Connecticut Conflict of Interest Disclosure for Member of Board of Directors of Corporation

Description

How to fill out Conflict Of Interest Disclosure For Member Of Board Of Directors Of Corporation?

Locating the appropriate legal document template can be a challenge. Of course, there are numerous templates available online, but how can you find the legal form you need? Utilize the US Legal Forms website.

The platform offers a multitude of templates, including the Connecticut Conflict of Interest Disclosure for Members of the Board of Directors of a Corporation, which can serve both organizational and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to access the Connecticut Conflict of Interest Disclosure for Members of the Board of Directors of a Corporation. Use your account to browse through the legal documents you have previously purchased. Visit the My documents section of your account to download another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Connecticut Conflict of Interest Disclosure for Members of the Board of Directors of a Corporation. US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize this service to download professionally crafted documents that align with state requirements.

- First, ensure you have selected the correct form for your city/county.

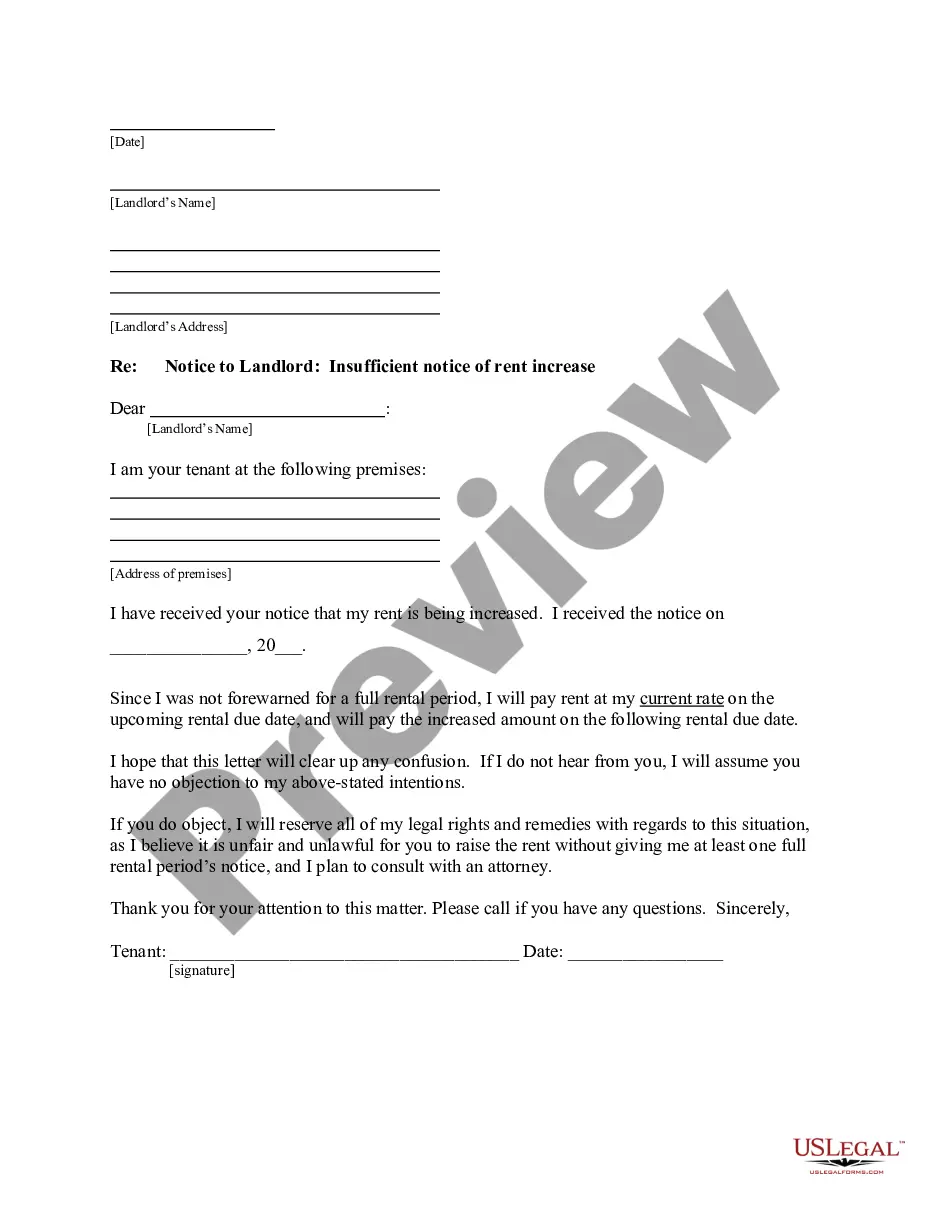

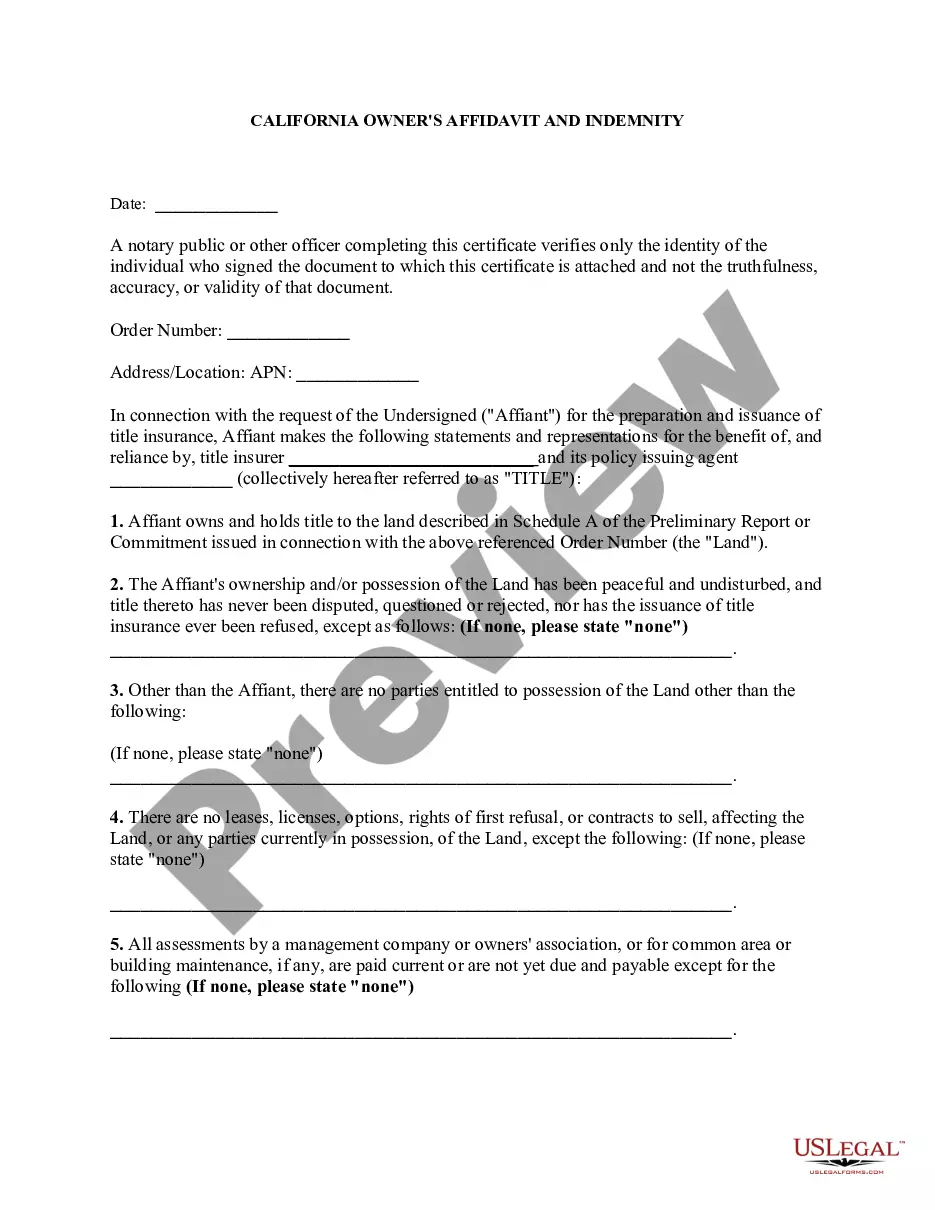

- You can preview the document using the Review button and read the form description to confirm it is appropriate for you.

- If the form does not meet your requirements, use the Search field to find the correct document.

- Once you are confident that the form is suitable, click the Get now button to obtain the document.

- Choose the pricing plan you wish to use and fill in the necessary details.

- Create your account and complete your purchase using your PayPal account or credit card.

Form popularity

FAQ

A Form 990 conflict of interest refers to disclosures made in the IRS Form 990, which non-profit organizations file annually. This form requires transparency about potential conflicts of interest among board members and executives. By adhering to the guidelines in the Connecticut Conflict of Interest Disclosure for Member of Board of Directors of Corporation, organizations can ensure compliance and maintain accountability. This practice ultimately supports ethical governance and public confidence.

Writing a conflict of interest declaration involves clearly stating any personal interests that may conflict with board responsibilities. Begin by outlining the nature of the conflict and how it relates to the board's duties. Utilizing the Connecticut Conflict of Interest Disclosure for Member of Board of Directors of Corporation format can guide you in structuring this declaration effectively. Clarity and honesty are crucial to ensure the board remains trustworthy and ethical.

A board member conflict of interest form is an essential document that captures relevant disclosures related to potential conflicts. It allows board members to formally declare interests that may affect their decision-making. By utilizing the Connecticut Conflict of Interest Disclosure for Member of Board of Directors of Corporation, boards can maintain integrity and public trust. This form aids in fostering transparency and accountability within an organization.

To effectively manage conflict of interest on a board, transparency is key. Each board member should disclose any potential conflicts using the Connecticut Conflict of Interest Disclosure for Member of Board of Directors of Corporation. Open discussions can help in deciding how to address these issues. Additionally, organizations should establish clear policies outlining procedures for managing conflicts.

The form for disclosing conflict of interest among board members is essential for documenting potential conflicts. This form, known as the Connecticut Conflict of Interest Disclosure for Member of Board of Directors of Corporation, outlines the necessary information to be reported. By completing this form, board members can ensure compliance with ethical standards and the organization's policies.

If a board member identifies a conflict of interest, they must disclose it according to established procedures. Submitting a Connecticut Conflict of Interest Disclosure for Member of Board of Directors of Corporation is a critical step in this process. This disclosure promotes accountability, allowing the board to assess the situation and take necessary actions, preserving the integrity of decision-making.

Resolving conflict among board members requires clear communication and a commitment to transparency. It is essential to encourage open discussions where members can express their concerns freely. Utilizing tools like the Connecticut Conflict of Interest Disclosure for Member of Board of Directors of Corporation can help clarify issues and build understanding among members, leading to effective resolutions.

When a board member faces a conflict of interest, it is important for them to disclose this conflict immediately. They should submit a Connecticut Conflict of Interest Disclosure for Member of Board of Directors of Corporation. The board will then review the disclosure, allowing for a fair discussion and appropriate resolution of the issue to ensure informed decision-making.

The board policy on conflict of interest provides guidelines to prevent situations that could harm the corporation's decision-making integrity. It mandates that all board members disclose potential conflicts, such as personal or financial interests that may affect their judgment. This policy is part of the Connecticut Conflict of Interest Disclosure for Member of Board of Directors of Corporation, which fosters accountability and ethical governance.

If a conflict of interest arises, it is crucial to address it promptly. The affected board member should disclose the conflict through the Connecticut Conflict of Interest Disclosure for Member of Board of Directors of Corporation process. Following the disclosure, the board may discuss the matter to determine the appropriate steps, ensuring transparency and maintaining trust within the organization.