Connecticut Exempt Survey is a comprehensive and mandatory assessment conducted by the state of Connecticut to determine the eligibility of certain properties for tax exemptions. This survey aims to identify and categorize properties that may qualify for exemption from property taxes based on specific criteria defined by state laws and regulations. The Connecticut Exempt Survey is especially relevant for property owners, real estate professionals, and local tax authorities who need to understand the exemption status of various properties within the state. Conducted periodically, this survey plays a crucial role in ensuring fair and accurate property taxation. There are several types of Connecticut Exempt Survey, each targeting specific categories of property exemptions. Some notable types include: 1. Exempt Survey for Non-Profit Organizations: This survey focuses on properties owned by non-profit organizations, such as religious institutions, charitable organizations, educational institutions, and hospitals. These entities may be eligible for property tax exemptions under certain conditions. 2. Exempt Survey for Agricultural Land: This survey specifically evaluates properties used for agricultural purposes, such as farms, orchards, nurseries, and other agricultural operations. Agricultural land may qualify for tax exemptions based on criteria like size, use, and productivity. 3. Exempt Survey for Historical Buildings: This survey examines properties that are designated as historical landmarks or properties situated within historical districts. State regulations may provide tax incentives or exemptions to preserve and maintain these cultural assets. 4. Exempt Survey for Renewable Energy Installations: This survey focuses on properties with renewable energy installations, such as solar panels, wind turbines, or geothermal systems. Connecticut offers tax exemptions and incentives to encourage the development and use of renewable energy sources. 5. Exempt Survey for Veterans' Organizations: This survey evaluates properties owned by veteran organizations, including halls, memorials, and meeting places. These organizations may be eligible for property tax exemptions as a recognition of their services and contributions to veterans and society. It is important for property owners and organizations to comply with the Connecticut Exempt Survey to ensure accurate taxation and take advantage of potential tax relief opportunities. Regularly updating and submitting survey information allows for proper assessment and consideration of property tax exemptions as per state laws and guidelines.

Connecticut Exempt Survey

Description

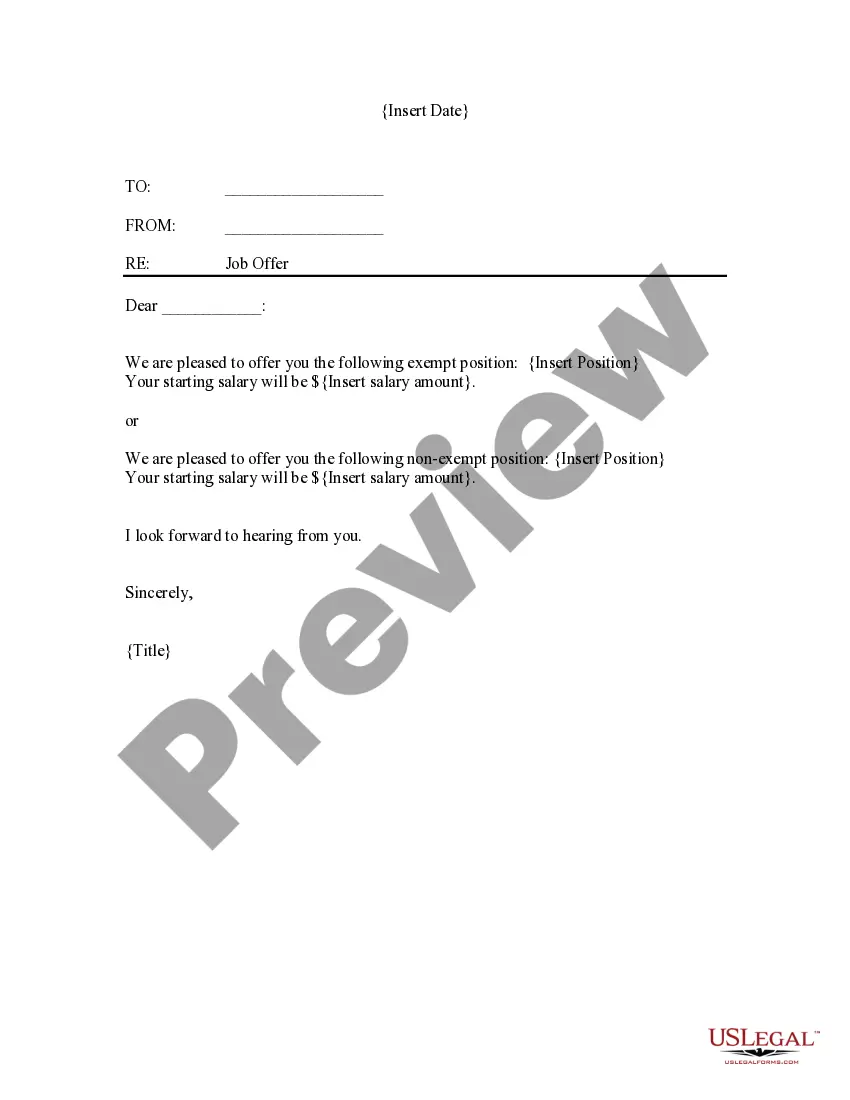

How to fill out Connecticut Exempt Survey?

You may commit several hours on-line trying to find the authorized record template which fits the federal and state requirements you want. US Legal Forms offers a huge number of authorized kinds that are analyzed by pros. You can easily acquire or printing the Connecticut Exempt Survey from your service.

If you already have a US Legal Forms account, you are able to log in and then click the Obtain option. Following that, you are able to complete, modify, printing, or signal the Connecticut Exempt Survey. Every authorized record template you purchase is the one you have permanently. To acquire one more version for any obtained kind, go to the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms web site the first time, stick to the easy instructions below:

- Very first, make certain you have chosen the best record template for the area/area that you pick. Browse the kind explanation to ensure you have chosen the correct kind. If readily available, take advantage of the Preview option to check throughout the record template as well.

- If you want to get one more model of the kind, take advantage of the Lookup area to get the template that meets your requirements and requirements.

- After you have discovered the template you want, simply click Get now to proceed.

- Pick the prices strategy you want, key in your credentials, and register for an account on US Legal Forms.

- Complete the purchase. You may use your credit card or PayPal account to cover the authorized kind.

- Pick the structure of the record and acquire it for your product.

- Make adjustments for your record if necessary. You may complete, modify and signal and printing Connecticut Exempt Survey.

Obtain and printing a huge number of record templates while using US Legal Forms site, that offers the greatest variety of authorized kinds. Use professional and status-particular templates to tackle your small business or personal needs.