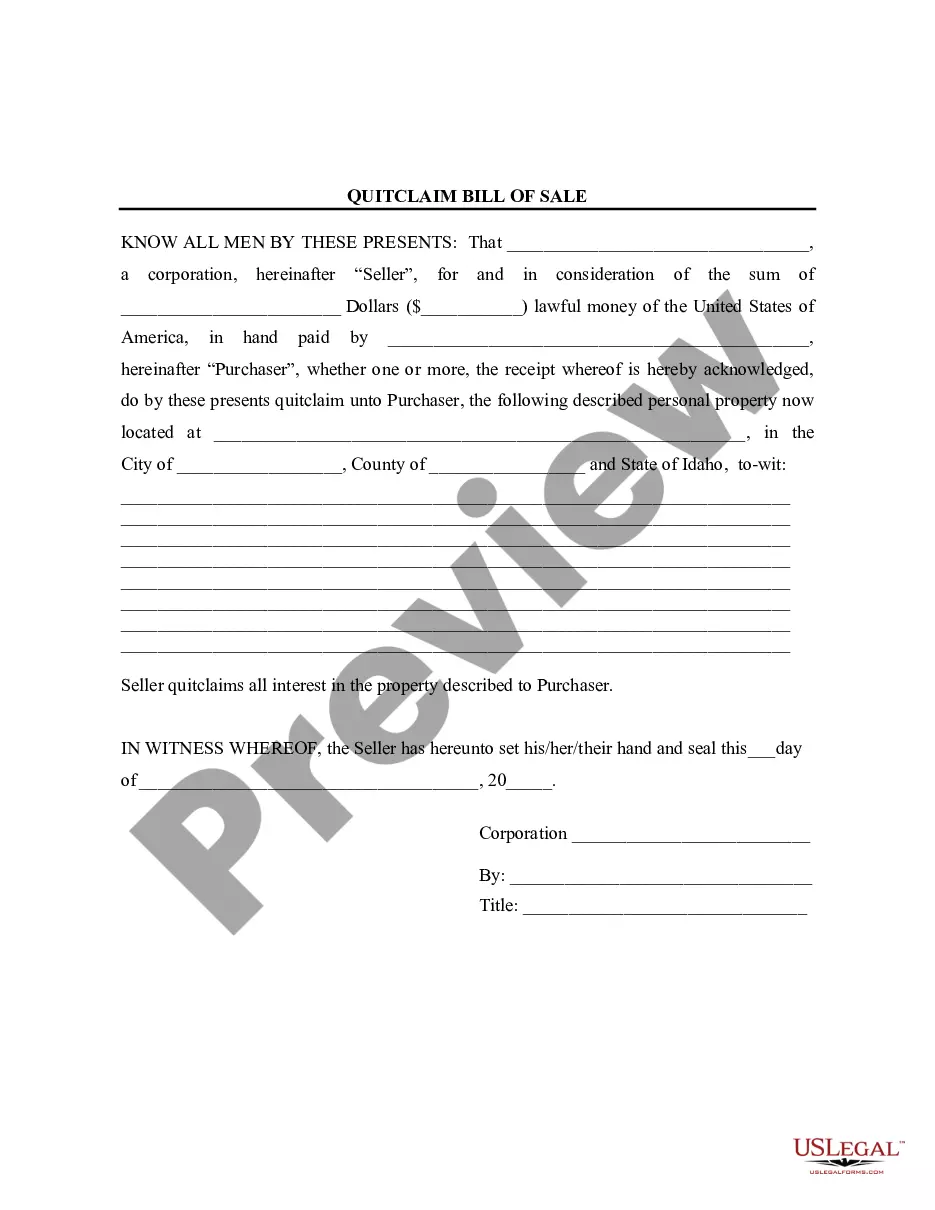

How to fill out Connecticut Employment Agreement Of Executive With Deferred Compensation And Cost-of-Living Increases?

Are you presently inside a situation in which you need papers for possibly organization or personal purposes virtually every working day? There are tons of legal record themes available online, but getting types you can rely on isn`t straightforward. US Legal Forms offers thousands of type themes, such as the Connecticut Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases, which are created to fulfill state and federal demands.

If you are currently knowledgeable about US Legal Forms web site and also have a free account, simply log in. Following that, you may down load the Connecticut Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases web template.

Should you not have an bank account and want to begin using US Legal Forms, follow these steps:

- Get the type you will need and make sure it is to the appropriate area/region.

- Use the Preview button to analyze the form.

- See the outline to ensure that you have selected the appropriate type.

- When the type isn`t what you are trying to find, use the Look for field to discover the type that suits you and demands.

- Once you find the appropriate type, click on Get now.

- Pick the pricing strategy you would like, fill out the required info to produce your account, and pay money for an order making use of your PayPal or credit card.

- Pick a convenient file formatting and down load your copy.

Discover every one of the record themes you possess purchased in the My Forms menus. You can aquire a additional copy of Connecticut Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases at any time, if necessary. Just click on the essential type to down load or produce the record web template.

Use US Legal Forms, by far the most considerable selection of legal kinds, to save time and prevent faults. The assistance offers professionally manufactured legal record themes which you can use for a selection of purposes. Generate a free account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

An employer will offer the opportunity for you to defer a portion of your compensation for a number of years, and doing so defers taxes on any earnings until you take a withdrawal. Examples include pensions, retirement plans, and stock options.

The Employee acknowledges and agrees that he is being offered a position of employment by the Company with the understanding that the Employee possesses a unique set of skills, abilities, and experiences which will benefit the Company, and he agrees that his continued employment with the Company, whether during the

An employer will offer the opportunity for you to defer a portion of your compensation for a number of years, and doing so defers taxes on any earnings until you take a withdrawal. Examples include pensions, retirement plans, and stock options.

An executive employment contract is an employment agreement between a company and an executive. These written contracts outline things like an executive's compensation, duties, bonuses, as well as competition, and confidentiality.

Further, there are six key provisions that will almost always appear in your executive employment agreement.Compensation. Your employment agreement will outline your compensation.Target Annual Bonus v. sales commission:Sign-on bonus:Retention Bonus:Exemption status:Equity or Equity-Related Awards:

5 Key Considerations When Negotiating an Executive Employment AgreementProtect the Company's Confidential Information and Property.Restrictive Covenants Are Important, But Should Not Overreach.Set Clear Grounds and Procedures for Termination of the Agreement.More items...?

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

An executive compensation agreement is a binding contract between a company and one of its most important and powerful employees.

Reduce Income Taxes Deferred compensation plans also reduce the current year's tax burden on employees. When a person contributes to a deferred compensation plan, the amount contributed over the year reduces taxable income for that year, thus reducing the total income taxes paid.

The CARES Act allowed employers to defer deposit and payment of the employer's portion of Social Security taxes and self-employed individuals to defer their equivalent portions of self-employment taxes otherwise due between March 27, 2020, and Dec.