Connecticut Yearly Expenses: A Comprehensive Guide Connecticut, a state in the New England region of the United States, is known for its picturesque landscapes, thriving economy, and high quality of life. However, it's crucial for residents, tourists, and potential residents alike to have a clear understanding of the various expenses associated with living in Connecticut. This comprehensive guide aims to provide a detailed description of the different types of Connecticut yearly expenses, shedding light on key aspects and using relevant keywords to provide relevant information. 1. Housing Expenses: Connecticut is renowned for its beautiful residential areas, but they come at a cost. The housing expenses in Connecticut include mortgage or rent payments, property taxes, homeowners' insurance, and utilities (such as gas, electricity, water, and internet services). The keywords associated with housing expenses in Connecticut are "housing costs," "rent prices," "real estate taxes," "home insurance," and "utilities in Connecticut." 2. Transportation Expenses: Connecticut offers an extensive transportation network, including highways, railways, and public transportation options. However, transportation expenses can be significant for residents. These expenses include car payments, insurance premiums, fuel costs, parking fees, toll charges, and public transportation fares. Keywords related to transportation expenses in Connecticut include "auto loans," "car insurance rates," "gas prices," "parking costs," and "train or bus fares." 3. Healthcare Expenses: Healthcare costs are an essential consideration for individuals and families residing in Connecticut. These expenses encompass health insurance premiums, co-pays for doctor's visits, prescription medication costs, dental and vision care expenses, and related medical expenses. Relevant keywords for healthcare expenses in Connecticut are "health insurance rates," "medical costs," "prescription drug prices," "dental care," and "vision expenses." 4. Education Expenses: Connecticut boasts a strong education system, including public and private schools, colleges, and universities. However, education-related expenses can vary significantly depending on the level and type of education. Key expenses may include tuition fees, school supplies, textbooks, extracurricular activities, and higher education costs like student loans. Keywords linked to education expenses in Connecticut are "college tuition fees," "private school costs," "textbooks prices," "extracurricular activities fees," and "student loans in Connecticut." 5. Grocery Expenses: Understanding the cost of groceries is vital for maintaining a household budget. Grocery expenses in Connecticut may differ based on location, food preferences, and family size. Keywords associated with grocery expenses include "supermarket prices," "grocery bills," "food costs," "eating out expenses," and "organic food prices in Connecticut." 6. Entertainment and Recreation Expenses: Connecticut offers a wide range of entertainment and recreational activities, but they may come with a price tag. These expenses include movie tickets, dining out, recreational facilities like gyms or sports clubs, concert tickets, and other leisure activities. Relevant keywords for entertainment and recreation expenses in Connecticut are "movie theater prices," "restaurant bills," "gym membership costs," "concert tickets in Connecticut," and "recreational activities expenses." By considering the various expenses outlined above and using the relevant keywords, individuals can gain insights into the yearly costs of living in Connecticut. This comprehensive guide can assist in planning and budgeting effectively, enabling both residents and prospective residents to make informed financial decisions.

Connecticut Yearly Expenses

Description

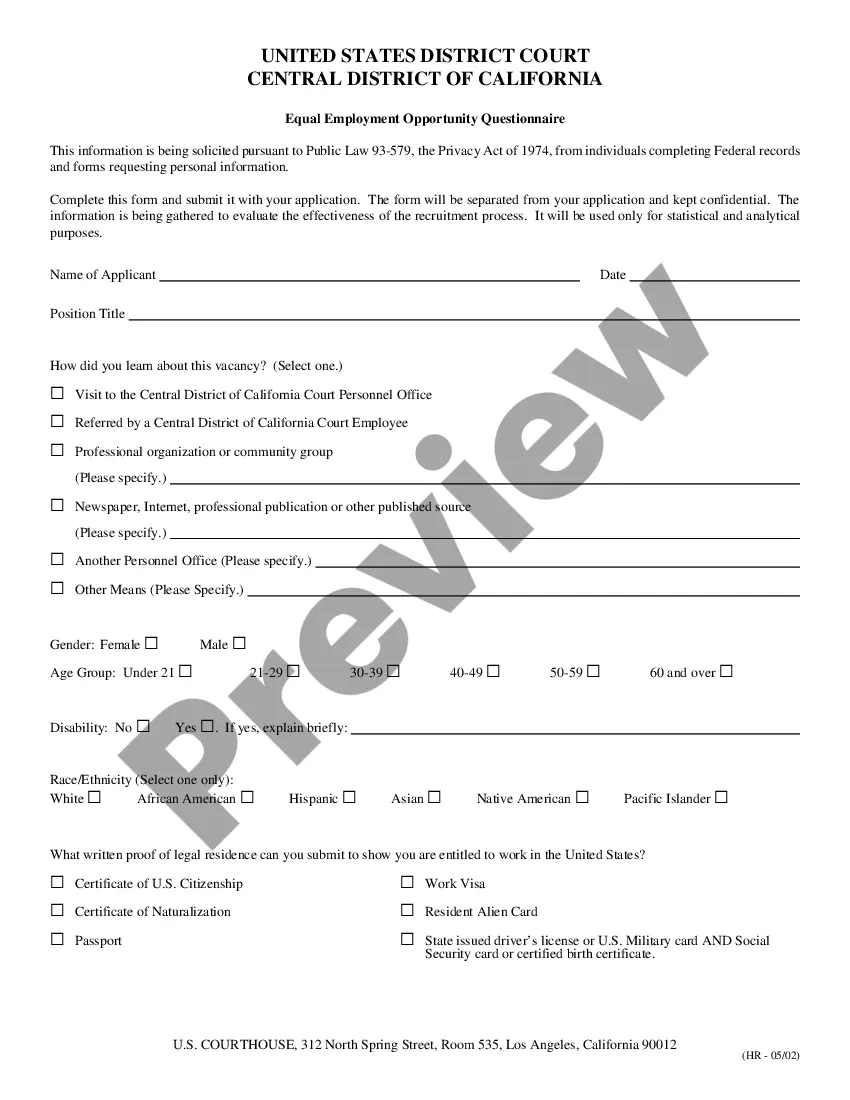

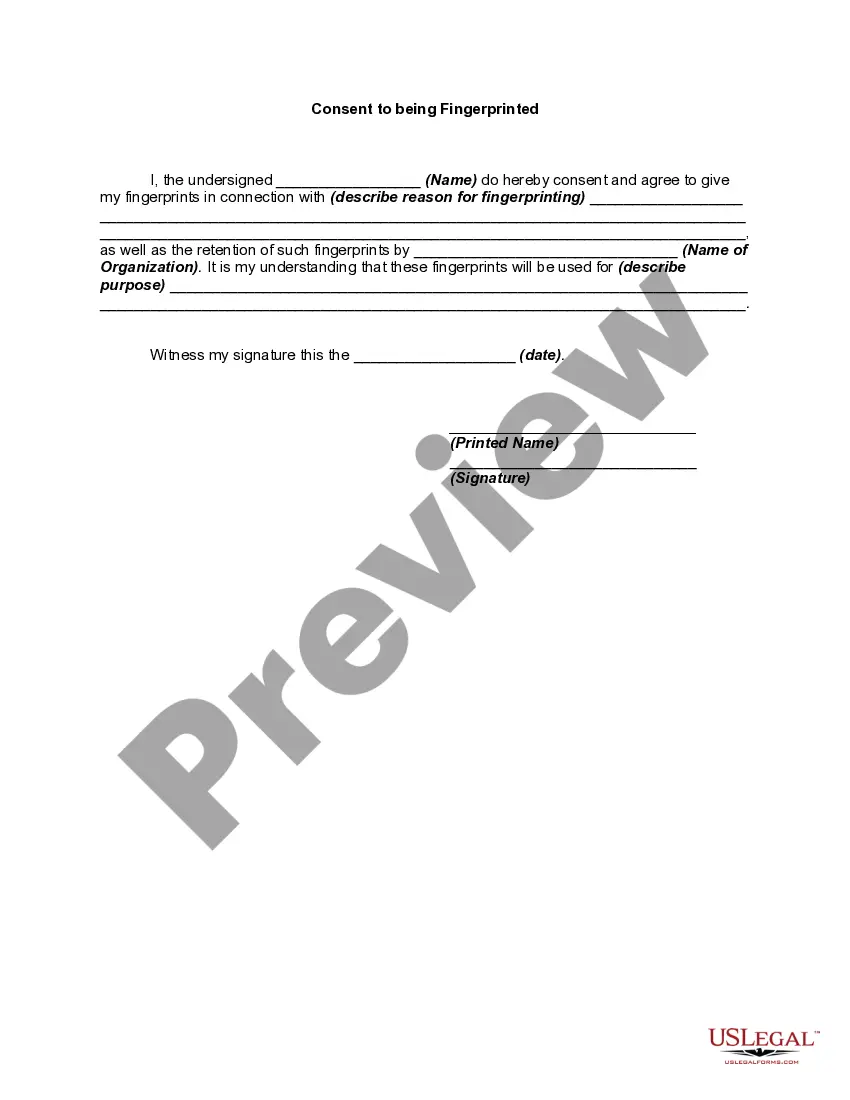

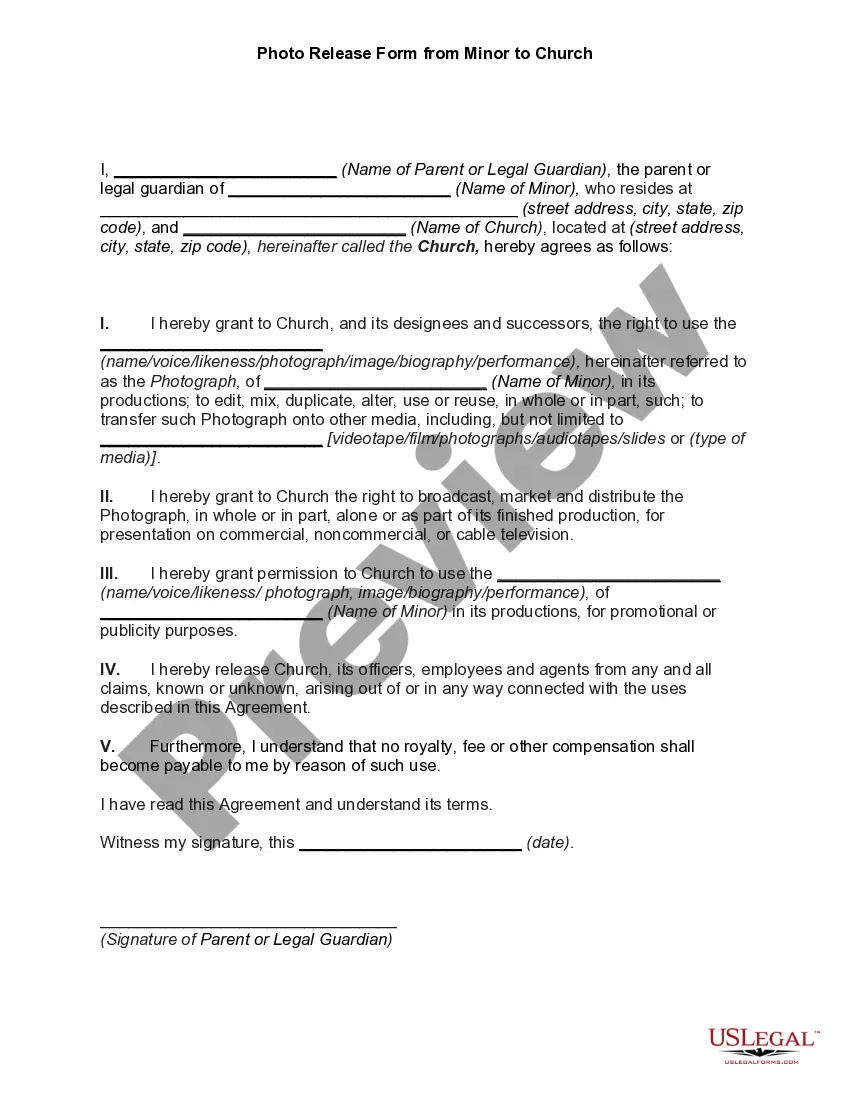

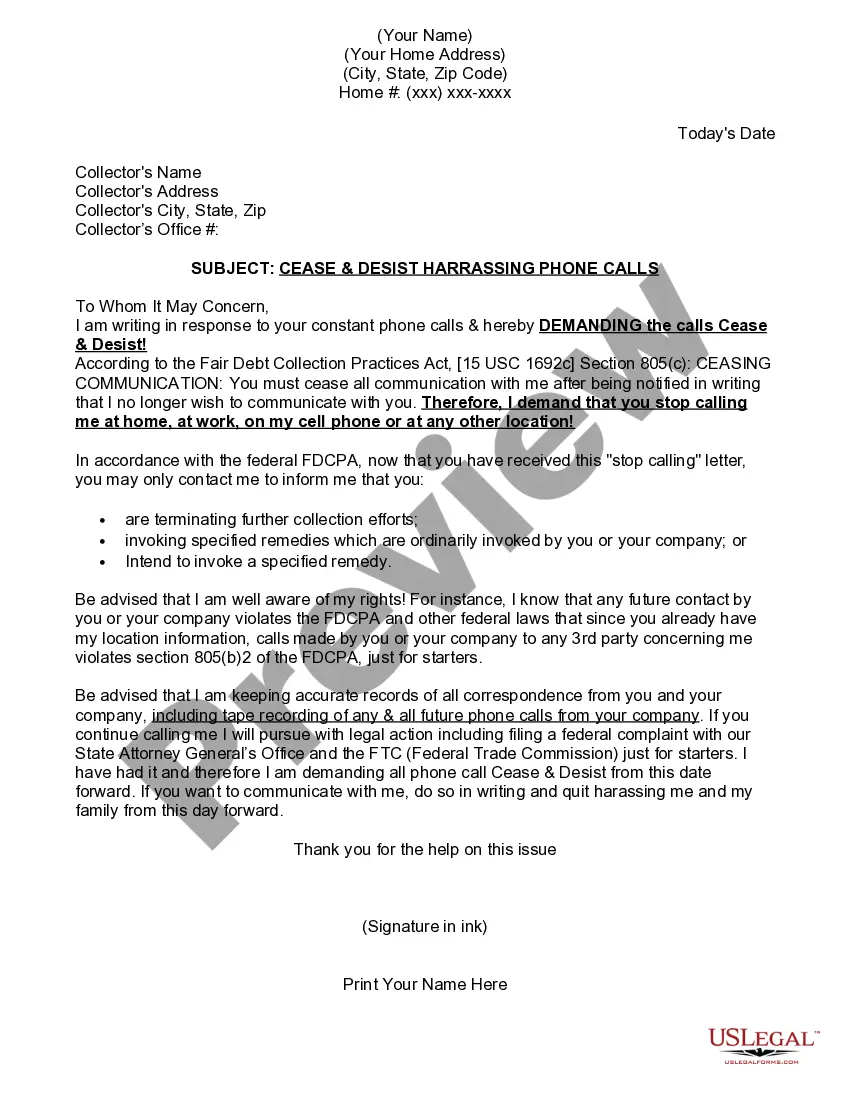

How to fill out Connecticut Yearly Expenses?

Choosing the best authorized document template can be quite a battle. Obviously, there are plenty of themes accessible on the Internet, but how would you get the authorized type you will need? Use the US Legal Forms website. The service delivers thousands of themes, like the Connecticut Yearly Expenses, which you can use for enterprise and private needs. Every one of the varieties are examined by professionals and meet state and federal requirements.

In case you are previously authorized, log in for your accounts and then click the Obtain button to find the Connecticut Yearly Expenses. Use your accounts to search with the authorized varieties you possess purchased in the past. Proceed to the My Forms tab of your own accounts and obtain yet another copy of your document you will need.

In case you are a new consumer of US Legal Forms, allow me to share easy guidelines that you should stick to:

- First, make certain you have chosen the proper type to your area/state. You are able to check out the form while using Preview button and look at the form information to guarantee it is the best for you.

- In case the type fails to meet your preferences, take advantage of the Seach industry to discover the right type.

- Once you are positive that the form is proper, click the Get now button to find the type.

- Select the rates prepare you would like and enter in the required details. Design your accounts and buy the transaction using your PayPal accounts or credit card.

- Choose the file structure and acquire the authorized document template for your gadget.

- Full, modify and print out and indication the attained Connecticut Yearly Expenses.

US Legal Forms is the largest collection of authorized varieties that you can discover a variety of document themes. Use the company to acquire appropriately-created documents that stick to status requirements.

Form popularity

FAQ

Your living expenses are the items you can't afford to cut out of your budget. These expenses keep you safe and healthy and allow your home to run smoothly. This list includes things like your mortgage, food, water and electricity.

Living expenses are expenditures necessary for basic daily living and maintaining good health. They include the main categories of housing, food, clothing, healthcare, and transportation. Understanding what's involved in each of these areas will help you to budget for them.

On paper, Lamont will propose roughly a 2% increase to the preliminary $23.85 billion budget he and lawmakers adopted last June for the 2022-23 fiscal year.

How to Calculate Your Annual Living ExpensesAdd up all of your fixed-monthly housing expenses.Add your monthly transportation costs.Add your health costs.Add estimates of how much you spend on food each month.Add your monthly spending money.Add any additional monthly expenses.More items...

As per the government, Connecticut is well above the U.S. average in terms of income, education, and health. So, for improving the quality of life, it is an excellent choice to move to Connecticut.

The 58.7 percent of residents who answered that it is very or somewhat difficult to maintain their standard of living said the reasons include increases in state taxes, rising utility and fuel costs such as electricity, gas and oil, and overall increases in the cost of general goods.

The cost of living in Connecticut is 22% higher than the national average. Housing is 40% higher than the national average, while utilities are 32% higher. When it comes to basic necessities such as food and clothing, groceries are around 18% higher than in the rest of the country, while clothing costs 18% higher.

Connecticut's cost of living index is 121.6, making it the eighth-most expensive state in the United States. The average single-family dwelling in the state costs $318,096, while rent for a two-bedroom apartment is $1,177 a month. Utilities are among the highest in the nation, costing an average of $438.21 a month.

Cost of Living in Connecticut A family of two adults and two children would need a combined income of $118,551 per yearor $9,879 every monthto live comfortably. In Hartford, this goes down to $87,464 annually (or $7,289 per month).

Annual Expenses means those Expenses incurred or to be incurred, as the case may be, by the Association in a particular financial year in furthering the objects and purpose of the Constitution, as contemplated and envisaged in clauses 6 and 7 of this Constitution; Sample 1.

More info

Connecticut Income Calculators Income Calculator Average income cost living calculator average income calculator Connecticut Income Statistics Income Calculator cost of living data Connecticut Income Calculator salary calculator cost of living calculator salary calculator Connecticut CostofLiving Average income statistics average income statistics.