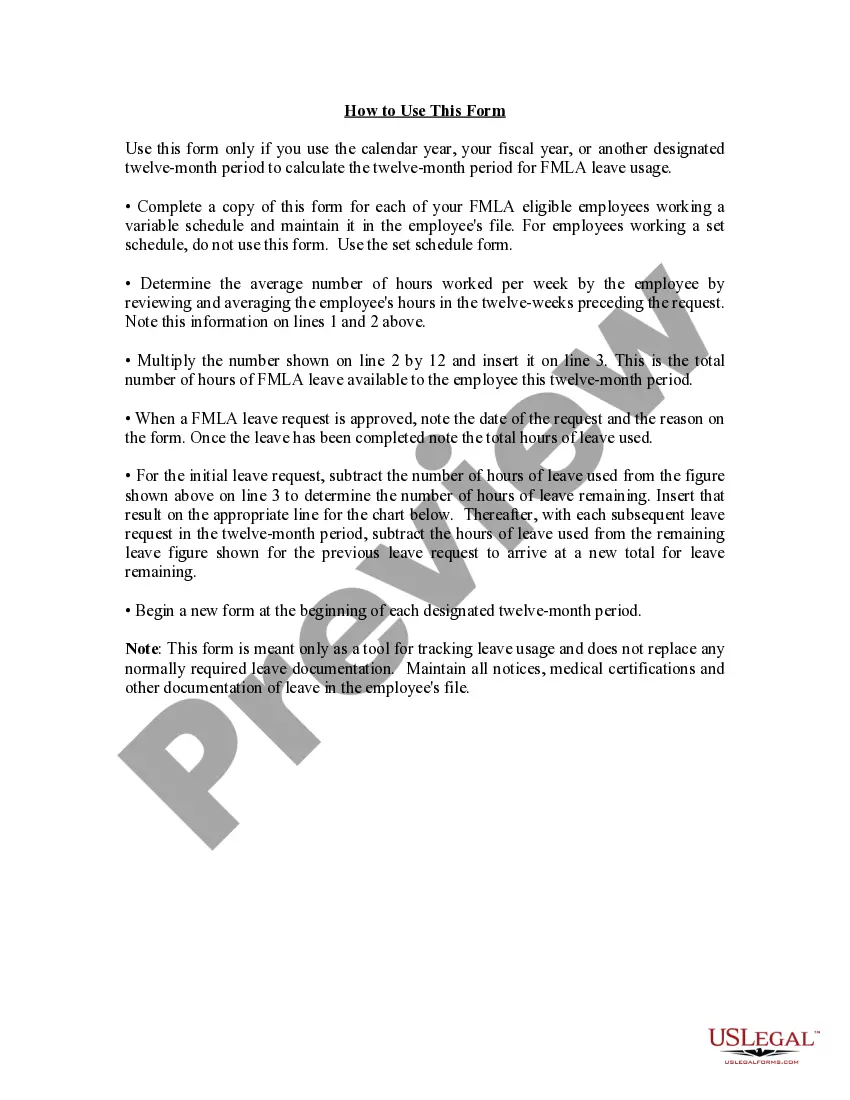

Connecticut FMLA Tracker Form Calendarda— - Fiscal Year Method - Employees with Variable Schedule The Connecticut FMLA Tracker Form is a vital tool for employers and employees alike when it comes to managing leave under the Family and Medical Leave Act (FMLA) in Connecticut. Specifically designed for employees with a variable schedule, this tracker form helps ensure compliance with the state's FMLA regulations. The main purpose of the Connecticut FMLA Tracker Form is to assist employers in accurately documenting and tracking an employee's leave entitlements, allowing for seamless administration of FMLA benefits. By utilizing the calendar-based approach and the fiscal year method, employers can easily calculate an employee's eligible FMLA leave and keep track of important dates and milestones. Key features of the Connecticut FMLA Tracker Form Calendarda— - Fiscal Year Method - Employees with Variable Schedule include: 1. Comprehensive Record-Keeping: The form allows employers to record detailed information about an employee's FMLA leave, including the dates of the leave, the reason for the leave, and the number of hours taken. 2. Accurate Leave Calculation: By factoring in an employee's variable schedule, the tracker form ensures that FMLA leave is calculated correctly. It takes into account the number of hours an employee would have worked in a given week based on their usual schedule. 3. Customization for Fiscal Year: The tracker form is designed to align with the employer's fiscal year, simplifying leave calculation and tracking processes by using a consistent time frame. 4. Segmentation of Leave Type: The form allows for the differentiation of different types of FMLA leave, such as continuous or intermittent leave, ensuring accurate tracking and calculation for each type. Different types/names of the Connecticut FMLA Tracker Form Calendarda— - Fiscal Year Method - Employees with Variable Schedule: 1. Standard Connecticut FMLA Tracker Form: This is the basic template of the tracker form, suitable for most employers with employees having variable schedules. 2. Expanded Connecticut FMLA Tracker Form: This version includes additional fields or sections to accommodate more complex employee scheduling patterns or multiple leave types. 3. Customized Connecticut FMLA Tracker Form: This form is tailored to meet the specific needs of an employer or industry with unique variables or reporting requirements. In summary, the Connecticut FMLA Tracker Form Calendarda— - Fiscal Year Method - Employees with Variable Schedule is an essential tool for employers in Connecticut to track and manage FMLA leave. Its customization options and accurate leave calculation make it an ideal solution for businesses of different sizes and industries, ensuring compliance with Connecticut's FMLA regulations while efficiently managing employee leave entitlements.

Connecticut FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule

Description

How to fill out Connecticut FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Variable Schedule?

Are you in the placement in which you require documents for either company or individual purposes nearly every day time? There are plenty of authorized document layouts available on the net, but finding types you can rely isn`t effortless. US Legal Forms offers a huge number of kind layouts, just like the Connecticut FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule, that happen to be composed in order to meet federal and state requirements.

When you are previously acquainted with US Legal Forms website and also have your account, basically log in. Following that, you may acquire the Connecticut FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule design.

Should you not offer an account and wish to start using US Legal Forms, abide by these steps:

- Obtain the kind you will need and make sure it is for that right metropolis/state.

- Utilize the Review key to analyze the shape.

- Browse the explanation to actually have chosen the appropriate kind.

- If the kind isn`t what you are trying to find, make use of the Lookup area to obtain the kind that meets your needs and requirements.

- Once you find the right kind, click Buy now.

- Opt for the costs program you desire, fill out the required details to make your account, and pay for an order with your PayPal or charge card.

- Decide on a practical paper file format and acquire your copy.

Find every one of the document layouts you have bought in the My Forms menu. You can obtain a additional copy of Connecticut FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule whenever, if needed. Just select the needed kind to acquire or print the document design.

Use US Legal Forms, probably the most comprehensive variety of authorized varieties, to save efforts and prevent errors. The support offers expertly created authorized document layouts which can be used for a selection of purposes. Create your account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

When a holiday falls during a week in which an employee is taking the full week of FMLA leave, the entire week is counted as FMLA leave.

The 12-month rolling sum is the total amount from the past 12 months. As the 12-month period rolls forward each month, the amount from the latest month is added and the one-year-old amount is subtracted. The result is a 12-month sum that has rolled forward to the new month.

Even if a holiday occurs within a work week during which FMLA leave is taken, the week is still counted as one week of FMLA leave and counts towards the employee's 12 week maximum eligibility. The fact that a holiday occurs within a week taken as FMLA leave has no effect.

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.

The regulations provide that an eligible employee is entitled to a combined total of 26 workweeks of military caregiver leave and leave for any other FMLA-qualifying reason in this single 12-month period, provided that the employee may not take more than 12 workweeks of leave for any other FMLA-qualifying reason during

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

The next 12-month period would begin the first time FMLA leave is taken after completion of any previous 12-month period. As an example, if the employee begins FMLA leave on June 1, 2019, then the next 12-week period would begin again on June 1, 2020.

For example, an employer considers Thanksgiving a holiday and is closed on that day, and none of its employees work. One of its employees is taking 12 weeks of unpaid FMLA leave the last 12 weeks of the calendar year. The employer would count Thanksgiving Day as FMLA leave for that employee.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022 Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.