Connecticut Expense Reimbursement Form for an Employee is a document utilized by employers in the state of Connecticut to reimburse employees for business-related expenses incurred during the course of their job duties. This form allows employees to request reimbursement for expenses they have personally paid out of pocket. It is important for businesses to have a formal reimbursement process in place to ensure fairness and accuracy in handling employee expenses. Keywords: Connecticut, expense reimbursement form, employee, business-related expenses, job duties, out of pocket, reimbursement process. There are primarily two types of Connecticut Expense Reimbursement Forms for an Employee, namely: 1. Connecticut Mileage Reimbursement Form: This form is used to request reimbursement for mileage expenses incurred by an employee while using their personal vehicle for work-related purposes. Employees can enter their name, date, destination, purpose of the trip, starting and ending odometer readings, and the total mileage traveled. This form ensures that the employee is compensated for the wear and tear on their vehicle and fuel costs. 2. Connecticut Miscellaneous Expense Reimbursement Form: This form covers various types of business-related expenses incurred by an employee, excluding mileage expenses. It allows employees to specify the nature of the expense, provide supporting documentation such as receipts or invoices, and enter the amount to be reimbursed. Examples of expenses covered include meals, hotel accommodations, office supplies, transportation fees, and parking charges. Both types of reimbursement form typically require the employee to fill in their contact information, employee identification number, department, and supervisor's name. They also contain a section for the employee to provide an explanation or justification for each expense, ensuring transparency and accountability. Employers are responsible for reviewing the completed forms, verifying the accuracy of the information provided, and approving the reimbursement requests. Once approved, the employee's reimbursement is processed, and the amount is either paid in their next paycheck or through a separate reimbursement check. It is crucial for employers to familiarize themselves with Connecticut labor laws and regulations to ensure compliance regarding expense reimbursement policies and procedures. Additionally, maintaining organized records of all reimbursement forms and supporting documentation is essential for future reference and potential audits. In conclusion, Connecticut Expense Reimbursement Forms for an Employee play a vital role in maintaining a fair and transparent reimbursement process for employees' out-of-pocket business-related expenses. By utilizing these forms, both employers and employees can ensure accurate and timely reimbursement, fostering a positive working environment.

Connecticut Expense Reimbursement Form for an Employee

Description

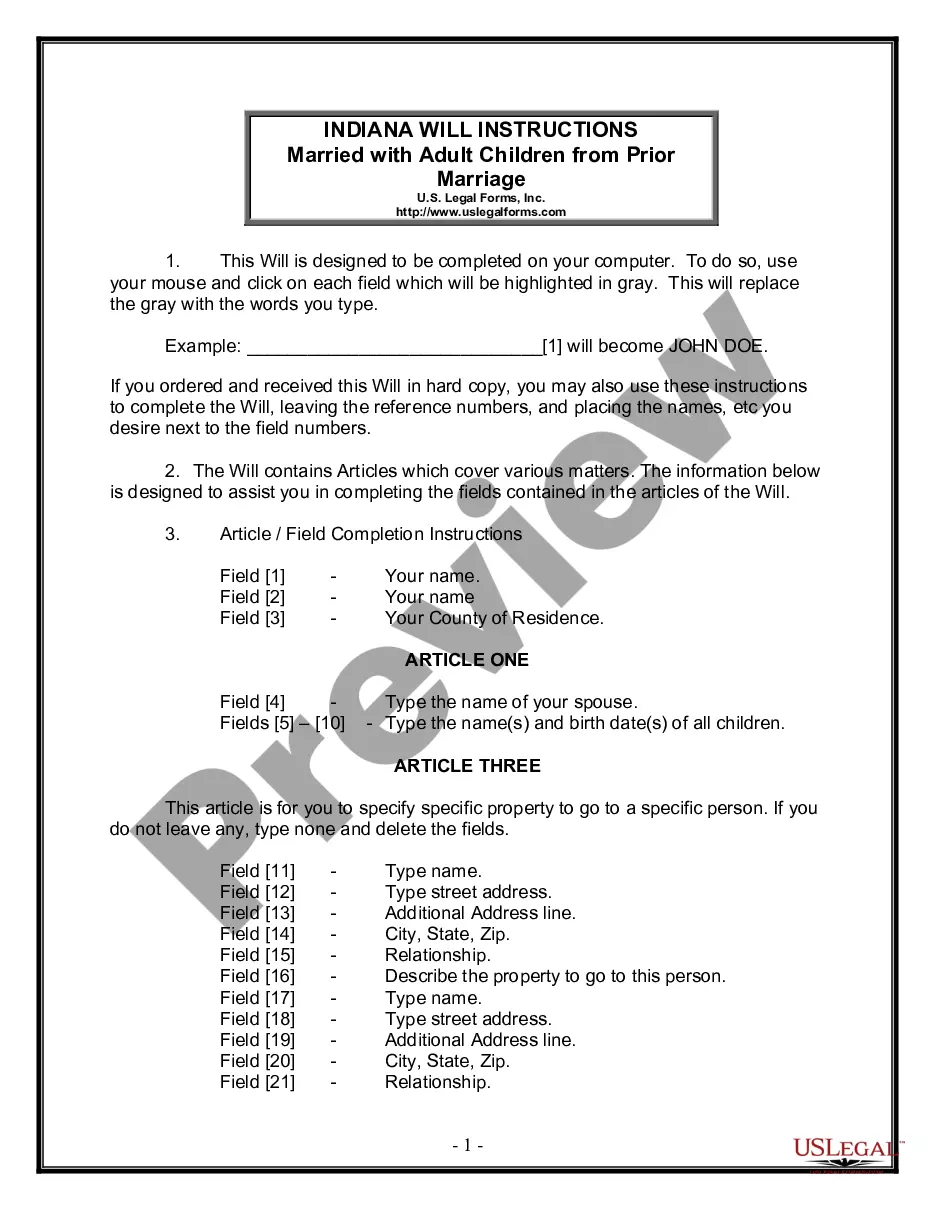

How to fill out Connecticut Expense Reimbursement Form For An Employee?

You are able to invest time on the web searching for the legitimate document format that meets the federal and state needs you need. US Legal Forms supplies thousands of legitimate types which are examined by professionals. You can actually down load or produce the Connecticut Expense Reimbursement Form for an Employee from your support.

If you have a US Legal Forms bank account, it is possible to log in and click on the Obtain button. Afterward, it is possible to full, edit, produce, or indicator the Connecticut Expense Reimbursement Form for an Employee. Every single legitimate document format you buy is your own permanently. To have yet another duplicate of any bought develop, proceed to the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms internet site the first time, stick to the simple directions listed below:

- Initially, make certain you have selected the proper document format for that county/city of your choice. Look at the develop outline to make sure you have selected the proper develop. If offered, take advantage of the Preview button to appear through the document format also.

- If you wish to find yet another variation of the develop, take advantage of the Look for discipline to discover the format that meets your requirements and needs.

- Upon having discovered the format you desire, simply click Buy now to proceed.

- Select the rates strategy you desire, type in your accreditations, and sign up for a free account on US Legal Forms.

- Full the purchase. You may use your charge card or PayPal bank account to pay for the legitimate develop.

- Select the file format of the document and down load it in your product.

- Make changes in your document if required. You are able to full, edit and indicator and produce Connecticut Expense Reimbursement Form for an Employee.

Obtain and produce thousands of document templates making use of the US Legal Forms site, which offers the greatest selection of legitimate types. Use professional and express-distinct templates to take on your small business or personal requires.

Form popularity

FAQ

Reimbursement Documents means this Agreement, the Mortgage, and the Collateral Documents, and any other agreements, documents, or instruments now or hereafter executed or delivered by or on behalf of the Borrower or the Authority to the Bank in connection with the issuance of the Letter of Credit.

How to Complete an Expense Reimbursement Form:Add personal information.Enter purchase details.Sign the form.Attach receipts.Submit to the management or accounting department.

bystep guide to employee expense reimbursementForm a policy for the expense reimbursement process.Determine what expenses employees can claim.Create a system for collecting employee expense claims.Verify the legitimacy of expenses.Pay reimbursements within a specified timeframe.

Reimbursement is money paid to an employee or customer, or another party, as repayment for a business expense, insurance, taxes, or other costs. Business expense reimbursements include out-of-pocket expenses, such as those for travel and food.

bystep guide to employee expense reimbursementForm a policy for the expense reimbursement process.Determine what expenses employees can claim.Create a system for collecting employee expense claims.Verify the legitimacy of expenses.Pay reimbursements within a specified timeframe.

Because reimbursements under the accountable plan are not wages and are not taxed, you do not have to report the amount. Do not include the amount with the employee's wages on Form W-2. Instead, report it in Form W-2 box 12 with code L.

The expense reimbursement process allows employers to pay back employees who have spent their own money for business-related expenses. When employees receive an expense reimbursement, typically they won't be required to report such payments as wages or income.

An employee reimbursement form is a standardized template an employee may use to report expenses paid on behalf of the company to receive reimbursement. The exact reimbursable items will be strictly up to the agreement between the employer and employee.

Business expense reimbursements are not considered wages, and therefore are not taxable income (if your employer uses an accountable plan). An accountable plan is a plan that follows the Internal Revenue Service regulations for reimbursing workers for business expenses in which reimbursement is not counted as income.