Connecticut Purchase Invoice

Description

How to fill out Purchase Invoice?

Are you in the circumstance where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a wide array of document templates, such as the Connecticut Purchase Invoice, which are designed to comply with state and federal regulations.

Once you obtain the correct document, simply click Purchase now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Connecticut Purchase Invoice template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you require and ensure it is for the correct city/state.

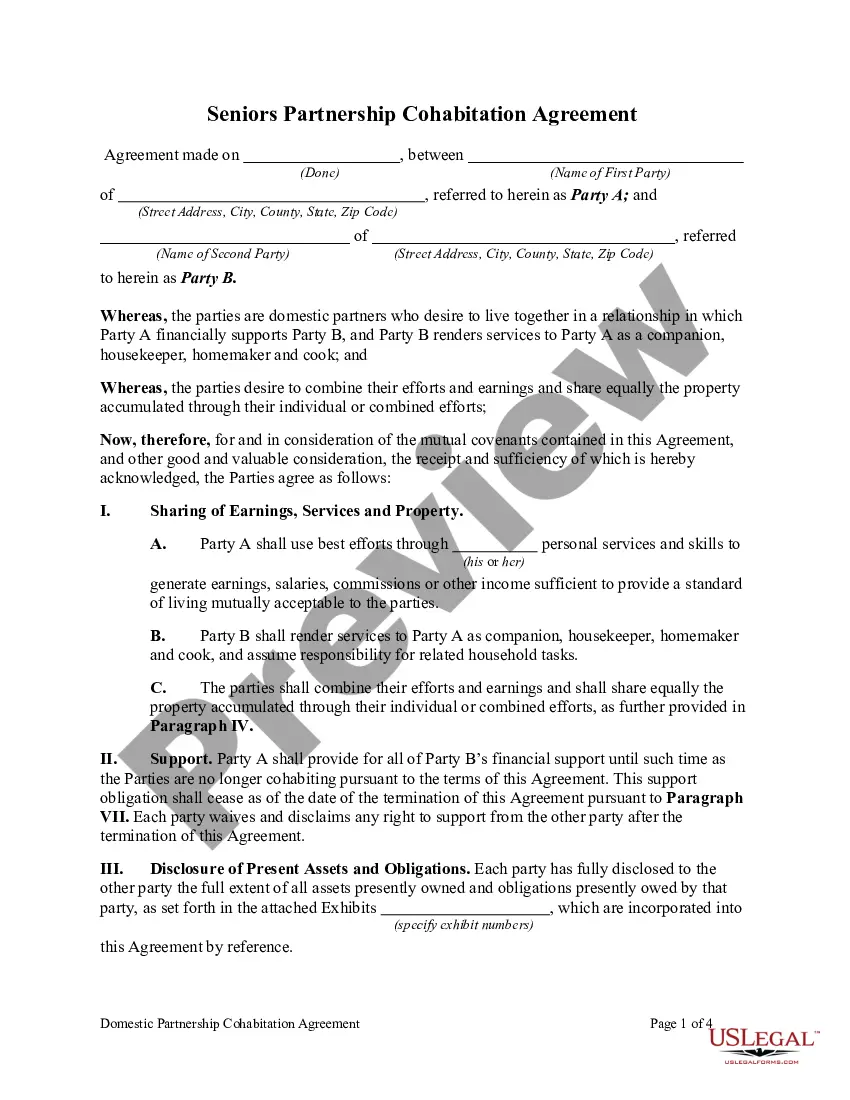

- Use the Review option to examine the form.

- Read the description to confirm that you have selected the appropriate document.

- If the document isn't what you're looking for, utilize the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

A proper Connecticut Purchase Invoice typically includes essential elements such as your business name, contact information, and a unique invoice number. It also displays the date of the transaction, a detailed list of products or services purchased, along with their quantities and prices. Additionally, it should state the total amount due, payment terms, and any relevant tax information. Using a structured format not only enhances professionalism but also ensures clarity for both parties involved.

Filling out a sales invoice involves designated sections for seller and buyer details, along with a breakdown of sale items. Clearly itemize each product or service, specifying unit prices and quantities to calculate totals. By using a Connecticut Purchase Invoice template from US Legal Forms, you ensure that all necessary information is included efficiently and accurately.

Filling out an invoice correctly starts with providing complete and accurate information. Make sure to include your information, the client's name, item descriptions, prices, and invoice total. Consistency in presentations, such as using a standard format like a Connecticut Purchase Invoice, enhances professionalism and accountability in your transactions.

To fill out a tax invoice statement, include essential details such as your business name, tax identification number, and the client’s information. Be specific about the goods or services provided, including tax amounts applicable. This clarity helps in financial reporting and compliance, making your Connecticut Purchase Invoice vital for tax purposes.

Properly filling out a commercial invoice requires careful attention to detail. Begin with your company information and the buyer's details, followed by a description of the goods. Don't forget to include the total amount and payment terms. Utilizing a Connecticut Purchase Invoice provides clarity and professionalism, reflecting your business standards.

To fill up a billing invoice sample, first download a suitable template that meets your specific needs. Enter your business details and those of your client in the designated fields. Include descriptions of products or services, along with their costs. A well-structured Connecticut Purchase Invoice clearly communicates the transaction details, ensuring clarity for both parties.

Filling out an invoice properly involves accurate information capture. Start with your name and address, followed by the client's details. List each item provided, alongside prices and total amounts. It's best to utilize a template from US Legal Forms for a reliable Connecticut Purchase Invoice, which guides you through the process.

To obtain a digital Connecticut Purchase Invoice, start by visiting the US Legal Forms website. You can find a variety of templates that cater to your specific needs. After selecting the appropriate form, complete the required fields to generate your invoice digitally. Once finalized, you can easily download, print, or email your Connecticut Purchase Invoice directly from the platform.

Filing invoices involves several straightforward steps. First, ensure that each invoice is accurate and complete. Next, determine whether you want to file them physically or electronically. If you choose to go digital, consider using uslegalforms to create organized Connecticut Purchase Invoices. This method saves time and keeps your financial records in order.

Filing invoices electronically involves using digital tools to create, store, and manage your invoices. Consider utilizing specialized software or online platforms like uslegalforms for efficient invoice management. With electronic filing, you can easily track your Connecticut Purchase Invoices, reduce paper clutter, and ensure that all documents are searchable and accessible.