Title: Connecticut Resolution of Meeting of LLC Members to Sell Assets: Understanding the Process Introduction: A Connecticut Resolution of Meeting of LLC Members to Sell Assets refers to the formal decision-making process undertaken by the members of a Limited Liability Company (LLC) in Connecticut to sell the assets of their business entity. This document outlines the key steps involved, the importance of such resolutions, and potential variations that may exist. Keywords: Connecticut resolution of meeting, LLC members, sell assets, decision-making, formal process, business entity, importance, variations. 1. Importance of a Connecticut Resolution of Meeting of LLC Members to Sell Assets: When an LLC in Connecticut intends to sell its assets, a formal resolution becomes crucial to ensure compliance with legal obligations and foster transparency among members. The resolution serves as a written record of the decision, helping protect the interests of all parties involved. Keywords: Compliance, transparency, legal obligations, written record, protect interests, parties involved. 2. Steps Involved in a Connecticut Resolution of Meeting of LLC Members to Sell Assets: a. Call for a Meeting: The LLC members must convene a meeting to discuss and make a decision regarding the proposed asset sale. b. Notice and Agenda: Proper notice must be given to all members, accompanied by a detailed agenda outlining the purpose of the meeting. c. Voting Procedure: The resolution is typically adopted through a voting process, where each member casts their vote in favor or against the sale. d. Majority Vote: The resolution must be passed by the majority or a specified percentage of votes, as defined in the LLC's operating agreement. e. Documentation: The approved resolution should be carefully drafted, signed, and maintained as an official record of the decision. Keywords: Meeting, notice, agenda, voting procedure, majority vote, documentation. 3. Potential Types of Connecticut Resolution of Meeting of LLC Members to Sell Assets: a. General Resolution: This is the most common type of resolution, applicable when the LLC members collectively agree to sell the assets as a whole. b. Partial Asset Sale Resolution: In certain situations, LLC members may decide to sell specific assets or divisions of the company while retaining others. c. Dissolution and Liquidation Resolution: If the LLC intends to wind up its operations entirely, a resolution for dissolution and subsequent liquidation of assets may be required. d. Approval of Asset Sale Agreement: It is common for LCS to pass a resolution approving a specific asset sale agreement before its execution. Keywords: General resolution, partial asset sale resolution, dissolution, liquidation, approval of asset sale agreement. Conclusion: A Connecticut Resolution of Meeting of LLC Members to Sell Assets is a crucial document that outlines the decision-making process of an LLC's members when selling their business assets. Adhering to the proper steps and variations ensures legal compliance, transparency, and the protection of all parties involved. Keywords: Decision-making process, legal compliance, transparency, protection, proper steps, variations.

Connecticut Resolution of Meeting of LLC Members to Sell Assets

Description

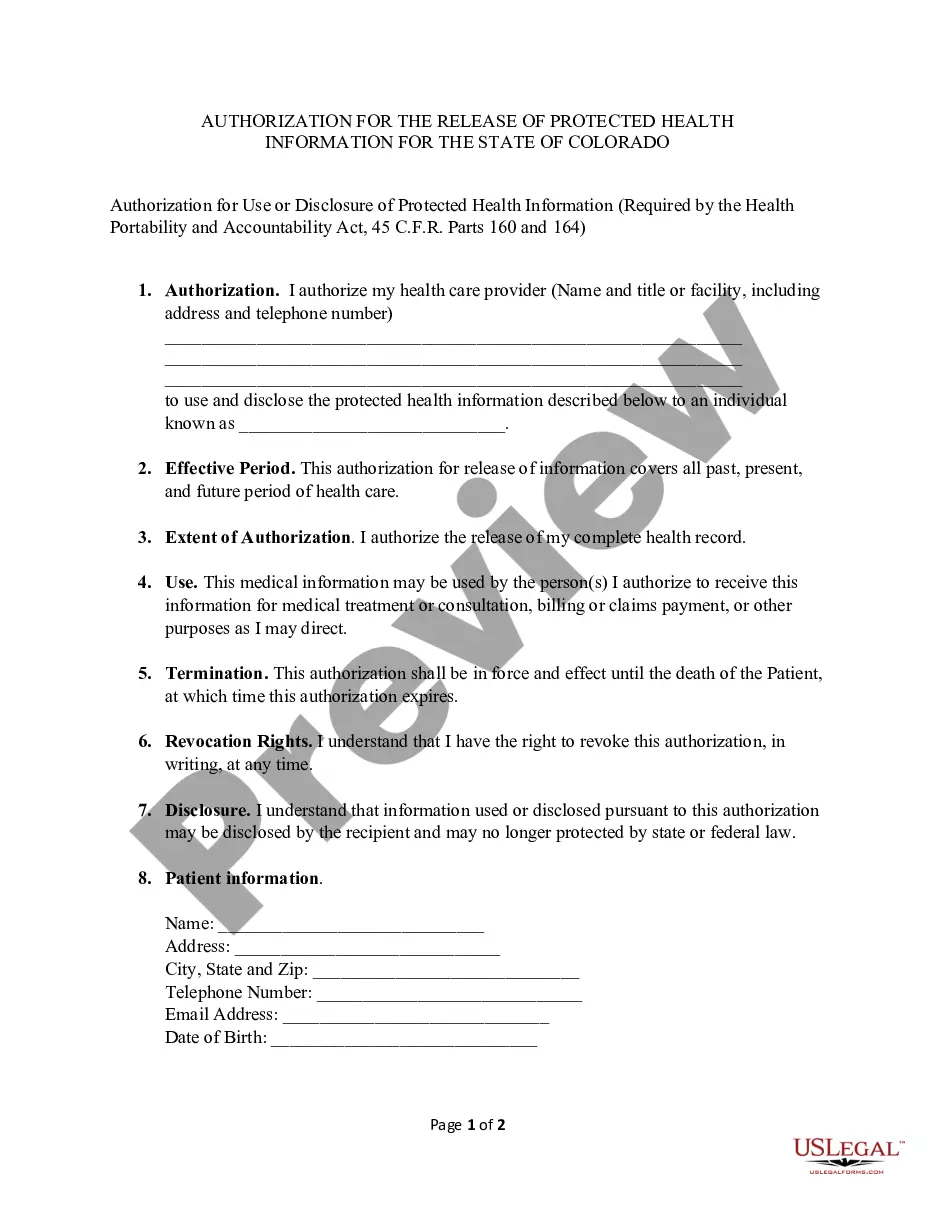

How to fill out Connecticut Resolution Of Meeting Of LLC Members To Sell Assets?

Are you presently in the place in which you need paperwork for both organization or personal purposes nearly every day time? There are tons of legitimate file web templates available online, but getting ones you can rely is not easy. US Legal Forms gives a huge number of form web templates, like the Connecticut Resolution of Meeting of LLC Members to Sell Assets, which are composed to meet federal and state specifications.

When you are previously knowledgeable about US Legal Forms web site and have a merchant account, merely log in. Following that, you may obtain the Connecticut Resolution of Meeting of LLC Members to Sell Assets template.

If you do not provide an bank account and need to begin using US Legal Forms, follow these steps:

- Get the form you require and ensure it is for the appropriate metropolis/region.

- Take advantage of the Preview key to review the form.

- See the outline to ensure that you have selected the correct form.

- In case the form is not what you`re searching for, use the Search industry to discover the form that meets your needs and specifications.

- When you discover the appropriate form, click on Get now.

- Pick the rates prepare you want, fill in the desired information and facts to produce your money, and buy your order using your PayPal or charge card.

- Pick a hassle-free document file format and obtain your backup.

Locate every one of the file web templates you might have bought in the My Forms food list. You can obtain a extra backup of Connecticut Resolution of Meeting of LLC Members to Sell Assets any time, if possible. Just go through the needed form to obtain or produce the file template.

Use US Legal Forms, the most comprehensive collection of legitimate types, to save lots of some time and avoid faults. The service gives skillfully made legitimate file web templates which can be used for a selection of purposes. Generate a merchant account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

Prepare an Operating AgreementAn LLC operating agreement is not required in Connecticut, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

What should a resolution to open a bank account include?LLC name and address.Bank name and address.Bank account number.Date of meeting when resolution was adopted.Certifying signature and date.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.