Connecticut Payroll Deduction — Special Services, also known as CT Payroll Deduction — Special Services, is a system that allows employees in Connecticut to deduct specific items from their paychecks. This convenient payroll deduction service is offered by various entities to assist employees in managing their finances effectively. One prominent example of Connecticut Payroll Deduction — Special Services involves retirement savings plans. Employees can opt to set a portion of their salary aside to contribute towards retirement. A popular retirement savings plan facilitated through payroll deductions in Connecticut is the State of Connecticut Deferred Compensation Plan. This plan enables employees to contribute a portion of their pre-tax income towards their retirement savings, helping them secure their financial future. Another type of Connecticut Payroll Deduction — Special Service relates to healthcare and insurance-related deductions. Employers often partner with insurance providers to allow employees to conveniently pay for their health insurance premiums through payroll deductions. This ensures that the employee's insurance coverage remains intact without worrying about separate payment arrangements. Some key insurance plans that Connecticut payroll deduction systems often accommodate include medical insurance, dental insurance, vision insurance, and life insurance. Employees can choose to have the premiums for these plans automatically deducted from their paychecks, reducing administrative efforts for both the employer and the individual. Connecticut Payroll Deduction — Special Services also encompass other voluntary benefits like flexible spending accounts (FSA's). FSA's enable employees to allocate pre-tax dollars towards eligible expenses such as medical expenses (Medical FSA) or dependent care expenses (Dependent Care FSA). The payroll deduction system deducts the desired amount from the employee's paycheck before taxes are applied, lowering the individual's taxable income. Additionally, Connecticut Payroll Deduction — Special Services extend to charitable contributions. Some employers provide their employees with the option to contribute a portion of their salary to eligible charitable organizations via payroll deduction. This method makes it convenient for employees to support causes they care about without the need for separate donations. In summary, Connecticut Payroll Deduction — Special Services encompasses various voluntary benefits, including retirement savings plans (such as the State of Connecticut Deferred Compensation Plan), healthcare and insurance-related deductions, flexible spending accounts (FSA's), and charitable contributions. These services aim to streamline payroll processes, improve employee financial well-being, and simplify the management of various aspects of an employee's financial life.

Connecticut Payroll Deduction - Special Services

Description

How to fill out Connecticut Payroll Deduction - Special Services?

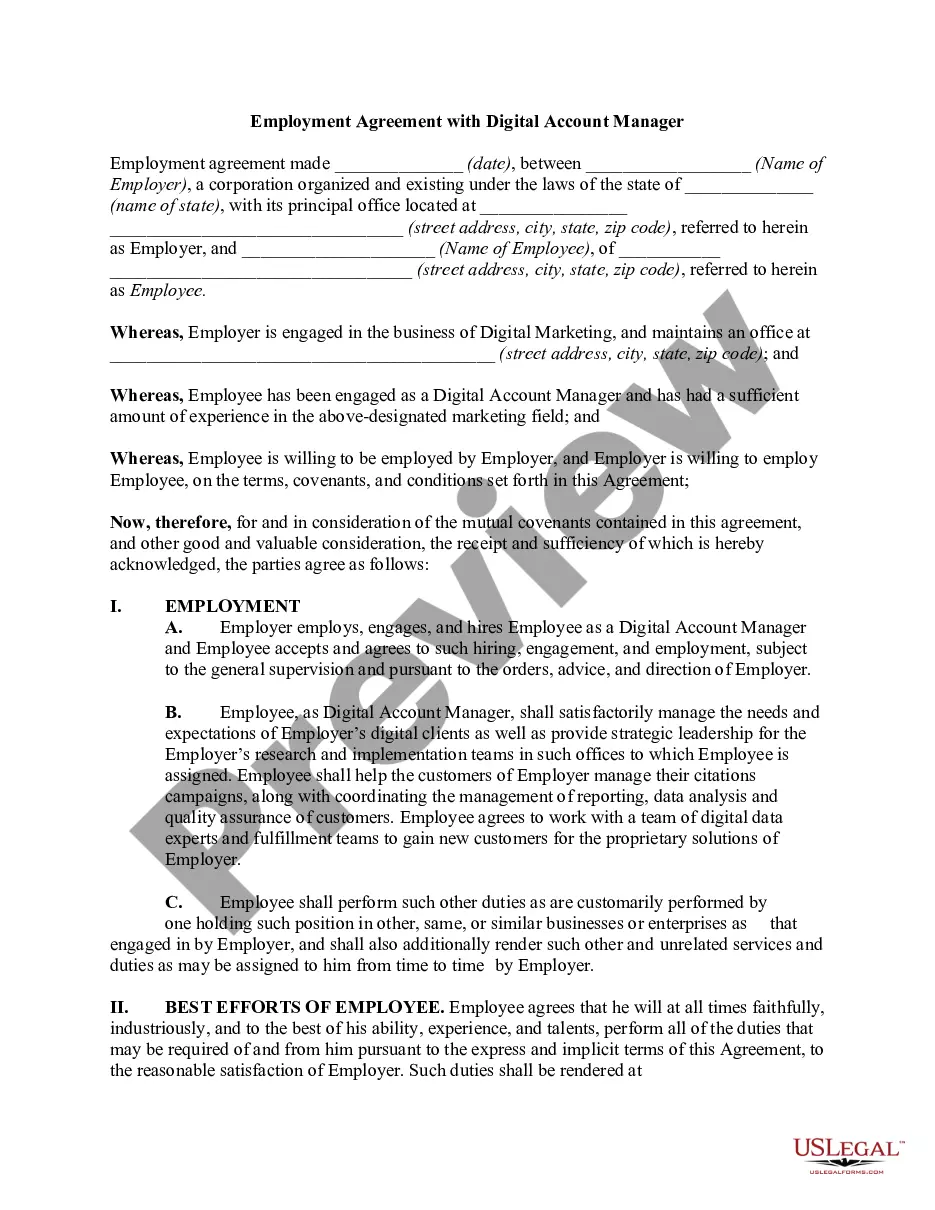

Choosing the right lawful papers template could be a have difficulties. Naturally, there are plenty of templates available online, but how do you discover the lawful kind you need? Utilize the US Legal Forms website. The services provides a large number of templates, including the Connecticut Payroll Deduction - Special Services, which you can use for company and private demands. Each of the kinds are examined by professionals and satisfy state and federal specifications.

Should you be already signed up, log in to the account and click the Acquire button to obtain the Connecticut Payroll Deduction - Special Services. Make use of account to appear throughout the lawful kinds you may have purchased earlier. Proceed to the My Forms tab of the account and have an additional version of the papers you need.

Should you be a new user of US Legal Forms, allow me to share basic directions for you to adhere to:

- Initially, ensure you have selected the correct kind to your town/area. You are able to look over the shape making use of the Review button and browse the shape outline to make certain this is the right one for you.

- In the event the kind does not satisfy your needs, use the Seach area to get the correct kind.

- Once you are certain the shape would work, click the Acquire now button to obtain the kind.

- Select the rates prepare you want and enter in the essential info. Make your account and pay for the order with your PayPal account or Visa or Mastercard.

- Opt for the data file formatting and acquire the lawful papers template to the gadget.

- Full, revise and produce and sign the attained Connecticut Payroll Deduction - Special Services.

US Legal Forms will be the biggest library of lawful kinds in which you can discover different papers templates. Utilize the company to acquire skillfully-made paperwork that adhere to express specifications.